Rio Tinto (LSE:RIO) share price had plunged by as much as 28.00 pence by 2:10 pm today from yesterday’s close of 3,458.00. The company announced the ouster of CEO Tom Albanese and Energy CEO Doug Ritchie.

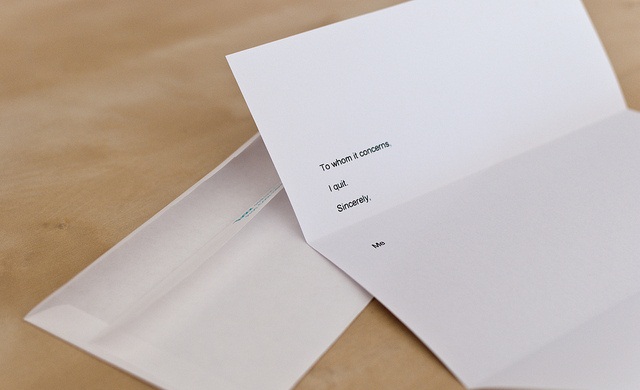

As with all announcements of this kind, the termination was described as a “mutual agreement.” Why do they say that when we all know the guys got canned? Of course the “stepping down” was part and parcel of the company’s announcement entitled “Rio Tinto Impairments and Management Changes.” Hmm. Do you think the two things might be related?

Looking forward to the release of its full year financials, the board is already aware that it is facing a non-cash impairment charge in the neighborhood of $14 billion US related to Rio Tinto Coal Mozambique and Rio Tinto Alcan. One can be relatively certain that the nose dive on the LSE was more due to the impairment charges that the “resignations.” It is even more certain that the departures were are result of the impairment charges.

Jan du Plessis, Board Chairman, said, “The Rio Tinto Board fully acknowledges that a write-down of this scale in relation to the relatively recent Mozambique acquisition is unacceptable. We are also deeply disappointed to have to take a further substantial write-down in our aluminium businesses, albeit in an industry that continues to experience significant adverse changes globally.”

The back story is that Albanese and Ritchie were the pathfinders in the 2007 acquisition of Alcan in 2007. That acquisition cost $38 billion up front and has been has been a pain in Rio Tinto’s balance sheet and P&L ever since. The company had already suffered an $8.9 billion charge on their aluminum assets last year. That acquisition was as much a move to stave off potential take-over bids from competitors as anything else. That is a recipe for digging your own grave. Personally or professionally, it’s a good rule of thumb to delay making important decisions when you are under pressure. In a situation like Albanese and Ritchie faced, the pressure of the perceived immediate need appears to have resulted in a probably less-than-thorough due diligence and a gaining a subsequently ill-advised long-term investment. The bottom line purpose of M&A is growth, not year after year of losses and impairment charges. Although it works, the primary purpose of an acquisition should not be to avoid a take over.

Similarly, the purchase of RTCM must surely have been lacking in due diligence as the company found itself in a bidding war. Bidding wars often become more emotional that analytical. If the plan is simply “We want to acquire that company,” danger is lurking in the corner of the boardroom. The plan needs to include a limit on the price and a real good fix on the potential for profit, including answers to what it is going to cost to operate the enterprise. If the prize is the acquisition at any cost, facts coming out of due diligence tend to be ignored andthe only thing of importance is the prize itself. Subsequently, the prize turns into a surprise. A surprise as in “Surprise! You no longer have a job here.”

Speaking of which, Albanese and Ritchie will continue with the company, albeit not in their most recent positions, to assist in a smooth transition. Their pay and benefits have been adjusted accordingly.

The board has appointed Sam Walsh as its new CEO.

Hot Features

Hot Features