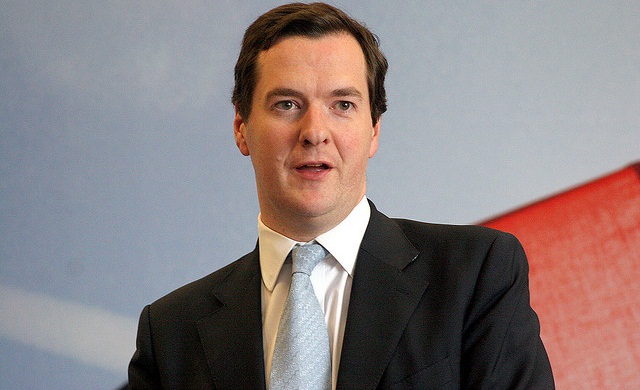

One of the wisest things that I have ever heard, especially with respect to governmental budgeting, is that “Public works bake the cake, most politicians care only about the icing, and the public is concerned only about how much cake they are entitled to.” From what we know today, George Osborne will buck that trend tomorrow when he unveils his 2013 budget.

We are informed that Osborne will announce £2.7 billion in spending cuts over the next two years. These cuts will be in addition to those in last year’s Autumn Statement. This will drive politicians and the public absolutely nuts. Economists will have a field day for the rest of the week debating the merits of cutting spending and, in this case, why some of the savings will be used to repair the country’s out-of-date and crumbling infrastructure (public works). Speaking of cake and icing, have you ever noticed that politicians love to pose for photo ops at the dedication of a new bridge or the opening of a new highway? Well, how often do you see them posing at the repair of a hundred year old water line that has been leaking because there was inadequate money budgeted to keep it maintained? Just food for thought.

IMHO, the Chancellor has the right perspective on the broad picture, which economist Roger Bootle describes as having “never known a situation as grim as this.”

The problem is that each line item in the budget has its own proponents. Over the years government spending tends to expand as proponents lobby for more money. During good economic times, in an effort to please every entity that pleads a good case, funds available are increased on a rather subjective basis. I say subjective because at every level of building the national budget, someone or some department is fudging, trying to get a bigger slice.

There was a time not all that long ago when department heads reckoned that they had to spend their entire budget for the current year in order to be allocated more funding the next year. Perhaps that’s still happening. I wonder.

Here’s the thing that is going to rub everyone’s fur the wrong way – spending the savings on infrastructure. Economists will say that that will not contribute to economic growth. But I submit that it will contribute to preventing infrastructure collapse. It has come time for Britain to pay the piper. The country has failed to spend the money required to adequately maintain its infrastructure, spending the money on so many foolish things that neither time nor space permit listing.

Osborne’s budget may not please everybody, but it is a much wiser strategy than increasing spending. His budget will not fix all the infrastructure problems, whether they be repairs or expansion, but it will stop the deterioration.

Hot Features

Hot Features