The share price of ARM Holdings (LSE:ARM) (NASDAQ:ARMH) jumped 5.88% today to 882.50, helping to prop up the FTSE, following the publication of its results for the second quarter and first half of 2014. Let me say right from the start that I am a fan of ARM Holdings, from a strategic investment and operational perspective. Its entire business model is innovative and one that, as long as they have the talent and the foresight and are managed properly, should keep them ahead of the competition for years to come.

A Review of the ARM Business Model

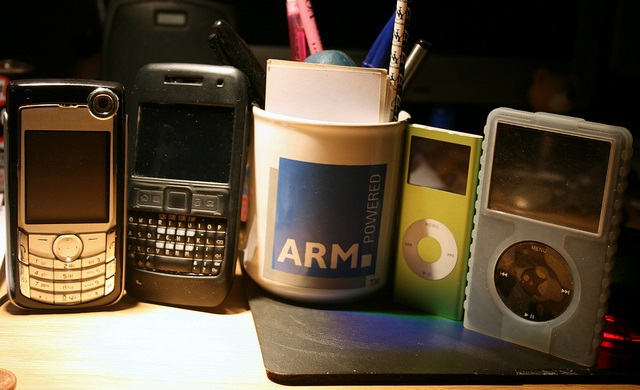

ARM is a high-tech circuit and chip design company. Its engineers are commissioned with the responsibility of designing more powerful and more efficient chip designs. It does not build chips. It revenue stream comes from the licensing fees and royalties generated by the companies, such as Apple and Samsung, who use ARM designs. I’m in love with the concept as well as its success on both the front and back ends.

They essentially have no product other than intellectual property. Whilst others hold their IP closely, ARM licenses it and earns far greater returns on it. The sales end of the model is just as ingenious. Licensing fees are collected upfront, while royalties kick in within a couple of years.

A Review of the ARM Report

If you’re having a difficult time trying to find some good news lately, I suggest you read the ARM report. It’s hard to find any bad news in it.

Second Quarter

- Total revenue was $309.6 million (£187.1 million), up 17% year on year

- Total licensing revenue was $146.1 million (£89.6 million), up 42%

- Total royalty revenue was steady at $135.5 million (£80.3 million)

- Pretax profit was £94.2 million,up 9%

- Earnings per share were 5.43 pence , up 11%

First Half

- Total revenue was $614.8 million (£373.7 million), up 16% year on year

- Total licensing revenue was $276.0 million (£170.5 million), up 40%

- Total royalty revenue was $280.3 million (£167.1 million) , up 2%

- Pretax profit was £191.3 million, up 9%

- Earnings per share were 11.02 pence, up 8%

CEO Simon Sigars said that, “Our continued strong licensing performance reflects the intent of existing and new customers to base more of their future products on ARM technology. The 41 processor licences signed in Q2 were driven by demand for ARM technology in smart mobile devices, consumer electronics and embedded computing chips for the Internet of Things, and include further licences for ARMv8-A and Mali processor technology. This bodes well for growth in ARM’s medium and long term royalty revenues.”

2.7 billion chips based on licensed ARM designs were shipped during the second quarter, an increase of 11% over the same period in 2013.

Whilst some many consider the royalty revenue increase to have been somewhat thin, Sigars sees it within the perspective of the rapidly changing world of technology wherein the term “a new generation” has shrunk to infinitesimal proportion compared to the traditional use of the term. Given the company’s pipeline and “new generation” technologies, the rest of the year bodes well for continuing success.

Hot Features

Hot Features