Debt like inflation appears hell-bent on an upward trajectory. At the time of writing, the US national debt was hovering around $21.147 trillion, with no relief in sight.

The US has an insatiable appetite for expenditure, as evidenced by the Buy Now Pay Later mentality of Western society. Our future-oriented payment regimen makes sense given the impossibility of paying for everything that we want up front. For the most part, debt-financed investments are an accepted means of growing your financial portfolio.

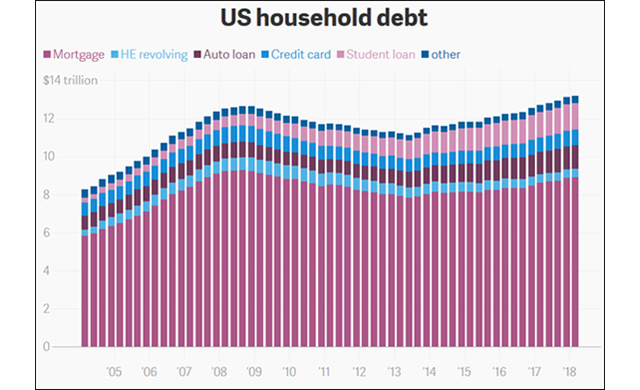

Provided the return from the underlying asset is greater than the cost of financing it, it’s a win-win. Economists estimate that US household debt is now standing at $13.2 trillion (Q1 2018) up $63 billion from Q4 2017. The Federal Reserve Bank of New York indicated that the bulk of this debt is mortgage-fueled. Based on the analysis, mortgage debt makes up $8.9 trillion of all household debt. It is the most significant contributor to overall debt, with automobile loans, student loans, and credit card debt making up the remainder.

Despite these growing figures, the Fed is rather sanguine about the state of the US economy. For starters, our debt burden is growing at a far slower pace than it did prior to the 2008 global financial crisis. This is evident in the sharp slope pre-2008 versus the gradual slope leading into 2018. More importantly, US households can maintain their mortgage repayments, and less delinquencies have been reported.

The recovery has taken years to get underway, and it appears to be a robust one. Other factors which bode well for the current state of the economy include the median credit score for approved mortgages at 761, up 6 points from the average of 755. Prior to 2008, 15% of borrowers had credit scores under 620. Now, that figure is approximately 3%. In other words, there are much lower levels of subprime mortgages being offered.

Debt Is Not Bad If It Is Used for Good Reasons

There are delinquencies taking place in the US economy, but they are being reported in other areas like automobile loans, credit cards, and a greater number of student loans. We have seen a sharp uptick in housing prices since the crisis, with values estimated at around $14 trillion. Unfortunately, there aren’t as many homeowners in the younger age groups, particularly people under 35. Pre-crisis 43% of under 35’s owned homes, now that figure is just 35%.

One of the leading authorities on debt, DebtConsolidation.com conducted extensive analysis of debt throughout history in the US. The results of the studies indicate that debt is not necessarily bad if it is used for good purposes. Indeed, some of the best presidents were responsible for raising the debt ceiling the most, such as president Ronald Reagan, while some of the least favored such as president George Bush Junior was on par with President Obama!

Hot Features

Hot Features