Tax agencies are coming for what they’re owed. What else is new, right? But this time they’re targeting an entire industry: cryptocurrency. Guidance passed down by authorities in the United States, Great Britain and several other countries dispels the notion that crypto-holders might conceivably avoid liability for transacting virtual tokens. And those who have pocketed their hard-won profits to date are most likely to show up on the radar.

A Crypto Tax Crackdown

It’s not just investors and traders: those who have received crypto in exchange for goods and services are also potentially on the hook. And while hodlers aren’t due the taxman a penny, they have been warned to keep comprehensive records of their investments. After all, they’ll need them to work out capital gains liability when they cash out. (And being hodlers, they’re hoping to cash out for a lot.)

There’s no doubting the ability of authorities to take punitive measures against tax dodgers. Amazon is quite capable of squirming free of its pecuniary obligations, but individuals will have a harder time. In an attempt to address persistent tax evasion, both the IRS and HMRC have taken to petitioning cryptocurrency exchanges to fork over details of people conducting business on their platform. The IRS also dispatched letters to 10,000 crypto traders, requesting they confirm that taxes on crypto gains and losses were filed correctly – or amend their filings accordingly.

Crypto is now referenced on the most common tax filing form in the United States: “At any time during the year, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?” Not much room for issuing an ambiguous answer to that one.

All of which is to say that tax agencies are getting tough. They want people operating in the cryptosphere to treat crypto like money – even though, paradoxically, they say it isn’t money at all. It’s all very confusing.

Transacting Crypto? Here’s What You Need to Do

Needless to say, tax laws vary from country to country and as such, you are well advised to fully familiarize yourself with your local regulations moving forward. The IRS guidance, released in October 2019, is here. HMRC’s, published around the same time, is here.

In any case, the record-keeping procedures are broadly similar wherever you are. Meaning you must faithfully record details of every transaction you make which involves cryptocurrency. The goal, for everyone, should be to create complete financial records of cryptocurrency holdings and past trades. You’ll be glad you took such steps if an audit notification lands in your inbox.

Of course, the task of calculating crypto profit and loss is something of an art – particularly if you do it yourself. Not only do you have to document the date and time you acquired your crypto assets, but you have to record the market value at the time of purchase, then repeat the same process when you offload said assets, along with the value received. A consistent methodology must also be used to arrive at the appropriate value, and you must retain records of said methodology.

As anyone who’s operated in this space for a while will know, it’s not simply a matter of trading tokens and adding figures to a ledger. When you factor in the convoluted peculiarities of hard forks, airdrops, mining operations and token sales, it can get very confusing very quickly. The aforementioned national tax authorities have tried to cover their backs by releasing lengthy documents containing multiple FAQs and example scenarios, but they will have to author book-length policies to cover every conceivable transaction.

Blox.io is one of the many tools available on the market to help traders and investors manage their taxes

Do You Need Professional Help?

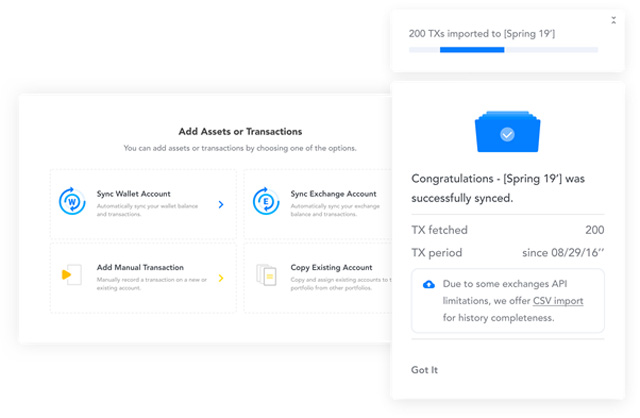

For those who cannot countenance the idea of manually keeping records, and answering the various complex questions that are sure to spring up along the way, there are a number of cryptocurrency portfolio tracking tools which promise to lighten the load. Even if you’re planning to speak to a crypto CPA, using such a tool is a great idea, as it will automate much of the record-keeping process by letting you sync (or import) information from various exchanges and blockchains. Although the IRS has mainly issued guidance pertaining to bitcoin, most crypto tax programs support hundreds, if not thousands, of cryptocurrency assets.

In essence, these tools analyze data from your crypto activity to produce comprehensive reports that also flag up opportunities to save money by claiming losses. Reports can then be exported to traditional tax platforms used by CPAs.

Worried that you’ve racked up a huge unpaid tax bill in recent years? Bamboozled by the regulations? You might consider speaking to a tax specialist, possibly even a tax attorney, to get a better idea of your options going forward. Just make sure they’re up to speed on the latest crypto guidance – because many tax specialists operate solely in the fiat world. By the same token, there are now tax consultants who specialize exclusively in cryptocurrency.

Investors and traders who fail to report their gains or losses may learn a hard lesson in the years to come. The sensible approach is to educate oneself on the appropriate regulations, diligently maintain records (ideally using specialist software), and put as much effort into accurately filing your crypto tax as you would any other tax. Oh, and keep a close eye on the regulations – since they are certain to evolve.

Hot Features

Hot Features

I have been using Blox for almost a year and wow is it helpful!

Crypto accounting and tax deserve more attention. As a CPA with many crypto clients, its unfortunate to see how many people are uneducated and uninformed! Haven’t used Blox but heard amazing things from fellow colleagues. Cheers.