During an economic downturn, it’s natural to want to protect your wealth. History is littered with figures who lost eye-watering sums during periods of market strife, and recent events illustrate this well: during February’s pandemic-driven market drubbing, the combined fortunes of the world’s 500 richest people plummeted by $444 billion, with the Dow Jones Industrial Average falling more than 12%.

Image: Depositphotos

Global and local economies have been severely affected by widespread shutdowns and stay-at-home orders, and with an ever-expanding debt bubble hanging over governments, private sectors and households, it’s hard to see light at the end of the tunnel. That said, there are many things you can do to protect your personal wealth in the short- and long-term. In this article, we’ll explore some compelling hedges that can provide sanctuary in financial crises.

Why Smart Investors Are Buying Bitcoin

Bitcoin has long been positioned as a hedge against inflation. And given the extent of recent central bank stimulus packages and quantitative easing, that narrative has only strengthened in 2020.

Bitcoin has fared better than many traditional markets this year, and the outflow of funds from crypto exchanges suggests investors are less likely to sell their bitcoin holdings in the short-term. Falling exchange reserves tend to occur when bitcoin enters an accumulation phase, and the bulls have been making bold predictions about the currency’s price of late. Already up 30% since the beginning of the year, BTC will soar to $300,000 within the next five years according to crypto pioneer Adam Back.

It’s not just crypto figures who are bullish, of course. Last month, legendary investor Paul Tudor Jones called bitcoin “a great speculation,” saying it reminded him of gold in the 1970s. “Every day that goes by that bitcoin survives, the trust in it will go up,” added Jones, explaining that he held about 2% of his wealth in bitcoin, which finished the 2010s as the decade’s best-performing asset.

So what makes bitcoin so attractive to an investor? Well, its scarcity for one: its supply is strictly limited and capped at 21 million bitcoins, though that figure won’t be reached until 2140. Of course, each bitcoin is divisible into 100 million units – but its digital scarcity and diminishing supply following every quadrennial “halving” makes it an attractive store of value. Particularly given the activities of central banks, who artificially expand the monetary supply whenever they like.

Buying bitcoin (or selling it, for that matter) is easy these days thanks to platforms like Skrill. You can make payment with up to 40 fiat currencies, using one of 100+ deposit methods, safe in the knowledge that your purchase is overseen by a reputable and well-established platform with 20 years of experience. Better still, you can take advantage of price movements without logging in with automated orders. This is an especially good idea if, like many investors, you see bitcoin’s price rising steadily in the coming years. If you’re interested in actively trading cryptocurrencies, meanwhile, an exchange like Binance or Huobi is the way to go.

The Timelessness of Gold

Bitcoin reminds Paul Tudor Jones of gold in the 1970s. But what about gold in the here and now? Well, it hit a seven-year high in April as the rest of the economy struggled. The fact is, gold will always be valuable due to its physical properties and scarcity. We have thousands of years of evidence for that. Its status as the ultimate long-term safe haven is, well, safe.

Those interested in buying gold have a few options: one is to purchase paper gold – gold-backed contracts and derivatives, a.k.a. exchange-traded funds (ETFs) or gold-backed cryptocurrency – and the other is to buy physical gold. As ever, there are pros and cons to each option.

While paper contracts for gold are highly convenient and cost-effective, and can act as risk controllers in a portfolio stocked with volatile assets, they are, at base, gold IOUs. If there is ever a gold run, and you want to take ownership of the physical metal to which you have a right, you may find yourself in a long line of creditors.

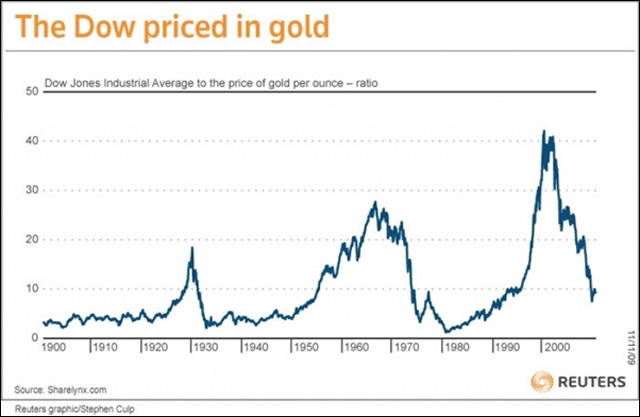

The Dow priced in gold, Source: Stephen Culp, Reuters

Buying physical gold for delivery, meanwhile, comes with a premium and entails significant security costs: after all, you don’t want to have gold coins and bars lying around your property. Physical gold in the form of coins and ingots can be sourced from banks, gold dealers and jewellers, and liquidated at the holder’s convenience whenever a need arises.

Cash Still Offers Unrivalled Liquidity

There is a reason why companies large and small seek to free up cash during a crisis, a feat that can be achieved by reducing working capital, optimizing financial structure, delaying spending or focusing on cash inflow. The greenback has traditionally been useful during downturns, enabling mobility and purchase power when markets drop. Those who hold onto cash during market turbulence are regarded favorably by investors and can actually increase their valuation while others scrabble to shore up capital.

Speaking of which, Grayscale Investments has used its vast wealth to buy up more than 1.5x the number of bitcoins mined since its third halving. By the end of May, the investment firm held $3.7 billion worth of digital assets, with most capital inflows coming from hedge funds. Such moves are only possible when cash is to hand.

Of course, fears over handling physical cash have intensified in recent months. Something to bear in mind if there’s a mountain of paper money propping up your mattress.

Change How You Consume

Throughout the world, consumers are cautiously managing their finances and, in many instances, limiting purchases to essential goods. This is unsurprising given the economic picture, not to mention the number of physical stores that have yet to reopen.

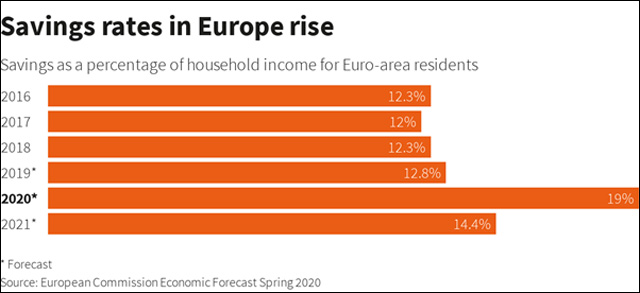

People who previously favored a high time preference have transitioned to a lower time preference, delaying their gratification by hoarding cash and reducing credit card spending. Consuming spending in the U.S. saw its biggest ever fall in April while the savings rate in Europe has increased by over 6% year-on-year.

While spending is good for the whole economy, at a personal level it pays to be both circumspect and frugal during times of economic turbulence.

By hedging your portfolio with assets like gold and bitcoin, retaining a reasonable amount of cash, and reducing your spending, capital preservation is possible. Seek a degree of exposure to alternative assets, exercise common sense in assessing your investments, and be thrifty until the clouds clear.

Hot Features

Hot Features