Since blockchain technology was first introduced in 2008, it has been reconfigured and moulded to fit a huge array of use cases, and has widely been described as a potentially transformative technology for many industries.

But while blockchain could have a hand in disrupting practically every modern industry, some are already mid-transformation, as a number of early-movers in the blockchain space have begin laying down the foundations for change.

Here, we take a look at three such projects already well on their way to disrupting their respective industries.

Online Advertising

Advertising, it’s a crucial but often overlooked part of nearly any business. Those that get it right can achieve tremendous success and growth, while those that get it wrong can suffer financial ruins — it’s generally a delicate balance between trial and error and tried and tested techniques.

But the online advertising industry in particular has been plagued with ad fraud, which sees businesses lose a sizeable chunk of their ad spend to fraud, while dubious publishers get paid for providing.

This is exactly what AdEx looks to resolve with its blockchain-powered online advertising solution, which ensures advertisers pay only for real traffic thanks to its unique validator system, which sees a decentralized network of nodes confirm the genuineness of traffic before a campaign is rewarded.

Beyond this, it hosts an open marketplace which allows supply and demand-based price discovery for advertising campaigns, ensuring advertisers always pay the going rate, while publishers get the best bang for their buck for their inventory — without losing any fees to middlemen.

With a reported 20% of all ad dollars lost due to fraud, AdEx’s solution could be poised to disrupt the $200 billion digital advertising industry. And thanks to its use of a native cryptocurrency — the AdEx token (ADX) — practically anybody can tag along for the ride, by simply bonding their ADX tokns towards validators to earn rewards.

The Credit Market

By some estimates, the global consumer credit market is a $10.7 billion industry poised to grow at a healthy CAGR of 5% between 2021 and 2027. But despite being such a massive industry, there has been very little in the way of innovation in recent years, with overdrafts and bank loans still being the most common form of credit.

However, peer-to-peer lending platforms built on the blockchain are gradually changing that. These platforms democratize access to capital and earning opportunities, while drastically reducing barriers to entry.

EasyFi, in particular, is arguably leading the charge when it comes to innovation in the open lending sector. Unlike other platforms, it is built on a layer-2 solution known as Polygon, which helps it eliminate some of the major issues associated with older platforms — including high fees, slow disbursement times, and overly complicated user experiences.

By building on the ultra-efficient Polygon blockchain, EasyFi is able to provide small and low-interest loans to individuals and businesses, by almost eliminating the fees that come with depositing collateral and withdrawing funds.

It’s also unique in that it is the only open lending platform capable of supporting undercollateralized loans thanks to its use of the TrustScore system, thereby allowing borrowers to optimize their LTV while lenders gain access to an even larger pool of borrowers.

Making Fundraising Safer

You may already know DAO Maker as the firm that launched the Dynamic Coin Offering (DYCO) model — i.e. the world’s first refundable token sale system, which was used to launch the massively popular Orion Protocol (ORN).

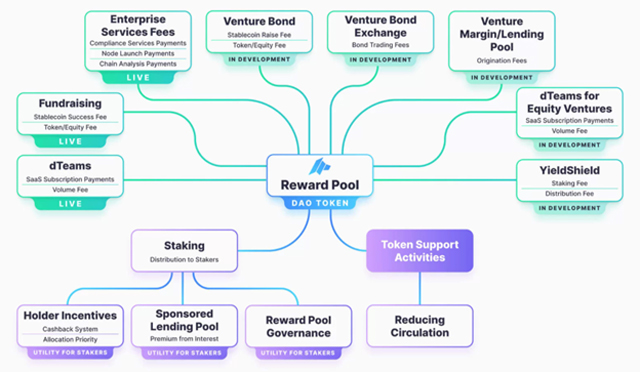

But what you may not know, is that it also launched its own suite of financial products — powered by the DAO Maker token (DAO). This new range of financial products is aimed at reducing the frictions that investors have when making investments in promising early-stage blockchain projects.

It will achieve this by launching a range of new investment solutions, which allow users to easily manage their risk exposure while investing in both traditional and crypto projects thanks to a range of unique protection mechanisms.

For example, with the DAO Maker Venture Bond (VB) solution, users are able to help fund new projects in return for equity or tokens with essentially zero risks, since the funds are simply used to generate interest via insured CeFi and DeFi products — and this interest is funneled to the projects. At the end of the bond period, the investors get their money back in its entirety and keep any equity or tokens earned as part of the venture bond.

Despite already being a behemoth in the cryptocurrency fundraising scene, DAO Maker’s token only launched recently and is still largely under the radar. The alpha launch of the venture bond solution is currently scheduled for launch in Q1 2021.

Hot Features

Hot Features