The EU granted the UK’s flextension until 31st October, four-month longer than PM May requested. Yet whilst today’s ‘meh’ reaction points towards Brexit fatigue, the coiling nature of GBP suggests volatility could be brewing.

As Matt Weller pointed out just yesterday, it was more a question of how long an extension would be over whether one would arrive. With Brexit delayed until October 31st, the EU appeared to have taken the middle ground between May’s request for a short extension and calls for 9-12 months from some EU members. This essentially provides the UK government over 6-months of further quarrelling and heckling in a bid to agree with a majority how they would like to leave the EU. Assuming they do.

By a thin margin, GBP is currently today’s strongest major although it would be easy to miss, with cable notching up a 17-pip range. Today’s ‘meh’ reaction perfectly encapsulates Brexit fatigue, as such a headline even just a couple of months ago may have provoked a noteworthy reaction. Kicking the can down the road does little to appease investors who remain uncertain of how a post-Brexit Britain will fare, and investors (or traders for that matter) don’t like uncertainty.

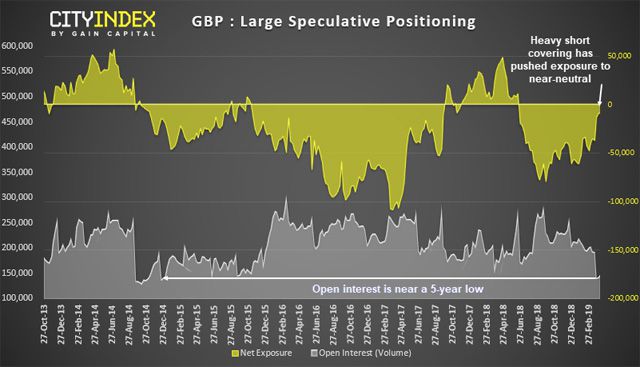

Open interest on GBP futures are near their lowest levels in 5 years. Although net-short exposure has risen to its least bearish level since late 2017 (and not far from flipping to net-long) it accounts for little if volumes have dropped to the point that speculators appear hesitant to speculate. So, until progress of an outcome is made (one way or the other) GBP could prove to be frustrating to position trade over any meaningful hold-time.

Still, volatility tends to arrive when you least expect it, so perhaps the coiling nature of cable could be indicative of a surprise. We can see on the daily chart that GBP/USD chopping its way down to the December trendline, forming a triangular pattern and meandering its 200-day eMA’s. Whilst this currently underscore cable’s directional indecisiveness, we should remember that volatility is bipolar, so we shouldn’t take our eye off the ball as GBP/USD could be building up for a more exciting move.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features