Weekly COT Report:

As of Tuesday 4th June:

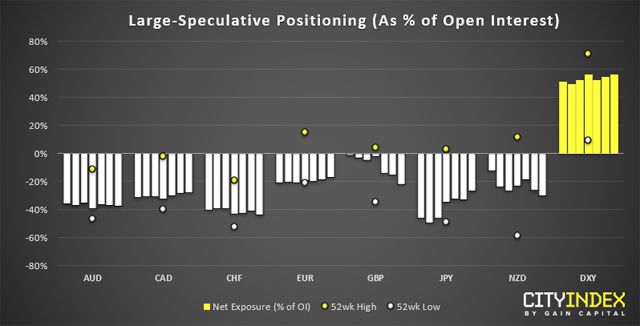

- Large speculators were net-long USD by $30.9 billion, -$0.36 billion from the prior week ($34.7 billion against G10 currencies

- JPY net-short exposure fell to a 3-month low

- Traders are their most bearish on GBP since mid-January

- GBP and JPY saw the largest volume change of -15.8k and 11.2k respectively

USD: Last week we suggested a top could be in place and, since the report, the US dollar index (DXY) has fallen to a 10-week low. Without access to long or short positioning from this data set, its trickier to be confident with an inflection point, but we can see that prices are now falling after several failed attempts to break higher which net-long exposure remains near historically high levels.

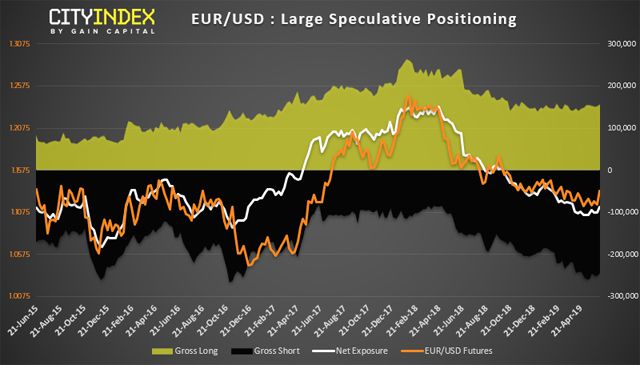

EUR: Traders are the least bearish on EUR futures since the end of March, and the net-short positioning has been moved by an increase in longs and decrease of shorts. With prices having found support at 1.1100 before springing higher, we suspect EUR/USD has further upside to come.

GBP: Despite net-positioning being its most bearish since mid-January, GBP/USD has rallied over 1.6% since its cycle low in the face of a falling US dollar. However, it’s worth noting that the increase of net-short exposure has been seen with rising short interest and falling long interest, which makes it a bearish read none the less. So, whilst it remains bullish against the USD, we prefer to remain short on GBP against other currencies.

As of Tuesday 4th June:

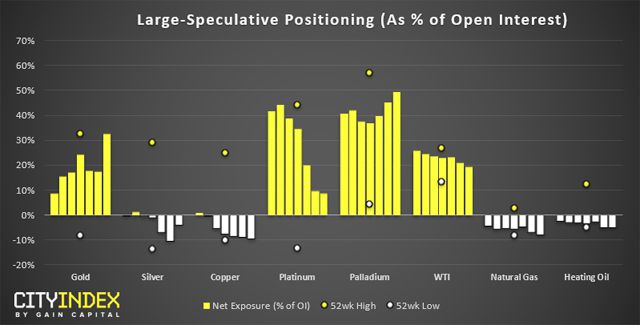

- Net-long exposure on gold was its most bullish since April 2018

- WTI traders reduced net-long exposure to its least bullish level since mid-March

- Traders are their most bearish on copper since mid-January

- Large speculators are their most bearish on natural gas since August 2018

Gold: The yellow metal saw net-long exposure increase by +69.4k contracts, its largest weekly change since December2017. Moreover, it was fuelled by an increase of +46k long contracts and reduction of -23.4k contracts to show confidence in the move. Over the near-term we continue to expect gold will remain beneath the 2019 highs but, after a retracement or sideways consolidation, could look to break to new highs.

WTI: Prices came close to testing $50 last week but its interesting to note the declines have been seen on falling longs and shorts, among large speculators. For a more compelling bearish move we’d prefer to see shorts increase and longs reduce exposure, so it appears traders are simply de-risking as opposed to taking a bearish view on WTI. For now, the trend points lower but appears expended to the downside, so a corrective rally seems plausible. However, until we see volumes increase in favour of the bull or bear camp, we’d prefer to remain nimble on WTI.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features