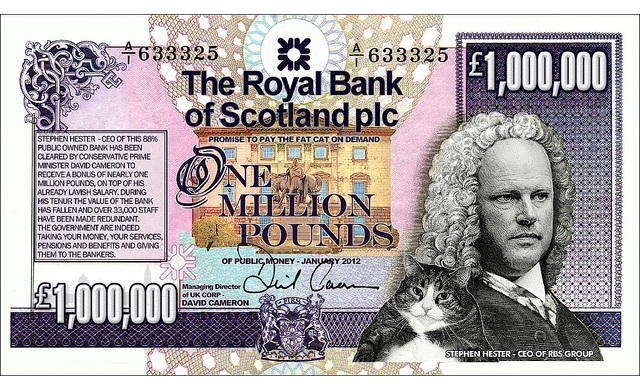

Bank chief Stephen Hester predicts that it will soon be ready for reprivatisation.

Stephen Hester, Chief Executive of the Royal Bank of Scotland, has told the BBC that bank will be ready for reprivatisation within the next two years.

Arguing that it is was the responsibility of the government, who currently has an 80% stake in RBS, to decide when the bank would be returned to private hands Mr Hester said it was his role to “deliver an RBS that other investor want to own shares in so the government has the option to sell”.

Mr Hester stated that at present the “clean-up of RBS is entering its last phases” and that Privatisation is now a light coming down the tunnel”.

The bank has seen losses rise considerably, with a reported a pre-tax loss of £5.17bn in 2012 compared to one of £766m the previous year.

Commenting on the losses the bank claimed that during 2012 it had tried to “put right past mistakes”.

In a statement to shareholders the Group Chairman, Philip Hampton, addressed the bank’s recent failings saying that during 2012 that it became “painfully clear” that some “employees had behaved in ways that do not represent the values of RBS. Their misconduct casts a shadow across our progress and the good work of many thousands in the Group.

“I have already spoken about the behaviour of some people in RBS in making LIBOR submissions. It was wrong. The RBS Board has acknowledged that there were serious shortcomings in our risk and control systems” Mr Hampton added.

Citing the efforts made to repair the bank from the damage of the recent financial crisis Stephen Hester stated to shareholders that the “physical weaknesses uncovered by the financial crisis – of leverage, risk concentration and business stretch – are close to being fixed. RBS’s total assets have already been reduced by £906 billion from their peak in 2008 – more than any other entity worldwide has achieved.

The principles behind this strategy are sound and working. But it will continue to evolve. A much slower economic recovery and tougher set of regulatory and policy pressures need to be absorbed. We have done this with more emphasis on customer service, balance sheet conservatism and while asking staff to do more with less during a period of significant change. Our business ambitions have been trimmed as a necessary reaction”.

Hot Features

Hot Features