MOU with a Congolese Distributor for the Supply of Minimum 150,000MT of Fertiliser in the Democratic Republic of Congo

African Potash, the AIM listed exploration company focused on sub-Saharan potash assets and the vertical integration of fertiliser operations, has entered into a memorandum of understanding with a local Congolese distributor with a view to supplying in excess of 150,000MT of fertiliser into the Democratic Republic of Congo.

Highlights:

· Fourth fertiliser supply agreement to be established pursuant the framework of the landmark trading agreement with COMESA announced on 4 August 2015 (the “COMESA Trading MOU”)

· Under the Trading MOU African Potash will supply 150,000MT of fertiliser into the Democratic Republic of Congo

· African Potash will utilise its network to source, deliver and finance supply transaction

· Trading MOU is in line with African Potash’s strategy to create a vertically integrated fertiliser business (comprising mining, production and distribution of fertiliser)

· Further agreements pursuant to the COMESA Trading MOU are being negotiated

· Further details of the Trading MOU are set out below

COMESA will receive a commission fee of between 5-7.5% from sales made pursuant to the Trading MOU and will, amongst other matters, use its best endeavours to assist on any government related issues in COMESA member states relating to the implementation of the Trading MOU and generally assist and support the implementation of the Trading MOU. At present DAP fertiliser is trading at a price of approximately US$470/MT and Urea at approximately US$273/MT; based on these prices, it is expected that the Company will be able to generate net profit of 5-15%/MT on each transaction under the Trading MOU.

The Trading MOU, which will lead to supply to a Congolese distributor, is being implemented as a result of the COMESA Trading MOU, pursuant to which African Potash and Mask Africa Crowd Farm Fund Limited agreed to supply and deliver at least 500,000MT of fertilisers to off-takers identified and introduced by COMESA, during an initial 3-year period (subject to a mutual renewal term of 10 years).

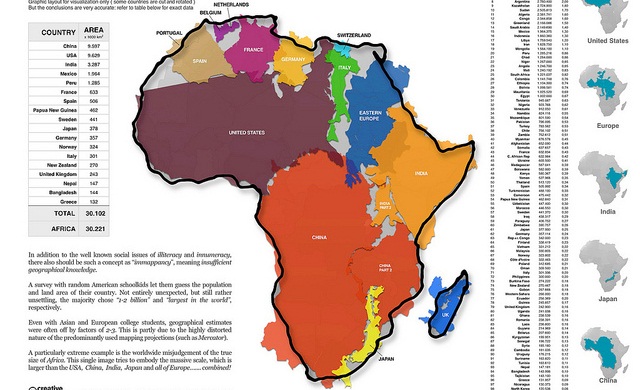

African Potash Executive Chairman Chris Cleverly said, “No region of the world has been able to expand agricultural growth rates, and thus tackle hunger, without increasing fertilizer use. Despite economic growth rates of 8.9% in 2014, according to World Bank figures the Democratic Republic of Congo currently uses only 1kg of fertiliser per hectare of arable land whereas India uses 16kg per hectare and the United Kingdom uses 234kg per hectare.”

Hot Features

Hot Features