UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) November 25, 2024

AIM

IMMUNOTECH INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-27072 |

|

52-0845822 |

| (state

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2117

SW Highway 484, Ocala FL |

|

34473 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (352)

448-7797

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

AIM |

|

NYSE

American |

Item

7.01 Regulation FD Disclosure.

On

November 27, 2024, AIM ImmunoTech Inc. (the “Company”) issued a press release regarding the establishment of a Cash

Conservation Plan, as described in Item 8.01 hereto. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated

by reference in this Item 7.01.

The

information furnished in this Item 7.01, including Exhibit 99.1, is being furnished, and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Item

8.01 Other Events.

On

November 25, 2024, the Compensation Committee (the “Committee”) of the Company’s Board of Directors (the “Board”)

established a cash conservation plan (the “Cash Conservation Plan”). Pursuant to the Cash Conservation Plan, the Company’s

independent directors will receive 100% of their Board compensation in shares of the Company’s common stock, effective immediately.

They will not receive any director compensation in cash. This does not apply to Mr. Equels because he is not an independent director

and he does not receive any compensation for serving as a director. In lieu of cash payments, each independent director will receive

twice-a-month stock grants at a valuation equal to the closing price of the shares of the Company’s common stock on the last trading

day before such grants are made. The Cash Conservation Plan will stay in effect for as long as the Committee determines, in its sole

discretion, consistent with the compensation policies of the Company.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits are filed herewith:

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AIM ImmunoTech Inc. |

| |

|

|

| Date: November 27, 2024 |

By |

/s/ Thomas

K. Equels |

| |

|

Thomas K. Equels, CEO |

Exhibit

99.1

AIM

ImmunoTech Announces Cash Conservation Plan

Independent

Board Members to Receive 100% of Director Compensation in AIM Stock

Follows

Previously Disclosed Amendments to Executive Employment Agreements to Reduce Cash Component of Compensation for CEO and COO

Board

and Management are Deeply Aligned with All AIM Shareholders and Remain Committed to Unlocking the Full Potential of Ampligen

OCALA,

Fla., November 27, 2024 — AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM” or the “Company”)

today announced that the Compensation Committee of the Company’s Board of Directors (the “Board”) has established a

cash conservation plan (the “Cash Conservation Plan”). The Cash Conservation Plan is a key part of the Board and management

team’s efforts to bolster the Company’s ability to maintain its momentum in achieving key clinical milestones in areas with

critical unmet needs – which we believe will ultimately create increased shareholder value.

The

first steps of the Cash Conservation Plan encompass the following:

| ● | Effective

immediately, AIM’s independent directors will receive 100% of their Board compensation

in shares of the Company’s common stock. They will not receive any director compensation

in cash. In lieu of cash payments, each independent director will receive twice a month stock

grants, at a valuation equal to the closing price of AIM shares on the last trading day before

such grants are made. |

| | | |

| ● | As

previously disclosed, AIM Executive Vice Chairman of the Board, CEO & President Thomas

K. Equels and Chief Operating Officer Peter W. Rodino agreed to amend their employment agreements,

effective as of September 11, 2024, to reduce the cash portion of their base salaries and

receive shares of AIM stock equal to the value of those reductions. The amount of reduced

cash compensation is $200,000 for Mr. Equels and $50,000 for Mr. Rodino. Mr. Equels will

continue to receive no additional compensation for his Board service. More details are available

in the Company’s Quarterly Report on Form 10-Q for the period ended June 30,

2024. |

Notably,

Mr. Equels purchased 361,458 of the Company’s shares between November 2023 and November 2024 (231,458 via the Employee & Director

Stock Purchase Plan that allows executives to put cash back into the Company, and 130,000 on the open market, with the most recent purchase

being 20,000 shares on November 21, 2024). None of the group of activist investors’ (collectively, the “Activist Group”)

nominees appear to have purchased AIM stock in all of 2024.

Dr.

William M. Mitchell, Chairman of the Board, stated:

“The

Board is unanimous in its strong belief in Ampligen’s significant potential to help patients with unmet lethal medical needs –

especially in high value indications – and its ability to thereby deliver enhanced value for all shareholders. By implementing

the Cash Conservation Plan, the Board and management are further aligning ourselves with all shareholders and helping to ensure the Company

can achieve its full potential.

There

is no doubt that many shareholders have endured declines in the value of their investment, but it is imperative to recognize that as

a research and development company, our primary way to deliver significant value for all shareholders is to commercialize Ampligen to

help the most patients possible. That is why we remain focused on maintaining sufficient runway to advance our clinical pipeline, especially

in oncology, which we believe will best position the Company for long-term value creation.”

AIM

will continue to share additional components of its Cash Conservation Plan going forward.

***

AIM

also encourages shareholders to vote FOR the Board’s incumbent candidates – Stewart L. Appelrouth, Nancy

K. Bryan, Thomas K. Equels and Dr. William M. Mitchell – in connection with the upcoming 2024 Annual Meeting

of Stockholders (the “Annual Meeting”), presently scheduled for December 17, 2024, on the WHITE universal proxy

card.

For

more information on how to vote, visit: www.SafeguardAIM.com.

About

AIM ImmunoTech Inc.

AIM

ImmunoTech Inc. is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers,

immune disorders and viral diseases, including COVID-19. The Company’s lead product is a first-in-class investigational drug called

Ampligen® (rintatolimod), a dsRNA and highly selective TLR3 agonist immuno-modulator with broad spectrum activity in clinical

trials for globally important cancers, viral diseases and disorders of the immune system.

For

more information, please visit aimimmuno.com and connect with the Company on X, LinkedIn, and Facebook.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”).

Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “continue,”

“believe,” “potential,” “upcoming” and other variations thereon and similar expressions (as well

as other words or expressions referencing future events or circumstances) are intended to identify forward-looking statements. Many of

these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical success seen to

date does not guarantee that Ampligen will be approved as a treatment or therapy for any diseases or conditions. The Company urges investors

to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and any risk factors or cautionary

statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed with the U.S. Securities and

Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. Among other things, for those statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the PSLRA. The Company does not undertake to update any of these forward-looking statements

to reflect events or circumstances that occur after the date hereof.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Annual Meeting. The Company filed its definitive proxy statement (the “Definitive Proxy Statement”)

and a WHITE universal proxy card with the SEC on November 4, 2024 in connection with such solicitation of proxies from the Company’s

stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING WHITE UNIVERSAL

PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

ANNUAL MEETING. The Definitive Proxy Statement contains information regarding the identity of the participants, and their direct

and indirect interests, by security holdings or otherwise, in the Company’s securities and can be found in the section titled “Principal

Stockholders” of the Definitive Proxy Statement and available here. Information regarding subsequent changes to their holdings

of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website

available here or through the SEC’s website at www.sec.gov. Stockholders will be able to obtain the Definitive Proxy

Statement, any amendments or supplements thereto and other documents filed by the Company with the SEC at no charge at the SEC’s

website at www.sec.gov. Copies will also be available at no charge at the Company’s website at https://aimimmuno.com/sec-filings/.

Investor

Contact:

JTC

Team, LLC

Jenene

Thomas

908-824-0775

AIM@jtcir.com

Media

Contact:

Longacre

Square Partners

Joe

Germani / Miller Winston

AIM@longacresquare.com

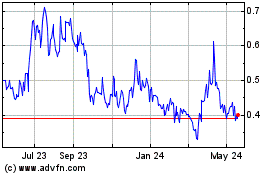

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

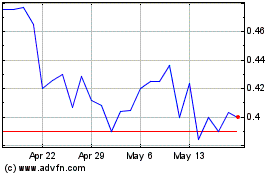

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Nov 2023 to Nov 2024