UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under § 240.14a-12 |

AIM

ImmunoTech Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

November 25, 2024, AIM ImmunoTech Inc. (the “Company”) issued a press release, a copy of which is attached hereto as Exhibit

1. Additionally, on November 25, 2024, the Company posted updates to its website, www.SafeguardAim.com, including an updated timeline

of events detailing significant contacts between the Company and members of the dissident group. Excerpts and screenshots of such updates

are attached hereto as Exhibit 2. Also on November 25, 2024, the Company made the following update to its investor presentation originally

issued on November 22, 2024, a screenshot of which is attached hereto as Exhibit 3. Also on November 25, 2024, the Company issued the

following materials, copies of which are attached hereto as Exhibit 4.

Forward

Looking Statements

The

materials attached contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). Words such as “may,” “will,” “expect,” “plan,” “anticipate,”

“continue,” “believe,” “potential,” “upcoming” and other variations thereon and similar

expressions (as well as other words or expressions referencing future events or circumstances) are intended to identify forward-looking

statements. Many of these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical

success seen to date does not guarantee that Ampligen will be approved as a therapy for endometriosis or ovarian cancer. The Company

urges investors to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and any risk

factors or cautionary statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed with the

U.S. Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of the materials attached hereto. Among other things, for those statements, the Company claims

the protection of the safe harbor for forward-looking statements contained in the PSLRA. The Company does not undertake to update any

of these forward-looking statements to reflect events or circumstances that occur after the date hereof.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Company

filed its definitive proxy statement (the “Definitive Proxy Statement”) and a WHITE universal proxy card with

the SEC on November 4, 2024 in connection with such solicitation of proxies from the Company’s stockholders. STOCKHOLDERS OF

THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND ALL OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The

Definitive Proxy Statement contains information regarding the identity of the participants, and their direct and indirect interests,

by security holdings or otherwise, in the Company’s securities and can be found in the section titled “Principal Stockholders”

of the Definitive Proxy Statement and available here. Information regarding subsequent changes to their holdings of the Company’s

securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website available here

or through the SEC’s website at www.sec.gov. Stockholders will be able to obtain the Definitive Proxy Statement, any amendments

or supplements thereto and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov.

Copies will also be available at no charge at the Company’s website at https://aimimmuno.com/sec-filings/.

Exhibit

1

AIM

ImmunoTech Issues Presentation Detailing Case for Re-Electing Current Directors to Oversee Continued Momentum and Drive Strategy to Create

Long-Term Value for Patients and Shareholders

Highlights

How Positive Data in AIM’s Clinical Pipeline and Big Pharma Partnerships are Positioning the Company for Commercialization Opportunities

in High-Value Indications Including Pancreatic Cancer

Warns

Shareholders of Its Belief that the Activist Group and Its Nominees Have a Self-Interested Agenda and Could Put AIM’s Clinical

Progress at Risk

Urges

Shareholders to Safeguard AIM by Voting “FOR” ALL Four of the Board’s Incumbent Candidates and Discarding Any Proxy

Materials from the Activist Group

Shareholders

Can View and Download the Presentation Here

OCALA,

Fla., November 25, 2024 — AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM” or the “Company”) today issued

a presentation in connection with its upcoming 2024 Annual Meeting of Stockholders the (“Annual Meeting”), presently

scheduled for December 17, 2024.

Highlights

of the presentation include the following:

| ● | AIM

is executing on its strategy to create long-term value for patients and shareholders

by driving clinical development programs in areas with critical unmet needs, especially in

the high-value pancreatic cancer space. |

| ● | AIM’s

clinical pipeline has significant momentum and is laying the groundwork for commercialization

opportunities by delivering exciting data across clinical trials, including in two ongoing

studies with AstraZeneca and Merck. These commercialization opportunities are what can drive

substantial value creation. |

| ● | If

elected, the Activist Group intends to seek over $5 million from AIM to pay for its

previous takeover attempts and litigation against the Company that the Activist Group lost,

in addition to any expenses incurred in connection with its solicitation for this year’s

Annual Meeting. The Activist Group disclosed that it does not intend to put this personal

reimbursement to a shareholder vote. |

| ● | Despite

AIM’s best attempts at a constructive settlement that would put two of the Activist

Group’s nominees on the Board, the Activist Group has continued to insist it receive

upwards of $8 million to make all litigants whole in connection with certain litigation

as part of any resolution – this represents more than 50% of AIM’s current

market capitalization. |

| ● | The

Activist Group has indicated it would likely appoint Robert Chioini as interim CEO while the Board runs a succession process should

its nominees gain control of the Board. Mr. Chioini was fired as CEO of Rockwell Medical in 2018 because of his “sustained

mismanagement” of the company and “blatant disregard for shareholder concerns,” according to

a Rockwell Medical spokesperson. 1 Following his termination, Mr. Chioini “refuse[d] to accept the

decision” and, without authorization, filed a Current Report on Form 8-K on the company’s behalf “making

various assertions regarding the five independent directors who voted in favor of Mr. Chioini’s

removal.” 2 This behavior indicates, in our view, that Mr. Chioini is unfit to serve as a public company

director – let alone CEO. |

AIM

encourages shareholders to review its presentation and vote FOR the Board’s incumbent candidates – Stewart L. Appelrouth,

Nancy K. Bryan, Thomas K. Equels and Dr. William M. Mitchell – on the WHITE universal proxy

card.

For

more information on how to vote, visit: www.SafeguardAIM.com.

WE

URGE YOU TO COMPLETE, SIGN, DATE AND RETURN THE WHITE UNIVERSAL PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED,

OR VOTE BY INTERNET AS INSTRUCTED ON THE WHITE UNIVERSAL PROXY CARD, WHETHER OR NOT YOU PLAN TO VIRTUALLY ATTEND THE ANNUAL MEETING.

THE

BOARD RECOMMENDS A VOTE “FOR” ALL OF OUR BOARD’S CANDIDATES (STEWART L. APPELROUTH, NANCY K. BRYAN, THOMAS K. EQUELS

AND DR. WILLIAM M. MITCHELL) ON PROPOSAL 1 USING THE WHITE UNIVERSAL PROXY CARD.

About

AIM ImmunoTech Inc.

AIM

ImmunoTech Inc. is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers,

immune disorders and viral diseases, including COVID-19. The Company’s lead product is a first-in-class investigational drug called

Ampligen® (rintatolimod), a dsRNA and highly selective TLR3 agonist immuno-modulator with broad spectrum activity in clinical

trials for globally important cancers, viral diseases and disorders of the immune system.

For

more information, please visit aimimmuno.com and connect with the Company on X, LinkedIn, and Facebook.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”).

Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “continue,”

“believe,” “potential,” “upcoming” and other variations thereon and similar expressions (as well

as other words or expressions referencing future events or circumstances) are intended to identify forward-looking statements. Many of

these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical success seen to

date does not guarantee that Ampligen will be approved as a treatment or therapy for any diseases or conditions. The Company urges investors

to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and any risk factors or cautionary

statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed with the U.S. Securities and

Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. Among other things, for those statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the PSLRA. The Company does not undertake to update any of these forward-looking statements

to reflect events or circumstances that occur after the date hereof.

1 See Modern Healthcare, Former pharma executives sue over firings (June

18, 2018).

2 See Press

Release issued by Rockwell Medical on May 24, 2018, available at: https://www.prnewswire.com/news-releases/rockwell-medical-issues-statement-300654699.html.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Annual Meeting. The Company filed its definitive proxy statement (the “Definitive Proxy Statement”)

and a WHITE universal proxy card with the SEC on November 4, 2024 in connection with such solicitation of proxies from the Company’s

stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING WHITE UNIVERSAL

PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

ANNUAL MEETING. The Definitive Proxy Statement contains information regarding the identity of the participants, and their direct

and indirect interests, by security holdings or otherwise, in the Company’s securities and can be found in the section titled “Principal

Stockholders” of the Definitive Proxy Statement and available here. Information regarding subsequent changes to their holdings

of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website

available here or through the SEC’s website at www.sec.gov. Stockholders will be able to obtain the Definitive Proxy

Statement, any amendments or supplements thereto and other documents filed by the Company with the SEC at no charge at the SEC’s

website at www.sec.gov. Copies will also be available at no charge at the Company’s website at https://aimimmuno.com/sec-filings/.

Investor

Contact:

JTC

Team, LLC

Jenene

Thomas

908-824-0775

AIM@jtcir.com

Media

Contact:

Longacre

Square Partners

Joe

Germani / Miller Winston

AIM@longacresquare.com

Exhibit

2

On

October 8, 2024, representatives of Abrams, BakerHostetler and V&E held a telephonic meeting during which representatives of Abrams

and BakerHostetler rejected the September 30 Offer and presented a counter-proposal seeking to provide control of the Board to the dissident

group, pursuant to which (i) the Board would consist of Messrs. Kellner, Deutsch, Chioini and Sweeney along with one incumbent director

and (ii) the Company would make a payment, which totaled to several million dollars, to make all litigants whole in connection with certain

litigation (the “October 8 Offer”).

On

October 14, 2024, representatives of V&E emailed representatives of Abrams and BakerHostetler to inform the latter that the Company

rejected the October 8 Offer and presented a counter-proposal, pursuant to which (i) the Board would increase in size by two and appoint

Messrs. Kellner and Sweeney to fill such vacancies, (ii) the Company would not repay fees and expenses and (iii) Messrs. Kellner and

Sweeney would disassociate themselves publicly from Messrs. Chioini, Deutsch, Tudor and Xirinachs (the “October 14 Offer”).

On

October 15, 2024, the Company filed its preliminary proxy statement with the SEC in connection with the 2024 Annual Meeting.

On

October 17, 2024, representatives of BakerHostetler emailed representatives of V&E to convey that Mr. Kellner rejected the October

14 Offer and requested a call between representatives of BakerHostetler and Abrams, representatives of V&E, as well as Messrs. Equels

and Kellner, to further discuss potential alternatives to resolve the proxy contest.

On

October 18, 2024, the dissident group filed their preliminary proxy statement with the SEC in connection with the 2024 Annual Meeting.

Also

on October 18, 2024, representatives of V&E emailed representatives of Abrams and BakerHostetler to inform the latter of the Company’s

openness to discussing a potential counter-proposal in response to the October 14 Offer. Representatives of V&E also noted the Company’s

willingness to arrange a call between representatives of BakerHostetler and Abrams, representatives of V&E, as well as Messrs. Equels

and Kellner once a counter-proposal has been presented in response to the October 14 Offer.

On

October 25, 2024, representatives of BakerHostetler emailed representatives of V&E to convey that Mr. Kellner did not have a counter-proposal

to present in response to the October 14 Offer and reiterated the proposed terms under the October 8 Offer as Mr. Kellner’s offer.

On

October 29, 2024, representatives of V&E emailed representatives of Abrams and BakerHostetler to request a call between representatives

of BakerHostetler and Abrams and representatives of V&E, to discuss the issues raised in the October 25, 2024 email from representatives

of BakerHostetler.

On

October 30, 2024, the dissident group filed Amendment No. 1 to their preliminary proxy statement with the SEC in connection with the

2024 Annual Meeting.

Also

on October 30, 2024, the Company filed Amendment No. 1 to its preliminary proxy statement with the SEC in connection with the 2024 Annual

Meeting.

On

November 1, 2024, representatives of Abrams, BakerHostetler and V&E held a telephonic meeting during which representatives of V&E

stated that there was likely flexibility on the number of directors that can be added to the Board in a settlement so long as there was

balance in the boardroom.

On

November 4, 2024, the Company filed its definitive proxy statement with the SEC in connection with the 2024 Annual Meeting.

Also

on November 4, 2024, representatives of Abrams, BakerHostetler and V&E held a telephonic meeting during which representatives of

BakerHostetler presented a counter-proposal, pursuant to which, among other things, (i) the Board would consist of either (a) Messrs.

Kellner, Chioini and Sweeney along with two incumbent directors and a new independent director chosen by the two incumbent directors

who would remain on the Board (who must be approved by Mr. Kellner), as well as an additional independent director to be chosen by Mr.

Kellner who possesses skills and expertise relevant to the Board or (b) Messrs. Kellner, Deutsch, Chioini and Sweeney along with one

incumbent director and (ii) the Company would make a payment, which totaled to several million dollars, to make all litigants whole in

connection with certain litigation (the “November 4 Offer”). Under the first option for Board composition,

representatives of Abrams and BakerHostetler stated there would be no guarantee of a position or compensation for Mr. Equels.

On

November 6, 2024, the dissident group filed their definitive proxy statement with the SEC in connection with the 2024 Annual Meeting.

On

November 12, 2024, representatives of Abrams, BakerHostetler and V&E held a telephonic meeting during which representatives of V&E

informed representatives of BakerHostetler and Abrams that the Company rejected the November 4 Offer and presented a counter-proposal,

pursuant to which (i) the Board would consist of four incumbent directors, Messrs. Kellner and Sweeney, and two independent directors

with relevant industry experience selected by Mr. Kellner (both of whom must be unaffiliated with Messrs. Chioini, Deutsch, Tudor and/or

Xirinachs). Representatives of V&E also informed representatives of BakerHostetler and Abrams of its belief that if the respective

parties could align on Board composition, the parties could then continue discussions regarding any potential monetary component to settlement

(the “November 12 Offer”).

On

November 15, 2024, representatives of BakerHostetler and Abrams emailed representatives of V&E to convey that Mr. Kellner rejected

the November 12 Offer and presented a counter-proposal, pursuant to which, among other things, (i) the Board would consist of Messrs.

Kellner, Sweeney, Chioini and Equels, and Ms. Bryan, as well as a new independent director with a background in oncology or other relevant

scientific background to be identified by an independent search firm, with no prior relationship to any of the current Board members

to be proposed by Mr. Equels and thereafter approved by Mr. Kellner, (ii) the Board’s Compensation Committee would consist of three

members, with at least two of Mr. Kellner’s nominees serving on the committee, (iii) Messrs. Equels and Rodino would be required

to surrender certain shares they received in August 2024, (iv) Mr. Equels must agree to terminate his employment contract and negotiate

a new contract for a one-year term (including an agreement that such changes to the Board do not trigger a change of control under Mr.

Equels’ employment contract) and (v) the Company would make a payment, which totaled to several million dollars, to make all litigants

whole in connection with certain litigation (the “November 15 Offer).

On

November 18, 2024, representatives of V&E emailed representatives of Abrams and BakerHostetler to inform the latter that the Company

was reviewing the November 15 Offer but that the new terms were a non-starter and proposed a potential meeting between Messrs. Equels

and Kellner to discuss Board composition and expense reimbursement. Between November 18 and the date hereof, representatives of Abrams,

BakerHostetler and V&E continued to engage in discussions regarding a potential settlement framework.

Exhibit 3

Exhibit 4

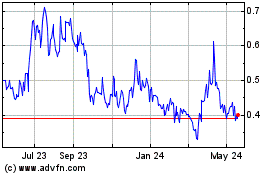

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

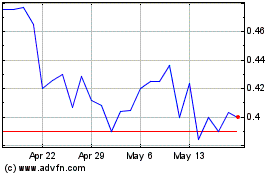

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Nov 2023 to Nov 2024