false

0000921114

0000921114

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 30, 2024

ARMATA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Washington |

|

001-37544 |

|

91-1549568 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 5005 McConnell Avenue, Los Angeles, California |

|

90066 |

| (Address of principal executive offices) |

|

(Zip Code) |

(310) 655-2928

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

ARMP |

|

NYSE American |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e)

On September 26,

2024, Armata Pharmaceuticals, Inc. (the “Company”) disclosed that it had reached an agreement with Richard Rychlik,

the Company’s Vice President, Corporate Controller, pursuant to which Mr. Rychlik’s employment would conclude effective

as of September 30, 2024.

In connection

with Mr. Rychlik’s separation, on September 30, 2024, the Company entered into a Confidential Separation and Release Agreement

with Mr. Rychlik (the “Separation Agreement”) pursuant to which, in consideration for Mr. Rychlik’s

general release of claims in favor of the Company and its affiliates, Mr. Rychlik will be entitled to the continued payment of his

base salary through December 31, 2024 and subsidized COBRA premiums for the same period. Mr. Rychlik’s receipt of the

foregoing payments and benefits is subject to his compliance with the Separation Agreement.

The foregoing summary of the Separation Agreement does not purport

to be complete and is subject to, and qualified in its entirety by, the full text of the Separation Agreement, a copy of which is attached

as Exhibit 10.1 to this report and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: October 3, 2024 |

Armata Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/ David D. House |

| |

Name: |

David D. House |

| |

Title: |

Senior Vice President, Finance and Principal Financial Officer |

Exhibit 10.1

CONFIDENTIAL SEPARATION AND RELEASE AGREEMENT

This Confidential Separation

and Release Agreement (this “Agreement”), originally delivered September 24, 2024, confirms the following

understandings and agreements between Armata Pharmaceuticals, Inc. (the “Company”) and Richard Rychlik

(hereinafter referred to as “you” or “your”).

In consideration of the promises

set forth herein, you and the Company agree as follows:

1. Opportunity

for Review; Acceptance.

(a) You

have until October 16, 2024 (the “Review Period”), to review and consider this Agreement. To accept

this Agreement, and the terms and conditions contained herein, prior to the expiration of the Review Period (but in no event earlier

than the Separation Date (as defined below)), you must execute and date this Agreement where indicated below and return the executed

copy of this Agreement to Deborah Birx (the “Company Representative”), Chief Executive Officer, 5005 McConnell

Avenue, Los Angeles, California 90066, by email, or by a recognized national overnight courier service to the address specified above

or by other electronic copies (complying with the U.S. federal ESIGN Act of 2000 (e.g., DocuSign)). You acknowledge that,

to the extent there are changes made to the terms of this Agreement after the date hereof, whether they are material or immaterial, the

Review Period is not recommenced.

(b) Notwithstanding

anything contained herein to the contrary, this Agreement will not become effective or enforceable for a period of seven (7) calendar

days following the date of your execution of this Agreement (the “Revocation Period”), during which time

you may revoke your acceptance of this Agreement by notifying the Company Representative, in writing, as specified above. To be effective,

such revocation must be received by the Company Representative no later than 11:59 p.m. Pacific Time on the seventh (7th)

calendar day following your execution of this Agreement. Provided that this Agreement is executed during the Review Period and you do

not revoke it during the Revocation Period, the eighth (8th) calendar day following the date on which this Agreement is executed

and delivered to the Company Representative shall be its effective date (the “Effective Date”). In the

event that you fail to execute and deliver this Agreement prior to the expiration of the Review Period or, if you revoke this Agreement

during the Revocation Period, this Agreement will be null and void and of no effect, and neither you nor the Company nor any other member

of the Company Group (as defined below) will have any obligations hereunder.

2. Employment

Status; Accrued Benefits; Separation Benefits.

(a) Employment

Status. You acknowledge and agree that your employment with the Company and, to the extent applicable, any of its direct and indirect

parent(s), subsidiaries, and affiliates (collectively, with the Company, the “Company Group”), shall terminate

effective as of the close of business on September 30, 2024 (the “Separation Date”), and after the

Separation Date, you will not represent yourself as being an employee, officer, agent, or representative of the Company or any other member

of the Company Group. You hereby confirm your resignations from all offices, directorships, trusteeships, committee memberships and fiduciary

and other capacities held with, or on behalf of, the Company Group effective as of the Separation Date and your execution of this Agreement

will be deemed the grant by you to the officers of the Company of a limited power of attorney to sign in your name and on your behalf

any such documentation as may be required to be executed solely for the limited purposes of effectuating such resignations. You agree

that within five (5) business days following the Separation Date, you will update your accounts or profiles on any social media platform

(including, but not limited to, Facebook, X (formerly known as Twitter) or LinkedIn) to reflect that you are no longer actively employed

by or affiliated with the Company Group.

(b) Accrued

Benefits. The Separation Date shall be the termination date of your employment for purposes of participation in and coverage under

all employee benefit plans and programs or arrangements sponsored by or through the Company and any other member of the Company Group

in which you are eligible to participate, except as otherwise provided herein. Regardless of whether you sign this Agreement, you will

be paid for (i) all of your earned but unpaid salary through the Separation Date on the Separation Date, and (ii) any business

expenses incurred by you prior to the Separation Date and properly submitted in accordance with the Company’s policies and procedures

within ten (10) days following the Separation Date. In addition, if applicable, you will be entitled to continued medical and health

benefits under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), and additional information

concerning such benefits will be provided to you under separate cover following the Separation Date.

(c) Separation

Benefits. In consideration of your promises herein, and subject to your execution, delivery and non-revocation of this Agreement and

your continued compliance with this Agreement, the Company will provide you with (i) continued payment of your base salary (at the

rate currently in effect) through December 31, 2024, and (ii) subject to your timely election of COBRA continuation coverage,

continuation of your enrollment under the Company’s group health insurance plan as of the Separation Date during the period beginning

on the Separation Date and ending on December 31, 2024 (the “Health Continuation Expiration Date”), with

your contribution to such plan as if you were employed by the Company, such contributions to be paid by you in the same period (e.g.,

monthly, bi-weekly, etc.) as all other employees of the Company; provided, that the reduced contribution rate pursuant to this clause

(ii) shall cease earlier than the Health Continuation Expiration Date in the event that you become eligible to receive any group

health benefits from a subsequent employer (which such eligibility shall be promptly reported by you to the Company), or you are no longer

eligible to receive COBRA continuation coverage (collectively, (i) and (ii) being, the “Consideration”).

(d) Deferral

of Payments. Notwithstanding the foregoing, in the event that any amount would otherwise have been payable as a result of paragraph

2(c) above prior to the Effective Date, such amount shall not be paid until the first regularly scheduled payroll date that is at

least five (5) business days following the Effective Date.

(e) Full

Discharge. You acknowledge and agree that the payment(s) and other benefits provided pursuant to this paragraph 2 are in

full satisfaction and discharge of any and all liabilities and obligations of the Company or any other member of the Company Group to

you, monetarily, with respect to employee benefits or otherwise, including, but not limited to, any and all obligations, including, without

limitation, notice and severance obligations, arising under that certain employment agreement between you and the Company, dated August 31,

2023 (the “Employment Agreement”), any other alleged written or oral employment agreement, policy, plan

or procedure of the Company or any other member of the Company Group and/or any alleged understanding or arrangement between you and the

Company or any other member of the Company Group (other than claims for accrued and vested benefits under an employee benefit, insurance,

or pension or other retirement plan of the Company or any other member of the Company Group (excluding any severance or similar plan or

policy), subject to the terms and conditions of such plan(s)). You further acknowledge and agree that, as of the Separation Date, all

outstanding, unvested options and restricted stock units held by you will be forfeited and that any vested options are subject to forfeiture

to the extent not exercised during the ninety (90) days immediately following the Separation Date.

(f) Taxes.

The Company Group will withhold all applicable taxes, including, but not limited to, income, employment and social insurance taxes,

as shall be required by law, from the amounts and benefits provided hereunder, including, without limitation, the Consideration.

3. Release

and Waiver of Claims.

(a) As

used in this Agreement, the term “claims” will mean all claims, covenants, warranties, promises, undertakings,

actions, suits, causes of action, obligations, debts, accounts, attorneys’ fees, judgments, losses and liabilities, of whatsoever

kind or nature, in law, equity or otherwise.

(b) For

and in consideration of the payments and benefits described in paragraph 2 above, and other good and valuable consideration, you,

for and on behalf of yourself and your heirs, administrators, executors and assigns, effective as of the Effective Date, do fully and

forever release, remise and discharge each member of the Company Group (including any co-employer of any member of the Company Group)

and each of their successors and assigns, together with their respective current and former officers, directors, partners, members, stockholders

(including any management company of a member or stockholder), employees and agents (collectively, and with the Company, the “Company

Parties”) from any and all claims whatsoever up to the date you execute this Agreement which you had, may have had, or now

have against the Company Parties, whether known or unknown, for or by reason of any matter, cause or thing whatsoever, including any claim

arising out of or attributable to your employment or the termination of your employment with the Company or any member of the Company

Group, whether for tort, breach of express or implied contract, intentional infliction of emotional distress, wrongful termination, unjust

dismissal, violation of public policy, defamation, libel or slander, or under any federal, state or local law dealing with discrimination,

harassment or retaliation, and any other purported restriction on an employer’s right to terminate the employment of employees.

This release of claims includes, but is not limited to, all claims arising under Title VII of the Civil Rights Act of 1964, the Age Discrimination

in Employment Act of 1967, as amended (the “ADEA”), the Americans with Disabilities Act of 1990, the Civil

Rights Act of 1991, the Family and Medical Leave Act of 1993, the Equal Pay Act of 1963, the Worker Adjustment and Retraining Notification

Act of 1988 and the Employee Retirement Income Security Act of 1974 (excluding claims for accrued, vested benefits under any retirement,

pension or other employee benefit plan of the Company Parties (other than any severance or similar plan or policy)), each as may be amended

from time to time, and all other federal, state and local laws, the common law or constitution of any jurisdiction. You intend the release

contained herein to be a general release of any and all claims to the fullest extent permissible by law and for the provisions regarding

the release of claims against the Company Parties to be construed as broadly as possible, and hereby incorporate in this release similar

federal, state or other laws, all of which you also hereby expressly waive.

(c) You

understand and agree that claims or facts in addition to or different from those which are now known or believed by you to exist may hereafter

be discovered, but it is your intention to fully and forever release, remise and discharge all claims which you had, may have had, or

now have against the Company Parties, whether known or unknown, suspected or unsuspected, asserted or unasserted, contingent or noncontingent,

without regard to the subsequent discovery or existence of such additional or different facts. Without limiting the foregoing, by signing

this Agreement, you expressly waive and release any provision of law that purports to limit the scope of a general release, including

any and all rights and benefits under Section 1542 of the Civil Code of the State of California (or any analogous law of any other

state, to the extent applicable), which provides as follows:

“A GENERAL RELEASE DOES NOT EXTEND

TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE

AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.”

(d) You

acknowledge and agree that as of the date you execute this Agreement, you have no knowledge of any facts or circumstances that give rise

or could give rise to any claims under any of the laws listed in the preceding paragraphs.

(e) Notwithstanding

any provision of this Agreement to the contrary, by executing this Agreement, you are not releasing any claims relating to: (i) your

rights with respect to payment and benefits under this Agreement; (ii) your right to accrued, vested benefits due to terminated employees

under any employee benefit plan of the Company or any other member of the Company Group in which you participated (excluding any severance

or similar plan or policy), in accordance with the terms thereof (including your right to elect COBRA continuation coverage); (iii) any

claims that cannot be waived by law or that arise after the date you execute this Agreement; (iv) your right to indemnification,

advancement and reimbursement of legal fees and expenses, and directors and officers liability insurance, as provided by, and in accordance

with the terms of, applicable law, the Company’s by-laws or otherwise; (v) your rights as a stockholder or optionholder of

the Company; or (vi) your right to unemployment insurance benefits (application for which shall not be contested by the Company,

provided that the Company shall truthfully respond to any government inquiries concerning you).

(f) Notwithstanding

any provision of this Agreement to the contrary, nothing herein or in any Company policy or agreement prevents you, without notifying

the Company, from (i) speaking with law enforcement, your attorney, the attorney general, the U.S. Equal Employment Opportunity Commission

or any state or local division of human rights or fair employment agency; (ii) filing a charge or complaint with, participating in

an investigation or proceeding conducted by, or reporting possible violations of law or regulation to any government agency; (iii) participating

in a whistleblower program administered by the U.S. Securities and Exchange Commission or any other government agency; (iv) truthfully

testifying in a legal proceeding or responding to or complying with a subpoena, court order, or other legal process; (v) filing or

disclosing any facts necessary to receive unemployment insurance, Medicaid, or other public benefits to which you may be entitled; or

(vi) discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other

conduct that you have reason to believe is unlawful; provided, however, in each case, you agree to forgo any monetary benefit

from the filing of a charge or complaint with a government agency except pursuant to a whistleblower program or where your right to receive

such a monetary benefit is otherwise not waivable by law.

(g) You

acknowledge and agree that as of the date you execute this Agreement, you have reported all accidents, injuries or illnesses relating

to or arising from your employment with the Company or the Company Group and that you have not suffered any on-the-job injury or illness

for which you have not yet filed a claim.

(h) By

signing below, you represent and warrant to the Company that (i) prior to the date you execute this Agreement, you have provided

the Company with written disclosure of any unethical or illegal behavior and any material violations of the Company’s code of ethics

or other material policy, in each case, that you observed, suspected or became aware of during the course of your employment or, if no

such written disclosure was provided, that you have not observed, suspected or become aware of any such behavior or violations and (ii) you

have complied with all laws and Company policies in respect of your employment with the Company.

4. Knowing

and Voluntary Waiver. You expressly acknowledge and agree that you:

(a) are

able to read the language, and understand the meaning and effect, of this Agreement;

(b) have

no physical or mental impairment of any kind that has interfered with your ability to read and understand the meaning of this Agreement

or its terms, and that you are not acting under the influence of any medication, drug or chemical of any type in entering into this Agreement;

(c) are

specifically agreeing to the terms of the release contained in this Agreement because the Company has agreed to provide you the Consideration,

which the Company has agreed to provide because of your agreement to accept it in full settlement of all possible claims you might have

or ever had against the Company Parties, and because of your execution of this Agreement;

(d) acknowledge

that, but for your execution of this Agreement, you would not be entitled to the Consideration;

(e) had

or could have the entire Review Period in which to review and consider this Agreement, and that if you execute this Agreement prior to

the expiration of the Review Period, you have voluntarily and knowingly waived the remainder of the Review Period;

(f) understand

that, by entering into this Agreement, you do not waive rights or claims under the ADEA that may arise after the date you execute this

Agreement;

(g) have

not relied upon any representation or statement not set forth in this Agreement made by the Company Group or any of its representatives;

(h) are

hereby advised to consult with your attorney regarding the terms and effect of this Agreement; and

(i) have

signed this Agreement knowingly and voluntarily.

5. No

Suit. You represent and warrant that you have not previously filed and, except as otherwise provided in paragraph 3(f) and

to the maximum extent permitted by law, you agree that you will not file, a complaint, charge or lawsuit against any of the Company Parties

regarding any of the claims released herein. Except as otherwise provided in paragraph 3(f), if, notwithstanding this representation

and warranty, you have filed or file such a complaint, charge or lawsuit, you agree that you shall cause such complaint, charge or lawsuit

to be dismissed with prejudice and shall pay any and all costs required in obtaining dismissal of such complaint, charge or lawsuit, including,

without limitation, the attorneys’ fees of any of the Company Parties against whom you have filed such a complaint, charge or lawsuit.

6. No

Re-Employment. You hereby agree to waive any and all claims to re-employment with the Company or any of its direct or indirect parent(s) or

subsidiaries. You affirmatively agree not to seek further employment with the Company or any its direct or indirect parent(s) or

subsidiaries. You acknowledge that if you re-apply for or seek employment with the Company or any of its direct or indirect parent(s) or

subsidiaries, the refusal to hire you based on this provision will provide a complete defense to any claims arising from your attempt

to apply for employment.

7. Successors

and Assigns. The provisions hereof shall inure to the benefit of your heirs, executors, administrators, legal personal representatives

and assigns and shall be binding upon your heirs, executors, administrators, legal personal representatives and assigns.

8. Severability;

Third-Party Beneficiaries. If any provision of this Agreement shall be held by any court of competent jurisdiction to be illegal,

void or unenforceable, such provision shall be of no force and effect. The illegality or unenforceability of such provision, however,

shall have no effect upon and shall not impair the enforceability of any other provision of this Agreement. You acknowledge and agree

that each of the Company Parties shall be a third-party beneficiary to the releases set forth in paragraph 3 above, with full rights

to enforce this Agreement and the matters documented herein.

9. Cooperation.

(a) You

agree that you will provide reasonable cooperation to the Company and/or any other member of the Company Group and its or their respective

counsel in connection with any investigation, administrative proceeding or litigation relating to any matter that occurred during your

employment in which you were involved or of which you have knowledge. The Company agrees to reimburse you for reasonable out-of-pocket

expenses incurred by you at the request of the Company with respect to your compliance with this paragraph 9(a).

(b) Except

as otherwise provided in paragraph 3(f) above, you agree that, in the event you are subpoenaed by any person or entity (including,

but not limited to, any government agency) to give testimony or provide documents (in a deposition, court proceeding or otherwise) which

in any way relates to your employment by the Company and/or any other member of the Company Group, you will give prompt written notice

of such request to the Company Representative, in writing, as specified above (or the Company Representative’s successor or designee)

and will make no disclosure until the Company and/or the other member of the Company Group has had a reasonable opportunity to contest

the right of the requesting person or entity to such disclosure. The Company agrees to reimburse you for reasonable out-of-pocket expenses

incurred by you at the request of the Company with respect to your compliance with this paragraph 9(b).

10. Affirmation

of Continuing Obligations. You hereby acknowledge and agree that you have and will continue to comply with all of your ongoing obligations

to any member of the Company Group under any confidentiality, invention assignment, non-disparagement or similar agreement or arrangement

to which you are a party with any member of the Company Group, including, without limitation, the obligations set forth in that certain

Proprietary Information and Invention Assignment Agreement with the Company that was executed in connection with you commencing employment

with the Company (the “Restrictive Covenants”), which obligations are hereby incorporated into this Agreement

and shall survive the termination of your employment with the Company, and you hereby acknowledge, reaffirm and ratify your continuing

obligations to the Company Group pursuant to such agreements or arrangements. You further hereby acknowledge that your continued compliance

with these obligations is a condition of your receiving the Consideration described in paragraph 2 above.

11. Return

of Property. You agree that you will promptly return to the Company (or, if in electronic form and not unique, permanently delete),

and you will retain no copies in any form (including electronic) of, all property belonging to the Company and/or any other member of

the Company Group, including but not limited to all proprietary and/or confidential information and documents (including any copies thereof)

in any form (including email) belonging to the Company, cell phone, iPhone or other mobile device, keys, credit card, identification card

or badge, access card, employee handbook, laptop, computer or other office equipment, computer user name and password, disks, data files,

thumb drives, and/or voicemail code. If you discover after the Separation Date that you have retained any proprietary and/or confidential

information (including, without limitation, proprietary and/or confidential information contained in any electronic documents or email

systems in your possession or control), you agree immediately upon discovery to send an email to the Company Representative to inform

the Company of the nature and location of the proprietary and/or confidential information that you have retained so that the Company may

arrange to remove, recover, and/or collect such information. You further acknowledge and agree that the Company shall have no obligation

to provide the Consideration described in paragraph 2 above unless and until you have satisfied all your obligations pursuant to

this paragraph 11.

12. Non-Admission.

Nothing contained in this Agreement will be deemed or construed as an admission of wrongdoing or liability on the part of you or any member

of the Company Group. Accordingly, this Agreement is inadmissible except in an action to enforce it.

13. Entire

Agreement. This Agreement and the Restrictive Covenants constitute the entire understanding and agreement of the parties hereto regarding

the termination of your employment. This Agreement and the Restrictive Covenants supersede all prior negotiations, discussions, correspondence,

communications, understandings and agreements between the parties relating to the subject matter of this Agreement and the Restrictive

Covenants.

14. Attorneys’

Fees and Costs. You hereby acknowledge and agree that, except as provided in paragraph 16 (Arbitration), the Company Parties

are entitled to recover from you all reasonable attorneys’ fees and costs associated with their efforts to enforce this Agreement

or the Restrictive Covenants and/or to recover damages for a breach of this Agreement or the Restrictive Covenants by you, and/or which

are incurred by the Company Parties as a result of a breach of this Agreement or the Restrictive Covenants by you.

15. Governing

Law; Jurisdiction. EXCEPT WHERE PREEMPTED BY FEDERAL LAW, THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE

LAWS OF THE STATE OF CALIFORNIA, APPLICABLE TO AGREEMENTS MADE AND TO BE PERFORMED IN THAT STATE, WITHOUT REGARD TO CONFLICT OF LAWS RULES.

BY EXECUTION OF THIS AGREEMENT, EACH PARTY TO THIS AGREEMENT HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS

LOCATED IN THE STATE OF CALIFORNIA AND HEREBY WAIVES ANY RIGHT TO TRIAL BY JURY IN CONNECTION WITH ANY DISPUTE ARISING UNDER OR CONCERNING

THIS AGREEMENT.

16. Arbitration.

EXCEPT WHERE PREEMPTED BY FEDERAL LAW, ALL DISPUTES ARISING UNDER OR CONCERNING THIS AGREEMENT, EXCEPT CLAIMS FOR IMMEDIATE INJUNCTIVE

RELIEF AS REFERENCED BELOW, AS WELL AS ALL CLAIMS ARISING OUT OF YOUR EMPLOYMENT OR THE TERMINATION THEREOF, INCLUDING WITHOUT LIMITATION

ALL CLAIMS FOR PAYMENT OF WAGES, DISCRIMINATION, RETALIATION, AND ALL OTHER CLAIMS BASED ON ANY STATE, FEDERAL OR COMMON LAW WILL BE RESOLVED

THROUGH BINDING ARBITRATION BEFORE A SINGLE ARBITRATOR PURSUANT TO THE FEDERAL ARBITRATION ACT. THE ARBITRATION SHALL BE ADMINISTERED

BY JAMS, UNDER ITS THEN APPLICABLE RULES FOR EMPLOYMENT DISPUTES. IF JAMS CANNOT SERVE AS THE ARBITRATION ADMINISTRATOR, THEN THE

ARBITRATION WILL BE THROUGH THE AMERICAN ARBITRATION ASSOCIATION, UNDER ITS THEN APPLICABLE RULES FOR EMPLOYMENT DISPUTES. THE COMPANY

SHALL PAY ALL ARBITRATION FEES IN EXCESS OF THE ADMINISTRATIVE FEES THAT YOU WOULD BE REQUIRED TO PAY IF THE DISPUTE WERE DECIDED IN A

COURT OF LAW. THE EXCLUSIVE VENUE OF ANY SUCH ARBITRATION WILL BE LOS ANGELES, CALIFORNIA. THE NON-PREVAILING PARTY WILL PAY

THE REASONABLE ATTORNEYS’ FEES AND COSTS OF THE PREVAILING PARTY. THE ARBITRATOR SHALL HAVE AUTHORITY TO ISSUE EQUITABLE AND

LEGAL RELIEF, INCLUDING WITHOUT LIMITATION INJUNCTIVE RELIEF AND MONETARY DAMAGES, BUT THE ARBITRATOR MAY NOT CONSOLIDATE THE

CLAIMS OF MORE THAN ONE PERSON OR ENTITY, NOR MAY THE ARBITRATOR PRESIDE OVER ANY FORM OF REPRESENTATIVE OR CLASS PROCEEDING.

QUESTIONS OF WHETHER A CLAIM IS SUBJECT TO ARBITRATION UNDER THIS AGREEMENT SHALL BE DECIDED BY THE ARBITRATOR. ALL ARBITRATION

PROCEEDINGS SHALL BE CONFIDENTIAL. THIS ARBITRATION PROVISION DOES NOT PREVENT EITHER PARTY FROM SEEKING IMMEDIATE INJUNCTIVE RELIEF

IN COURT TO REMEDY A BREACH OR THREATENED BREACH OF THIS AGREEMENT.

17. Construction.

The section or paragraph headings or titles herein are for convenience of reference only and shall not be deemed a part of this Agreement.

The parties hereto acknowledge and agree that each party has reviewed and negotiated the terms and provisions of this Agreement and has

had the opportunity to contribute to its revision. Accordingly, the rule of construction to the effect that ambiguities are resolved

against the drafting party, including, but not limited to Section 1654 of the California Civil Code, shall not be employed in the

interpretation of this Agreement. Rather, the terms of this Agreement shall be construed in a reasonable manner to effect the intentions

of both parties hereto and not in favor or against either party.

18. Section 409A.

Payments made under this Agreement are intended to be exempt from, or comply with, Section 409A of the Internal Revenue Code of 1986,

as amended (“Section 409A”), and this Agreement will be interpreted to achieve this result. For purposes

of this Agreement, each payment in a series of payments hereunder shall be deemed to be a separate payment for purposes of Section 409A.

In no event is the Company responsible for any tax or penalty owed by you (other than for withholding obligations or other obligations

applicable to employers, if any, under Section 409A) with respect to payments under this Agreement.

19. Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which shall constitute one and the

same instrument, and electronically delivered copies of executed counterparts shall be deemed to be originals for all purposes.

* * *

IN WITNESS WHEREOF, the parties

hereto have executed this Agreement as of the date set forth below.

| |

armata

pharmaceuticals, inc. |

| |

|

| |

By: |

/s/ Deborah Birx |

| |

|

Deborah Birx, M.D. |

| |

|

Chief Executive Officer |

| |

|

| |

EMPLOYEE |

| |

|

| |

/s/ Richard Rychlik |

| |

Richard Rychlik |

| |

|

| |

Dated: Sept. 30, 2024 |

[Signature Page to R. Rychlik Confidential

Separation and Release Agreement]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

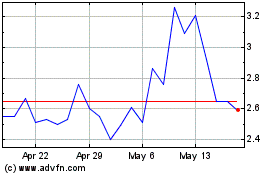

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

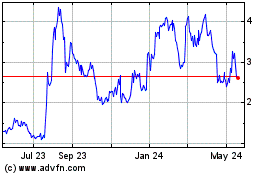

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Nov 2023 to Nov 2024