false

0000921114

0000921114

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 31, 2024

ARMATA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Washington |

|

001-37544 |

|

91-1549568 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 5005 McConnell Avenue, Los Angeles, California |

|

90066 |

| (Address of principal executive offices) |

|

(Zip Code) |

(310) 655-2928

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

ARMP |

|

NYSE American |

| |

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(b) and (c)

On July 31, 2024, Armata Pharmaceuticals, Inc.

(the “Company”) entered into an employment letter agreement (the “Agreement”) with David House,

pursuant to which he has agreed to serve as the Company’s Senior Vice President, Finance, effective August 16, 2024 (the “Effective

Date”). On August 15, 2024, the Company announced Mr. House’s appointment as Senior Vice President, Finance

in the press release furnished hereto as Exhibit 99.1. The Company delayed the filing of this Current Report on Form 8-K until

the date on which the Company made a public announcement of such appointment pursuant to the instruction to Item 5.02(c) of Form 8-K.

Before joining the Company, Mr. House, age

40, served as Corporate Controller and Vice President of Accounting at ZO Skin Health, Inc., a multi-channel physician-dispensed

skincare company, from October 2018 to May 2024. At ZO Skin Health, he led global accounting operations, managed financial reporting,

and played a crucial role in the company’s acquisition by Blackstone. He also established international subsidiaries and oversaw

financial integration for mergers and acquisitions. Mr. House’s experience includes similar financial leadership roles at Peregrine

Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, and Avid Bioservices, Inc. (CDMO), a contract development

and manufacturing organization where he served as Controller and was responsible for implementing ASC 606, managing technical accounting,

and conducting Securities and Exchange Commission (the “SEC”) reporting. His career also includes roles at Viant, Inc.

(DSP), Sourcing Solutions, LLC, and Apria Healthcare (APR), where he held various accounting and financial management positions. In the

early stages of his career, Mr. House worked as a Senior Auditor at Windes, a public accounting firm. There, he managed comprehensive

audits for public, private, and not-for-profit entities and contributed to SEC filings and internal control evaluations. Mr. House

holds a Bachelor of Arts in Business Administration with an Accounting concentration from California State University, Fullerton. He obtained

his California Certified Public Accountant license on January 5, 2011, which is currently inactive.

The Agreement with Mr. House, pursuant to

which he has agreed to serve as the Company’s Senior Vice President, Finance, provides for an initial annual base salary of $350,000,

with a target annual bonus opportunity equal to 40% of his base salary, with the actual bonus payable in respect of any fiscal year dependent

on actual performance as determined by the Company’s board of directors or compensation committee. As soon as practicable following

the Agreement’s effective date, Mr. House will be granted an option under the Company’s 2016 Equity Incentive Plan (the

“Plan”) to purchase 75,000 shares of the Company’s common stock, which will vest, conditioned upon his continuous

service, in equal annual installments on the first four anniversaries of the date of grant (the “Option”). The per

share exercise price of the Option will be the fair market value of the Company’s common stock on the date of grant in accordance

with the Plan. Mr. House will also be eligible to participate in the benefits programs made available by the Company to its senior

executives.

The Agreement provides that if the Company terminates

Mr. House’s employment other than for “cause” (as defined in the Agreement), or Mr. House terminates his employment

for “good reason” (as defined in the Agreement), then, subject to his execution of a release and compliance with his restrictive

covenants, he will be entitled to (i) a continuation of his then-current base salary for six months (or 12 months if such termination

occurs during the CIC Protection Period, which is defined as the period commencing one month prior to and ending 12 months following a

“change in control” (as defined in the Agreement)) and (ii) payment of COBRA premiums for up to 12 months if such termination

occurs during the CIC Protection Period. In addition, if such termination occurs during the CIC Protection Period, all unvested equity

awards held by Mr. House that are subject to time-based vesting requirements will vest in full in connection with such termination.

There is no arrangement

or understanding between Mr. House and any other persons pursuant to which Mr. House was selected as principal financial officer.

There are also no family relationships between Mr. House and any of the Company’s directors or executive officers, and he has

no direct or indirect material interest in any transaction that would be required to be disclosed under Item 404(a) of Regulation

S-K.

As of the Effective

Date, Mr. House will be the Company’s principal financial officer, a role that he will assume from the Company’s current

principal financial officer, Richard Rychlik, who will continue in his role as the Company’s Vice President, Corporate Controller.

The foregoing

description of the Agreement does not constitute a complete summary of the terms of the Agreement and is qualified in its entirety by

reference to the full text of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated

herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 15, 2024 |

Armata Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/ Deborah L. Birx |

| |

Name: |

Deborah L. Birx, M.D. |

| |

Title: |

Chief Executive Officer |

| |

|

(Principal Executive Officer) |

Exhibit 10.1

Armata Pharmaceuticals, Inc.

5005 McConnell Ave.

Los Angeles, CA 90066

July 29, 2024

Dear David:

We are pleased to confirm our offer of employment

with Armata Pharmaceuticals, Inc. (the “Company”) in the position of Senior Vice President, Finance, effective

16 August 2024, (the “Effective Date”) on the terms set forth in this letter agreement (the “Agreement”).

1. Position.

As Senior Vice President, Finance, you will be responsible for overseeing all the financial affairs of the Company and supervising the

Controller and finance team. You will report directly to the Chief Executive Officer of the

Company. You will be the Principal Financial Officer for SEC reporting. You agree to devote your full business time and attention to

your work for the Company. Except upon the prior written consent of the Board of the Directors of the Company (the “Board”),

you will not, during your employment with the Company, (i) accept or maintain any other employment, or (ii) engage, directly

or indirectly, in any other business activity (whether or not pursued for pecuniary advantage) that might interfere with your duties

and responsibilities as a Company employee or create a conflict of interest with the Company.

2. Salary.

Effective as of 16 August, 2024 your base salary will be paid at the annualized rate of $350,000 per year on the Company’s regular

payroll dates and subject to approved deductions and required withholdings. Your salary will be reviewed from time to time by the Board

or its compensation committee and may be adjusted in the sole discretion of the Board or its compensation committee.

3. Bonus.

You will be eligible to earn an annual performance bonus based on achievement of Company performance objectives to be established by the

Board or its compensation committee and provided to you. Your annual target performance bonus will initially be equal to 40% of your base

salary, although the amount of any payment will be dependent upon actual performance as determined by the Board or its compensation committee.

You must be employed by the Company through the last day of the fiscal year for which bonuses are paid in order to be eligible to receive

a bonus. Your annual performance bonus, if any, shall be paid to you on or before March 15 of the year following the year to which

it relates. Your annual target performance bonus percentage is subject to modification from time to time in the discretion of the Board

or its compensation committee.

4. Equity

Award. As soon as practicable following the Effective Date, you will be granted an option under

the Company’s 2016 Equity Incentive Plan (the “Plan”) to purchase 75,000 shares of the Company’s common

stock (the “Option”). The Option shall vest over time conditioned upon your continuous service to the Company in equal

annual installments on the first four anniversaries of the date of grant. The exercise price of the Option shall be the fair market value

of the Company’s common stock on the date of grant in accordance with the Plan and shall be subject to the terms and conditions

of the Plan, stock option grant notice and option agreement to be entered into between you and the Company.

5. Benefits.

You will be eligible to participate in the benefits made generally available by the Company to its senior executives, in accordance with

the benefit plans established by the Company, and as may be amended from time to time in the Company’s sole discretion.

6. At-Will

Employment. The Company is an “at-will” employer. Accordingly, either you or the

Company may terminate the employment relationship at any time, with or without advance notice, and with or without cause.

7. Termination.

Upon any termination of your employment, you will be deemed to have resigned, and you hereby resign, from all offices and directorships,

if any, then held by you with the Company or any subsidiary. In the event of termination of your employment with the Company, regardless

of the reasons for such termination, the Company shall pay your base salary and accrued but unused vacation up to and through the date

of termination, less applicable payroll and tax withholdings (the “Accrued Obligations”).

| 8. | Severance. You shall be eligible for the severance benefits described in this Section. |

a. In

the event (i) the Company terminates your employment without Cause (as defined below and other than due to your death or disability),

or (ii) you terminate your employment for Good Reason (as defined below), and provided in either case of (i) or (ii) such

termination or resignation constitutes a “separation from service” (as defined under Treasury Regulation Section 1.409A-1(h),

without regard to any alternative definition thereunder, a “Separation from Service”) (such termination or resignation,

an “Involuntary Termination”) and such Involuntary Termination does not occur during the CiC Protection Period (as

defined below), then, in addition to the Accrued Obligations, subject to your obligations in Section 8(c) below, you shall be

entitled to receive an amount equal to six (6) months of your then current base salary (ignoring any decrease in base salary that

forms the basis for Good Reason), less all applicable withholdings and deductions, paid on the schedule described in Section 8(c) below

(the “Severance Pay”).

b. In

the event that you experience an Involuntary Termination during the period (the “CiC Protection Period”) commencing

one (1) month prior to the consummation of the first Change in Control (as defined in Section 9 below) to occur following the

Effective Date and ending on the date that is twelve (12) months immediately following the consummation of such Change in Control, then,

in addition to the Accrued Obligations and subject to the obligations set forth in Section 8(c) below, you shall be entitled

to the following payments and benefits (the “CiC Severance Pay”): (i) an amount equal to twelve (12) months of

your then-current base salary, less all applicable withholdings and deductions, paid on the schedule described in Section 8(c), and

(ii) to the extent permitted by applicable law without any penalty to you or the Company and subject to your timely election of COBRA

continuation coverage under the Company’s group health plan, on the first regularly scheduled payroll date of each month for a period

of twelve (12) months (the “COBRA Period”), the Company will pay, directly to or on your behalf, an amount equal to

the monthly COBRA premium cost for your coverage thereunder; provided, that the payments pursuant to this clause (ii) shall

cease earlier than the expiration of the COBRA Period in the event that, during the COBRA Period, (x) you become eligible to receive

any health benefits, including through a spouse’s employer or (y) you are no longer eligible for benefits under COBRA.

c. The

Severance Pay or CiC Severance Pay, as applicable, is conditioned upon (i) your continuing to comply with your obligations under

your PIIA (as defined in Section 11) during the period of time in which you are receiving the Severance Pay or CiC Severance Pay,

as applicable; (ii) your delivering to the Company an executed separation agreement and general release of claims in favor of the

Company (the “Release”), in a form provided by the Company, within the time period set forth therein, which becomes

effective in accordance with its terms, which shall be no later than sixty (60) days following your Separation from Service. The Severance

Pay or CiC Severance Pay, as applicable, will be paid in equal installments on the Company’s regular payroll schedule over the period

outlined above following the date of your Separation from Service; provided, however, that no payments will be made prior to the sixtieth

(60th) day following your Separation from Service. On the sixtieth (60th) day following your Separation from Service,

the Company will pay you in a lump sum the amount of the Severance Pay that you would have received on or prior to such date under the

original schedule but for the delay while waiting for the sixtieth (60th) day, with the balance of the Severance Pay being

paid as originally scheduled.

d. “Cause”

for purposes of your Severance Pay means (i) your gross negligence or willful failure substantially to perform your duties and responsibilities

to the Company or deliberate violation of a Company policy; (ii) your commission of any act of fraud, embezzlement or dishonesty

against the Company or any other willful misconduct that has caused or is reasonably expected to result in material injury to the Company;

(iii) your unauthorized use or disclosure of any proprietary information or trade secrets of the Company or any other party to whom

you owe an obligation of nondisclosure as a result of your relationship with the Company; or (iv) your willful breach of any of your

obligations under any written agreement or covenant with the Company, including without limitation this Agreement and your PIIA (as defined

below).

e. “Good

Reason” for purposes of your Severance Pay means the occurrence at any time of any of the following without your prior written

consent: (i) a material reduction in your authority, duties or responsibilities (other than a mere change in title following any

merger or consolidation of the Company with another entity); (ii) a material reduction in your base salary; or (iii) any willful

failure or willful breach by the Company of any of its material obligations under this Agreement. For purposes of this subsection, no

act, or failure to act, on the Company’s part shall be deemed “willful” unless done, or omitted to be done, by the Company

not in good faith and without reasonable belief that the Company’s act, or failure to act, was in the best interest of the Company.

In order to terminate your employment under this Agreement for Good Reason, you must (1) provide written notice to the Company within

ninety (90) days of the first occurrence of the events described above, (2) allow the Company at least thirty (30) days from such

receipt of such written notice to cure such event, and (3) if such event is not reasonably cured within such period, resign from

all position you then hold with the Company effective not later than the one- hundred eightieth (180th) day after the initial

occurrence of such event.

9. Change

in Control Acceleration. Notwithstanding any other provision contained herein, if your Involuntary

Termination occurs during the CiC Protection Period, then the vesting of all of your outstanding equity awards (including the Option)

that are subject to time-based vesting requirements shall accelerate in full such that all such equity awards shall be deemed fully vested

as of the date of such Involuntary Termination (or Change in Control, if later). For purposes of this Agreement, the term “Change

in Control” shall have the meaning ascribed to such term in the Plan, except that Innoviva, Inc. and each of its majority-owned

subsidiaries and affiliates shall be considered Legacy Investors (as defined in the Plan) for purposes of determining whether or not a

Change in Control has occurred.

10. Taxes.

All amounts paid under this Agreement shall be paid less all applicable state and federal tax withholdings (if any) and any other withholdings

required by any applicable jurisdiction or authorized by you.

a. Section 409A.

The Severance Pay provided in this Agreement is intended to qualify for an exemption from application of Section 409A of the Internal

Revenue Code of 1986, as amended (the “Code”) and the regulations and other guidance thereunder and any state law of

similar effect (collectively “Section 409A”) or to comply with its requirements to the extent necessary to avoid

adverse personal tax consequences under Section 409A, and any ambiguities herein shall be interpreted accordingly. Each installment

of Severance Pay is a separate “payment” for purposes of Treasury Regulations Section 1.409A-2(b)(2)(i), and the Severance

Pay is intended to satisfy the exemptions from application of Section 409A provided under Treasury Regulations Sections 1.409A-1(b)(4),

1.409A-1(b)(5) and 1.409A-1(b)(9). However, if such exemptions are not available and you are, upon Separation from Service, a “specified

employee” for purposes of Section 409A, then, solely to the extent necessary to avoid adverse personal tax consequences under

Section 409A, the timing of the Severance Pay shall be delayed until the earlier of (i) six (6) months and one day after

your Separation from Service, or (ii) your death. Except to the minimum extent that payments must be delayed because you are a “specified

employee”, all amounts of Severance Pay will be paid as soon as practicable in accordance with the schedule provided herein and

in accordance with the Company’s normal payroll practices.

b. Section 280G.

If any payment or benefit you will or may receive from the Company or otherwise (a “280G Payment”) would (i) constitute

a “parachute payment” within the meaning of Section 280G of the Code, and (ii) but for this sentence, be subject

to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then any such 280G Payment pursuant

to this Agreement or otherwise (a “Payment”) shall be equal to the Reduced Amount. The “Reduced Amount”

shall be either (x) the largest portion of the Payment that would result in no portion of the Payment (after reduction) being subject

to the Excise Tax or (y) the largest portion, up to and including the total, of the Payment, whichever amount (i.e., the amount determined

by clause (x) or by clause (y)), after taking into account all applicable federal, state and local employment taxes, income taxes,

and the Excise Tax (all computed at the highest applicable marginal rate), results in your receipt, on an after-tax basis, of the greater

economic benefit notwithstanding that all or some portion of the Payment may be subject to the Excise Tax. If a reduction in a Payment

is required pursuant to the preceding sentence and the Reduced Amount is determined pursuant to clause (x) of the preceding sentence,

the reduction shall occur in the manner (the “Reduction Method”) that results in the greatest economic benefit for

you. If more than one method of reduction will result in the same economic benefit, the items so reduced will be reduced pro rata (the

“Pro Rata Reduction Method”).

Notwithstanding the foregoing,

if the Reduction Method or the Pro Rata Reduction Method would result in any portion of the Payment being subject to taxes pursuant to

Section 409A that would not otherwise be subject to taxes pursuant to Section 409A, then the Reduction Method and/or the Pro

Rata Reduction Method, as the case may be, shall be modified so as to avoid the imposition of taxes pursuant to Section 409A as follows:

(A) as a first priority, the modification shall preserve to the greatest extent possible, the greatest economic benefit for you as

determined on an after-tax basis; (B) as a second priority, Payments that are contingent on future events (e.g., being terminated

without Cause), shall be reduced (or eliminated) before Payments that are not contingent on future events; and (C) as a third priority,

Payments that are “deferred compensation” within the meaning of Section 409A shall be reduced (or eliminated) before

Payments that are not deferred compensation within the meaning of Section 409A.

Unless you and the Company

agree on an alternative accounting firm, the accounting firm engaged by the Company for general tax compliance purposes as of the day

prior to the effective date of the change of control transaction triggering the Payment shall perform the foregoing calculations. If the

accounting firm so engaged by the Company is serving as accountant or auditor for the individual, entity or group effecting the change

of control transaction, the Company shall appoint a nationally recognized accounting firm to make the determinations required hereunder.

The Company shall bear all expenses with respect to the determinations by such accounting firm required to be made hereunder. The Company

shall use commercially reasonable efforts to cause the accounting firm engaged to make the determinations hereunder to provide its calculations,

together with detailed supporting documentation, to you and the Company within fifteen (15) calendar days after the date on which your

right to a 280G Payment becomes reasonably likely to occur (if requested at that time by you or the Company) or such other time as requested

by you or the Company.

If you receive a Payment for

which the Reduced Amount was determined pursuant to clause (x) of the first paragraph of this Section 10(b) and the Internal

Revenue Service determines thereafter that some portion of the Payment is subject to the Excise Tax, you shall promptly return to the

Company a sufficient amount of the Payment (after reduction pursuant to clause (x) of the first paragraph of this this Section 10(b) so

that no portion of the remaining Payment is subject to the Excise Tax. For the avoidance of doubt, if the Reduced Amount was determined

pursuant to clause (y) in the first paragraph of this this Section 10(b), you shall have no obligation to return any portion

of the Payment pursuant to the preceding sentence.

11. Other.

As a condition of your commencement of employment hereunder, you must execute and deliver to the Company the Proprietary Information

and Invention Assignment Agreement delivered to you under separate cover (the “PIIA”), which (among other provisions)

prohibits any unauthorized use or disclosure of Company proprietary, confidential or trade secret information. The parties hereto acknowledge

and agree that this Agreement and the PIIA shall be considered separate contracts, and the PIIA will survive the termination of this

Agreement for any reason.

12. Entire

Agreement. This Agreement, together with your PIIA, sets forth our entire agreement and understanding

regarding the terms of your employment with the Company and supersedes any prior representations or agreements, whether written or oral.

This Agreement may not be modified in any way except in a writing signed by the Company’s Chief Executive Offer (or another duly

authorized officer of the Company) upon due authorization by the Board or its compensation committee and you. It shall be governed by

California law, without regard to principles of conflicts of laws.

(Signatures are on the following page)

IN WITNESS WHEREOF, the parties have executed this Agreement as of

the date set forth below.

Sincerely,

| /s/

Deborah Birx |

|

| Deborah

Birx, M.D. |

|

| Chief

Executive Officer |

|

ACCEPTED AND AGREED:

| /s/

David House |

|

7/31/24 |

| David

House |

|

|

| SVP,

Finance |

|

Date |

[Signature Page to D. House Employment

Agreement]

Exhibit 99.1

Armata Pharmaceuticals Announces Appointment

of Life Sciences Accounting and Finance Veteran David House as SVP of Finance and Principal Financial Officer

LOS ANGELES, Calif., August 15, 2024 -- Armata

Pharmaceuticals, Inc. (NYSE American: ARMP) (“Armata” or the “Company”), a biotechnology company

focused on the development of high-purity, pathogen-specific bacteriophage therapeutics for antibiotic-resistant and difficult-to-treat

bacterial infections, today announced the appointment of life sciences accounting and finance veteran David House as Senior Vice President,

Finance, effective August 16th. Armata’s Corporate Controller, Richard Rychlik, will retain the position of Controller.

“We are delighted to welcome David to the

Armata team,” stated Dr. Deborah Birx, Chief Executive Officer of Armata. “David’s extensive experience and track

record of serving in senior accounting and finance roles within both clinical and commercial stage life sciences companies will serve

us well as we continue to advance our two distinct programs – AP-PA02 and AP-SA02 – and prepare to initiate pivotal studies

next year. This is an exciting time at Armata, and the addition of David to our senior team helps ensure that we are best positioned to

achieve long-term success as we work to introduce an exciting new class of anti-infectives to treat serious drug-resistant bacterial infections.”

Before joining Armata, Mr. House served as

Corporate Controller and Vice President of Accounting at ZO Skin Health, Inc., a multi-channel physician-dispensed skincare company,

from October 2018 to May 2024. At ZO Skin Health, he led global accounting operations, managed financial reporting, and played

a crucial role in the company's acquisition by Blackstone. He also established international subsidiaries and oversaw financial integration

for mergers and acquisitions. Mr. House's experience includes similar financial leadership roles at Peregrine Pharmaceuticals, Inc.,

a clinical-stage biopharmaceutical company, and Avid Bioservices, Inc. (CDMO), a contract development and manufacturing organization

where he served as Controller and was responsible for implementing ASC 606, managing technical accounting, and conducting Securities and

Exchange Commission (the “SEC”) reporting.

Mr. House’s career also includes roles

at Viant, Inc. (DSP), Sourcing Solutions, LLC, and Apria Healthcare (APR), where he held various accounting and financial management

positions. In the early stages of his career, Mr. House worked as a Senior Auditor at Windes, a public accounting firm. There, he

managed comprehensive audits for public, private, and not-for-profit entities and contributed to SEC filings and internal control evaluations.

Mr. House holds a Bachelor of Arts in Business Administration with an Accounting concentration from California State University,

Fullerton. He obtained his California Certified Public Accountant license, which is currently inactive.

About Armata Pharmaceuticals, Inc.

Armata is a clinical-stage biotechnology company

focused on the development of pathogen-specific bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat

bacterial infections using its proprietary bacteriophage-based technology. Armata is developing and advancing a broad pipeline of natural

and synthetic phage candidates, including clinical candidates for Pseudomonas aeruginosa, Staphylococcus aureus, and other

pathogens. Armata is committed to advancing phage therapy with drug development expertise that spans bench to clinic including in-house

phage specific cGMP manufacturing.

Forward Looking Statements

This communication contains “forward-looking”

statements as defined by the Private Securities Litigation Reform Act of 1995. These statements relate to future events, results or to

Armata’s future financial performance and involve known and unknown risks, uncertainties and other factors which may cause Armata’s

actual results, performance or events to be materially different from any future results, performance or events expressed or implied by

the forward-looking statements. In some cases, you can identify these statements by terms such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of those terms,

and similar expressions. These forward-looking statements reflect management’s beliefs and views with respect to future events and

are based on estimates and assumptions as of the date of this communication and are subject to risks and uncertainties including risks

related to Armata’s development of bacteriophage-based therapies; ability to staff and maintain its production facilities under

fully compliant current Good Manufacturing Practices; ability to meet anticipated milestones in the development and testing of the relevant

product; ability to be a leader in the development of phage-based therapeutics; ability to achieve its vision, including improvements

through engineering and success of clinical trials; ability to successfully complete preclinical and clinical development of, and obtain

regulatory approval of its product candidates and commercialize any approved products on its expected timeframes or at all; and Armata’s

estimates regarding anticipated operating losses, capital requirements and needs for additional funds. Additional risks and uncertainties

relating to Armata and its business can be found under the caption “Risk Factors” and elsewhere in Armata’s filings

and reports with the SEC, including in Armata’s Annual Report on Form 10-K, filed with the SEC on March 21, 2024, and

in its subsequent filings with the SEC.

Armata expressly disclaims any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Armata’s

expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Media Contacts:

At Armata:

Pierre Kyme

Armata Pharmaceuticals, Inc.

ir@armatapharma.com

310-665-2928 x234

Investor Relations:

Joyce Allaire

LifeSci Advisors, LLC

jallaire@lifesciadvisors.com

212-915-2569

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

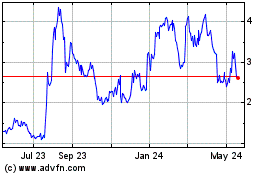

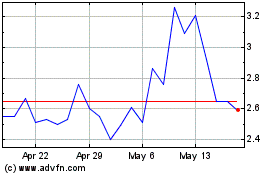

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Nov 2023 to Nov 2024