UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

|

Definitive

Proxy Statement |

| ☒ |

|

Definitive

Additional Materials |

| ☐ |

|

Soliciting

Material Pursuant to §240.14a-12 |

Better

Choice Company Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

|

| |

(1) |

Amount

previously paid: |

| |

|

|

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

| |

|

|

These

materials are important and require your immediate attention. They require the stockholders of Better Choice Company Inc. to make important

decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisor.

If you have any questions, you may contact Valter Pinto at KCSA Strategic Communications, the Company’s investor relations contact,

by telephone at 212-896-1254, or by email at valter@KCSA.com.

SUPPLEMENT

DATED MARCH 7, 2025 TO

PROXY STATEMENT DATED JANUARY 28, 2025

This

document is a supplement dated March 7, 2025 (the “Supplement”) to the proxy statement dated January 28, 2025 and first mailed

to stockholders of Better Choice Company Inc. (the “Company” or “Better Choice”) on or about January 28, 2025

(the “Proxy Statement”) in connection with a special meeting (as the same may be adjourned or postponed, the “Special

Meeting”) of common stockholders of the Company which was held on February 19, 2025 and which was adjourned, without conducting

any business, to March 21, 2025.

INTRODUCTION

AND EXPLANATORY NOTE

The

purpose of this Supplement is to supplement the Proxy Statement with additional information (the “Supplemental Disclosures”)

concerning the Arrangement. Except as described in this Supplement, the information provided in the Proxy Statement relating to the Arrangement

and the other proposals set forth therein continues to apply, and the information provided in the Proxy Statement is not amended, supplemented,

or otherwise modified. This Supplement and the documents referred to in this Supplement should be read in conjunction with the Proxy

Statement, the annexes and exhibits to the Proxy Statement, and the documents referred to in the Proxy Statement, each of which should

be read in its entirety. To the extent that information in this Supplement differs from, updates, or conflicts with information contained

in the Proxy Statement, the information in this Supplement supersedes the information in the Proxy Statement.

Capitalized

terms used herein, but not otherwise defined, shall have the meanings ascribed to such terms in the Proxy Statement.

SUPPLEMENTAL

DISCLOSURES

Choice

Transaction

On

March 7, 2025, Better Choice and SRx entered into a binding letter of intent with Choice Specialty Pharmacy Group (“Choice”),

pursuant to which the Combined Company agreed to purchase an option (the “Option”) to acquire all or substantially all of

the assets used in the business of Choice (the “Choice Transaction”). The purchase of the Option is intended to occur immediately

following the consummation of the Arrangement. The Combined Company shall pay $10.5 million (the “Option Price”) by the issuance

of shares of its common stock to Choice upon the purchase of the Option, and the remaining $17.5 million will be satisfied in cash or

a combination of cash and additional shares of common stock of the Combined Company for a total aggregate purchase price of $28.0 million

(the “Aggregate Purchase Price”).

The

Aggregate Purchase price is equal to approximately six times (6x) Choice’s 2024 unaudited adjusted EBITDA of approximately $4.67

million (a non-GAAP measure). The term of the Option begins on April 15, 2025 and expires on October 15, 2025. If the Combined Company

does not exercise the option to acquire Choice, nine-tenths of the shares issued for the option will be returned to the Combined Company

and the remaining one-tenth of the shares for the Option will remain with Choice.

Choice

is a specialty pharmacy enterprise operating in the Houston, Texas metropolitan area and comprised of eight (8) affiliated entities.

Choice focuses on high-cost, high-touch medication therapy for patients with complex disease states, which medications range from oral

to cutting edge injectable and biologic products. The disease states treated range from cancer, multiple sclerosis, and rheumatoid arthritis

to rare genetic conditions. Choice specializes in coordinating all of the processes to provide patients with complex, chronic and rare

health conditions optimal pharmaceutical care. Choice leads collaborative efforts to coordinate care with clinicians, healthcare professionals,

and payers while managing the patient’s treatment. In addition, Choice manages multiple therapies for patients if indicated.

SRx

Debt Conversion

On

or about March 3, 2025, SRx agreed with one of its largest suppliers of pharmaceutical products (“Supplier”) to convert CAD$4.0

million of accounts payable owed by SRx to Supplier into 875,000 common shares of SRx (the “Debt Conversion”). The value

of such shares is equal to approximately CAD$4.2 million, based on a good faith determination by SRx’s board, representing an approximately

5% premium. Upon the consummation of the Arrangement, such shares will be exchanged for shares of the Combined Company’s common

stock pursuant to the Arrangement Agreement.

Supplier

is a distributor of medicine and pharmaceuticals to retail pharmacies. The accounts payable being converted into SRx equity pursuant

to the Debt Conversion are trade accounts payable owing from purchases SRx has made through its pharmacies.

Pro

Forma Beneficial Ownership Information

The

following table sets forth information about the pro forma beneficial ownership of the Combined Company’s capital stock by (i)

each of its current directors, (ii) each of its named executive officers (iii) all its current directors and executive officers as a

group, and (iv) each person or group known by the Combined Company to own more than 5% of its common stock. The percentages reflect beneficial

ownership, as determined in accordance with the SEC’s rules, and are based on 38,028,995 shares of common stock issued and outstanding

at closing of the merger, on a pro forma basis, giving effect to the Arrangement, Choice Transaction, and the SRx Debt Conversion. Except

as noted below, the address for all beneficial owners in the table below is 12400 Race Track Road, Tampa, FL 33626:

| | |

| |

Shares Beneficially Owned | |

| Name of Beneficial Owner | |

| |

Number(1) | | |

% | |

| Named Executive Officers and Directors: | |

Title | |

| | | |

| | |

| | |

| |

| | | |

| | |

| Adesh Vora | |

Executive Chairman | |

| 17,285,117 | | |

| 45.5 | % |

| Kent Cunningham | |

Chief Executive Officer | |

| 22,727 | | |

| * | |

| Carolina Martinez | |

Chief Financial Officer | |

| 1,515 | | |

| * | |

| Dave Sohi | |

President | |

| 408,889 | | |

| 1.1 | % |

| Brock Clancy | |

President, SRx Canada | |

| 224,501 | | |

| 0.6 | % |

| Michael Young | |

Director, Compensation Committee Chair | |

| 52,795 | | |

| * | |

| Lionel F. Conacher | |

Director, Nominating and Governance Committee Chair | |

| 37,212 | | |

| * | |

| David White | |

Director, Audit Committee Chair | |

| 140,667 | | |

| * | |

| Simon Conway | |

Director | |

| - | | |

| * | |

| All executive officers and directors as a group (9 persons) | |

| |

| 18,173,423 | | |

| 47.8 | % |

| | |

| |

| | | |

| | |

| 5% Shareholders: | |

| |

| | | |

| | |

| (none) | |

| |

| | | |

| | |

*indicates

less than 0.5% owned

| (1) | In

calculating the number of shares beneficially owned by an individual or entity and the percentage

ownership of that individual or entity, shares underlying options, warrants or restricted

stock units held by that individual or entity that are either currently exercisable or exercisable

within 60 days from the date hereof are deemed outstanding. These shares, however, are not

deemed outstanding for the purpose of computing the percentage ownership of any other individual

or entity. Unless otherwise indicated and subject to community property laws where applicable,

the individuals and entities named in the table above have sole voting and investment power

with respect to all shares of our common stock shown as beneficially owned by them. |

Approval

of NYSE

The

consummation of the Arrangement is subject to certain closing conditions, including, among others, the approval of NYSE for initial listing

of the Combined Company. As a result of the Arrangement, the Combined Company will be deemed a “reverse merger company” by

NYSE and, as such, the Combined Company would be required by NYSE to meet the NYSE Initial Listing Standards at such time. If the Combined

Company does not meet such Initial Listing Standards, the Combined Company could be subject to immediate suspension and delisting proceedings

from NYSE. Better Choice and SRx are taking appropriate actions to allow the Combined Company to meet such standards as of immediately

following the consummation of the Arrangement. Better Choice and SRx cannot make any assurances that its actions and efforts will be

successful or that the Combined Company will meet the Initial Listing Standards as of immediately following the consummation of the Arrangement.

If the Combined Company does not meet the Initial Listing Standards, the Combined Company will be subject to immediate suspension of

trading in the common stock of the Combined Company and/or delisting proceedings following the consummation of the Arrangement.

If

the Combined Company does not meet the Initial Listing Standards, Better Choice and SRx may nevertheless decide to consummate the Arrangement.

If this should occur, the Combined Company will likely be delisted from NYSE and then may seek to list on another national exchange or

in the OTC Market. In the event that the Combined Company lists in the OTC Market rather than a national exchange, stockholders of the

Combined Company may face material adverse consequences, including, but not limited to, a lack of trading market for the Combined Company’s

common stock, reduced liquidity and market price of the Combined Company’s common stock, decreased analyst coverage of Combined

Company’s common stock, and an inability for the Combined Company to obtain any additional financing that it may need to fund its

operations.

Amendment

No. 3 to Arrangement Agreement and Amendment No. 2 to Plan of Arrangement

On

February 25, 2025, Better Choice and SRx entered into an Amendment No. 3 to the Arrangement Agreement and Amendment No. 2 to the Plan

of Arrangement, which is attached hereto as Annex A. Pursuant to such amendment, the Arrangement Agreement was amended to change the

Outside Date from February 28, 2025 to April 15, 2025. Further, the Plan of Arrangement was amended to (1) to change the name of Amalco

from “SRx Health Solutions Inc.” to “SRx Health Solutions (Canada) Inc.”; and (2) to clarify that the references

to “merge” and the “merger” of SRx and Acquireco within the Plan of Arrangement referred to an amalgamation in

accordance with Section 177(1) of the Business Corporations Act (Ontario).

Officers

and Directors

Notwithstanding

anything to the contrary contained in the Proxy Statement, the Combined Company’s Board of Directors following the consummation

of the transaction will consist of five members including Adesh A. Vora, Pharm. D., as Chairman, Michael Young, Lionel Conacher, Simon

Conway, and David White.

Cautionary

Note Regarding Forward-Looking Statements

This

communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the “safe harbor” created by

those sections. All statements in this communication that are not based on historical fact are “forward looking statements.”

These statements may be identified by words such as “estimates,” “anticipates,” “projects,” “plans,”

“strategy,” “goal,” or “planned,” “seeks,” “may,” “might”, “will,”

“expects,” “intends,” “believes,” “should,” and similar expressions, or the negative

versions thereof, and which also may be identified by their context. All statements that address operating performance or events or developments

the Company expects or anticipates will occur in the future, such as stated objectives or goals, refinement of strategy, attempts to

secure additional financing, exploring possible business alternatives, or that are not otherwise historical facts, are forward-looking

statements. While management has based any forward-looking statements included in this communication on its current expectations, the

information on which such expectations were based may change. Forward-looking statements involve inherent risks and uncertainties which

could cause actual results to differ materially from those in the forward-looking statements as a result of various factors, including

risks associated with the Company’s ability to obtain additional capital in the future, the proposed transaction with SRx, general

economic factors, competition in the industry and other factors that could cause actual results to be materially different from those

described herein as anticipated, believed, estimated or expected. Additional risks and uncertainties are described in or implied by the

Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of the Company’s

2023 Annual Report on Form 10-K, filed on April 12, 2024 and other reports filed from time to time with the Securities and Exchange Commission

(“SEC”). The Company urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Readers

are cautioned to not place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise

required by the federal securities laws, the Company disclaims any obligation or undertaking to publicly release any updates or revisions

to any forward-looking statement contained herein (or elsewhere) to reflect any change in its expectations with regard thereto, or any

change in events, conditions, or circumstances on which any such statement is based.

Additional

Information and Where to Find It

In

connection with the proposed Arrangement, Better Choice has filed with the SEC a definitive proxy statement (the “Definitive Proxy

Statement”) that has been sent to the stockholders of Better Choice seeking their approval of the Arrangement and the other proposals

set forth therein. Better Choice may also file other documents with the SEC regarding the Arrangement and such other proposals. This

communication is not a substitute for the Definitive Proxy Statement or any other document which Better Choice may file with the SEC.

INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Better

Choice’s stockholders will also be able to obtain a copy of such documents, without charge, by directing a request to Valter Pinto

at KCSA Strategic Communications, the Company’s investor relations contact, by telephone at 212-896-1254, or by email at valter@KCSA.com.

These documents, once available, can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov).

Participants

in the Solicitation

The

Company and its respective directors, executive officers and other members of their management and employees, under SEC rules, may be

deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the proposed transaction.

Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of the Company’s

directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 12, 2024.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s

stockholders in connection with the proposed transaction will be set forth in the proxy statement for the proposed business combination

when available. Information concerning the interests of the Company’s participants in the solicitation, which may, in some cases,

be different than those of the Company’s equity holders generally, will be set forth in the proxy statement relating to the proposed

business combination when it becomes available.

ANNEX

A – AMENDMENT NO. 3 TO ARRANGEMENT AGREEMENT AND AMENDMENT NO. 2 TO PLAN OF ARRANGEMENT

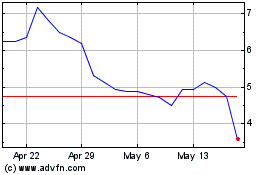

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

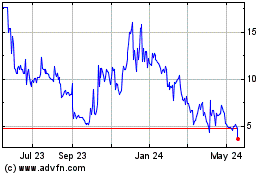

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Mar 2024 to Mar 2025