UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-35404

EMX ROYALTY CORPORATION

(Translation of registrant’s name into English)

Suite 501 – 543 Granville Street

Vancouver, British Columbia V6C 1XB

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [X] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| EMX ROYALTY CORPORATION |

| |

| (Registrant) |

| |

| Date: August 12, 2024 | By: | /s/ Rocio Echegaray |

| | |

| Name: | Rocio Echegaray |

| Title: | Corporate Secretary |

EMX Royalty Corporation

Condensed Consolidated Interim Financial Statements

(Unaudited)

June 30, 2024

Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s)

Condensed Consolidated Statements of Financial Position

| | | | | | | | | | | |

| As at June 30, | | As at December 31, |

| 2024 | | 2023 |

| | | |

| Assets | | | |

| | | |

| Cash and cash equivalents | $ | 21,421 | | | $ | 20,677 | |

Investments (Note 3) | 4,943 | | | 6,628 | |

Trade receivables and other assets (Note 4) | 9,395 | | | 7,743 | |

| Total current assets | 35,759 | | | 35,048 | |

| | | |

| Restricted cash | 144 | | | 144 | |

Investments (Note 3) | 3,374 | | | 3,940 | |

Trade receivables and other assets (Note 4) | 8,788 | | | 11,207 | |

Investment in associated entity (Note 5) | 62,288 | | | 58,827 | |

Royalty and other property interests (Note 6) | 44,499 | | | 48,099 | |

| Property and equipment | 770 | | | 853 | |

| Deferred financing charges | 464 | | | 450 | |

| Total non-current assets | 120,327 | | | 123,520 | |

| | | |

| Total Assets | $ | 156,086 | | | $ | 158,568 | |

| | | |

| Liabilities | | | |

| | | |

| Accounts payable and accrued liabilities | $ | 2,358 | | | $ | 2,818 | |

Advances from joint venture partners (Note 7) | 1,318 | | | 994 | |

Derivative liabilities (Note 8) | 834 | | | 754 | |

Loan payable (Note 9) | 33,670 | | | 32,752 | |

| Total current liabilities | 38,180 | | | 37,318 | |

| | | |

| Deferred income tax liability | 826 | | | 815 | |

| Total non-current liabilities | 826 | | | 815 | |

| | | |

| Total Liabilities | 39,006 | | | 38,133 | |

| | | |

| Shareholders' Equity | | | |

| | | |

Capital stock (Note 10) | 164,845 | | | 160,913 | |

| Reserves | 17,582 | | | 18,620 | |

| Deficit | (65,347) | | | (59,098) | |

| Total Shareholders' Equity | 117,080 | | | 120,435 | |

| | | |

| Total Liabilities and Shareholders' Equity | $ | 156,086 | | | $ | 158,568 | |

Nature of operations and going concern (Note 1)

Approved on behalf of the Board of Directors on August 8, 2024

| | | | | | | | | | | | | | | | | |

| Signed: | "David M Cole" | Director | Signed: | "Sunny Lowe" | Director |

| | | | | |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except per share amounts

Condensed Consolidated Statements of Loss

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

Revenue and Other Income (Note 11) | $ | 6,005 | | | $ | 3,408 | | | $ | 12,245 | | | $ | 6,150 | |

| | | | | | | |

| Costs and Expenses | | | | | | | |

General and administrative (Note 12) | 1,694 | | | 1,576 | | | 3,842 | | | 3,298 | |

Royalty generation and project evaluation, net (Note 13) | 2,907 | | | 2,200 | | | 5,841 | | | 5,022 | |

| Depletion, depreciation, and direct royalty taxes | 1,369 | | | 790 | | | 3,788 | | | 1,642 | |

Share-based payments (Note 14) | 872 | | | 122 | | | 1,049 | | | 265 | |

| 6,842 | | | 4,688 | | | 14,520 | | | 10,227 | |

| | | | | | | |

| Loss from operations | (837) | | | (1,280) | | | (2,275) | | | (4,077) | |

| | | | | | | |

| Gain (loss) on revaluation of investments | 1,142 | | | (1,383) | | | 1,226 | | | (709) | |

| Loss on sale of marketable securities | (1,535) | | | (17) | | | (1,946) | | | (459) | |

Gain (loss) on revaluation of derivative liabilities (Note 8) | (66) | | | 188 | | | (107) | | | (398) | |

Equity income from investment in associated entity (Note 5) | 1,411 | | | 1,340 | | | 2,208 | | | 2,255 | |

| Foreign exchange loss | (139) | | | (797) | | | (255) | | | (965) | |

| Gain on revaluation of receivables | - | | | 124 | | | - | | | 124 | |

| Impairment charges | - | | | - | | | (45) | | | - | |

Finance expense (Note 9) | (1,080) | | | (1,270) | | | (2,145) | | | (2,511) | |

Other losses (Note 15) | (2,326) | | | - | | | (2,326) | | | - | |

| | | | | | | |

| Loss before income taxes | (3,430) | | | (3,095) | | | (5,665) | | | (6,740) | |

| | | | | | | |

| Deferred income tax expense | (165) | | | (1,554) | | | (10) | | | (1,556) | |

| Income tax expense | (427) | | | (73) | | | (574) | | | (152) | |

| | | | | | | |

| Loss for the period | $ | (4,022) | | | $ | (4,722) | | | $ | (6,249) | | | $ | (8,448) | |

| | | | | | | |

| Basic loss per share | $ | (0.04) | | | $ | (0.04) | | | $ | (0.06) | | | $ | (0.08) | |

| Diluted loss per share | $ | (0.04) | | | $ | (0.04) | | | $ | (0.06) | | | $ | (0.08) | |

| | | | | | | |

| Weighted average no. of shares outstanding - basic | 113,076,261 | | 110,698,311 | | 112,664,381 | | 110,681,345 |

| Weighted average no. of shares outstanding - diluted | 113,076,261 | | 110,698,311 | | 112,664,381 | | 110,681,345 |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s)

Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| | | |

| Cash flows from operating activities | | | |

| Loss for the period | $ | (6,249) | | | $ | (8,448) | |

| Items not affecting operating activities: | | | |

| Interest income | (878) | | | (686) | |

| Effect of exchange rate changes on cash and cash equivalents | 151 | | | (51) | |

| Items not affecting cash: | | | |

| Gain on revaluation of investments | (1,226) | | | 709 | |

Equity income from investments in associate (Note 5) | (2,208) | | | (2,255) | |

Share-based payments (Note 14) | 1,543 | | | 225 | |

| Deferred income tax expense | 10 | | | 1,556 | |

| Depletion and depreciation | 3,743 | | | 1,668 | |

Finance expense (Note 9) | 2,145 | | | 2,511 | |

| Impairment charges | 45 | | | - | |

| Shares received pursuant to property agreements | (51) | | | (798) | |

Other non-cash movements (Note 19) | 1,820 | | | 475 | |

| | | |

Changes in non-cash working capital items (Note 19) | 1,668 | | | 759 | |

| Total cash provided by (used in) operating activities | 513 | | | (4,335) | |

| | | |

| Cash flows from investing activities | | | |

Dividends and other distributions (Note 5) | 3,579 | | | 3,566 | |

| Loan receivable | - | | | (750) | |

Purchase of investment in associated entity (Note 5) | (4,742) | | | (3,517) | |

| Proceeds from the sale of fair value through profit and loss investments, net | 1,359 | | | 676 | |

Other movements (Note 19) | 137 | | | (32) | |

| Total cash provided by (used in) investing activities | 333 | | | (57) | |

| | | |

| Cash flows from financing activities | | | |

Loan repayments (Note 9) | (1,227) | | | (1,572) | |

Purchase of common shares returned to treasury (Note 10) | (206) | | | - | |

| Proceeds from exercise of options and settlement of RSUs, net | 1,512 | | | 66 | |

| Deferred financing costs | (30) | | | - | |

| Total cash provided by (used) in financing activities | 49 | | | (1,506) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (151) | | | 51 | |

| | | |

| Change in cash and cash equivalents | 744 | | | (5,847) | |

| Cash and cash equivalents, beginning | 20,677 | | | 16,838 | |

| Cash in assets held for sale | - | | | (24) | |

| | | |

| Cash and cash equivalents, ending | $ | 21,421 | | | $ | 10,967 | |

Supplemental disclosure with respect to cash flows (Note 19)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except per share amounts

Condensed Consolidated Statements of Shareholders' Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of

common shares | | Capital stock | | Reserves | | Deficit | | Total |

| | | | | | | | | |

| Balance as at December 31, 2023 | 112,234,040 | | $ | 160,913 | | | $ | 18,620 | | | $ | (59,098) | | | $ | 120,435 | |

| Shares issued for exercise of stock options | 1,315,000 | | | 2,558 | | | (924) | | | - | | | 1,634 | |

| RSUs issued | 164,500 | | | 1,535 | | | (1,657) | | | - | | | (122) | |

| Share-based payments | - | | | - | | | 1,543 | | | - | | | 1,543 | |

| Common shares returned to treasury | (106,276) | | | (206) | | | - | | | - | | | (206) | |

| Shares issued for royalty | 30,000 | | | 45 | | | - | | | - | | | 45 | |

| Loss for the period | - | | | - | | | - | | | (6,249) | | | (6,249) | |

| | | | | | | | | |

| Balance as at June 30, 2024 | 113,637,264 | | $ | 164,845 | | | $ | 17,582 | | | $ | (65,347) | | | $ | 117,080 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of

common shares | | Capital stock | | Reserves | | Deficit | | Total |

| | | | | | | | | |

| Balance as at December 31, 2022 | 110,664,190 | | $ | 193,006 | | | $ | 11,753 | | | $ | (81,558) | | | $ | 123,201 | |

| Shares issued for exercise of stock options | 67,500 | | | 104 | | | (38) | | | - | | | 66 | |

| Reclass of warrants to derivative liability | - | | | - | | | (1,286) | | | - | | | (1,286) | |

| Share-based payments | - | | | - | | | 225 | | | - | | | 225 | |

| Foreign currency translation adjustment | - | | | (35,131) | | | 8,038 | | | 27,093 | | | - | |

| Loss for the period | - | | | - | | | - | | | (8,448) | | | (8,448) | |

| | | | | | | | | |

| Balance as at June 30, 2023 | 110,731,690 | | $ | 157,979 | | | $ | 18,692 | | | $ | (62,913) | | | $ | 113,758 | |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

1. Nature of Operations and Going Concern

EMX Royalty Corporation (the "Company" or "EMX") is a precious, base and battery metals royalty company, which engages in the generation, acquisition and management of resource royalties and similar strategic investments. The Company's royalty and exploration portfolio mainly consists of properties in North America, Türkiye, Europe, Australia, and Latin America. The Company's common shares are listed on the TSX Venture Exchange ("TSX-V"), and the NYSE American under the symbol of "EMX", and also trade on the Frankfurt Stock Exchange under the symbol "6E9". The Company's head office is located at 501 - 543 Granville Street, Vancouver, British Columbia, Canada V6C 1X8.

These condensed consolidated interim financial statements have been prepared using IFRS Accounting Standards ("IFRS") applicable to a going concern, which assumes that the Company will be able to realize its assets, discharge its liabilities and continue in operation for the following twelve months. As at June 30, 2024, the Company had a working capital deficit of $2,421 (December 31, 2023 - $2,270). The Company’s ability to continue as a going concern is dependent on its ability to generate profitable earnings, receive continued financial support from strategic shareholders, complete additional financing and/or refinance its existing debt. As a result of the credit agreement the Company entered into on June 19, 2024 with Franco-Nevada Corp. ("Franco-Nevada") (Note 9) management expects that its cash balance, cash flows from operating activities, and available credit facilities will be sufficient to fund the operations of the Company for at least the next twelve months. Subsequent to June 30, 2024, the Company closed the new credit agreement with Franco-Nevada. These condensed consolidated interim financial statements do not reflect the adjustments to the carrying values of assets and liabilities, the reported revenues and expenses and the consolidated statement of financial position classifications that would be necessary if the going concern assumption was inappropriate. These adjustments could be material.

Some of the Company's activities for royalty generation are located in emerging nations and, consequently, may be subject to a higher level of risk compared to other developed countries. Operations, the status of mineral property rights and the recoverability of investments in emerging nations can be affected by changing economic, legal, regulatory and political situations.

These condensed consolidated interim financial statements of the Company are presented in United States Dollars ("USD" or "US$"), unless otherwise noted, which is the functional currency of the parent company and its subsidiaries.

2. Statement of Compliance and Summary of Material Accounting Policies

Statement of Compliance

These condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting ("IAS 34") using accounting policies consistent with IFRS as issued by the International Accounting Standards Board ("IASB").

These condensed consolidated interim financial statements have been prepared on a historical cost basis, except for financial instruments classified as fair value through profit or loss, which are stated at their fair value. In addition, these condensed consolidated interim financial statements have been prepared using the accrual basis of accounting except for cash flow information.

Reclassification

Certain comparative figures have been reclassified to conform to the current year presentation.

Summary of Material Accounting Policies

These condensed consolidated interim financial statements follow the same accounting policies and methods of application as the Company's most recent annual financial statements, except as described below, and should be read in conjunction with the annual audited consolidated financial statements of the Company for the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 6 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

2. Statement of Compliance and Summary of Material Accounting Policies (continued)

Critical Accounting Judgments and Significant Estimates and Uncertainties

The critical judgments and estimates applied in the preparation of the Company's unaudited condensed consolidated interim financial statements for the six months ended June 30, 2024, are consistent with those applied in the Company's December 31, 2023, audited consolidated financial statements.

New Accounting Policies Issued But Not Yet Effective

Certain pronouncements have been issued by the IASB or IFRIC that are not mandatory for the current period and have not been early adopted. The amendments are effective for accounting periods beginning on or after January 1, 2025, with earlier application permitted. The Company has reviewed these updates and the amendment that is applicable to the Company is discussed below:

IFRS 18 Presentation and Disclosure in Financial Statements

IFRS 18 Presentation and Disclosure in Financial Statements, which will replace IAS 1, Presentation of Financial Statement aims to improve how companies communicate in their financial statements, with a focus on information about financial performance in the statement of profit or loss, in particular additional defined subtotals, disclosures about management-defined performance measures and new principles for aggregation of information. IFRS 18 is accompanied by limited amendments to the requirements in IAS 7 Statement of Cash Flows. IFRS 18 is effective from January 1, 2027. Companies are permitted to apply IFRS 18 before that date. The Company is currently assessing the impact of the new standard.

3. Investments

As at June 30, 2024, and December 31, 2023, the Company had the following investments:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Marketable securities | $ | 1,875 | | | $ | 4,001 | |

| Warrants | 203 | | | 195 | |

| Private company investments | 6,239 | | | 6,372 | |

| Total investments | 8,317 | | | 10,568 | |

| Less: current portion | (4,943) | | | (6,628) | |

| Non-current portion | $ | 3,374 | | | $ | 3,940 | |

The Company may purchase investments and receives investments as proceeds related to various property agreements, and may sell its holdings to the market where appropriate. During the six months ended June 30, 2024, the Company realized $1,359 (2023 - $930) in proceeds from sales of investments.

4. Trade Receivables and Other Assets

The Company's trade receivables and other assets are primarily related to royalty revenue receivable, deferred compensation and milestone payments, refundable taxes and VAT recoverable from government taxation authorities, recoveries of royalty generation costs from project partners, prepaid expenses and reclamation bonds.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 7 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

4. Trade Receivables and Other Assets (continued)

As at June 30, 2024, and December 31, 2023, trade receivables and other assets were as follows:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Royalty revenue receivable | $ | 4,417 | | | $ | 4,028 | |

| Refundable taxes | 921 | | | 1,093 | |

| Recoverable royalty generation expenditures and advances | 217 | | | 894 | |

| Deferred compensation | 11,504 | | | 11,572 | |

| Reclamation bonds | 284 | | | 295 | |

| Prepaid expenses, deposits and other | 840 | | | 1,068 | |

| Total receivables and other assets | 18,183 | | | 18,950 | |

| Less: current portion | (9,395) | | | (7,743) | |

| Non-current portion | $ | 8,788 | | | $ | 11,207 | |

Non-current trade receivables and other assets are comprised of the deferred payments from Aftermath Silver Ltd. ("Aftermath"), AbraSilver Resource Corp. ("AbraSilver") and Scout Discoveries Corp. ("Scout") expected to be collected after 12 months, and reclamation bonds held as security towards future royalty generation work and the related future potential cost of reclamation of the Company's land and unproven mineral interests. During the six months ended June 30, 2024, Scout exercised its early repayment option to settle the amount owed to the Company for the acquisition of former subsidiary, Scout Drilling LLC.

As at June 30, 2024, the Company has no material reclamation obligations and holds bonds to cover any non material reclamation requirements as required by local administrations. Once reclamation of the properties is complete, the bonds will be returned to the Company.

The following table summarizes the Company's deferred compensation as at June 30, 2024 and changes during the six months then ended:

| | | | | | | | | | | | | | | | | | | | | | | |

| Aftermath | | AbraSilver | | Scout | | Total |

| Balance as at December 31, 2023 | $ | 5,042 | | | $ | 5,870 | | | $ | 660 | | | $ | 11,572 | |

| | | | | | | |

| Interest accretion | 258 | | | 334 | | | 90 | | | 682 | |

| Amount received | - | | | - | | | (1,050) | | | (1,050) | |

| Gain on sale of subsidiary | - | | | - | | | 300 | | | 300 | |

| Balance as at June 30, 2024 | 5,300 | | | 6,204 | | | - | | | 11,504 | |

| Less: current portion | (3,000) | | | - | | | - | | | (3,000) | |

| Non-current portion | $ | 2,300 | | | $ | 6,204 | | | $ | - | | | $ | 8,504 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 8 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

5. Investment in Associated Entity

Caserones

During the six months ended June 30, 2024, the Company acquired an additional 2.737% interest in SLM California for cash consideration of $4,742 increasing the Company's effective royalty interest in the Caserones property to 0.8306%.

Summarized financial information for the Company's investment in SLM California and reflecting adjustments made by the Company, including adjustments made at the time of acquisition is as follows:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Current assets | $ | 8,508 | | | $ | 11,252 | |

| Total liabilities | (3,839) | | | (6,709) | |

| Net assets | 4,669 | | | 4,543 | |

| The Company's ownership % | 42.7 | | | 40.0 | |

| Acquisition fair value and other adjustments | 60,293 | | | 57,010 | |

| Carrying amount of investment in SLM California | $ | 62,288 | | | $ | 58,827 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Royalty revenue | $ | 6,442 | | | $ | 7,685 | | | $ | 11,247 | | | $ | 13,584 | |

| Net income | 3,303 | | | 3,216 | | | 5,167 | | | 5,640 | |

| The Company's ownership % | 42.7 | | | 40.0 | | | 42.7 | | | 40.0 | |

| Company's share of net income of SLM California | $ | 1,411 | | | $ | 1,340 | | | $ | 2,208 | | | $ | 2,255 | |

Income generated from the Company’s investment in SLM California is included in equity income from an investment in an associated entity. During the three and six months ended June 30, 2024, the Company’s share of the royalty revenue in SLM California totaled $2,753 and $4,806, respectively (2023 – $3,206 and $5,432, respectively).

The following table summarizes the changes in the carrying amount of the Company's investment in SLM California:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Opening Balance | $ | 58,827 | | | $ | 58,189 | |

| Capital investment | 4,742 | | | 3,517 | |

| Company's share of net income of SLM California | 2,208 | | | 4,134 | |

| Distributions | (3,489) | | | (7,013) | |

| Ending Balance | $ | 62,288 | | | $ | 58,827 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 9 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

6. Royalty and Other Property Interests

As at and for the six months ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Country | | December 31,

2023 | | Net Additions

(Recoveries) | | Depletion | | Impairment | | June 30,

2024 | | Historical cost | | Accumulated

depletion and

other** |

| Royalty Interests | | | | | | | | | | | | | | |

| Gediktepe | | Türkiye | | $ | 29,901 | | | $ | - | | | $ | (3,442) | | | $ | - | | | $ | 26,459 | | | $ | 43,746 | | | $ | (17,287) | |

| Leeville | | USA | | 4,141 | | | - | | | (219) | | | - | | | 3,922 | | | 38,869 | | | (34,947) | |

| Diablillos | | Argentina | | 6,582 | | | - | | | - | | | - | | | 6,582 | | | 7,224 | | | (642) | |

| Berenguela | | Peru | | 1,828 | | | - | | | - | | | - | | | 1,828 | | | 2,006 | | | (178) | |

| Revelo Portfolio | | Chile | | 401 | | | (267) | | | - | | | - | | | 134 | | | 186 | | | (52) | |

| Tartan Lake | | Canada | | 914 | | | - | | | - | | | - | | | 914 | | | 1,003 | | | (89) | |

| Timok | | Serbia | | 141 | | | - | | | (1) | | | - | | | 140 | | | 195 | | | (55) | |

| Other* | | Various | | 2,308 | | | 125 | | | - | | | - | | | 2,433 | | | 2,506 | | | (73) | |

| | | | 46,216 | | | (142) | | | (3,662) | | | - | | | 42,412 | | | 95,735 | | | (53,323) | |

| Other Property Interests | | | | | | | | | | | | | | |

| Perry Portfolio | | Canada | | 498 | | | (18) | | | - | | | (45) | | | 435 | | | 2,199 | | | (1,764) | |

| Revelo Portfolio | | Chile | | 709 | | | 267 | | | - | | | - | | | 976 | | | 976 | | | - | |

| Other* | | Various | | 676 | | | - | | | - | | | - | | | 676 | | | 3,324 | | | (2,648) | |

| | | | 1,883 | | | 249 | | | - | | | (45) | | | 2,087 | | | 6,499 | | | (4,412) | |

| Total | | | | $ | 48,099 | | | $ | 107 | | | $ | (3,662) | | | $ | (45) | | | $ | 44,499 | | | $ | 102,234 | | | $ | (57,735) | |

*Included in other are various royalty and other property interests held in Finland, Sweden, Argentina, Chile, Mexico, Canada and the U.S.A.

**Includes previously recognized recoveries and impairment charges.

As at and for the year ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Country | | December 31,

2022 | | Net Additions

(Recoveries) | | Depletion | | Impairment | | December 31,

2023 | | Historical cost | | Accumulated

depletion and

other** |

| Royalty Interests | | | | | | | | | | | | | | |

| Gediktepe | | Türkiye | | $ | 34,528 | | | $ | - | | | $ | (4,627) | | | $ | - | | | $ | 29,901 | | | $ | 43,746 | | | $ | (13,845) | |

| Leeville | | USA | | 4,546 | | | - | | | (405) | | | - | | | 4,141 | | | 38,869 | | | (34,728) | |

| Diablillos | | Argentina | | 6,582 | | | - | | | - | | | - | | | 6,582 | | | 7,224 | | | (642) | |

| Berenguela | | Peru | | 1,828 | | | - | | | - | | | - | | | 1,828 | | | 2,006 | | | (178) | |

| Revelo Portfolio | | Chile | | 1,137 | | | (709) | | | - | | | (27) | | | 401 | | | 453 | | | (52) | |

| Tartan Lake | | Canada | | 914 | | | - | | | - | | | - | | | 914 | | | 1,003 | | | (89) | |

| Timok | | Serbia | | 148 | | | - | | | (7) | | | - | | | 141 | | | 195 | | | (54) | |

| Other* | | Various | | 2,008 | | | 300 | | | - | | | - | | | 2,308 | | | 2,381 | | | (73) | |

| | | | 51,691 | | | (409) | | | (5,039) | | | (27) | | | 46,216 | | | 95,877 | | | (49,661) | |

| Other Property Interests | | | | | | | | | | | | | | |

| Perry Portfolio | | Canada | | 741 | | | (200) | | | - | | | (43) | | | 498 | | | 2,199 | | | (1,701) | |

| Revelo Portfolio | | Chile | | - | | | 709 | | | - | | | - | | | 709 | | | 709 | | | - | |

| Other* | | Various | | 993 | | | (317) | | | - | | | - | | | 676 | | | 3,324 | | | (2,648) | |

| | | | 1,734 | | | 192 | | | - | | | (43) | | | 1,883 | | | 6,232 | | | (4,349) | |

| Total | | | | $ | 53,425 | | | $ | (217) | | | $ | (5,039) | | | $ | (70) | | | $ | 48,099 | | | $ | 102,109 | | | $ | (54,010) | |

*Included in other are various royalty and other property interests held in Finland, Sweden, Argentina, Chile, Mexico, Canada and the U.S.A.

**Includes previously recognized recoveries, impairment charges and translation adjustments.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 10 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

6. Royalty and Other Property Interests (continued)

Royalty Interest

Timok Royalty

EMX’s Timok Royalty is located in the Bor Mining District of Serbia and covers the Cukaru Peki copper-gold deposit. On September 1, 2023 the Company executed an amended and restated royalty agreement for its Timok Royalty property with Zinjin Mining Group Ltd ("Zijin"). The Company and Zijin agreed that the Timok Royalty will consist of a 0.3625% NSR royalty that is uncapped and cannot be repurchased or reduced.

Gediktepe Royalty

The Company holds two royalties at Gediktepe in Türkiye, which cover assets currently being operated by Lidya Madencilik Sanayi ve Ticaret A.Ş., a private Turkish company. These include a perpetual 10% NSR royalty over metals produced from the oxide zone after cumulative production of 10,000 gold-equivalent oxide ounces; and (ii) a perpetual 2% NSR royalty over metals produced from the sulfide zone, payable after cumulative production of 25,000 gold-equivalent sulfide ounces. Upon achievement of production of 10,000 gold-equivalent oxide ounces, a $4,000 milestone payment was earned and received. Upon achievement of production of 25,000 gold-equivalent sulfide ounces, a $3,000 milestone payment will become payable, with a second $3,000 milestone payment becoming payable on the first anniversary of the sulfide production milestone.

Leeville Royalty

The Company holds a 1% gross smelter return ("GSR") royalty on portions of West Leeville, Carlin East, Four Corners, Turf and other underground gold mining operations and deposits in the Northern Carlin Trend of Nevada. The Leeville royalty property is included in the Nevada Gold Mines LLC and Barrick-Newmont Nevada joint venture. Royalty income from the Leeville Mine incurs a 5% direct gold tax.

Balya Royalty

The Company holds a 4% NSR royalty on the Balya property that is uncapped and is not subject to a buy back agreement previously acquired from the transfer of the Balya royalty property in Türkiye from Dedeman Madencilik San. Ve Tic. A. Ş. to Esan Eczacibaşi Endüstriyel Hammaddeler San. Ve Tic. A.Ş. ("Esan") a private Turkish company.

Gold Bar South Royalty

The Company holds a 1% NSR royalty in the Gold Bar South royalty property, operated by McEwen Mining Inc. ("McEwen"), which covers a sediment-hosted, oxide gold deposit situated southeast of McEwen's Gold Bar open pit mining operation in north-central Nevada.

7. Advances from Joint Venture Partners

Advances from joint venture partners relate to unspent funds received pursuant to approved exploration programs by the Company and its project partners. The Company's advances from project partners consist of the following:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| U.S.A. | $ | 1,299 | | | $ | 975 | |

| Fennoscandia | 18 | | | 19 | |

| Total | $ | 1,318 | | | $ | 994 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 11 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

8. Derivative Liabilities

As at June 30, 2024, the fair value of derivative liabilities was $834 (December 31, 2023 - $754). During the six months ended June 30, 2024, the Company recognized a loss of $107 (2023 - $398) on the revaluation of derivative liabilities. The fair values of derivative liabilities were estimated using the Black-Scholes pricing model with weighted average assumptions as follows:

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Risk free interest rate (%) | 3.83 | | | 3.67 | |

| Expected life (years) | 2.79 | | | 3.29 | |

| Expected volatility (%) | 41.29 | | | 42.80 | |

| Dividend yield | - | | - |

During the six months ended June 30, 2024, there were no changes in the number of warrants outstanding.

The following table summarizes information about the warrants which were outstanding as at June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| Date Issued | Number of Warrants | | Exercisable | | Exercise Price (C$) | | Expiry Date |

| April 14, 2022 | 3,812,121 | | 3,812,121 | | 4.45 | | | April 14, 2027 |

| Total | 3,812,121 | | 3,812,121 | | | | |

9. Loan Payable

Sprott Credit Facility

In August 2021, the Company entered into a credit facility with Sprott for $44,000 (the "Sprott Credit Facility") with a maturity date of July 31, 2022. The credit facility carries an annual interest rate of 7%, payable monthly and the Company is required to maintain $1,500 in funds held as a minimum cash balance under the agreement. The Sprott Credit Facility includes a general security agreement over select assets of EMX.

In January 2022, for a fee of 1.5% of the outstanding loan balance or $660 to be paid on maturity, the Company entered into an amended agreement to extend the term of the Sprott Credit Facility to December 31, 2024.

For the six months ended June 30, 2024, the Company recognized interest expense of $2,145 (2023 - $2,511) on the loan which was calculated using the revised annual effective interest rate and was included in finance expenses.

The following table summarizes the Company's loan payable as at June 30, 2024, and changes during the six months then ended:

| | | | | |

| Sprott Facility |

| Balance as at December 31, 2023 | $ | 32,752 | |

| Interest accretion | 2,145 | |

| Interest paid | (1,227) | |

| Balance as at June 30, 2024 | $ | 33,670 | |

In June 2024, the Company announced that it had entered into a $35,000 credit agreement with Franco-Nevada Corp. with a maturity date of July 1, 2029. As at June 30, 2024 the credit agreement had not closed. Closing and the advance of the loan are subject to delivery of certain security. Once received, the Company will use the proceeds of the loan to repay the outstanding balance of the Sprott Credit Facility and for general working capital purposes. Subsequent to the end of the period, the Company closed the new credit agreement with Franco-Nevada.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 12 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

10. Shareholders' Equity

Authorized

As at June 30, 2024, the authorized share capital of the Company was an unlimited number of common shares without par value.

Common Shares

During the six months ended June 30, 2024, the Company:

•Issued 30,000 common shares valued at $45 related to the acquisition of a royalty in Finland.

•Issued 1,315,000 common shares for gross proceeds of $1,634 pursuant to the exercise of stock options.

•Issued 164,500 common shares with a value of $1,535 pursuant to a restricted share unit plan with certain executives and management of the Company.

•Repurchased 106,276 common shares at a cost of $206 which were returned to treasury and cancelled pursuant to the Company's Normal Course Issuer Bid.

During the six months ended June 30, 2023, the Company:

•Issued 67,500 common shares for gross proceeds of $66 pursuant to the exercise of stock options.

Stock Options

The Company adopted a stock option plan (the "Plan") pursuant to the policies of the TSX-V. The maximum number of shares that may be reserved for issuance under the plan is limited to 10% of the issued common shares of the Company at any time. The vesting terms are determined at the time of the grant, subject to the terms of the plan.

During the six months ended June 30, 2024, the change in stock options outstanding was as follows:

| | | | | | | | | | | |

| Number | | Weighted Average

Exercise Price (C$) |

| Balance as at December 31, 2023 | 7,834,500 | | | $ | 2.72 | |

| Granted | 1,442,400 | | | 2.47 | |

| Exercised | (1,315,000) | | | 1.70 | |

| Forfeited | (70,500) | | | 3.06 | |

| Balance as at June 30, 2024 | 7,891,400 | | | $ | 2.84 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 13 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

10. Shareholders' Equity (continued)

The following table summarizes information about the stock options which were outstanding and exercisable at June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| Date Granted | Number of Options | | Exercisable | | Exercise Price (C$) | | Expiry Date |

| November 18, 2019 | 30,000 | | 30,000 | | 1.80 | | | November 18, 2024 |

| November 18, 2019 | 30,000 | | 30,000 | | 1.80 | | | November 19, 2024 |

| January 21, 2020 | 60,000 | | 60,000 | | 2.22 | | | January 21, 2025 |

| April 22, 2020 | 20,000 | | 20,000 | | 2.50 | | | April 22, 2025 |

| June 10, 2020 | 1,387,500 | | 1,387,500 | | 2.62 | | | June 10, 2025 |

| October 5, 2020 | 19,000 | | 19,000 | | 3.50 | | | October 5, 2025 |

| May 6, 2021 | 1,124,000 | | 1,124,000 | | 4.11 | | | May 6, 2026 |

| May 12, 2021 | 15,000 | | 15,000 | | 4.28 | | | May 12, 2026 |

| August 19, 2021 | 500,000 | | 500,000 | | 3.66 | | | August 19, 2026 |

| September 8, 2021 | 10,000 | | 10,000 | | 3.51 | | | September 8, 2026 |

| April 29, 2022 | 1,730,500 | | 1,730,500 | | 2.56 | | | April 29, 2027 |

| July 5, 2022 | 100,000 | | 100,000 | | 2.45 | | | July 5, 2027 |

| July 20, 2022 | 4,000 | | 11,000 | | 2.45 | | | July 20, 2027 |

| September 11, 2023 | 1,449,000 | | 1,441,000 | | 2.55 | | | September 11, 2028 |

| June 24, 2024 | 1,442,400 | | 1,427,400 | | 2.47 | | | June 24, 2029 |

| Balance as at June 30, 2024 | 7,891,400 | | 7,875,400 | | | | |

As at June 30, 2024, the weighted average remaining useful life of exercisable stock options was 2.84 (December 31, 2023 - 2.54).

The weighted average fair value of the stock options granted during the six months ended year ended June 30, 2024 was C$1.09 (2023 - SNil) per stock option. The fair value of stock options granted was estimated using the Black-Scholes option pricing model with weighted average assumptions as follows:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| Risk free interest rate (%) | 3.36 | | | N/A |

| Expected life (years) | 5.0 | | | N/A |

| Expected volatility (%) | 45.8 | | | N/A |

| Dividend yield (%) | - | | N/A |

Restricted share units

In 2017, the Company introduced a long-term restricted share unit plan ("RSUs"). The RSUs entitle employees, consultants directors, or officers to common shares of the Company upon vesting based on vesting terms determined by the Company's Board of Directors at the time of grant. A total of 3,200,000 RSUs are reserved for issuance under the plan and the number of shares issuable pursuant to all RSUs granted under this plan, together with any other compensation arrangement of the Company that provides for the issuance of shares, shall not exceed ten percent (10%) of the issued and outstanding shares at the grant date.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 14 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

10. Shareholders' Equity (continued)

Restricted share units with performance criteria

RSUs with performance criteria cliff vest on the third anniversary of the grant date subject to achievement of performance conditions relating to the Company's total shareholder return and certain other operational milestones. The number of RSUs determined to have vested as at the evaluation date will entitle the holder to acquire for no additional consideration, between zero and one and a half common shares of the Company.

The following table summarizes information about the RSUs with performance criteria which were outstanding at June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Evaluation Date | December 31,

2023 | | Granted | | Vested | | Expired/Cancelled | | June 30,

2024 |

| December 31, 2023* | 450,000 | | - | | (225,000) | | (225,000) | | - |

| December 31, 2024 | 500,000 | | - | | - | | - | | 500,000 |

| December 31, 2025 | 562,000 | | - | | - | | - | | 562,000 |

| December 31, 2026 | - | | 647,000 | | - | | - | | 647,000 |

| Total | 1,512,000 | | 647,000 | | (225,000) | | (225,000) | | 1,709,000 |

*Based on the achievement performance as evaluated by the Compensation Committee of the Board of Directors of the Company, it was ascertained that 225,000 RSU's with an evaluation date of December 31, 2023 had vested based on preset performance criteria previously established on the grant date.

Restricted share units with no performance criteria

RSUs with no performance criteria will entitle the holder to acquire one common share of the Company for no additional consideration and will vest in three equal tranches on the first, second and third anniversaries of the date of grant.

The following table summarizes information about the RSUs with no performance criteria which were outstanding at June 30, 2024:

| | | | | |

| Number |

| Balance as at December 31, 2023 | - | |

| Granted | 132,000 | |

| |

| |

| Balance as at June 30, 2024 | 132,000 | |

Normal Course Issuer Bid

During the six months ended June 30, 2024, the Company commenced a Normal Course Issuer Bid ("NCIB"). Under the NCIB, the Company may purchase for cancellation up to 5,000,000 common shares over a twelve-month period commencing on February 13, 2024. The NCIB will expire no later than February 12, 2025. The Company repurchased 106,276 shares during the six months ended June 30, 2024 for a total cost of $206. Subsequent to period end, the Company repurchased 167,199 shares for a total cost of $305.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 15 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

11. Revenue and Other Income

During the three and six months ended June 30, 2024 and 2023 the Company had the following sources of revenue and other income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Royalty revenue* | $ | 5,083 | | | $ | 2,059 | | | $ | 10,687 | | | $ | 3,776 | |

| Option and other property income | 492 | | | 1,011 | | | 680 | | | 1,700 | |

| Interest income | 430 | | | 338 | | | 878 | | | 674 | |

| $ | 6,005 | | | $ | 3,408 | | | $ | 12,245 | | | $ | 6,150 | |

*Excludes royalty revenue generated from the Company's equity interest in SLM California (Note 5)

The Company has a number of exploration stage royalties and royalty generation properties being advanced by the Company and within partnered agreements. Many of these projects include staged or conditional payments owed to the Company payable in cash or partner equity pursuant to individual agreements. The Company may also earn conditional payments on producing royalties.

During the three and six months ended June 30, 2024 and 2023 the Company had the following sources of royalty revenue:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Timok | $ | 1,586 | | | $ | - | | | $ | 2,853 | | | $ | - | |

| Gediktepe | 1,806 | | | 1,175 | | | 4,796 | | | 2,101 | |

| Leeville | 1,187 | | | 664 | | | 2,051 | | | 1,198 | |

| Balya | 311 | | | 9 | | | 508 | | | 162 | |

| Gold Bar South | 167 | | | 134 | | | 242 | | | 134 | |

| Advanced royalty payments | 26 | | | 77 | | | 237 | | | 181 | |

| $ | 5,083 | | | $ | 2,059 | | | $ | 10,687 | | | $ | 3,776 | |

During the six months ended June 30, 2024, the Company recognized staged cash payments totaling $210 (2023 - $378), and equity payments valued at $51 (2023 - $798) in connection with property agreements from various partners. These payments have been included in option and other property income within revenue and other income.

12. General and Administrative Expenses

During the six months ended June 30, 2024 and 2023 the Company had the following sources of general and administrative expenses:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Salaries, consultants, and benefits | $ | 778 | | | $ | 645 | | | $ | 1,756 | | | $ | 1,601 | |

| Professional fees | 467 | | | 361 | | | 703 | | | 536 | |

| Investor relations and shareholder information | 115 | | | 228 | | | 338 | | | 441 | |

| Transfer agent and filing fees | 39 | | | 33 | | | 160 | | | 167 | |

| Administrative and office | 251 | | | 235 | | | 811 | | | 465 | |

| Travel | 44 | | | 74 | | | 74 | | | 88 | |

| $ | 1,694 | | | $ | 1,576 | | | $ | 3,842 | | | $ | 3,298 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 16 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

13. Royalty Generation and Project Evaluation

During the six months ended June 30, 2024, the Company incurred the following royalty generation costs, which were expensed as incurred:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fennoscandia | | USA | | Eastern Europe and Morocco | | South America | | Other | | Technical support

and project

evaluation* | | Total |

| Administration costs | $ | 66 | | | $ | 188 | | | $ | 158 | | | $ | 2 | | | $ | - | | | $ | 62 | | | $ | 476 | |

| Drilling, technical, and support costs | 310 | | | 324 | | | 375 | | | - | | | 40 | | | 261 | | | 1,310 | |

| Personnel | 177 | | | 489 | | | 565 | | | 59 | | | 96 | | | 1,028 | | | 2,414 | |

| Property costs | 559 | | | 198 | | | 36 | | | 531 | | | 10 | | | - | | | 1,334 | |

| Professional costs | 160 | | | 17 | | | 96 | | | 98 | | | 10 | | | - | | | 381 | |

| Share-based payments | 60 | | | 128 | | | 53 | | | 14 | | | 17 | | | 222 | | | 494 | |

| Travel | 36 | | | 8 | | | 12 | | | - | | | 3 | | | 80 | | | 139 | |

| Total Expenditures | 1,368 | | | 1,352 | | | 1,295 | | | 704 | | | 176 | | | 1,653 | | | 6,548 | |

| Recoveries from partners | (91) | | | (616) | | | - | | | - | | | - | | | - | | | (707) | |

| Net Expenditures | $ | 1,277 | | | $ | 736 | | | $ | 1,295 | | | $ | 704 | | | $ | 176 | | | $ | 1,653 | | | $ | 5,841 | |

*Technical support, evaluation, and due diligence related to new and existing opportunities for royalty acquisitions and strategic investments

During the six months ended June 30, 2023, the Company incurred the following royalty generation costs, which were expensed as incurred:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fennoscandia | | USA** | | Eastern Europe and Morocco | | South America | | Other | | Technical support

and project

evaluation* | | Total |

| Administration costs | $ | 115 | | | $ | 219 | | | $ | 177 | | | $ | - | | | $ | 3 | | | $ | 35 | | | $ | 549 | |

| Drilling, technical, and support costs | 555 | | | 4,075 | | | 104 | | | 2 | | | 174 | | | 166 | | | 5,076 | |

| Personnel | 247 | | | 1,401 | | | 340 | | | 28 | | | 168 | | | 945 | | | 3,129 | |

| Property costs | 89 | | | 275 | | | 28 | | | 196 | | | 41 | | | - | | | 629 | |

| Professional costs | 65 | | | 54 | | | 62 | | | 16 | | | 22 | | | - | | | 219 | |

| Share-based payments | - | | | - | | | - | | | - | | | - | | | (40) | | | (40) | |

| Travel | 28 | | | 23 | | | - | | | - | | | 16 | | | 88 | | | 155 | |

| Total Expenditures | 1,099 | | | 6,047 | | | 711 | | | 242 | | | 424 | | | 1,194 | | | 9,717 | |

| Recoveries from partners | (580) | | | (4,115) | | | - | | | - | | | - | | | - | | | (4,695) | |

| Net Expenditures | $ | 519 | | | $ | 1,932 | | | $ | 711 | | | $ | 242 | | | $ | 424 | | | $ | 1,194 | | | $ | 5,022 | |

* Technical support, evaluation, and due diligence related to new and existing opportunities for royalty acquisitions and strategic investments

** Includes $1,273 in costs related to Scout Drilling LLC, which was sold in 2023.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 17 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

14. Share-based Payments

During the six months ended June 30, 2024, the Company recorded aggregate share-based payments of $1,543 (2023 - $225) as they relate to the fair value of stock options and RSU's vested, and forfeited.

Share-based payments for the six months ended June 30, 2024 are allocated to expense accounts as follows:

| | | | | | | | | | | | | | | | | |

| General and

Administrative Expenses | | Royalty Generation Costs | | Total |

| Fair value of options vested | $ | 681 | | | $ | 469 | | | $ | 1,150 | |

| RSUs with performance criteria | 367 | | | 23 | | | 390 | |

| RSUs with no performance criteria | 1 | | | 2 | | | 3 | |

| Total | $ | 1,049 | | | $ | 494 | | | $ | 1,543 | |

Share-based payments for the six months ended June 30, 2023 are allocated to expense accounts as follows:

| | | | | | | | | | | | | | | | | |

| General and

Administrative Expenses | | Royalty Generation Costs | | Total |

| RSUs with performance criteria | 265 | | | (40) | | | 225 | |

| Total | $ | 265 | | | $ | (40) | | | $ | 225 | |

15. Other Losses

In April 2024, one of the Company's subsidiaries in Türkiye was the subject of a cyber event resulting in the loss of $2,326. The Company has launched a full investigation of the event and is pursuing recovery of its funds through all legally available means in order to mitigate the loss amount to the fullest extent possible.

16. Related Party Transactions

The aggregate value of transactions and outstanding balances relating to key management personnel for the six months ended June 30, 2024 were as follows:

| | | | | | | | | | | | | | | | | |

| Salary and fees | | Share-based

Payments | | Total |

| Management | $ | 545 | | | $ | 304 | | | $ | 849 | |

| Outside directors | 392 | | | 475 | | | 867 | |

| Seabord Management Corp.* | 160 | | | - | | | 160 | |

| Total | $ | 1,097 | | | $ | 779 | | | $ | 1,876 | |

*Seabord Management Corp. (“Seabord”) is a management services company partially owned by the CFO and Chairman of the Board of Directors of the Company. Seabord provides accounting and administration staff, and office space to the Company. Neither the CFO nor the Chairman receives any direct compensation from Seabord in relation to services provided to the Company.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 18 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

16. Related Party Transactions (continued)

The aggregate value of transactions and outstanding balances relating to key management personnel for the six months ended June 30, 2023 were as follows:

| | | | | | | | | | | | | | | | | |

| Salary and fees | | Share-based

Payments | | Total |

| Management | $ | 494 | | | $ | 103 | | | $ | 597 | |

| Outside directors | 362 | | | 43 | | | 405 | |

| Seabord Management Corp.* | 151 | | | - | | | 151 | |

| Total | $ | 1,007 | | | $ | 146 | | | $ | 1,153 | |

*Seabord Management Corp. (“Seabord”) is a management services company partially owned by the CFO and Chairman of the Board of Directors of the Company. Seabord provides accounting and administration staff, and office space to the Company. Neither the CFO nor the Chairman receives any direct compensation from Seabord in relation to services provided to the Company.

Included in accounts receivable as at June 30, 2024 is $18 (December 31, 2023 - $Nil) owed from key management personnel.

17. Segmented Information

For the six months ended June 30, 2024, the Company had revenue and other income located geographically as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fennoscandia | | USA | | Eastern Europe and Morocco | | Other | | Total |

| Royalty revenue* | $ | 186 | | | $ | 2,343 | | | $ | 8,158 | | | $ | - | | | $ | 10,687 | |

| Option and other property income | 86 | | | 542 | | | - | | | 52 | | | 680 | |

| Interest income | 5 | | | 95 | | | - | | | 778 | | | 878 | |

| Total | $ | 277 | | | $ | 2,980 | | | $ | 8,158 | | | $ | 830 | | | $ | 12,245 | |

*Excludes royalty revenue generated from the Company's equity interest in SLM California (Note 5)

For the six months ended June 30, 2023, the Company had revenue and other income located geographically as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fennoscandia | | USA | | Eastern Europe and Morocco | | Other | | Total |

| Royalty revenue* | $ | 125 | | | $ | 1,388 | | | $ | 2,263 | | | $ | - | | | $ | 3,776 | |

| Option and other property income | 459 | | | 643 | | | - | | | 598 | | | 1,700 | |

| Interest income | 2 | | | 12 | | | - | | | 660 | | | 674 | |

| Total | $ | 586 | | | $ | 2,043 | | | $ | 2,263 | | | $ | 1,258 | | | $ | 6,150 | |

*Excludes royalty revenue generated from the Company's equity interest in SLM California (Note 5)

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 19 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

17. Segmented Information (continued)

As at June 30, 2024, the Company had royalty and other property interests, and property and equipment located geographically as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fennoscandia | | USA | | Eastern Europe and Morocco | | South America | | Other | | Total |

| Royalty and other property interests | | | | | | | | | | |

| As at June 30, 2024 | $ | 649 | | | $ | 5,392 | | | $ | 26,598 | | | $ | 9,716 | | | $ | 2,144 | | | $ | 44,499 | |

| As at December 31, 2023 | $ | 524 | | | $ | 5,611 | | | $ | 30,041 | | | $ | 9,715 | | | $ | 2,208 | | | $ | 48,099 | |

| Property and equipment | | | | | | | | | | | |

| As at June 30, 2024 | $ | 143 | | | $ | 550 | | | $ | 77 | | | $ | - | | | $ | - | | | $ | 770 | |

| As at December 31, 2023 | $ | 161 | | | $ | 605 | | | $ | 87 | | | $ | - | | | $ | - | | | $ | 853 | |

18. Risk and Capital Management: Financial Instruments

The Company considers items included in shareholders' equity as capital. The Company's objective when managing capital is to safeguard the Company's ability to continue as a going concern, so that it can continue to provide returns for shareholders and benefits for other stakeholders.

As at June 30, 2024, the Company had a working capital deficit of $2,421 (December 31, 2023 - $2,270). The Company has continuing royalty income that will vary depending on royalty ounces received and the price of minerals. The Company also receives additional cash inflows from the recovery of expenditures from project partners, investment income including dividends from investments in associated entities and pre-production property deals including anniversary and stage payments.

The Company manages the capital structure and makes adjustments in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue new shares through public and/or private placements, sell assets, renegotiate terms of debt, or return capital to shareholders.

The Company is not subject to externally imposed capital requirements other than as disclosed in Note 9.

Fair Value

The Company characterizes inputs used in determining fair value using a hierarchy that prioritizes inputs depending on the degree to which they are observable. The three levels of the fair value hierarchy are as follows:

a)Level 1: inputs represent quoted prices in active markets for identical assets or liabilities. Active markets are those in which transactions occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

b)Level 2: inputs other than quoted prices that are observable, either directly or indirectly. Level 2 valuations are based on inputs, including quoted forward prices for commodities, market interest rates, and volatility factors, which can be observed or corroborated in the market place.

c)Level 3: inputs that are less observable, unobservable or where the observable data does not support the majority of the instruments' fair value.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 20 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

18. Risk and Capital Management: Financial Instruments (continued)

During the six months ended June 30, 2024, derivative liabilities (Note 8) were added to the fair value hierarchy levels. Financial instruments measured at fair value on the statement of financial position are summarized in levels of the fair value hierarchy as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Assets | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments - shares | $ | 1,875 | | | $ | 2,360 | | | $ | - | | | $ | 4,235 | |

| Investments - warrants | - | | | 203 | | | - | | | 203 | |

| Total | $ | 1,875 | | | $ | 2,563 | | | $ | - | | | $ | 4,438 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Liability | Level 1 | | Level 2 | | Level 3 | | Total |

| Derivative liability - warrants | $ | - | | | $ | 834 | | | $ | - | | | $ | 834 | |

| Total | $ | - | | | $ | 834 | | | $ | - | | | $ | 834 | |

The carrying value of cash, restricted cash, current trade receivables and other assets, accounts payable and accrued liabilities, advances from joint venture partners and loan payable, approximate their fair value because of the short-term nature of these instruments.

The Company's financial instruments are exposed to certain financial risks, including credit risk, interest rate risk, market risk, liquidity risk and currency risk.

Credit Risk

Credit risk is the risk that a third party might fail to fulfill its performance obligations under the terms of a financial instrument. Credit risk arises from cash and cash equivalents and trade receivables. This risk is minimized by holding a significant portion of the cash funds in major Canadian and US banks. The Company's exposure with respect to its trade receivables is primarily related to royalty revenue, recoverable taxes, recovery of royalty generation costs, and the sale of assets.

Interest Rate Risk

The Company is exposed to interest rate risk because of fluctuating interest rates on cash and cash equivalents and restricted cash. The Company monitors its exposure to interest rates and although the interest rate on the Sprott Credit Facility (Note 9) is fixed, the Company anticipates increased exposure to interest rate risk as a result of the credit agreement entered into with Franco Nevada Corp. (Note 9) which will be subject to a floating interest rate.

Market Risk

Market risks are the risks that change in market factors, such as publicly traded securities, will affect the value of the Company’s financial instruments. The Company manages market risks by either accepting it or mitigating it through the use of economic strategies.

The Company is exposed to fluctuating values of its publicly traded marketable securities. The Company has no control over these fluctuations and does not hedge its investments. Based on the June 30, 2024 portfolio values, a 10% increase or decrease in effective market values would increase or decrease net shareholders’ equity by approximately $444.

Liquidity Risk

Liquidity risk is the risk of loss from not having access to sufficient funds to meet both expected and unexpected cash demands. The Company manages its exposure to liquidity risk through prudent management of its statement of financial position, including maintaining sufficient cash balances and evaluating options for additional resources. The Company has in place a planning and budgeting process to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 21 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

18. Risk and Capital Management: Financial Instruments (continued)

As at June 30, 2024, the Company held $35,759 in current assets (December 31, 2023 – $35,048) and $38,180 in current liabilities (December 31, 2023 - $37,318). Management continuously monitors and reviews both actual and forecasted cash flows as well as additional financing opportunities in order to settle all current liabilities.

Commodity Risk

The Company's royalty revenues are derived from a royalty interest and are based on the extraction and sale of precious and base minerals and metals. Factors beyond the control of the Company may affect the marketability of metals discovered. Metal prices have historically fluctuated widely. Consequently, the economic viability of the Company's royalty interests cannot be accurately predicted and may be adversely affected by fluctuations in mineral prices.

Currency Risk

Financial instruments that impact the Company’s net income (loss) due to currency fluctuations include cash and cash equivalents, loans receivable, marketable securities, trade and other receivables, trade and other payables and deferred tax assets and liabilities denominated in Canadian dollars. Based on the Company’s Canadian dollar denominated monetary assets and monetary liabilities at June 30, 2024 a 10% increase or decrease of the value of the Canadian dollar relative to the United States dollar would not have a material impact on net loss.

Balances denominated in another currency other than the Canadian dollar held in foreign operations are considered immaterial.

19. Supplemental Disclosure with Respect to Cash Flows

Changes in non-cash working capital:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | | 2023 | |

| Trade receivables and other assets | $ | 1,802 | | | $ | 1,513 | |

| Accounts payable and accrued liabilities | (457) | | | (432) | |

| Advances from joint venture partners | 323 | | | (322) | |

| Total | $ | 1,668 | | | $ | 759 | |

Other non-cash operating activities:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | | 2023 | |

| Loss on revaluation of derivative liabilities | $ | 107 | | | $ | 398 | |

| Gain on sale of subsidiary | (365) | | | - | |

| Gain on debt modification | - | | | (124) | |

| Realized loss on sale of investments | 1,946 | | | 459 | |

| Foreign exchange (gain) loss | 132 | | | (258) | |

| Total | $ | 1,820 | | | $ | 475 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 22 |

Notes to the Condensed Consolidated Interim Financial Statements

Unaudited - Expressed in U.S. Dollars ($000s), except where indicated

19. Supplemental Disclosure with Respect to Cash Flows (continued)

Other investing activities:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | | 2023 | |

| Option payments received | $ | 10 | | | $ | 44 | |

| Interest received on cash and cash equivalents | 196 | | | 45 | |

| Acquisition of royalty and other property interests, net | (80) | | | - | |

| Purchase and sale of property and equipment, net | - | | | (170) | |

| Reclamation bonds | 11 | | | 49 | |

| Total | $ | 137 | | | $ | (32) | |

During the six months ended June 30, 2024 and 2023, the Company paid interest and income tax as follows:

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | | 2023 | |

| Interest paid | $ | 1,226 | | | $ | 1,571 | |

| Income taxes paid | 711 | | | 293 | |

| Total | $ | 1,937 | | | $ | 1,864 | |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 23 |

EMX Royalty Corporation

Management's Discussion and Analysis

Six Months Ended June 30, 2024

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

General

This Management's Discussion and Analysis ("MD&A") for EMX Royalty Corporation, (the "Company", or "EMX") has been prepared based on information known to management as of August 8, 2024. This MD&A is intended to help the reader understand the consolidated financial statements and should be read in conjunction with the condensed consolidated interim financial statements of the Company for the six months ended June 30, 2024 prepared in accordance with IFRS Accounting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). All dollar amounts included therein and in the following MD&A are in United States dollars except where noted.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management's expectations. Readers are encouraged to read the "Forward-Looking Information and Cautionary Statement" at the end of this MD&A. Additional information related to the Company, including our Annual Information Form and Form 40-F, are available on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov, respectively. These documents contain descriptions of certain of EMX's producing royalties as well as summaries of the Company's advanced royalties and royalty generation assets. For additional information, please see our website at www.emxroyalty.com.

Overview

EMX Royalty Corporation is in the business of organically generating royalties derived from a portfolio of mineral property interests. The Company augments royalty generation with royalty acquisitions and strategic investments. EMX's royalty and mineral property portfolio consists of 281 properties in North America, Europe, Türkiye, Latin America, Morocco and Australia. The Company's portfolio is comprised of the following:

| | | | | |

| Producing Royalties | 6 |

| Advanced Royalties | 11 |

| Exploration Royalties | 140 |

| Royalty Generation Properties | 124 |

| |

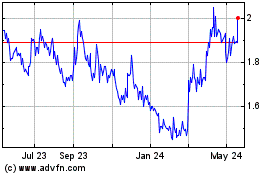

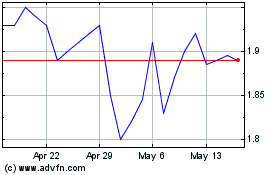

The Company's common shares are listed on the TSX Venture Exchange and the NYSE American Exchange under the symbol "EMX", and also trade on the Frankfurt Stock Exchange under the symbol "6E9".

Strategy

EMX's strategy is to provide our shareholders and other stakeholders exposure to exploration success and commodity upside through successful implementation of our royalty business. The Company believes in having a strong, balanced exposure to precious and base metals with an emphasis on gold and copper. The three key components of the Company's business strategy are summarized as:

•Royalty Acquisition. The purchase of royalty interests allows EMX to acquire assets that range from producing mines to development projects. In conjunction with the acquisition of producing and pre-production royalties in the base metals, precious metals, and battery metals sectors, the Company will also consider other cash flowing royalty acquisition opportunities, including the energy sector.

•Royalty Generation and Project Evaluation. EMX's more than 20-year track record of successful exploration initiatives has developed into an avenue to organically generate mineral property royalty interests. The strategy is to leverage in-country geological expertise to acquire prospective properties on open ground, and to build value through low-cost work programs and targeting. These properties are sold or optioned to partner companies for retained royalty interests, advance minimum royalty ("AMR") payments and annual advance royalty ("AAR") payments, project milestone payments, and other consideration that may include equity interests. Pre-production payments provide early-stage cash flows to EMX, while the operating companies build value through exploration and development. EMX participates in project upside optionality at no additional cost, with the potential for future royalty payments upon the commencement of production.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 2 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

•Strategic Investment. An important complement to EMX's royalty generation and royalty acquisition initiatives comes primarily from strategic equity investments in companies with what EMX considers to be under-valued mineral assets that have upside exploration or development potential. Exit strategies can include equity sales, royalty positions, or a combination of both.

EMX has a combination of producing royalties, advanced royalty projects, and early-stage exploration royalty properties providing shareholders exposure to immediate cash flow, near-term development of mines, and long-term exposure to class leading discoveries. Unlike other royalty companies, EMX has focused a significant portion of its expertise and capital toward organically generating royalties. We believe putting people on the ground generating opportunities and partnering with major and junior companies is where EMX can generate the highest return for our shareholders. This diversified approach towards the royalty business provides a foundation for supporting EMX's growth and increasing shareholder value over the long term.

Highlights

In Q2 2024, EMX continued on a strong uptrend due to robust royalty production and strong metal prices. Strong performance during the quarter was marked from Timok, Gediktepe, and Leeville. EMX continued to invest capital generating and acquiring royalties around the world while our partners invested significant capital to expand operations at existing mines, advance towards the development of new mines (e.g., updated resources for Parks-Salyer), and explore for new opportunities (e.g. Diablillos targets).

Summary of Financial Highlights for the three and six months ended June 30, 2024 and 2023:1

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (In thousands of dollars) | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | |

Statement of Loss | | | | | | | |

| Revenue and other income | $ | 6,005 | | | $ | 3,408 | | | $ | 12,245 | | | $ | 6,150 | |

| General and administrative costs | (1,694) | | | (1,576) | | | (3,842) | | | (3,298) | |

| Royalty generation and project evaluation costs, net | (2,907) | | | (2,200) | | | (5,841) | | | (5,022) | |

| Loss from operations | (837) | | | (1,280) | | | (2,275) | | | (4,077) | |

| Net loss | $ | (4,022) | | | $ | (4,722) | | | $ | (6,249) | | | $ | (8,448) | |

| | | | | | | |

| Statement of Cash Flows | | | | | | | |

| Cash flows from operating activities | $ | (514) | | | $ | (1,002) | | | $ | 513 | | | $ | (4,335) | |

| Cash flows from investing activities | 2,507 | | | 2,749 | | | 333 | | | (57) | |

| Cash flows from financing activities | $ | 662 | | | $ | (725) | | | $ | 49 | | | $ | (1,506) | |

| | | | | | | |

Non-IFRS Financial Measures1 | | | | | | | |

| Adjusted revenue and other income | $ | 8,758 | | | $ | 6,614 | | | $ | 17,051 | | | $ | 11,582 | |

| Adjusted royalty revenue | $ | 7,836 | | | $ | 5,265 | | | $ | 15,493 | | | $ | 9,208 | |

| GEOs sold | 3,352 | | | 2,662 | | | 7,047 | | | 4,750 | |

| Adjusted cash flows from operating activities | $ | 1,341 | | | $ | 1,452 | | | $ | 4,002 | | | $ | (983) | |

| | | | | | | |

| Adjusted EBITDA | $ | 4,639 | | | $ | 2,848 | | | $ | 7,862 | | | $ | 3,222 | |

| | | | | | | |

| Statement of Financial Position | | | | | | | |

| Cash and cash equivalents | | | | | $ | 21,421 | | | $ | 10,965 | |

Working capital1 | | | | | $ | (2,421) | | | $ | 24,885 | |

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 3 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Non-IFRS Financial Measures1:

The Company had adjusted revenue and other income and adjusted royalty revenue by metal of the following:

The Company had adjusted royalty revenue by asset and by GEOs of the following:

1 Refer to the "Non-IFRS financial measures" section on page 29 of this MD&A for more information on each non-IFRS financial measure.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 4 |

Management's Discussion & Analysis

(Expressed in U.S. Dollars, except where indicated)

Outlook

The Company is maintaining its 2024 guidance of GEOs sales of 11,000 to 14,000, adjusted royalty revenue of $22,000,000 to $27,500,000 and option and other property income of $2,000,000 to $3,000,000. The Company is currently on pace to achieve the upper end of its annual guidance for GEOs sold and adjusted royalty revenue, while aiming for the lower end of our option and other property income guidance.

The Company is excited about the prospect for continued growth in the portfolio for 2024 and the coming years. The driver for near and long term growth in cash flow will come from the large deposits of Caserones in Chile and Timok in Serbia. At Caserones, Lundin has initiated an exploration program which is intended to expand mineral resources and mineral reserves while at the same time looking to increase throughput at the plant. At Timok, Zijin Mining Group Co. continues to increase its production rates in the upper zone copper-gold deposit while developing the lower zone, which we believe will be one of the more important block cave development projects in the world.

In terms of other production royalty assets, the Company expects Gediktepe, Leeville, and Gold Bar South to mirror what occurred in 2023. In Türkiye, Gediktepe continues to perform well and is ahead of its production forecast for 2024 (as of the end of Q2) and production rates and grades at Balya North ramped up again in Q2. We are also excited about the advancement of Diablillos in Argentina by AbraSilver Resource Corp. where the company continues to expand the mineral resource.

The Company will continue to evaluate and work to acquire mineral rights and royalties in 2024. The Company expects it will invest similar amounts as in 2023 towards the royalty generation business. As in previous years, producing royalties will continue to be supplemented by option, advance royalty, and other pre-production payments from partnered projects across the global asset portfolio. Efforts and programs are underway to optimize and control costs as the Company continues to grow. EMX believes it is well positioned to identify and pursue new royalty and investment opportunities, while further filling a pipeline of royalty generation properties that provide opportunities for additional cash flow, as well as exploration, development, and production success.