0000040570false--09-30FY2024false0.000.002000000000.2500015300010100000000000000000000000.00393300001.180.96P7Y11M16D27000000.100000405702023-10-012024-09-300000040570job:UnallocatedExpensesMember2022-10-012023-09-300000040570job:UnallocatedExpensesMember2023-10-012024-09-300000040570us-gaap:ConsolidatedEntitiesMember2023-09-300000040570us-gaap:ConsolidatedEntitiesMember2024-09-300000040570us-gaap:ConsolidatedEntitiesMember2023-10-012024-09-300000040570us-gaap:ConsolidatedEntitiesMember2022-10-012023-09-300000040570job:ProfessionalStaffingServicesMember2023-09-300000040570job:ProfessionalStaffingServicesMember2024-09-300000040570job:ProfessionalStaffingServicesMember2022-10-012023-09-300000040570job:ProfessionalStaffingServicesMember2023-10-012024-09-300000040570job:IndustrialStaffingServicesMember2023-09-300000040570job:IndustrialStaffingServicesMember2024-09-300000040570job:IndustrialStaffingServicesMember2022-10-012023-09-300000040570job:IndustrialStaffingServicesMember2023-10-012024-09-300000040570us-gaap:StateAndLocalJurisdictionMember2023-10-012024-09-300000040570us-gaap:StateAndLocalJurisdictionMember2024-09-300000040570job:FederalMember2023-10-012024-09-300000040570job:FederalMember2024-09-300000040570job:WarrantsMemberus-gaap:StockOptionMember2022-10-012023-09-300000040570job:WarrantsMemberus-gaap:StockOptionMember2023-10-012024-09-300000040570job:TwoThousandThirteenIncentiveStockPlanMember2022-10-012023-09-300000040570job:TwoThousandThirteenIncentiveStockPlanMember2023-10-012024-09-300000040570us-gaap:StockOptionMember2022-10-012023-09-300000040570us-gaap:WarrantMember2022-10-012023-09-300000040570us-gaap:WarrantMember2023-10-012024-09-3000000405702024-08-012024-08-130000040570us-gaap:SeriesCPreferredStockMember2024-09-300000040570us-gaap:SeriesBPreferredStockMember2024-09-300000040570us-gaap:SeriesAPreferredStockMember2024-09-300000040570srt:BoardOfDirectorsChairmanMember2023-04-012023-04-270000040570job:StockOptionsMember2024-09-300000040570job:StockOptionsMember2023-10-012024-09-300000040570job:StockOptionsMember2022-10-012023-09-300000040570job:StockOptionsMember2023-09-300000040570job:StockOptionsMember2022-09-300000040570us-gaap:RestrictedStockMember2024-09-300000040570us-gaap:RestrictedStockMember2022-10-012023-09-300000040570us-gaap:RestrictedStockMember2023-10-012024-09-300000040570us-gaap:RestrictedStockMember2022-09-300000040570us-gaap:RestrictedStockMember2023-09-300000040570job:performancebasedawardsThreeMember2021-10-012022-09-300000040570job:performancebasedawardsThreeMember2022-10-012023-09-300000040570job:performancebasedawardsTwoMember2021-10-012022-09-300000040570job:performancebasedawardsTwoMember2022-10-012023-09-300000040570job:performancebasedawardsoneMember2022-10-012023-09-300000040570job:performancebasedawardsoneMember2021-10-012022-09-300000040570job:BottomsMember2023-10-012024-09-300000040570job:TopsMember2023-10-012024-09-300000040570job:SecurityAndGuarantyAgreementMember2022-10-012023-09-300000040570job:SecurityAndGuarantyAgreementMember2023-09-300000040570job:SecurityAndGuarantyAgreementMember2024-09-300000040570job:SecurityAndGuarantyAgreementMember2023-10-012024-09-300000040570job:AccruedSeveranceMember2023-09-300000040570job:AccruedLegalFeesMember2023-09-300000040570job:AccruedClientRebatesMember2023-09-300000040570job:AccruedAuditFeesMember2023-09-300000040570job:OtherMember2023-09-300000040570job:ReserveForFalloffsMember2023-09-300000040570job:CurrentFinanceLeasesPayableMember2023-09-300000040570job:AccruedSeveranceMember2024-09-300000040570job:AccruedLegalFeesMember2024-09-300000040570job:AccruedClientRebatesMember2024-09-300000040570job:AccruedAuditFeesMember2024-09-300000040570job:OtherMember2024-09-300000040570job:ReserveForFalloffsMember2024-09-300000040570job:CurrentFinanceLeasesPayableMember2024-09-300000040570job:IndustrialServicesMember2023-10-012024-09-300000040570job:ProfessionalServicesMember2023-10-012024-09-300000040570job:TradeNameMember2023-10-012024-09-300000040570job:TradeNameMember2024-09-300000040570job:TradeNameMember2023-09-300000040570job:CustomerRelationshipMember2023-10-012024-09-300000040570job:CustomerRelationshipMember2024-09-300000040570job:CustomerRelationshipMember2023-09-300000040570job:IndustrialServicesReportingUnitMember2023-10-012024-09-300000040570job:IndustrialServicesReportingUnitMember2022-10-012023-09-300000040570job:IndustrialServicesReportingUnitMember2024-09-300000040570job:IndustrialServicesReportingUnitMember2023-09-300000040570job:ProfessionalServicesReportingUnitMember2023-10-012024-09-300000040570job:ProfessionalServicesReportingUnitMember2022-10-012023-09-300000040570job:ProfessionalServicesReportingUnitMember2024-09-300000040570job:ProfessionalServicesReportingUnitMember2023-09-300000040570job:OperatingleasesconsistedMember2024-09-300000040570job:OperatingleasesconsistedMember2023-09-300000040570job:financeleasesconsistedMember2024-09-300000040570job:financeleasesconsistedMember2023-09-300000040570job:OperatingleasesconsistedMember2023-10-012024-09-300000040570job:OperatingleasesconsistedMember2022-10-012023-09-300000040570job:financeleasesconsistedMember2023-10-012024-09-300000040570job:financeleasesconsistedMember2022-10-012023-09-300000040570us-gaap:LeaseholdImprovementsMember2024-09-300000040570us-gaap:ComputerEquipmentMember2024-09-300000040570us-gaap:FurnitureAndFixturesMember2024-09-300000040570us-gaap:LeaseholdImprovementsMember2023-09-300000040570us-gaap:FurnitureAndFixturesMember2023-09-300000040570us-gaap:ComputerEquipmentMember2023-09-300000040570job:ComputerSoftwareMember2024-09-300000040570job:ComputerSoftwareMember2023-09-300000040570us-gaap:RetainedEarningsMember2024-09-300000040570job:TreasuryStocksMember2024-09-300000040570us-gaap:CommonStockMember2024-09-300000040570us-gaap:RetainedEarningsMember2023-10-012024-09-300000040570job:TreasuryStocksMember2023-10-012024-09-300000040570us-gaap:CommonStockMember2023-10-012024-09-300000040570us-gaap:RetainedEarningsMember2023-09-300000040570job:TreasuryStocksMember2023-09-300000040570us-gaap:CommonStockMember2023-09-300000040570us-gaap:RetainedEarningsMember2022-10-012023-09-300000040570job:TreasuryStocksMember2022-10-012023-09-300000040570us-gaap:CommonStockMember2022-10-012023-09-3000000405702022-09-300000040570us-gaap:RetainedEarningsMember2022-09-300000040570job:TreasuryStocksMember2022-09-300000040570us-gaap:CommonStockMember2022-09-3000000405702022-10-012023-09-3000000405702023-09-3000000405702024-09-3000000405702024-12-1800000405702024-03-28iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended September 30, 2024

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 1-05707 |

|

GEE GROUP INC. |

(Exact name of registrant as specified in its charter) |

Illinois | | 36-6097429 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

7751 Belfort Parkway, Suite 150, Jacksonville, FL | | 32256 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (630) 954-0400 |

|

|

(Former name, former address and former fiscal year, if changed since last report) |

|

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, no par value | | JOB | | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

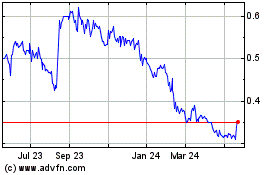

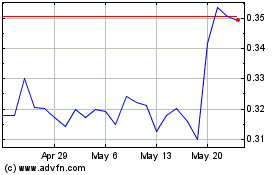

The aggregate market value of shares of common stock held by non-affiliates of the registrant on March 28, 2024 was 91,210,129 x $0.36 = $32,835,646.

The number of shares outstanding of the registrant’s common stock as of December 18, 2024 was 109,413,244.

TABLE OF CONTENTS

PART I

Forward Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company has based these forward-looking statements on the Company’s current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us and the Company’s subsidiaries that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue” or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a material difference include, but are not limited to, those discussed elsewhere in this Annual Report, including the section entitled “Risk Factors” and the risks discussed in the Company’s other Securities and Exchange Commission filings. The following discussion should be read in conjunction with the Company’s audited Financial Statements and related Notes thereto included elsewhere in this report.

Item 1. Business

General

GEE Group Inc. (the “Company,” “us,” “our” or “we”) was incorporated in the State of Illinois in 1962 and is the successor to employment offices doing business since 1893. We are a provider of human resources solutions which primarily include the provision of temporary and permanent personnel in the professional and industrial services sectors to customers located in the United Sates. We, through our operating subsidiaries, deliver our services from a network of three virtual locations and 23 branch office locations located in or near several major U.S. cities, including, but not limited to: Atlanta, Dallas, Denver, and Miami.

The Company has several subsidiary corporations all of which are wholly owned and consolidated under GEE Group Inc. Our material operating subsidiaries include Access Data Consulting Corporation, Agile Resources, Inc., BMCH, Inc., Paladin Consulting, Inc., Scribe Solutions, Inc., SNI Companies, Inc., Triad Logistics, Inc., and Triad Personnel Services, Inc. In addition, we and our operating subsidiaries own and operate under other trade names, including Accounting Now, Ashley Ellis, Staffing Now®, SNI Banking, SNI Certes®, SNI Energy®, SNI Financial®, SNI Technology®, GEE Group (Columbus), General Employment, Omni One and Triad Staffing.

Services Provided

We provide our services to a broad range of customers from small and medium-sized businesses to the Fortune 1000. Our services include the provision of highly specialized contract or permanently placed professionals in several verticals, including IT, engineering, accounting and finance, office support, and specialized contract healthcare professionals, including scribes who specialize in electronic medical record (“EMR”) services for emergency departments, specialty physician practices and clinics. We also provide temporary staffing services in the light industrial (blue collar) areas.

Our contract and placement services are principally provided under two operating divisions or segments: Professional Staffing Services and Industrial Staffing Services.

Our operating subsidiaries and end markets served under each of its operating divisions are as follows:

Professional Division

| · | Access Data Consulting provides hard-to-find IT talent to customers on a direct hire or contract basis and human resources consulting services and solutions in the higher-end IT vertical including project management support to businesses regionally (Western and Southwestern U.S.) and, to a lesser extent, throughout the rest of the U.S. |

| | |

| · | Agile Resources specializes in providing technical staffing services for AI-focused consulting, IT project support, and talent solutions across the Southeastern U.S. and, to a lesser extent, throughout out the rest of the U.S. Services include talent delivery for cutting-edge AI-driven application architecture and delivery, enterprise operations optimization, digital transformation, information lifecycle management, and project management. With flexible engagement options, Agile Resources offer both contract staffing and direct hire to meet the diverse needs of our clients in deploying advanced AI and technology solutions. |

| | |

| · | Ashley Ellis works with C-suite and senior executives to offer full cycle engineering and IT contract staffing services, with a focus on business intelligence, application development and network infrastructure, to clients in the Southeastern U.S. region and, to a lesser extent, throughout the rest of the U.S. |

| | |

| · | GEE Group (Columbus) primarily provides direct hire placement and contract staffing services in the accounting and engineering verticals, with an emphasis on placing personnel with specialized skills in the mechanical, manufacturing and equipment maintenance areas to clients throughout the Midwestern U.S. |

| | |

| · | Omni One specializes in technical and professional direct-hire and contract staffing solutions in the manufacturing and engineering verticals for clients primarily located in the Midwestern U.S. |

| | |

| · | Paladin Consulting primarily provides highly skilled IT professionals on a contract or direct hire basis directly to customers or through RPO, MSP and VMS arrangements and other non-IT staffing solutions to customers nationwide including government contractors who require that the provider of staffing services have required security clearance; such security certification is maintained by Paladin Consulting. |

| | |

| · | Scribe Solutions provides hospital and free-standing emergency rooms and physician practices in the Southeastern U.S. with highly trained medical scribes for personal assistant work in connection with EMR. |

| | |

| · | SNI Companies provides human resource solutions, including direct hire and contract staffing, project support and retained search services specializing primarily in the accounting, finance, banking, IT and office support verticals to customers located in major U.S. metropolitan markets, such as Dallas/Fort Worth, Austin, Houston, Chicago, Denver, Miami, Princeton, Tampa, Jacksonville, Hartford, Andover and surrounding areas. SNI Companies’ brands include Accounting Now, Staffing Now®, SNI Banking, SNI Certes®, SNI Energy®, SNI Financial®, and SNI Technology®. |

Industrial Division

| · | Triad Staffing provides traditional, on-demand and on-site staffing services in metropolitan business markets throughout Ohio. Triad Staffing's services are comprised of staffing and human resource solutions for clients and candidates within the Office Services, Commercial, Skilled Labor, Technical and Manufacturing Trades, and On-Site Management Services of the Light Industrial sector. Triad Staffing has been successful in providing staffing solutions to its clients because of its tenured team of highly skilled and dedicated staff, human resource expertise, training, and operating philosophy of providing single-source staffing solutions with the Triad Staffing Advantage. |

The percentage of revenues derived from each of the Company’s direct hire and contract services lines are as follows:

| | Fiscal | |

| | 2024 | | | 2023 | |

Professional direct hire placement services | | | 10.5% | | | | 12.7% | |

Professional contract services | | | 81.3% | | | | 78.7% | |

Industrial contract services | | | 8.2% | | | | 8.6% | |

Business Strategy

Our business strategy is multi-dimensional and encompasses both organic growth and growth through strategic acquisitions. Since 2015, the Company has completed four acquisitions, the most recent of which was SNI, which to date has been its largest. The main tenants of our strategy are to grow organically by:

| · | Providing innovative solutions for clients delivered through an enhanced and expanded menu of professional services offerings while increasing the penetration of clients in our existing markets for our IT, finance and accounting, healthcare, engineering and office support verticals; |

| | |

| · | Entering other fast-growing markets following existing customers who are expanding their operations and cross-selling services by leveraging strategic customer relationships capitalizing on the Company’s national managed services agreements MSA, MSP and VMS relationships; |

| | |

| · | Expanding our geographic footprint of professional services offerings into new markets believed to possess high growth potential, particularly with regard to our IT brands; |

| | |

| · | Adding recruiting and sales talent to our existing delivery network to obtain new customers and increase the number of placements made to increase revenue; |

| | |

| · | Increasing scalability and expanding operating margins through the on-going process of streamlining back- office operations, establishing and leveraging regional centers of excellence, improving upon per desk production averages, elimination of duplicative costs among our businesses, and continued realization of economies of scale; and |

| | |

| · | Capitalizing on hiring opportunities created by volatility in the economic and labor markets by providing on-demand labor to fill the personnel voids of businesses following corporate America’s reactions and resulting on-going realignments since the on-set of the COVID-19 pandemic. As the economy recovers and companies have returned to sustained operations and growth, demand for our services has accelerated, with a particular focus on IT, E-Commerce and Logistics. We expect to continue to capitalize on these opportunities and to explore and innovate others, particularly in IT, including frontier areas such as digital content and information management disciplines. |

Growth Through Strategic Acquisitions:

Since 2015, a significant portion of our growth has been achieved through acquisitions of complementary businesses. We intend to continue to expand our business through strategic acquisitions, subject to our business plans and management’s ability to identify, acquire and develop suitable acquisition or investment targets in both new and existing service categories. Along with our significant business growth to date, we have built a robust platform with the appropriate infrastructure and scalability, which we believe is necessary to assimilate acquisitions.

We continue to explore opportunities for potential acquisitions in the fragmented staffing industry. Our acquisition strategy includes, but is not limited to, targeting companies or transactions that we believe may have one or more of the following characteristics:

| · | A focus on IT specialties and other verticals, including healthcare, cyber security, government and other targets in the professional services sectors; |

| | |

| · | A well-managed business with experienced operators and with high gross profit and earnings before interest, taxes, depreciation, and amortization (“EBITDA”) margins, as well as consistent revenue growth; |

| | |

| · | Limited enterprise risk and successful due diligence; and |

| | |

| · | Pricing commensurate with profitability and growth, must be accretive to earnings and consideration generally consisting of a combination of cash, seller and/or bank financing and stock. |

Marketing

We market our staffing services using our corporate and trade names in our respective vertical markets. As of September 30, 2024, we operated from locations in eleven (11) states, including twenty-three (23) branch offices in downtown or suburban areas of major U.S. cities and three (3) additional U.S. locations utilizing local staff members working remotely. We have offices or serve markets remotely, as follows; (i) one office in each of Connecticut, Georgia, Illinois, and New Jersey, and one remote local market presence in Virginia; (ii) two offices each in Massachusetts and Colorado; (iv) two offices and one additional local market presences in Texas; (v) six offices and one additional local market presence in Florida; and (vi) seven offices in Ohio.

We market our staffing services to prospective clients primarily through the use of the internet, specialty brands and corporate websites, digital direct mail campaigns, publishing annual electronic and widely distributed salary guides, advertising in tech, HR and accounting publications, attendance and booth displays at specialty trade shows, participation and membership in chambers of commerce and other business organizations, and support for our employees’ philanthropic activities. Our sales consultants and business development managers also engage in telephone marketing using our CRM tools to identify prospects, and through the mailing of tailored employment bulletins which list highly-skilled candidates available for placement and contract employees available for assignment.

There was no customer that represented 10% or more of the Company’s consolidated revenue in fiscal 2024 or 2023. There are two customers that, in aggregate, made up approximately 25% of the Company’s consolidated accounts receivable as of both September 30, 2024 and 2023. These two customers are offered extended payment terms due to the frequency and volume of our services they utilize. Each maintains excellent creditworthiness and the Company has not experienced any losses related to these two customers historically.

Competition

The staffing industry is highly fragmented with a multitude of competitors. There are relatively few barriers to entry by firms offering direct hire placement and staff augmentation services although significant amounts of working capital typically are required to fund the payroll of temporary workers for businesses providing contract staffing services. New entrants to the staffing industry are constantly introduced to the marketplace. Our competitors include sole-proprietorship operations, local and regional firms as well as national organizations. In the U.S., large national firms with annual revenue of at least $100 million or more, represent a relatively small portion of all U.S. staffing firms. Local and regional firms’ yearly revenue can range from one to several million dollars or more. The largest portion of the marketplace consists of small, individual-sized or family-run operations. With low barriers to entry, sole proprietorships and smaller entities routinely enter the staffing industry. Many of our competitors are larger corporations with substantially greater resources than ours; however, as described below, we believe we are able to compete successfully in the verticals and end markets in which we operate.

Our professional and industrial staffing services compete effectively by providing highly qualified candidates who are well matched for the position, by developing and maintaining outstanding client relationships on a local level, by responding quickly to client requests, and by establishing offices and presences in convenient locations. As part of our services, we provide professional reference checking, scrutiny of candidates’ work experiences and optional custom background checks. In general, we believe that a positive client experience is most important, and pricing often is secondary to quality of service as a competitive factor. During slow hiring periods, competition can put pressure on our pricing; however, we believe we are able to effectively compete on price in such situations.

Our Competitive Strengths

We believe that we are able to compete effectively in the staffing industry because we have:

| · | Deep experience and vertical specialization and expertise in niche markets; |

| | |

| · | Invested in robust sales programs and marketing tools and technology and CRM software to successfully identify, target and reach out to potential new customers; |

| | |

| · | Long-tenured division leaders, business development managers and vertical specialists (e.g., certified public accountants for accounting, tax and financial placements) with deep and relevant staffing industry experience; |

| | |

| · | Strong and proven capability to deliver outstanding results for our clients under significant time constraints on large-scale projects leveraging our wide office network and experienced project team leaders, including experience with MSP and VMS programs; |

| | |

| · | Well established strategies and procedures for both temporary and permanent virtual working environments supported by technology to facilitate communication, recruiting, onboarding and management of the business virtually; |

| | |

| · | Specialized state-of-the-art databases, applicant tracking systems (“ATS”) and other technology tools that facilitate swift, expert matching of candidates to job requirements providing highly qualified multiple choices to clients; |

| | |

| · | Localized decision-making and a lack of a multi-layered bureaucracy which provides for more rapid responses to customized client requests and a streamlined approval process in place for speedy recruitment of personnel; and |

| | |

| · | Hands-on training with specialized modules for newly hired recruiters and account management personnel. |

Recruiting

The success of our services is highly dependent on our ability to recruit and retain qualified candidates. Prospective employment candidates are generally recruited through job postings and contact made electronically using various internet tools as well as telephone contact by our employment consultants. For internet postings, we maintain our corporate web page at www.geegroup.com and our specialty brand web pages in addition to extensive use of internet job posting bulletin board services. We also maintain database records of applicants’ skills through our ATS to assist in matching applicant skills with job openings and contract assignments. We generally screen, interview and, in many cases, background check applicants who are presented to our clients.

Industry Overview

The staffing industry is divided into three major segments: temporary staffing services, professional employer organizations (“PEOs”) and placement agencies. Temporary staffing services provide workers for limited periods, often to substitute for absent permanent workers or to staff discreet projects, or to help during periods of peak demand. These workers, who are often employees of the temporary staffing agency, will generally fill administrative, clerical, accounting, and other professional technical positions, or industrial positions. In some cases, temporary staffing services may be provided to clients over prolonged periods in longer-term HR outsourcing type scenarios. PEOs, sometimes referred to as employee leasing agencies, contract to provide workers to customers for specific functions, often related to human resource management. In many cases, a customer’s employees are hired by a PEO and then contracted back to the customer. Placement agencies, sometimes referred to as executive recruiters or headhunters, find workers to fill permanent positions at customer companies. These agencies may specialize in placing senior managers, mid-level managers, technical workers, or clerical and other support workers.

Our business is mainly that of a temporary staffing company within the broader staffing industry, however, we also offer and provide permanent placement services in our Professional Staffing Services segment. We employ the substantial portion of our staff members we place on temporary assignments with our clients. In addition to assisting our clients in managing peaks and valleys in their staffing needs, the temporary workers we place come in the form of a broader human resources management solution. That is, our clients do not bear the usual employment risks and compliance costs and burdens associated with our temporary workers; instead, we retain these costs and risks as the employer of record. We believe this is a significant value add for many of our temporary staffing clients.

Staffing companies identify potential candidates through online advertising and referrals, and interview, test and counsel workers before sending them to the customer for approval. Pre-employment screening can include skills assessment and reference checking, as well as drug tests and criminal background checks. The personnel staffing industry has been radically changed by the internet. Many employers list available positions with one or several internet personnel sites, such as those offered by firms like Monster or CareerBuilder, and on their own websites. Personnel agencies operate their own sites and often still work as intermediaries by helping employers accurately describe job openings and by screening candidates who submit applications.

Major end-use customers include businesses from virtually all industries. Marketing involves direct sales presentations, referrals from existing clients and advertising. Agencies compete both for customers and workers. Depending on market supply and demand at any given time, agencies may allocate more resources either to finding potential employers or potential workers. Permanent placement agencies work either on a retained or on a contingency basis. Clients may retain an agency for a specific job search or on contract for a specific period. Temporary staffing services charge customers a fixed price per hour or a standard markup on prevailing hourly rates.

For many staffing companies, including ours, demand is lower late in the fourth calendar quarter and early in the first calendar quarter, partly because of holidays, and is higher during the rest of the year. Staffing companies may have high receivables from customers. Temporary staffing agencies and PEOs must manage a high cash flow because they make payroll payments to their employees on behalf of client employers. Cash flow imbalances also occur because agencies must pay workers even if they have not been paid by clients.

The revenue of staffing companies depends on the number of jobs they fill, which in turn can depend upon the economic environment. During economic slowdowns, many client companies may also slow down or stop hiring altogether. During the recent COVID-19 pandemic, many client companies closed their businesses and/or stopped hiring or contracting employees. Internet employment sites expand a Company’s ability to find and source potential workers without the help of traditional agencies. Staffing companies often work as intermediaries, helping employers accurately describe job openings and screen candidates. Increasing the use of sophisticated, automated job description and candidate screening tools could make many traditional functions of personnel agencies obsolete. Free social networking sites such as LinkedIn and Facebook are also becoming a common way for recruiters and employees to connect without the assistance of a staffing agency.

To avoid large placement agency fees, big companies may use in-house personnel recruiting staff, current employee referrals, or human resources consulting companies to find and hire new personnel. Because placement agencies typically charge a fee based on a percentage of the first year’s salary of a new worker, companies with many jobs to fill may have a financial incentive to avoid use of agencies where it is less costly to invest in in-house resources.

Many staffing companies are small and may depend heavily on a big customer for a large portion of revenue. Large customer concentration may lead to increased revenue, but also expose agencies to concentration risks. When major accounts experience financial hardships, and have less need for temporary employment services, agencies stand to lose large portions of revenue.

The loss of a staff member who handles a large volume of business may result in a large loss of revenue for a staffing company. Individual staff members, rather than the staffing company itself, often develop strong relationships with customers. Non-compete agreements are commonly used by staffing companies, however, staff members who move to another staffing company are often able to work around terms and conditions of their non-compete agreements and move customers with them.

Some of the best opportunities for temporary employment are in industries traditionally active in seasonal cycles, such as manufacturing, construction, wholesale and retail. However, seasonal demand for workers also creates cash flow fluctuations throughout the year.

Staffing companies are subject to regulations promulgated by the U.S. Department of Labor and the Equal Employment Opportunity Commission, and often by state authorities. Many federal anti-discrimination rules regulate the type of information that employment firms can request from candidates or provide to customers about candidates. In addition, the relationship between the agency and its temporary employees, or its employee candidates may not always be clear, resulting in legal and regulatory uncertainty.

Trends in the Staffing Business

Start-up costs for a staffing company can be relatively low. Individual offices can be profitable, and consolidation is driven by opportunities for large or growing agencies to develop national relationships with big customers or build resources and scale for future growth. Some agencies expand by starting new offices in promising markets, others prefer to buy existing independent offices with proven staff and an existing customer roster, while still others focus on both.

At some companies, temporary workers have become such a large part of the workforce that staffing company employees sometimes work at the customer’s site to recruit, train, and manage temporary employees. Staffing companies try to match the best qualified employees for the customer’s needs, but often provide additional training specific to that company, such as instruction in the use of proprietary software.

Some personnel consulting firms and human resource departments use psychological tests to evaluate potential job candidates. In addition to more comprehensive background checks, headhunters often check the credit history of prospective employees.

We believe the trends of outsourcing entire departments and dependence on temporary and leased workers will continue to expand creating opportunities for staffing companies. Taking advantage of their in-house expertise in assessing worker capabilities, some staffing companies manage their clients’ entire human resource functions. Human resources outsourcing (“HRO”) may include management of personnel and payroll administration, tax filings, and benefit administration services. HRO may also include recruitment process outsourcing (“RPO”), whereby an agency manages all recruitment activities for a client.

New online technology is improving staffing efficiency. For example, some online applications coordinate workflow for staffing agencies, their clients and temporary workers, and allow agencies and customers to share work order requests, submit and track candidates, approve timesheets and expenses, and run reports. Interaction between candidates and potential employers is increasingly being handled online.

Initially viewed as rivals, some Internet job-search companies and traditional employment agencies are now collaborating. While some Internet sites do not allow agencies to use their services to post jobs or look through resumes, others find that agencies are their biggest customers, earning the sites a large percentage of their revenue. Some staffing companies contract to help client employers find workers online.

The COVID-19 pandemic has caused staffing companies to significantly rethink and alter their operations and, in some cases, even their fundamental business models. Staffing companies played a prominent, if not leading, role in recent new workplace trends, including flexible scheduling and remote work arrangements, as two significant examples. A natural result of the shutdowns, quarantines, social distancing and other COVID-19 guidelines is reinforcement of these types of newer workplace trends in many cases. Therefore, we expect that even as the threat of COVID-19 has substantially lessened, these workplace trends are likely to continue on and occupy a permanent place going forward.

Staffing Industry Cyclicality

The U.S. staffing industry has experienced three distinct material cyclical downturns in this century. The first was in approximately 2000-2001, associated with the burst of the Dot-com bubble following unprecedented growth and expansion of technology and the internet in the 1990s. The second was in 2008-2009, corresponding with the “Great Recession” as it became known in the U.S. and abroad at the time. The most recent downturn began in 2023 following a robust post-COVID-19 pandemic recovery in 2021 and 2022. Unfortunately, that recovery (often referred to as the “post-COVID bounce”) was short-lived and was immediately followed by another staffing industry downturn that emerged amidst record high inflation and interest rates. This latest economic downturn is widely attributed to record amounts of stimulus money being pumped into the economy and increased government spending during and after the pandemic.

The staffing industry’s most recent cyclical downturn that began in 2023, also is being fueled by lingering volatility in employment that began during the pandemic, including mainly the significant rise in remote working arrangements, and a continuing reconciliation between the needs of workers and their employers since. Staffing Industry Analysts (“SIA”), a leading industry trade organization, recently published in its September 2024 U.S. Staffing Industry Forecast Update, that the U.S. Staffing Industry is expected to decline overall by 10% in 2024. This follows a 10% decline already experienced in 2023. The SIA report cites that the decline has been driven by widespread client caution and project delays, a depressed manufacturing sector, falling bill rates in sectors such as healthcare, and employer and worker heightened preferences for permanent positions over temporary positions.

The SIA report also forecasts that the staffing industry will grow 5% in 2025 to reach a market size of $198.3 billion. In terms of segments, SIA forecasts 6% growth in healthcare, 5% growth in IT, and 3% expansion in industrial staffing.

Employees

As of September 30, 2024, the Company had approximately 210 regular employees and the number of contract service employees varied week to week during fiscal 2024, from a minimum of approximately 1,245 to a maximum of 1,601.

Our Corporate Information

We were incorporated in the State of Illinois in 1962 and are the successor to employment offices doing business since 1893. Our principal executive offices are located at 7751 Belfort Parkway, Suite 150, Jacksonville, Florida 32256, and our telephone number at that location is (904) 512-7501.

Available Public Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a), 14 and 15(d) of the Exchange Act. The public may obtain these filings at the Securities and Exchange Commission (the “SEC”) Public Reference Room at 100 F Street, NE, Washington DC 20549 or by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding the Company and other companies that file material with the SEC electronically. Copies of the Company’s reports can be obtained, free of charge, electronically through our internet website, www.geegroup.com. Information on the Company’s website is not incorporated in this report by the foregoing reference.

Item 1A. Risk Factors.

We operate in a changing environment that involves numerous known and unknown risks and uncertainties that could materially adversely affect our operations. The risks described below highlight some of the factors that have affected, and in the future could affect our operations and financial condition. Additional risks we do not yet know of or that we currently think are immaterial may also affect our business operations. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected.

THE U.S. ECONOMY CURRENTLY IS BEING NEGATIVELY IMPACTED BY HISTORICALLY SIGNIFICANT INFLATION, A LOOMING RESCESSION, AND DISRUPTIONS IN SUPPLY AND THE WORKFORCE; RECENT GLOBAL SOCIOECONOMIC TRENDS, INCLUDING THE WARS IN UKRAINE AND THE MIDDLE EAST AND U.S. RELATIONS WITH CERTAIN FOREIGN POWERS MAY HAVE A FURTHER ADVERSE EFFECT ON THE U.S. ECONOMY AND OUR BUSINESS.

The U.S. and larger global economies experienced historically high inflation during 2022, which has continued into 2024. The Federal Reserve and other Central Banks already have raised interest rates more aggressively and to their highest levels in decades. Although inflation and interest rates have begun to subside, the prospect for a recession is considered by many to be possible. Some sources have declared that the U.S. already has experienced a recession. Consumer prices, including basic costs of food, fuel, utilities, healthcare, mortgage and personal loan rates, and other non-discretionary and discretionary consumer items have risen significantly and remain high. Wages are up, however, increases in wages have lagged price inflation resulting in a net decline in real personal incomes relative to consumer spending. Volatility continues to exists in the workforce making it more difficult and costly for employers to recruit, hire and/or retain workers. U.S. unemployment remains relatively low, however the labor utilization rate and ratio of workers to the total population also remain low. Shortages in the workforce have been a significant factor in supply shortages relative to demand and also help fuel inflation. On the global stage, two wars are now being waged, the first led by the invasion of Ukraine by Russia, and the second, following the recent invasion of Israel by Hamas terrorists. These and overtures by China over Taiwan and the South China Sea, also add instability to the uncertainty driving socioeconomic forces, which in turn, impact the Company’s and its subsidiaries’ operations.

The present conditions and state of our U.S. and global economies make it difficult to predict the extent to which a recession has occurred or will occur or worsen in the near future, and we and other members of the U.S. Staffing Industry already have seen significant declines in business in 2023 and 2024. In the event of recurring or worsening conditions, in which the U.S. economy remains uncertain or contracts, we expect that our business will continue to be negatively impacted, accordingly. The Company has taken significant actions to shore up its resources and means in order to mitigate the negative effects of economic downturns; however, should economic conditions remain uncertain or worsen in the future, one may expect either scenario to continue to have an adverse effect on the business of the Company and its subsidiaries.

THE TERMS OF OUR SENIOR BANK ASSET BACKED LOAN AGREEMENT MAY PLACE SOME RESTRICTIONS ON OUR OPERATING AND FINANCIAL FLEXIBILITY, AND FAILURE TO COMPLY WITH COVENANTS OR TO SATISFY CERTAIN CONDITIONS OF THE AGREEMENT MAY RESULT IN ACCELERATION OF OUR REPAYMENT OBLIGATIONS, WHICH COULD HARM OUR LIQUIDITY, FINANCIAL CONDITION, OPERATING RESULTS, BUSINESS AND PROSPECTS AND CAUSE THE PRICE OF OUR SECURITIES TO DECLINE.

GEE Group Inc. and its subsidiaries, Agile Resources, Inc., Access Data Consulting Corporation, BMCH, Inc., GEE Group Portfolio, Inc., Paladin Consulting, Inc., Scribe Solutions, Inc., SNI Companies, Inc., Triad Personnel Services, Inc., and Triad Logistics, Inc. are co-borrowers under a Loan, Security and Guaranty Agreement for a $20 million asset-based senior secured revolving credit facility (the “Facility”) with First Citizens Bank (“FCB”) (formerly CIT Bank, N.A.). The Facility is collateralized by 100% of the assets of the Company and its subsidiaries who are co-borrowers and/or guarantors. The Facility matures on the fifth anniversary of the closing date (May 14, 2026). The Facility contains some restrictions and limitations that might inhibit our ability to engage in certain activities and transactions that may otherwise be in our long-term best interests. The affirmative and negative covenants contained in the Credit Agreement that may adversely affect our ability to operate our business include covenants that limit and restrict, among other things, our ability to incur additional indebtedness, transfer or sell certain assets, issue stock of subsidiaries, pay dividends on, repurchase or make distributions with respect to our capital stock or make other restricted payments, incur or permit liens or other encumbrances on assets, make certain investments, loans and advances, acquire other businesses, merge, consolidate, sell or otherwise dispose of all or substantially all of our assets, enter into certain transactions with our affiliates and amend certain agreements, without amendment of the Facility or the express approval of FCB. Under the Facility, advances are subject to a borrowing base formula based on 85% of eligible accounts receivable of the Company and subsidiaries, as defined, and subject to certain other criteria, conditions, and applicable reserves, including any additional eligibility requirements as determined by the administrative agent. Although the stated face amount of the Facility is $20 million, the borrowing base formula significantly limits amounts available for us to borrow.

The Facility also contains customary events of default, including, among others, payment default, bankruptcy events, cross-default, breaches of covenants and representations and warranties, change of control and judgment defaults. A breach of any of these covenants could result in default under our Credit Agreement, which could prompt the lenders to declare all amounts outstanding under the Credit Agreement to be immediately due and payable and terminate all commitments to extend further credit. In addition, a breach of the Credit Agreement would cause a cross-default of certain other indebtedness. If we were unable to repay those amounts, the lenders could proceed against the collateral granted to them to secure that indebtedness. If the lenders under the Credit Agreement accelerate the repayment of borrowings, we cannot ensure that we will have sufficient assets and funds to repay the borrowings under the Credit Agreement and our other indebtedness. An acceleration of our outstanding indebtedness could have serious consequences to our financial condition, operating results, and business, and could cause us to become insolvent or enter bankruptcy proceedings.

IF WE ARE UNABLE TO GENERATE OR BORROW SUFFICIENT CASH TO MAKE PAYMENTS ON OUR INDEBTEDNESS OUR FINANCIAL CONDITION WOULD BE MATERIALLY HARMED, OUR BUSINESS COULD FAIL AND OUR SHAREHOLDERS MAY LOSE ALL OF THEIR INVESTMENT.

Our ability to make scheduled payments on or to refinance our obligations is dependent upon our financial and operating performance, which is affected by economic, financial, competitive, business, and other factors, some of which are beyond our control. While we believe we will be able to meet our liquidity requirements for the foreseeable future and for at least the next twelve months, we cannot assure you that our business will generate sufficient cash flow from operations to service our indebtedness or to fund our other liquidity needs. If we are unable to meet our debt obligations or fund our other liquidity needs, we may need to restructure or refinance all or a portion of our indebtedness on or before maturity. We cannot assure you that we will be able to restructure or refinance any of our indebtedness on commercially reasonable terms, if at all, which could cause us to default on our debt obligations and impair our liquidity. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations.

THE COMPANY HAS MATERIAL INTANGIBLE ASSETS, INCLUDING GOODWILL, CUSTOMER LISTS, AND TRADENAMES. THESE ASSETS ARE SUBJECT TO IMPAIRMENT RISKS, WHICH COULD RESULT IN FUTURE MATERIAL IMPAIRMENT CHARGES TO INCOME AND NEGATIVELY IMPACTING THE FUTURE OPERATING RESULTS AND THE FINANCIAL POSITION OF THE COMPANY.

The Company is required to evaluate its goodwill annually or when one or more triggering events or circumstances indicate that assets might be impaired. The other long-lived assets, including definite-lived intangible assets, have to be tested for impairment only when triggering events occur or circumstances indicate that these assets might be impaired. The Company has recognized impairments of its goodwill and its other long-lived assets, including most recently during the third quarter of its fiscal year ended September 30, 2024. In testing for impairments, management applies one or more valuation techniques to estimate the fair values of the reporting units, individual assets or groups of individual assets, as required under the circumstances. These valuation techniques rely on assumptions and other factors, such as the estimated future cash flows, the discount rates used to determine the present value of associated cash flows, and the market comparable assumptions. Changes to input assumptions and other factors used or considered in the analysis could result in materially different evaluations of impairment.

The valuation techniques utilized by management for impairment testing, including estimated future cash flows, fundamentally include the inherent underlying assumption that the economy, the markets served by the Company, and the Company itself, will continue to grow. In the event the assumptions relied upon by management are not achieved, including assumed future growth rates, impairments of goodwill or other long-lived assets could be recorded and such amounts could be material to the consolidated financial statements. A reduction in the projected long-term operating performance of one or both of the Company’s reporting units or other long-lived assets, future market declines, changes in discount rates or other conditions also could result in material impairments in the future. Thus, there can be no assurance that the Company’s goodwill or other long-lived assets will not become impaired in the future.

WE HAVE SIGNIFICANT WORKING CAPITAL NEEDS AND IF WE ARE UNABLE TO SATISFY THOSE NEEDS FROM CASH GENERATED FROM OUR OPERATIONS OR BORROWINGS UNDER OUR DEBT INSTRUMENTS, WE MAY NOT BE ABLE TO CONTINUE OUR OPERATIONS.

We require significant amounts of working capital to operate our business. We often have high receivables from our customers, and as a staffing company, we are prone to cash flow imbalances because we have to fund payroll payments to temporary workers before receiving payments from clients for our services. If we experience a significant and sustained drop in operating profits, or if there are unanticipated reductions in cash inflows or increases in cash outlays, we may be subject to cash shortfalls. If a sustained shortfall were to occur, it could have an adverse effect on our business. In particular, we use working capital to fund expenses relating to our temporary workers and our other operating expenses and liabilities. As a result, we must maintain sufficient cash availability to pay temporary workers and fund payroll taxes and other payroll-related expenses prior to receiving payment from customers.

In addition, our operating results tend to be unpredictable from quarter to quarter. Demand for our services is typically lower during traditional national vacation periods in the United States when customers and candidates are on vacation. No single quarter is predictive of results of future periods. Any extended period of time with low operating results or cash flow imbalances could have a material adverse effect on our business, financial condition and results of operations.

We derive working capital for our operations through cash generated by our operating activities and borrowings under our debt instruments. If our working capital needs increase in the future, we may be forced to seek additional sources of capital, which may not be available on commercially reasonable terms. The amount we are entitled to borrow under our debt instruments is calculated monthly based on the aggregate value of certain eligible trade accounts receivable generated from our operations, which are affected by financial, business, economic and other factors, as well as by the daily timing of cash collections and cash outflows. The aggregate value of our eligible accounts receivable may not be adequate to allow for borrowings for other corporate purposes, such as capital expenditures or growth opportunities, which could reduce our ability to react to changes in the market or industry conditions.

THE LINGERING EFFECTS OF THE CORONAVIRUS PANDEMIC AND ITS SUBSEQUENT VARIANTS AND CARES ACT REQUIREMENTS COULD ADVERSELY AFFECT OUR BUSINESS, LIQUIDITY AND FINANCIAL RESULTS.

Recent global socioeconomic conditions, including the negative effects of the Coronavirus Pandemic (“COVID-19”), and disruption of financial markets, severely affected our business and results of operations during fiscal 2020 and, although to a lesser extent, fiscal 2021. The negative effects initially limited our access to credit or equity capital, our ability to refinance debt and disrupted ours and our clients’ businesses. In fiscal 2021 and 2022, we were able to regain reasonable access to credit and equity capital markets, but also have continued to experience some lingering negative effects on our business operations in certain markets.

The operations and liquidity of our operating subsidiaries were severely impacted by COVID-19. As a result and out of necessity, in fiscal 2020, we applied for and obtained financial relief in the form of funds received in exchange for promissory notes issued by the U.S. Small Business Administration (“SBA”) and U.S. Treasury under the Payroll Protection Program of the CARES Act (“PPP loans”). The Company and eight of its operating subsidiaries received PPP loans, totaling $20 million, and have since applied for and received forgiveness of their respective PPP loans from the SBA. The forgiveness of these loans, including their respective accrued and unpaid interest amounts, have been recognized by eliminating them from the Company’s consolidated balance sheets with corresponding gains in consolidated net income in fiscal 2021 and 2022.

The former PPP loans obtained by GEE Group Inc., and its operating subsidiaries together as an affiliated group, exceeded the $2 million audit threshold established by the SBA, and therefore, will be subject to audit by the SBA in the future. If any of the nine forgiven PPP loans are reinstated in whole or in part as the result of a future audit, or other Federal mandate or initiative, a charge or charges would be incurred, accordingly, and they would need to be repaid. If the companies are unable to repay the portions of their PPP loans that ultimately may be reinstated from available liquidity or operating cash flow, we may be required to raise additional equity or debt capital to repay the PPP loans.

OUR REVENUE CAN VARY BECAUSE OUR CUSTOMERS CAN TERMINATE THEIR RELATIONSHIP WITH US AT ANY TIME WITH LIMITED OR NO PENALTY.

We focus on providing professional and light industrial personnel on a temporary assignment-by-assignment basis, which customers can generally terminate at any time or reduce their level of use when compared to prior periods. To avoid large placement agency fees, large companies may use in-house personnel staff, current employee referrals, or human resources consulting companies to find and hire new personnel. Because placement agencies typically charge fees as a mark-up to the hourly pay rate or based on a percentage of the first year’s salary of a new worker, companies with many jobs to fill may have a large financial incentive to avoid agencies.

Our business is also significantly affected by our customers’ hiring needs and their views of their future prospects. Our customers may, on very short notice, terminate, reduce or postpone their recruiting assignments with us and, therefore, affect demand for our services. As a result, a significant number of our customers can terminate their agreements with us at any time, making us particularly vulnerable to a significant decrease in revenue within a short period of time that could be difficult to quickly replace. This could have a material adverse effect on our business, financial condition and results of operations.

MOST OF OUR CONTRACTS DO NOT OBLIGATE OUR CUSTOMERS TO UTILIZE A SIGNIFICANT AMOUNT OF OUR STAFFING SERVICES AND MAY BE CANCELLED ON LIMITED NOTICE, SO OUR REVENUE STREAM MAY BE INCONSISTENT AND IS NOT GUARANTEED.

Substantially all of our revenue is derived from contracts or master service agreements that are renewable or perpetual and that are terminable by our customers for their convenience and at their discretion. Under our renewable or perpetual agreements, we contract to provide staffing services through work or service orders at the customers’ request. Under these agreements, our customers often have little or no obligation to request our staffing services. In addition, most of our contracts are cancellable on limited notice and without material penalties, even if we are not in default under the contract. We may hire employees permanently to meet anticipated demand for services under these agreements that may ultimately be delayed or cancelled. We could face a significant decline in revenues and our business, financial condition or results of operations could be materially adversely affected if we see a significant decline in the staffing services requested from us under our service agreements; or our customers cancel or defer a significant number of staffing requests; or our existing customer agreements expire or lapse and we cannot renew or replace them with similar agreements.

IF WE ARE UNABLE TO RETAIN A BROAD GROUP OF EXISTING CUSTOMERS, LOSE ONE OR MORE SIGNIFICANT CUSTOMERS, OR FAIL TO ATTRACT NEW CUSTOMERS, OUR RESULTS OF OPERATIONS COULD SUFFER.

Increasing the growth and profitability of our business is particularly dependent upon our ability to retain existing customers and capture additional customers. Our ability to do so is dependent upon our ability to provide high quality services and offer competitive prices. If we are unable to execute these tasks effectively, we may not be able to attract a significant number of new customers and our existing customer base could decrease, including the loss of a significant customer, either or all of which could have an adverse impact on our revenues.

SUBSTANTIAL ALTERATION OF OUR CURRENT BUSINESS AND REVENUE MODEL COULD HURT SHORT-TERM RESULTS.

Our present business and revenue model represents our view of optimal business and revenue generation, which is to derive revenues and achieve profitability in the shortest period. There can be no assurance that current models will not be altered significantly or replaced with one or more alternatives driven by motivations other than near-term revenues and/or profitability (for example, building market share ahead of our competitors). Any such alteration or replacement of our current business and revenue model may ultimately result in the deferring of certain revenues in favor of potentially establishing larger market share. We cannot assure that any such adjustment or change in the business and revenue model would prove to be successful whether adopted in response to industry changes or for other reasons.

WE DEPEND ON OUR SENIOR MANAGEMENT TEAM AND THE LOSS OF ONE OR MORE KEY EMPLOYEES OR AN INABILITY TO ATTRACT AND RETAIN HIGHLY SKILLED EMPLOYEES COULD ADVERSELY AFFECT OUR BUSINESS.

Our success depends largely upon the continued services of our executive officers and on certain other mission-critical individual contributors. We rely on our leadership team for the management and oversight of our business operations, including but not limited to, developing and executing our strategy, business and financial planning, research and development, marketing, sales, human resources, client services, finance, and other general and administrative functions. From time to time, our executive management team may change from the hiring or departure of executives, which could disrupt our business. Employment agreements with our executive officers or other key personnel contain terms and conditions while employed by us, however, they also continue to be considered “at will” employees and, as such, they are not legally required to continue to work for us for any specified period and may terminate their employment with us at any time should they choose. The loss of one or more of our executive officers or key employees could have a serious adverse effect on our business.

To execute our growth plan, we must attract and retain highly qualified personnel. Competition for outstanding personnel is intense, especially for experienced software engineers and senior sales executives. If we are unable to attract such personnel in cities where we are located, we may need to hire in other locations, which may add to the complexity and costs of our business operations. We expect to continue to experience challenges in hiring and retaining employees with appropriate qualifications. Extended stay-at-home, business closure, and other restrictive orders also may be expected to impact our ability to identify, hire, and train new personnel. Many of the companies with which we compete for experienced personnel have greater resources than we have. If we hire employees from competitors or other companies, their former employers may attempt to assert that these employees or we have breached legal obligations, resulting in a diversion of our time and resources. In addition, job candidates and existing employees often consider the value of the stock awards they receive in connection with their employment. If the perceived value of our stock awards declines, it may adversely affect our ability to recruit and retain highly skilled employees. If we fail to attract new personnel or fail to retain and motivate our current personnel, it could adversely affect our business and future growth prospects.

WE DEPEND ON ATTRACTING, INTEGRATING, MANAGING, AND RETAINING QUALIFIED PERSONNEL.

Our success depends upon our ability to attract, integrate, manage and retain personnel who possess the skills and experience necessary to fulfill our clients’ needs. Our ability to hire and retain qualified personnel could be impaired by any diminution of our reputation, decrease in compensation levels relative to our competitors, modifications to our total compensation philosophy that might be perceived negatively, or aggressive competitor hiring programs. If we cannot attract, hire and retain required qualified personnel, our business, financial condition and results of operations would be negatively impacted. Our future success also depends upon our ability to manage the successful performance of our personnel. Failure to successfully manage the performance of our personnel could affect our profitability by causing operating inefficiencies that could increase operating expenses and reduce operating income.

WE DEPEND ON OUR ABILITY TO ATTRACT AND RETAIN QUALIFIED TEMPORARY WORKERS.

In addition to the members of our own team, our success is substantially dependent on our ability to recruit and retain large numbers of qualified temporary workers who possess the skills and experience necessary to meet the staffing requirements of our customers. We are required to continually evaluate our base of available qualified personnel to keep pace with changing customer needs. Competition for individuals with proven professional skills is intense, and demand for these individuals is expected to remain strong for the foreseeable future.

Staffing Industry Analysts, a leading industry trade organization, recently published in its September 2024 U.S. Staffing Industry Forecast update, that the U.S. Staffing Industry is expected to decline by 10% in 2024. This follows a 10% decline already experienced in 2023. The SIA report cites that the forecasted 2024 decline is expected due to widespread client caution and project delays, a depressed manufacturing sector, falling bill rates in sectors such as healthcare, and employer and worker heightened preferences for permanent positions over temporary positions.

WE OPERATE IN AN INTENSELY COMPETITIVE AND RAPIDLY CHANGING BUSINESS ENVIRONMENT, AND THERE IS A SUBSTANTIAL RISK THAT OUR SERVICES COULD BECOME OBSOLETE OR UNCOMPETITIVE.

The markets for our services are highly competitive and include many larger, more established companies. Our markets are characterized by pressures to provide high levels of service, incorporate new capabilities and technologies, accelerate job completion schedules and reduce prices. Furthermore, we face competition from a number of sources, including other executive search firms and professional search, staffing and consulting firms. Several of our competitors have greater financial and marketing resources than we do. New and existing competitors are aided by technology, and the market has low barriers to entry. Furthermore, Internet employment sites expand a company’s ability to find workers without the help of traditional agencies. Personnel agencies often work as intermediaries, helping employers accurately describe job openings and screen candidates. Increasing the use of sophisticated, automated job description and candidate screening tools, especially those that now utilize Artificial Intelligence, or “AI”, could make many traditional functions of staffing companies obsolete. Specifically, the increased use of the internet may attract technology-oriented companies to the professional staffing industry. Free social networking sites such as LinkedIn and Facebook are also becoming a common way for recruiters and employees to connect without the assistance of a staffing company.

Our future success will depend largely upon our ability to anticipate and keep pace with those developments and advances. Current or future competitors could develop alternative capabilities and technologies that are more effective, easier to use or more economical than our services. In addition, we believe that, with continuing development and increased availability of IT aided by AI, the industries in which we compete may attract new competitors. If our capabilities and technologies become obsolete or uncompetitive, our related sales and revenue would decrease. Due to competition, we may experience reduced margins on our services, loss of market share, and loss of customers. If we are not able to compete effectively with current or future competitors as a result of these and other factors, our business, financial condition and results of operations could be materially adversely affected.

CHANGES IN GOVERNMENT REGULATION COULD LIMIT OUR GROWTH OR RESULT IN ADDITIONAL COSTS OF DOING BUSINESS.

We are subject to the same federal, state, and local laws as other companies conducting placement and staffing services, which are extensive. The adoption or modification of laws that affect the placement and staffing industry, including but not limited to, Federal and state laws and regulations pertaining to labor and minimum wages, workplace standards and safety, workers compensation laws, independent contractor status, the Family Medical Leave Act, Affordable Care Act, and others could harm our business, operating results, and financial condition by increasing our costs and administrative burdens.

WE MAY NOT BE ABLE TO OBTAIN THE NECESSARY ADDITIONAL FINANCING TO ACHIEVE OUR STRATEGIC GOALS.

There is no guarantee that we will be able to obtain any additional financing that may be required to continue to expand our business. Our continued viability depends on our ability to raise capital. Changes in economic, regulatory or competitive conditions may lead to cost increases. Management may also determine that it is in our best interest to expand more rapidly than currently intended, to expand marketing activities, to develop new or enhance existing services or products, to respond to competitive pressures or to acquire complementary services, businesses or technologies. In any such case or other change of circumstance, additional financing will be necessary. If any additional financing is required, there can be no assurances that we will be able to obtain such additional financing on terms acceptable to us and at times required by us, if at all. In such event, we may be required to materially alter our business plan or curtail all or a part of our expansion plans.

WE MAY NOT BE ABLE TO MANAGE EXPECTED GROWTH AND INTERNAL EXPANSION.

Our ability to manage growth effectively will be important to our business and future results of operations and financial condition. Expansion of our resources and operations will be required to address anticipated growth of our customer base and market opportunities. Expansion may be expected to place additional strain on our management, operational and financial resources, and thereby our ability to provide quality services and support for our clients and other stakeholders. In these regards, we anticipate the need to enhance existing resources, processes and controls, including but not limited to, implementation of new operational and financial systems, and development of additional procedures and controls to expand, train and manage our growing employee base and to service new and growing customers. Our failure to manage growth effectively, therefore, could have a materially negative effect on our business, results of operations and financial condition.

WE ARE DEPENDENT UPON TECHNOLOGY SERVICES, AND IF WE EXPERIENCE DAMAGE, SERVICE INTERRUPTIONS OR FAILURES IN OUR COMPUTER AND TELECOMMUNICATIONS SYSTEMS, OUR EXISTING CUSTOMER RELATIONSHIPS AND OUR ABILITY TO ATTRACT NEW CUSTOMERS MAY BE ADVERSELY AFFECTED.

Our business could be interrupted by damage to or disruption of our computer and telecommunications equipment and software systems, and we may lose data. Our customers’ businesses may be adversely affected by any system or equipment failure we experience. As a result of any of the foregoing, our relationships with our customers may be impaired, we may lose customers, our ability to attract new customers may be adversely affected and we could be exposed to contractual liability. Precautions in place to protect us from, or minimize the effect of, such events may not be adequate. If an interruption by damage to or disruption of our computer and telecommunications equipment and software systems occurs, we could be liable and the market perception of our services could be harmed.

WE COULD BE HARMED BY IMPROPER DISCLOSURE OR LOSS OF SENSITIVE OR CONFIDENTIAL COMPANY, EMPLOYEE, ASSOCIATE OR CLIENT DATA, INCLUDING PERSONAL DATA, BY EMPLOYEE ERROR AND/OR CYBER RISKS.

In connection with the operation of our business, we store, process and transmit a large amount of data, including personnel and payment information, about our employees, clients, associates and candidates, a portion of which is confidential and/or personally sensitive. In doing so, we rely on our own technology and systems, and those of third-party vendors we use for a variety of processes. We and our third-party vendors have established policies and procedures to help protect the security and privacy of this information. Unauthorized disclosure or loss of sensitive or confidential data may occur through a variety of methods. These include, but are not limited to, systems failure, employee negligence, fraud or misappropriation, or unauthorized access to or through our information systems, whether by our employees or third parties, including a cyberattack by computer programmers, hackers, members of organized crime and/or state-sponsored organizations, who may develop and deploy viruses, worms or other malicious software programs.

Such disclosure, loss or breach could harm our reputation and subject us to government sanctions and liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenues. It is possible that security controls over sensitive or confidential data and other practices we and our third-party vendors follow may not prevent the improper access to, disclosure of, or loss of such information. The potential risk of security breaches and cyberattacks may increase as we introduce new services and offerings, such as mobile technology. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions in which we provide services. Any failure or perceived failure to successfully manage the collection, use, disclosure, or security of personal information or other privacy related matters, or any failure to comply with changing regulatory requirements in this area, could result in legal liability or impairment to our reputation in the marketplace.

OUR STRATEGY OF GROWING THROUGH ACQUISIIONS MAY BE IMPEDED BY A LACK OF FINANCIAL RESOURCES AND IMPACT OUR BUSINESS IN UNEXPECTED WAYS. WE COULD BE ADVERSELY AFFECTED BY RISKS ASSOCIATED WITH ACQUISITIONS.

We intend to expand our business through acquisitions of complementary businesses, technologies, services or products, subject to our business plans and management’s ability to identify, acquire and develop suitable acquisition or investment targets in both new and existing service categories. In certain circumstances, acceptable acquisition or investment targets might not be available. Acquisitions involve a number of risks, including, but not limited to:

| · | difficulty in integrating the operations, technologies, products and personnel of an acquired business, including consolidating redundant facilities and infrastructure; |

| | |

| · | potential disruption of our ongoing business and the distraction of management from our day-to-day operations; |

| | |

| · | difficulty entering markets in which we have limited or no prior experience and in which competitors have a stronger market position; |

| | |

| · | difficulty maintaining the quality of services that such acquired companies have historically provided; |

| | |

| · | impact of liabilities of the acquired businesses undiscovered or underestimated as part of the acquisition due diligence; |

| | |

| · | failure to realize anticipated growth opportunities from a combined business, because existing and potential clients may be unwilling to consolidate business with a single supplier or to stay with the acquirer post acquisition; |

| | |

| · | impacts of cash on hand and debt incurred to finance acquisitions, thus increasing debt leverage and reducing liquidity for other significant strategic objectives; |

| | |

| · | internal controls, disclosure controls, corruption prevention policies, human resources and other key policies and practices of the acquired companies may be inadequate or ineffective; |

| | |