Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration No. 333-263930

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 28, 2022)

Up to $5,319,149 Principal Amount 6.0% Convertible Promissory Note

and Registered Commitment Shares

We have entered into a securities purchase agreement dated September 19, 2024, with Kips Bay Select, LP (including any designee(s) thereof, the “Investor”), relating to our issuance of up to a $5,319,149 (the “Principal Amount”) 6.0% Convertible Promissory Note due January 19, 2026 (the “Convertible Note”). On the initial closing date, the Investor will fund an initial tranche of $3,500,000, which shall result in an aggregate principal amount of $3,723,404 (that is, $3,500,000 in cash plus original issue discount of $223,404). On October 30, 2024, the Company may elect to request an additional funding of $1,500,000, which shall result in a principal amount for such second tranche of 1,595,795 (that is, $1,500,000 in cash plus $95,795 of original issue discount). On the eleventh day following the applicable Closing of the Convertible Note, the Company will issue to the Investor (i) restricted shares of the Company’s common stock equal to 2% of the Principal Amount of the Convertible Note, based on a price per share equal to the 20-day VWAP for the period beginning on the 10th trading day prior to the closing of the Convertible Note and ending on the 10th trading day after the closing of the Convertible Note (the “VWAP Period”), and (ii) registered shares of the Company’s common stock equal in value to 3% of the Principal Amount of the Convertible Note (the “Registered Commitment Shares”), based on a price per share equal to the 20-day VWAP for the VWAP Period, in each case, for no additional consideration

Comstock can prepay the Convertible Note for cash 30-days following closing by providing no less than 30 days’ written notice of its intention to prepay the Convertible Note at 120% of the Face Value, plus accrued interest. The Convertible Note is convertible into common stock: (i) 200% of the Closing Price on the Disbursement Date, as defined in the Convertible Note, for the first consecutive twenty (20) calendar days after the Disbursement Date, and (ii) thereafter, 88% of the lowest VWAP (80% during an event of default) of the six (6) trading days prior to and including the date of the Conversion Notice. “VWAP” means, for or as of any date, the dollar volume-weighted average price for such security on the trading market as reported by www.quotemedia.com.

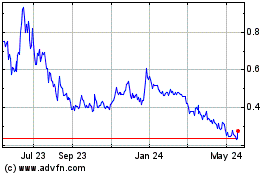

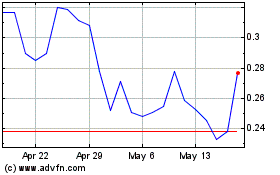

Our common stock is listed on the NYSE American under the symbol “LODE.” The last reported sale price of our common stock on the NYSE American on September 18, 2024 was $0.39 per share.

The Investor may be deemed to be an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act. For more information, please see the section of this prospectus supplement titled “Plan of Distribution” beginning on page S-11.

Investing in our common stock involves significant risk. Please read carefully the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement.

Neither the Securities and Exchange Commission (the “Commission”) nor any state securities commission has approved or disapproved of the common stock or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 19, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. By using a shelf registration statement, we may offer the Convertible Note and the Registered Commitment Shares.

We provide information to you about this offering in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering; and (2) the accompanying base prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus, the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

You should rely only on the information contained in, or incorporated by reference into, this prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. We have not, and the Investor has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the Investor is not, making an offer to sell or soliciting an offer to buy our securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation by Reference.”

We are offering to sell, and seeking offers to buy, shares of common stock, and securities convertible into shares of common stock, only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common stock, and securities convertible into shares of common stock, in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We may also authorize one or more “free writing prospectuses” (i.e., written communications concerning the offering that are not part of this prospectus supplement) that may contain certain material information relating to this offering. Before you invest in the common stock offered under this prospectus supplement, you should carefully read both this prospectus supplement and the accompanying prospectus together with additional information under the heading “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

References in this prospectus supplement and the accompanying prospectus to the terms “we,” “us,” “our” “Comstock” or “the Company” or other similar terms mean Comstock Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file periodic reports, proxy statements and other information relating to our business, financial and other matters with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our filings are available to the public over the Internet at the Commission’s web site at http://www.sec.gov. You may also read and copy any document we file with the Commission at, and obtain a copy of any such document by mail from, the Commission’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, at prescribed charges. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room and its charges.

We have filed with the Commission a registration statement on Form S-3 under the Securities Act with respect to our securities described in this prospectus. References to the “registration statement” or the “registration statement of which this prospectus is a part” mean the original registration statement and all amendments, including all schedules and exhibits. This prospectus does, and any prospectus supplement will, not contain all of the information in the registration statement because we have omitted parts of the registration statement in accordance with the rules of the Commission. Please refer to the registration statement for any information in the registration statement that is not contained in this prospectus or a prospectus supplement. The registration statement is available to the public over the Internet at the Commission’s web site described above and can be read and copied at the locations described above.

Each statement made in this prospectus or any prospectus supplement concerning a document filed as an exhibit to the registration statement is qualified in its entirety by reference to that exhibit for a complete description of its provisions.

We make available, free of charge, on or through our web site, copies of our proxy statements, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file them with or furnish them to the Commission. We maintain a web site at http://www.comstock.inc. The information contained on our web site is not part of this prospectus, any prospectus supplement or the registration statement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We have filed the following documents with the Commission pursuant to the Exchange Act and hereby incorporate them by reference in the registration statement:

We incorporate by reference the documents listed below and any future documents that we file with the Commission under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement:

| |

(a)

|

Our annual report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 27, 2024 (the “2023 Form 10-K”); and

|

| |

(b)

|

Our quarterly reports on Form 10-Q for the quarter ended March 31, 2024, filed with the Commission on April 29, 2024, and for the quarter ended June 30, 2024, filed with the Commission on August 8, 2024 (the “Form 10-Qs”); and

|

| |

(c)

|

Our current reports on Form 8-K filed with the Commission on January 8, 2024, February 14, 2024, March 29, 2024 (as amended), April 8, 2024, April 24, 2024, April 24, 2024, April 30, 2024, May 20, 2024, May 31, 2024, July 19, 2024, August 8, 2024 and September 18, 2024.

|

| |

(d)

|

The description of our Common Stock contained in our Form 8-A (File No. 001-35200), filed with the Commission under Section 12 of the Exchange Act on June 8, 2011 (the “Form 8-A”); and

|

| |

(e)

|

Our proxy statement on Schedule 14A, filed with the Commission on April 16, 2024.

|

All documents subsequently filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in the registration statement and to be a part hereof from the date of filing of such documents.

Notwithstanding the foregoing, documents or portions thereof containing information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, are not incorporated by reference in this prospectus.

We make available copies of the documents incorporated by reference in this prospectus to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request. Such requests should be directed to:

Comstock Inc.

117 American Flat Road

Virginia City, Nevada 89440

Attention: Investor Relations

Telephone: (775) 847-5272

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

The information appearing under “Cautionary Notice Regarding Forward-Looking Statements” in the 2023 Form 10-K and the Form 10-Q is hereby incorporated by reference.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. We urge you to read this entire prospectus and the documents incorporated by reference carefully, including the section entitled “Risk Factors” and the financial statements and other information included or incorporated by reference in this prospectus.

The Company

Comstock innovates and commercializes technologies that enable systemic decarbonization, primarily by enabling the extraction and conversion of under-utilized natural resources into renewable energy products that integrate into existing global supply chains to extract and convert under-utilized natural resources into renewable energy and related products that reduce reliance on fossil fuels and contribute to net zero mobility.

Our goal is to Accelerate the Commercialization of Hard Technologies for the Energy Transition primarily in renewable fuels, electrification metals, and artificial intelligence enabled mineral and materials development. Our strategic plan is based on innovating, enabling and commercializing material science solutions that use our technologies to reduce reliance on long cycle fossil fuels, to shift to short cycle fuels, and to lead and support the adoption and growth of a profitable, balanced short cycle ecosystem that continuously offsets, recycles, and/or neutralizes carbon emissions. We are pushing the boundaries in technology development and sustainability by leveraging our teams’ unique skills, our diverse technology portfolio, and our frontier research networks toward achieving breakthrough innovations that deliver meaningful positive impact across industries, economies, and communities.

Our approach integrates frontier scientific discovery with our systemic management practices into One System aligned and capable to meet the demand for commercial-ready energy transition solutions. Our operations primarily involve the innovation, development, and commercialization of our intellectual properties and related assets, with integrated teams focused on each core function in dedicated lines of business organized to address high impact decarbonization targets. We innovate and develop technologies to achieve significant growth on industry-wide scales by creating financial and other incentives for rapid integration into and across entire industries. Our commercialization plans are designed to facilitate that result, such as by selling process solutions, engineering services and technology licenses that enable clients to use their capital, infrastructure, and other resources to maximize the rate and scale of adoption, thereby simultaneously maximizing the rate we build shareholder wealth.

We are currently commercializing pioneering intellectual properties for refining lignocellulosic (woody) biomass into renewable replacements for fossil crude at remarkably high yields, recycling increasingly scarce electrification metals from end-of-life photovoltaics and other electronic devices, and advanced physics based artificial intelligence for precision mining and materials discovery. We make, own and manage investments in related assets to support our businesses, including multiple, existing minority equity positions in strategic technology developers, a renewable fuels demonstration facility in Wisconsin, a metals recycling demonstration facility in Nevada, and direct investments in northern Nevada real estate comprised of strategic water rights and about twelve square miles of mining claims and surface parcels with measured and indicated mineral resources containing 605,000 ounces of gold and 5,880,000 ounces of silver, and inferred mineral resources containing an additional 297,000 ounces of gold and 2,572,000 ounces of silver. We also announced the execution of agreements with RenFuel to make an up to $3,000,000 strategic investment over the next three years for the continued development and commercialization of advanced applications of RenFuel’s and Comstock’s complimentary technologies.

Lines of Business

Fuels Segment

Our Fuels Segment develops and commercializes technologies that extract and convert wasted and unused lignocellulosic biomass into intermediates for refining into advanced renewable fuels. Most renewable fuels draw from the same pool of conventional fats, oils and greases (‘FOG”) feedstocks, but the total existing FOG supply can only meet a small fraction of the global mobility demand. Our technologies unblock that constraint by converting abundant, lignocellulosic biomass into biointermediates for refining into high-yielding renewable fuels.

While innovation and development are ongoing and we expect additional advancements, our existing commercially available technologies have proven the potential to produce more than 100 gallons per dry tonne of woody biomass as measured on a Gasoline Gallon Equivalent Basis (“GGE”) basis, with Carbon Intensity (“CI”) scores of 15 or less for Cellulosic Ethanol and our proprietary hydro-deoxygenated Bioleum oil (“HBO”). HBO is used by biofuel refineries to blend with, diversify, and extend conventional hydroprocessed FOG feedstocks to enhance production of renewable fuels.

We are evaluating our first demonstration scale commercial facility and several, related joint development solutions and systems based on our technologies, as well as feedstock and offtake agreements, licenses, engineering services, and direct investments into Comstock Fuels Corporation, primarily from technologically sophisticated and well capitalized partners.

Execution of additional commercial agreements, including but not limited to, joint development agreements, offtake agreements, feedstock agreements, licensing agreements and direct investments supporting the deployment and enablement of our solutions in the form of our first demonstration scale commercial facility, primarily with operationally experienced and technologically sophisticated customers, represents an ongoing objective and the primary focus for 2024. The joint development agreements represent up to five phases of development and represent material upfront engineering and professional service fees, ultimately enabling licenses and royalties that could create more than 20 years of recurring revenues from the production of lignocellulosic biointermediaries and fuels.

Metals Segment

Our Metals Segment recently secured its first industry-scale facility lease, the related county permit for storage, and sufficient supplier commitments and all of the necessary permits for operating its previously commissioned demonstration scale commercial photovoltaic recycling facility and commenced receiving revenue in the form of tipping fees during the second quarter of 2024, and to a lesser extent, will begin receiving recycled metal sales from processed end-of-life photovoltaic materials in later 2024.

During the first half of 2024, we expanded our metals recycling team, commissioned our first production site, secured all permitting for our first demonstration scale commercial facility, and secured long term supply agreements from our first customers and commenced production commissioning activities while we continued expanding existing revenue generating supply commitments. We have also completed the site selection and secured for our first “industry-scale” production facility and commenced the design and the permitting thereto, having already received our first county-level permit for industry-scale storage and processing. Submitting all prerequisite permits, finalizing the industry-scale engineering and ordering all of the industry-scale equipment are the key 2024 Metals objectives.

Mining Segment

Our Mining Segment is generating income in the form of leases, licenses, and related fees during 2024, and is administered by our wholly owned subsidiaries, Comstock Mining LLC, Comstock Processing and various other local subsidiaries that collectively own or control twelve square miles of properties of patented mining claims, unpatented mining claims and surface parcels in northern Nevada, including six and a half miles of continuous mineralized strike length (the “Comstock Mineral Estate”).

Completing the preliminary economic assessment for the Dayton resource and progressing toward full economic feasibility for the southern part of the district and the ultimate development of full mine and reclamation plans are key objectives for 2024.

Strategic Investments Segment

We own and manage several investments and projects that are strategic to our plans and ability to produce and maximize throughput in our Fuels, Metals and Mining Segments, that are held for the purpose of complimenting or enhancing our mission of enabling systemic decarbonization and creating value but that are not a component of such other segments or otherwise have distinct operating activities. Our Strategic Investments Segment includes minority equity investments in Quantum Generative Materials LLC (“GenMat”) (physics-based artificial intelligence), Green Li-ion Pte Limited (“Green Li-ion”) (lithium-ion battery component recycler and remanufacturing), Sierra Springs Opportunity Fund (“SSOF”) (strategic direct investment in northern Nevada real estate), and other equity or equity-linked investments.

We also recently announced the execution of agreements with RenFuel to acquire a development stage biorefinery project to refine byproducts of paper production into biointermediates for refining into renewable fuels and fund up to $3,000,000 over the next three years in RenFuel for the continued development and commercialization of advanced applications of RenFuel’s and Comstock’s complimentary renewable fuels technologies.

Investment in GenMat – We invested our minority interest of GenMat as an enhancement and an integral component of our innovation strategy. GenMat has developed and launched a new generative AI that we believe is capable of simulating critical properties of known materials with high accuracy. GenMat also plans on using its AI to simulate new material characteristics for new and existing applications. We believe these generative AI models can be employed today, on GenMat’s existing high-performance computing platform, well before quantum computers become mainstream.

During 2023, GenMat began elevating material simulation capabilities to commercial readiness by synthesizing and directly testing new AI simulated materials in high value applications and potentially engage early adopter enterprise clients for this use. GenMat also initiated new mineral exploration capabilities with the successful launch of GENMAT-1, GenMat’s own Hyperspectral Remote Sensing Imaging (“HRSI”) system for optimizing future mineral exploration using their proprietary physics-based artificial intelligence (AI) and newly developing hyperspectral sensing technology. GenMat and Comstock Mining are collaborating to develop and test GenMat’s technologies by combining Comstock’s existing geologic data with newly collected information across a broader electromagnetic spectrum from the new GENMAT-1 HRSI system and importantly, applying probabilistic algorithms powered with GenMat’s physics-based AI.

Investment in Green Li-ion – Our wholly owned LINICO subsidiary has owned 37,162 preferred shares of Green Li-ion since 2021. On September 12, 2023, LINICO received gross proceeds of $795,510 from the sale of 1,500 Green Li-ion preferred shares (representing approximately 4% of the 37,162 of the shares then owned by LINICO). In 2023, the Company adjusted our investment's carrying value to fair value by increasing that value by $14,577,627 for the remaining 35,662 Green Li-ion preferred shares representing 13.34% of Green Li-ion. The Company intends to sell its remaining shares during late 2024, or early 2025.

Investment in SSOF – During 2019, the Company invested $335,000 for 6,700,000 shares. From 2020 through November of 2023, the Company advanced $6,985,000 to SSOF and its subsidiary, for the purpose of purchasing land, payments for deposits on land and payments for an option on land and water rights purchases. On December 29, 2023, the Company and SSOF agreed to convert the full amount of the outstanding advances for an additional 3,880,556 common shares of SSOF stock (at a dollar value of $1.80 per share) that also resulted in an unrealized gain recognized of $11,725,000 on the original 6,700,000 shares. In the first half of 2024, the Company invested $530,000 in SSOF at $1.80 per share increasing our equity ownership to 17.50%.

SSOF is a qualified opportunity zone fund, that owns 100% of SSE, a qualified opportunity zone business. SSE and its subsidiaries own or controls approximately 2,500 acres of land, a manufacturing facility, significant senior, junior and effluent water rights, sewer rights and also owns and operates the Silver Springs Regional Airport LLC. The substantial majority of these properties are contiguous and strategically located within immediate proximity of Highway 50, State Route 492, the Northern Nevada Industrial Center and the Tahoe Reno Industrial Center where companies like Tesla, Switch, Google, Microsoft, and Redwood Materials, and over one hundred more companies are currently located, expanding or locating in this industrializing region.

Other

Investments in Properties – The Company directly owns three types of properties in Silver Springs, NV, including 98 acres of industrial land, 160 acres of commercial land, both centrally located in Silver Springs, just south of the Silver Springs Regional Airport and a portfolio of water rights. The Company has begun marketing these assets for sale as both industrial and commercial development as interest in Silver Springs, NV continuously increased during 2024, and accordingly has classified these assets as held for sale in the condensed consolidated balance sheet.

Recent Developments

Comstock historically focused on natural resource exploration, development, and production, with an emphasis on mining gold and silver resources from its extensive contiguous property holdings in the historic Comstock and Silver City mining districts in Nevada (collectively, the “Comstock Mineral Estate”). Between 2012 and 2016, we mined and processed about 2.6 million tons of mineralized material from the Comstock Mineral Estate, producing 59,515 ounces of gold and 735,252 ounces of silver.

During 2021, 2022 and 2023, we completed a series of foundational transactions designed to build on our competencies and position us and our technologies to address and capitalize on the global transition to clean energy and to enhance our exploration and mineral discovery capabilities. Those transactions primarily included our acquisitions of intellectual property and resources through the 100% acquisition of Comstock Innovations Corporation, Comstock Engineering Corporation, FLUX Photon Corporation, and LINICO Corporation, leading to the subsequent establishment of Comstock Fuels Corporation and Comstock Metals Corporation, and our minority investment interest in GenMat. Collectively, these transactions added the management, employees, facilities, intellectual properties, and other assets we needed to restructure and transform our company and business into an emerging leader in both the innovation and licensing of the technology that enables sustainable production of renewable energy, including through lignocellulosic fuels and the recycling of electrification metals, especially solar panels, and data enhanced mineral exploration and sustainable mining.

OUTLOOK

Our goal is to Accelerate the Commercialization of Hard Technologies for the Energy Transition. We are pushing the boundaries of what is possible in technology and sustainability by leveraging our teams’ unique skills, our diverse technology portfolio and our frontier research and development networks toward achieving breakthrough innovations that deliver meaningful positive impact across industries, economies and communities. The primary focus for 2024 is the commercialization and capitalization of our businesses and the continuous innovation, development and engineering of technologies and solutions.

Technology Readiness

Comstock Fuels biorefining technologies are commercially ready and offer growth-enabling performance for its prospective customers. Comstock Fuels is actively engaged in the panning and deployment of our first commercial demonstration facility and pursuing joint development and licensing agreements representing strategic capital and future revenue sources from technical and engineering services, including securing associated supply chain participants, including offtake and feedstock agreements, performing preliminary and final engineering, facilitating commissioning, construction and operations with globally recognized and developing renewable fuel producers.

Comstock Metals is also commercially ready and has deployed and is currently commissioning its first commercial demonstration facility. The facility is being commissioned on one shift and is currently expanding to three shifts over the next two to three months. Site selection, design and permitting is currently underway for the next “Industry Scale” photovoltaic recycling facility and related storage capacity. Industry Scale facilities are anticipated to scale up to 10-15 times the capacity of the operating demonstration facility (that is, from approximately 7,000 tons per annum of capacity for the demonstration facility up to 70,000 – 100,000 tons per annum of capacity for Industry Scale). Regional site assessment and selection activities are ongoing for the next two facilities.

Comstock’s team has decades of diverse technology development and commercialization experience. The Company uses a disciplined approach to devising, qualifying, and elevating innovations from conception through increasing degrees of commercial readiness. The Company has adopted a widely used Technology Readiness Level (“TRL”) measurement system for objectively assessing Comstock’s progress, risks, investment qualifications, and commercial maturity. Comstock’s SMART milestones and commercialization process involve meticulous planning that is informed by many factors, including the total addressable markets, their growth rates and the speed that the Company can initiate and increase revenue.

Commercialization – Lines of Business

Comstock Fuels

Most current forms of renewable fuel draw from the same pool of conventional feedstocks, including corn and vegetable oils in the U.S., but the entire available supply of those feedstocks could only meet a small fraction of the rapidly growing demand for renewable fuels. Comstock's patented and patent-pending biorefining technologies unblock that constraint by converting underutilized lignocellulosic or "woody" biomass into biointermediates for refining drop-in and other renewable fuels.

The Company’s objectives for the second half of 2024 include:

| |

•

|

Closing on a $200 million investment, primarily to deploy the first commercial demonstration facility;

|

| |

•

|

Execute multiple, revenue generating commercial agreements for industry-scale joint developments;

|

| |

•

|

Advancing and expanding our innovation network for even higher yields and lower costs; and

|

| |

•

|

Expand our integrated bio-intermediate production system, including cellulosic ethanol and HBO.

|

Our first commercial demonstration facility is designed to be profitable and to confirm the scale of multiple industry-scale facilities. Each joint development project could result in millions of dollars of technical services and engineering revenues and ultimately, license agreements for additional production facilities that would generate royalty revenues.

Comstock Metals

End of life solar panels are one of the primary metals-based products that can cause a massive amount of pollution if simply allowed to be landfilled at the end of life with no recovery of any of the underlying metal values.

The Company’s objectives for the second half of 2024 include:

| |

•

|

Closing on a $22 million investment, primarily to deploy the first two commercial demonstration facilities;

|

| |

•

|

Commissioning the photovoltaic material recycling;

|

| |

•

|

Commencing full, three-shift production of the demonstration scale production facility;

|

| |

•

|

Confirming the ability to fully and cleanly reprocess and reuse all residual materials;

|

| |

•

|

Advancing the technology readiness for broader material recycling, prioritizing photovoltaics, to TRL 7;

|

| |

•

|

Expanding our existing revenue generating supply and offtake commitments; and

|

| |

•

|

Finalizing the site selection for our first three “industry-scale” facilities and commence permitting.

|

Comstock Metals has secured all permits for operating its demonstration scale production facility in Silver Springs, NV, with commissioning of operations occurring now with ongoing production immediately thereafter. Comstock Metals has also secured the initial county level permits for industry-scale operations and storage and is actively engaged in expanded revenue generating supply and now, also, residual material offtake commitments.

Comstock Mining

The Company has amassed the single largest known repository of historical and current geological data within the Comstock mineral district, including extensive geophysical surveys, geological mapping, and drilling data, including the Dayton resource.

On June 30, 2023, the Company signed a Mineral Exploration and Mining Lease Agreement (the “Mining Lease”) with Mackay. The Mining Lease provides a twenty-year term granting Mackay the rights to conduct exploration on certain of the Company’s mineral properties in Storey County, Nevada. Mackay paid a lease initiation fee of $1,250,000 and made their first two quarterly lease payments totaling $875,000, with quarterly lease payments of $375,000 due for the next three and a half years, and then quarterly lease payments of $250,000 thereafter. Mackay committed to expenditures of $1,000,000 per year on a cumulative basis, and increasingly detailed technical reports after five, ten, and fifteen years. Mackay reimburses carrying costs and will pay a 1.5% NSR production royalty.

The Company’s objectives for the second half of 2024 include:

| |

•

|

Closing on a $50 million investment, in part, to finalize the resource, design and mine plan for Dayton;

|

| |

•

|

Receive cash proceeds of more than $2 million from mineral leases leveraging the northern district claims;

|

| |

•

|

Commercialize mineral development agreements that enable resource expansion of the central district claims;

|

| |

•

|

Develop with GenMat, AI-based exploration tools, using Comstock's extensive geologic data along with GENMAT-1’s hyperspectral imaging solution to condition, develop and validate the AI predictions; and

|

| |

•

|

Complete the mine plans that enables the economic development of the southern district claims.

|

The Company’s 2024 efforts apply economic analysis to Comstock’s existing gold and silver resources progressing toward full economic feasibility for the southern part of the district and the ultimate development of full mine and reclamation plans and the development of post productive land and community development plans.

Strategic Investments

Investment in GenMat

Investment in physics-based AI is a meaningful component of Comstock’s technology innovation strategy. GenMat develops and commercializes proprietary generative artificial intelligence models for the discovery and manipulation of matter. This includes AI models that can be employed today, for commercial use on GenMat’s existing, high-performance computing platforms. Comstock has a minority investment interest in GenMat.

GenMat's AI uses atoms and molecules to generate physical systems and harness math and science to discover new materials in an exponentially shorter time than traditional methods allow. New material discovery typically takes many years and many millions of dollars. GenMat's AI can simulate thousands of unique new materials in seconds.

GenMat’s objectives for the second half of 2024 include:

| |

•

|

Elevate new material simulation to TRL 7 by synthesizing and directly testing the AI’s ability to predict material properties to confirm the precision and accuracy of those simulations;

|

| |

•

|

Commercialize its space-based hyperspectral imaging sensor for mineral discovery applications; and

|

| |

•

|

Commercialize physics-based AI solutions to clients for advanced materials and satellite enabling solutions.

|

GenMat has recently announced revenue generating agreements as GenMat's technologies, including its space-based satellite systems, are maturing much faster than anticipated, with multiple commercial agreements now likely in 2024.

Investment in Green Li-ion

Green Li-ion continues making meaningful progress in the development and deployment of its system that remanufactures critical precursor cathode active materials (“PCAM”), having now deployed its first commercial battery remanufacturing facility from fully recycled battery materials deployed. The Company intends to sell the remaining 35,662 Green Li-ion preferred shares in late 2024 or early 2025.

Investments in others non-mining real estate, water rights and securities

The Company has announced an indicative agreement selling its non-mining real estate and water rights for $50 million in gross (approximately $47 million in net proceeds) during the fourth quarter of 2024.

Corporate Information

The Company’s executive offices are located at 117 American Flat Road, Virginia City, Nevada 89440 and its telephone number is (775) 847-5272. The Company’s mailing address is P.O. Box 1118, Virginia City, Nevada 89440. The Company’s website address is www.comstock.inc. The Company’s website and the information contained on, or that can be accessed through, the website are not part of this prospectus.

THE OFFERING

|

Securities offered by us

|

Up to $5,319,149 Principal Amount 6.0% Convertible Promissory Note and common shares equal in value to 3% of the principal amount of such promissory note, the Registered Commitment Shares. On the initial closing date, the Investor will fund an initial tranche of $3,500,000, which shall result in an aggregate principal amount of $3,723,404 (that is, $3,500,000 in cash plus original issue discount of $223,404). On October 30, 2024, the Company may elect to request an additional funding of $1,500,000, which shall result in a principal amount for such second tranche of 1,595,795 (that is, $1,500,000 in cash plus $95,795 of original issue discount).

|

| |

|

|

Use of Proceeds

|

General corporate purposes, including the payment of existing indebtedness.

|

| |

|

|

Risk Factors

|

You should carefully read and consider the information set forth in “Risk Factors” below of this prospectus before investing in our common stock.

|

| |

|

|

NYSE American LLC symbol

|

LODE

|

RISK FACTORS

Investing in our common stock involves significant risk. Prior to making a decision about investing in our common stock, you should carefully consider the specific risk factors included below, as well as the risk factors discussed under the heading “Risk Factors” in the 2023 Form 10-K and the Form 10-Q, each of which are incorporated by reference in this prospectus supplement and the accompanying prospectus and may be amended, supplemented or superseded from time to time by other reports we file with the Commission in the future. The risks and uncertainties we have described are not the only ones we may face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also affect our operations. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our common stock decline, and you could lose all or a part of your investment.

Risks Relating to the Company’s Common Stock and this Offering

The Company may issue additional common stock or other equity securities in the future that could dilute the ownership interest of existing shareholders.

The Company is currently authorized to issue 245,000,000 shares of common stock, of which 206,634,788 were issued and outstanding as of September 19, 2024, and 50,000,000 shares of preferred stock, of which no Preferred Shares are issued or outstanding as of September 19, 2024. To maintain its capital at desired levels or to fund future growth, the Board may decide from time to time to issue additional shares of common stock, or securities convertible into, exchangeable for or representing rights to acquire shares of common stock. The sale of these securities may significantly dilute stockholders’ ownership interest and the market price of the common stock. New investors in other equity securities issued by the Company in the future may also have rights, preferences and privileges senior to the Company’s current stockholders that may adversely impact its current stockholders.

You may experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

If the price per share of our common stock is offered at price that is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. The net tangible book value of our common stock on June 30, 2024, was approximately $0.38 per share. Purchasing our common stock at a purchase price in excess of the net tangible book value per share, will result in you suffering an immediate and substantial dilution. See the section entitled “Dilution” in this prospectus for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

If we are unable to maintain the listing standards of the NYSE American LLC, our common stock may be delisted, which may have a material adverse effect on the liquidity and value of our common stock.

Our common stock is traded on the NYSE American LLC. To maintain our listing on the NYSE American LLC, we must meet certain financial and liquidity criteria. The market price of our common stock has been and may continue to be subject to significant fluctuation as a result of periodic variations in our revenues and results of operations. If we fail to meet any of the NYSE American LLC’s listing standards, we may be delisted. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which could have a material adverse effect on the market liquidity and value of our common stock.

We will have broad discretion in how we use the proceeds, and we may use the proceeds in ways in which you and other stockholders may disagree.

We intend to use the net proceeds from this offering for strategic development programs, working capital and other general corporate purposes. See the section entitled “Use of Proceeds.” Our management will have broad discretion in the application of the proceeds from this offering and could spend the proceeds in ways that do not necessarily improve our operating results or enhance the value of our common stock.

The price of our common stock has and may continue to fluctuate significantly, which could negatively affect the Company and holders of our common stock.

The market price of our common shares is subject to volatility, has fluctuated, and may continue to fluctuate significantly due to, among other things, changes in market sentiment regarding our operations, financial results or business prospects, the mining, metals, recycling or environmental remediation industries generally, coordinated trading activities, large derivative positions or the macroeconomic outlook. The price of our common stock has been, and may continue to be, highly volatile in response to our recent transactions. Certain events or changes in the market or our industries generally are beyond our control. In addition to the other risk factors contained or incorporated by reference herein, factors that could impact our trading price include:

|

•

|

our actual or anticipated operating and financial results, including how those results vary from the expectations of management, securities analysts and investors;

|

|

•

|

changes in financial estimates or publication of research reports and recommendations by financial analysts or actions taken by rating agencies with respect to us or other industry participants;

|

|

•

|

failure to declare dividends on our common stock from time to time;

|

|

•

|

reports in the press or investment community relating to our reputation or the financial services industry;

|

|

•

|

developments in our business or operations, or our industry sectors generally;

|

|

•

|

any future offerings by us of our common stock;

|

|

•

|

any coordinated trading activities or large derivative positions in our common stock, for example, a short squeeze, which occurs when a number of investors take a short position in a stock and have to buy the borrowed securities to close out the position at a time that other short sellers of the same security also want to close out their positions, resulting in surges of stock prices when demand is greater than supply;

|

|

•

|

legislative or regulatory changes affecting our industry generally or our business and operations specifically;

|

|

•

|

the operating and stock price performance of companies that investors consider to be comparable to us;

|

|

•

|

announcements of strategic developments, acquisitions, restructurings, dispositions, financings and other material events by us or our competitors;

|

|

•

|

expectations of (or actual) equity dilution, including the actual or expected dilution to various financial measures, including earnings per share, that may be caused by this offering;

|

|

•

|

actions by our current shareholders, including future sales of common shares by existing shareholders, including our directors and executive officers;

|

|

•

|

proposed or final regulatory changes or developments;

|

|

•

|

anticipated or pending regulatory investigations, proceedings, or litigation that may involve or affect us; and

|

|

•

|

other changes in U.S. or global financial markets, global economies and general market conditions, such as interest or foreign exchange rates, stock, commodity prices, credit or asset valuations or volatility.

|

USE OF PROCEEDS

General corporate purposes, including repayment of certain existing debt.

DILUTION

Investors in shares of our common stock offered in this offering will experience an immediate dilution in the net tangible book value of their common stock from the public offering price of the common stock. The net tangible book value of our common stock as of June 30, 2024, was approximately $60.2 million, or approximately $0.38 per share of common stock. Net tangible book value per share of our common stock is calculated by subtracting our total liabilities from our total tangible assets (which is equal to total assets less intangible assets) and dividing this amount by the number of shares of common stock outstanding as of such date.

Dilution per share represents the difference between the public offering price per share of our common stock and the adjusted net tangible book value per share of our common stock included in this offering after giving effect to this offering. Any sale of our common stock in this offering at a price per share greater than the net tangible book value per share will result in (after giving effect to such sale and deducting discounts, commissions estimated offering expenses payable by us) an increase in our as adjusted net tangible book value per share of common stock with respect to our existing stockholders and an immediate and substantial dilution in net tangible book value per share of common stock to new investors purchasing shares in this offering.

PLAN OF DISTRIBUTION

We have entered into a securities purchase agreement with Kips Bay Select, LP (including any designees thereof, the “Investor”), relating to our issuance sale of an 6.0% Convertible Promissory Note due January 19, 2026 (the “Convertible Note”). In accordance with the terms of such agreement and the Convertible Note, we may issue up to 25,000,000 shares (assuming a conversion price of approximately $0.22 per share) to the Investor upon conversion of the Convertible Note. On the eleventh day following the closing of the Convertible Note, the Company will issue to the Investor (i) restricted shares of the Company’s common stock equal to 2% of the Principal Amount of the Convertible Note, based on a price per share equal to the 20-day VWAP for the VWAP Period, and (ii) registered shares of the Company’s common stock equal in value to 3% of the Principal Amount of the Convertible Note (the “Registered Commitment Shares”), based on a price per share equal to the 20-day VWAP for the VWAP Period, in each case, for no additional consideration.

The Convertible Note may be issued with an original aggregate principal amount up to $5,319,149 (the “Face Value”). The Convertible Note is issued with a 6% original issue discount, meaning that the purchase price paid by the Investor for the Convertible Note will be up to $5,000,000. On the initial closing date, the Investor will fund an initial tranche of $3,500,000, which shall result in an aggregate principal amount of $3,723,404 (that is, $3,500,000 in cash plus original issue discount of $223,404). On October 30, 2024, the Company may elect to request an additional funding of $1,500,000, which shall result in a principal amount for such second tranche of 1,595,795 (that is, $1,500,000 in cash plus $95,795 of original issue discount). The Convertible Note accrues interest at a per annum interest rate of 6%. The Convertible Note has a maturity date of January 19, 2026. The closing for the Convertible Note is September 19, 2024 (the “Closing Date”). The Convertible Note can be prepaid for cash 30-days following closing by the Company providing no less than 30 days’ notice of its intention to prepay the Convertible Note at 120% of the Face Value, plus accrued interest.

The Convertible Note is convertible into common stock at: (i) 200% of the Closing Price on the Disbursement Date, for the first consecutive twenty (20) calendar days after the Disbursement Date, and (ii) thereafter, 88% of the lowest VWAP (80% during an event of default) of the six (6) trading days prior to and including the date of the Conversion Notice.

The Convertible Note also provides that the Investor is entitled to receive consideration that common shareholders receive in the event of certain “Fundamental Transactions,” as defined.

The Investor may be deemed to be an “underwriter” within the meaning of the Securities Act and any broker-dealers or agents that are involved in selling the Convertible Note or shares issued upon conversion of the Convertible Note may also be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Because the Investor may be deemed to be an “underwriter” within the meaning of the Securities Act, the Investor will be subject to the prospectus delivery requirements of the Securities Act. This prospectus may be made available and distributed to investors in electronic format.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Investor will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the common stock by the Investor.

The Investor has agreed not to enter into any “short sales” of our common stock while the Convertible Note is outstanding.

Listing and Transfer Agent

Our common stock is listed on the NYSE American under the symbol “LODE.” We have submitted an application to the NYSE American to list the shares of common stock offered hereby. The transfer agent and registrar for our common stock is Equiniti, located at 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120-4100. Its telephone number is (303) 282-4800.

LEGAL MATTERS

The validity of the issuance of the securities offered in this offering and certain other legal matters has been passed upon for us by McDonald Carano LLP, Reno, Nevada.

EXPERTS

The consolidated financial statements for the fiscal year ended December 31, 2023 and December 31, 2022, incorporated in this Prospectus by reference from the 2023 Form 10-K have been audited by Assure CPA, LLC, an independent registered public accounting firm, as stated in its report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the reports of such firm given upon its authority as an expert in accounting and auditing.

No expert or counsel named in this prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our Common Stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

PROSPECTUS

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Rights

Units

Warrants

From time to time, we may offer up to an aggregate of $50,000,000 of any combination of the securities described in this prospectus, either individually or in units. We may also offer shares of our $0.000666 par value, per share common stock (“Common Stock”) or preferred stock upon conversion of debt securities, Common Stock upon conversion of preferred stock, or Common Stock, preferred stock or debt securities upon the exercise of warrants. We will provide the specific terms of these offerings and securities in one or more supplements to this prospectus. We may also authorize the provision to you of one or more free writing prospectuses in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information we include in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents we incorporate by reference, before buying any of the securities being offered.

You should read this prospectus and any applicable prospectus supplement, as well as the documents incorporated by reference or deemed incorporated by reference into this prospectus and any prospectus supplement, carefully before you invest in our shares.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

Our common stock is listed on the NYSE AMERICAN LLC under the symbol “LODE.” The last reported price of our common stock on the NYSE AMERICAN LLC on March 25, 2022 was $1.80 per share. The aggregate market value of our outstanding voting common stock held by non-affiliates, based upon a closing sale price of our common stock on March 25, 2022 was $102,955,594.

Investing in our securities involves risks that are referenced in the “Risk Factors” section, at page 4, of this prospectus and are set forth in our periodic reports filed with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 28, 2022

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the Commission, utilizing a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell securities pursuant to this prospectus. This prospectus provides you with a general description of the securities we may offer.

Each time we offer and sell our securities, we will provide a prospectus supplement that will contain specific information about the terms of the specific securities being offered and which may add, update or change information in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you must rely on the information in the prospectus supplement. You should read carefully both this prospectus and any prospectus supplement, together with additional information described below under “Where You Can Find More Information” before you invest in our securities.

You should rely only on the information contained or incorporated by reference in this prospectus, any prospectus supplement or any free writing prospectus related to the applicable securities that is prepared by us or on our behalf or that is otherwise authorized by us. We have not authorized any other person to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information that we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operation and prospects may have changed since those dates.

We will not use this prospectus to offer and sell securities unless it is accompanied by a prospectus supplement that more fully describes the securities being offered and the terms of the offering.

This prospectus does not contain all the information provided in the registration statement we filed with the Commission. For further information about us or the securities offered hereby, you should refer to that registration statement, which you can obtain from the Commission as described below under “Where You Can Find More Information.”

In this prospectus, unless otherwise specified or the context otherwise requires, “Comstock,” “we,” “us” and “our,” “our Company” or the “Company” refer to Comstock Inc. and its consolidated subsidiaries. In addition, unless the context requires otherwise, reference to the “Board” refers to the Board of Directors of Comstock Inc.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file periodic reports, proxy statements and other information relating to our business, financial and other matters with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our filings are available to the public over the Internet at the Commission’s web site at http://www.sec.gov. You may also read and copy any document we file with the Commission at, and obtain a copy of any such document by mail from, the Commission’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, at prescribed charges. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room and its charges.

We have filed with the Commission a registration statement on Form S-3 under the Securities Act with respect to our securities described in this prospectus. References to the “registration statement” or the “registration statement of which this prospectus is a part” mean the original registration statement and all amendments, including all schedules and exhibits. This prospectus does, and any prospectus supplement will, not contain all of the information in the registration statement because we have omitted parts of the registration statement in accordance with the rules of the Commission. Please refer to the registration statement for any information in the registration statement in accordance with the rules of the Commission. Please refer to the registration statement for any information in the registration statement that is not contained in this prospectus or a prospectus supplement. The registration statement is available to the public over the Internet at the Commission’s web site described above and can be read and copied at the locations described above.

Each statement made in this prospectus or any prospectus supplement concerning a document filed as an exhibit to the registration statement is qualified in its entirety by reference to that exhibit for a complete description of its provisions.

We make available, free of charge, on or through our web site, copies of our proxy statements, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file them with or furnish them to the Commission. We maintain a web site at http://www.comstock.inc. The information contained on our web site is not part of this prospectus, any prospectus supplement or the registration statement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We have filed the following documents with the Commission pursuant to the Exchange Act and hereby incorporate them by reference in the registration statement:

We incorporate by reference the documents listed below and any future documents that we file with the Commission under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement:

(a) Our annual report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Commission on March 28, 2022 (the “2021 Form 10-K”); and

(b) The description of our Common Stock contained in our Form 8-A (File No. 001-35200), filed with the Commission under Section 12 of the Exchange Act on June 8, 2011 (the “Form 8-A”).

All documents subsequently filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in the registration statement and to be a part hereof from the date of filing of such documents.

Notwithstanding the foregoing, documents or portions thereof containing information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, are not incorporated by reference in this prospectus.

We make available copies of the documents incorporated by reference in this prospectus to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request. Such requests should be directed to:

Comstock Inc.

P.O. Box 1118

Virginia City, Nevada 89440

Attention: Investor Relations

Telephone: (775) 847-5272

SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read this summary together with the more detailed information included elsewhere or incorporated by reference in this prospectus, including financial statements and the related notes. You should carefully consider, among other things, the matters discussed under “Risks Factors” in the 2021 Form 10-K, the Form 10-Qs and in other documents that we subsequently file with the Commission that are incorporated by reference herein.

The Company innovates technologies that contribute to global decarbonization and circularity by efficiently converting supplies of unused and under-utilized natural resources into renewable fuels and electrification products that contribute to decarbonization. The Company intends to achieve growth and financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, by selling an array of complimentary process solutions and related services, and by licensing selected technologies to qualified strategic partners.

Corporate Information

The Company’s executive offices are located at 117 American Flat Road, Virginia City, Nevada 89440 and its telephone number is (775) 847-5272. The Company’s mailing address is P.O. Box 1118, Virginia City, Nevada 89440. The Company’s website address is www.comstock.inc. The Company’s website and the information contained on, or that can be accessed through, the website are not part of this prospectus.

FORWARD LOOKING STATEMENTS

The information appearing under “Cautionary Notice Regarding Forward Looking Statements” in the 2021 Form 10-K, is hereby incorporated by reference.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to the 2021 Form 10-K or periodic reports we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

USE OF PROCEEDS

Except as may be described otherwise in any applicable prospectus supplement or free writing prospectus, we will use the net proceeds from the sale by us of the securities under this prospectus for general corporate purposes, which may include, among other things, repayment of existing debt, funding acquisitions, capital expenditures and other general corporate purposes.

DESCRIPTION OF COMMON STOCK

The information appearing under “Item 1. Description of Registrant’s Securities to be Registered” in the Form 8-A, is hereby incorporated by reference. The Company currently has 67,707,832 shares of Common Stock issued and outstanding.

DESCRIPTION OF PREFERRED STOCK

Pursuant to our articles of incorporation, the Board has the authority, without further action by the stockholders (unless such stockholder action is required by applicable law or NYSE AMERICAN rules), to designate and issue up to 50,000,000 shares of preferred stock in one or more series or classes, to establish from time to time the number of shares to be included in each such series or classes, and to fix the rights, privileges and preferences of such series or classes. The Company currently has no issued and outstanding shares of preferred stock.

The Board will fix the rights, privileges and preferences of the preferred stock of each series or class, as well as the qualifications, limitations or restrictions thereon, in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the Commission, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance of that series of preferred stock. This description will include:

|

•

|

the number of shares we are offering;

|

|

•

|

the liquidation preference per share;

|

|

•

|

the purchase price;

|

|

•

|

the dividend rate, period and payment date and method of calculation for dividends;

|

|

•

|

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

|

|

•

|

the procedures for any auction and remarketing, if any;

|

|

•

|

the provisions for a sinking fund, if any;

|

|

•

|

the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

|

|

•

|

any listing of the preferred stock on any securities exchange or market;

|

|

•

|

whether the preferred stock will be convertible into our Common Stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period;

|

|

•

|

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period;

|

|

•

|

voting rights, if any, of the preferred stock;

|

|

•

|

preemptive rights, if any;

|

|

•

|

restrictions on transfer, sale or other assignment, if any;

|

|

•

|

whether interests in the preferred stock will be represented by depositary shares;

|

|

•

|

a discussion of any material United States federal income tax considerations applicable to the preferred stock;

|

|

•

|

the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

|

|

•

|

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

|

|

•

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

|

The Board may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Common Stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our company or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our Common Stock.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. Pursuant to the terms of our outstanding indebtedness and a Stockholders Agreement with our largest shareholder, we are prohibited from issuing debt without the prior written consent. While the terms we have summarized below will apply generally to any debt securities that we may offer under this prospectus, we will describe the particular terms of any debt securities that we may offer in more detail in the applicable prospectus supplement. The terms of any debt securities offered under a prospectus supplement may differ from the terms described below. Unless the context requires otherwise, whenever we refer to the indentures, we also are referring to any supplemental indentures that specify the terms of a particular series of debt securities.

We will issue the senior debt securities under the senior indenture that we will enter into with the trustee named in the senior indenture. We will issue the subordinated debt securities under the subordinated indenture that we will enter into with the trustee named in the subordinated indenture. Generally, the indentures will be qualified under the Trust Indenture Act of 1939. We use the term “debenture trustee” to refer to either the trustee under the senior indenture or the trustee under the subordinated indenture, as applicable. We will file forms of indentures to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the Commission.

The following summaries of material provisions of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety by reference to, all of the provisions of the indenture applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplements and any related free writing prospectuses related to the debt securities that we may offer under this prospectus, as well as the complete indentures that will contain the terms of the debt securities. Except as we may otherwise indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

We will describe in the applicable prospectus supplement the terms of the series of debt securities being offered, including:

|

•

|

the title;

|

|

•

|

whether or not such debt securities are guaranteed by our subsidiaries or other entities;

|

|

•

|

the principal amount being offered, and if a series, the total amount authorized and the total amount outstanding;

|

|

•

|

any limit on the amount that may be issued;

|

|

•

|

whether or not we will issue the series of debt securities in global form, the terms and who the depositary will be;

|

|

•

|

the maturity date;

|

|

•

|

whether and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a United States person for tax purposes, and whether we can redeem the debt securities if we have to pay such additional amounts;

|

|

•

|

the annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for interest payment dates or the method for determining such dates;

|

|

•

|