false

0001174940

0001174940

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934.

Date

of Report: August 13, 2024

(Date

of earliest event reported)

Oragenics,

Inc.

(Exact

name of registrant as specified in its charter)

| FL |

|

001-32188 |

|

59-3410522 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

Number) |

1990

Main Street

Suite

750

Sarasota,

FL |

|

34236 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

813-286-7900

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

OGEN |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

3.01. NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

On

August 16, 2024, Oragenics, Inc. (the “Company”) issued a press release announcing it received a notice from the NYSE American

indicating that the Company remains in non-compliance with the Section 1003(a) of the NYSE American’s continued listing standards.

As previously disclosed, on April 16, 2024, the NYSE American notified the Company that it was not in compliance with subsections (ii)

and (iii) of Section 1003(a). The NYSE American has now informed the Company that it also is not in compliance with subsection (i) Section

1003(a), which requires stockholders’ equity of no less than $2,000,000 if the Company has sustained losses from continuing operations

and/or net losses in two of its three most recent fiscal years. A copy of the Press Release is attached hereto as Exhibit 99.1 and is

incorporated by reference herein.

ITEM

8.01. OTHER INFORMATION.

On

August 16, 2024, the Company issued a press release announcing recent achievements related to the development of the Company’s

leading drug candidate, ONP-002, an innovative neurosteroid designed to treat mild Traumatic Brain Injury (mTBI), commonly referred to

as concussion. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

ITEM

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d)

Exhibits

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized on this 16thh day of August, 2024.

| |

ORAGENICS,

INC.

(Registrant) |

| |

|

| |

BY: |

/s/

Janet Huffman |

| |

|

Janet

Huffman

Chief

Financial Officer |

Exhibit

99.1

Oragenics,

Inc. Provides Update on its Drug Intended to Treat Concussion and Non-Compliance with NYSE American Continued Listing Standards

SARASOTA,

Fla., August 16, 2024 (GLOBE NEWSWIRE) Oragenics, Inc. (NYSE American: OGEN) (“the Company”), a company focused on

developing unique, intranasal pharmaceuticals for the treatment of neurological disorders, today announced recent and key 2024 business

progress. The Company continues to execute its business strategy to develop and advance its lead candidate, ONP-002, for the treatment

of concussion. Phase 2 human trials are being planned with anticipation of starting in the fourth quarter of this year.

Achievements:

| |

● |

Stability

of ONP-002 Across a Wide Temperature Range: Demonstrated that ONP-002 is stable at high and low temperatures, eliminating the

need for cumbersome cold storage. This stability is critical for field delivery in diverse environments, including for military training and contact sports that are often conducted in extreme temperatures. |

| |

● |

Phase

2 Clinical Trial Preparation: The Company made significant strides in preparing for a Phase 2 clinical trial regarding

ONP-002, a new chemical entity (NCE) designed to target the brain through delivery into the nasal cavity and onward to the brain.

In May, the company partnered with Avance Clinical to conduct the upcoming trial in Australia. Phase 1 data has been reviewed and

accepted establishing that ONP-002 is safe to move into a Phase 2 trial to further evaluate safety and efficacy. Clinical sites are

being identified and educated on the patient enrollment process. The spray dry drug formulation and filling of devices for use in

Phase 2 clinical trials is near completion. |

| |

● |

Improvements

in Drug Formulation: Improved the intranasal drug formulation, increasing the amount of ONP-002 per dose by 4X, thereby increasing

the amount of drug that the brain will be exposed to with a single treatment. |

| |

● |

Development

of Automated Intranasal Device: Completed the prototype for an automated intranasal device designed for use in concussed patients

who are initially dazed, confused, or unconscious, facilitating drug administration during the acute phase of injury. |

| |

● |

Successful

Completion of FDA-Required Testing: ONP-002 cleared FDA-required cardiotoxicity and genotoxicity testing, confirming the safety

of the drug for further clinical development. These results strengthen the safety profile of ONP-002, paving the way for the upcoming

Phase 2 trials. These were the final studies required to submit an Investigational New Drug (IND) application to the U.S.

Food and Drug Administration (FDA). Currently, the IND package is being generated with the support of Syneos Health’s

regulatory team and will be the basis for starting a Phase 2b study in the U.S. to evaluate the effects of ONP-002 on

clinical outcome measures following concussion. |

| |

● |

Completed

Public Offering: Closed a public offering, raising approximately $1.1 million, to support the continued development of ONP-002

and other corporate needs. |

| |

● |

Appointed

Medical Advisors: Dr. William ‘Frank’ Peacock, a leading expert in emergency medicine and diagnostic biomarkers,

was named as Chief Clinical Officer, and Dr. James ‘Jim’ Kelly, a world renown neurologist and key opinion leader in

concussion, joined as Chief Medical Officer. These new team members were appointed to oversee the upcoming Phase 2 clinical trial

for treating concussion in the emergency department. |

“We

are pleased with the significant progress this year, particularly in advancing ONP-002 toward Phase 2 clinical trials,”

commented Michael Redmond, President of Oragenics. “Our team’s efforts in enhancing drug safety, completing key FDA tests,

and improving our delivery technology and formulation demonstrate our commitment to addressing the urgent need for concussion treatments.

These advancements, along with the strategic leadership appointments, position Oragenics as a leader in the development of medical solutions

for acute neurological trauma, bringing us closer to meeting this critical unmet need.”

Continued

Non-Compliance and NYSE Approved Plan to Gain Compliance

As

previously disclosed, the Company is not in compliance with subsections (ii) and (iii) of Section 1003(a) of the NYSE American’s

continued listing standards. On August 13, 2024, the Company received a notice from the NYSE American LLC informing the Company that

it also is not in compliance with subsection (i) Section 1003(a), which requires stockholders’ equity of no less than $2,000,000

if the Company has sustained losses from continuing operations and/or net losses in two of its three most recent fiscal years. The Company

previously submitted a Plan of Compliance (the “Plan”) to the NYSE American. The NYSE American approved the Plan. The Company

has until October 18, 2025 to regain compliance under the approved Plan. The NYSE non-compliance notices do not affect the listing or

trading of Oragenics’ stock, which will continue under the symbol “OGEN” with a “.BC” designation to indicate

the status of the Common Stock as “below compliance”. The Company remains committed to addressing this issue while advancing

its business and clinical operations.

About

Concussion

Concussion

is an unmet medical need. There are an estimated 69 million concussions annually reported worldwide. Common causes of concussion include

falls, motor vehicle accidents, and contact sports. Other neurological disorders, including Alzheimer’s Disease, Parkinson’s

Disease, and Chronic Traumatic Encephalopathy (CTE), have been linked to concussion. Post-concussion symptomology is linked to long-term

disability and occurs in as high as 20% of concussed patients.

About

Oragenics

Oragenics

is a development-stage biotechnology company focused on nasal delivery of pharmaceutical medications in neurology and fighting infectious

diseases, including drug candidates for treating mild traumatic brain injury, also known as concussion, and for treating Niemann Pick

Disease Type C, as well as proprietary powder formulation and an intranasal delivery device. For more information, please visit www.oragenics.com.

Forward-Looking

Statements

This

communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, including without limitation statements regarding the ability of the Company to timely and

successfully undertake Phase II clinical trial using its novel drug-device combination for the treatment of mild traumatic brain injury.

These forward-looking statements are based on management’s beliefs and assumptions and information currently available. The words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “project”

and similar expressions that do not relate solely to historical matters identify forward-looking statements. Investors should be cautious

in relying on forward-looking statements because they are subject to a variety of risks, uncertainties, and other factors that could

cause actual results to differ materially from those expressed in any such forward-looking statements. These factors include, but are

not limited to: the Company’s ability to advance the development of its product candidates, including the neurology assets, under

the timelines and in accord with the milestones it projects; the Company’s ability to raise capital and obtain funding, non-dilutive

or otherwise, for the development of its product candidates; the regulatory application process, research and development stages, and

future clinical data and analysis relating to its product candidates, including any meetings, decisions by regulatory authorities, such

as the FDA and investigational review boards, whether favorable or unfavorable; the Company’s ability to obtain, maintain and enforce

necessary patent and other intellectual property protection; the nature of competition and development relating to concussion treatments;

the Company’s expectations as to the outcome of preclinical studies and clinical trials and the potential benefits, activity, effectiveness

and safety of its product candidates including as to administration, transmission, manufacturing, storage and distribution; and general

economic and market conditions and risks, as well as other uncertainties described in our filings with the U.S. Securities and Exchange

Commission. All information set forth is as of the date hereof unless otherwise indicated. You should consider these factors in evaluating

the forward-looking statements included and not place undue reliance on such statements. We do not assume any obligation to publicly

provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by law.

Oragenics,

Inc.

Janet

Huffman, Chief Financial Officer

813-286-7900

jhuffman@oragenics.com

Investor

Relations:

Rich

Cockrell

CG

Capital

404-736-3838

ogen@cg.capital

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

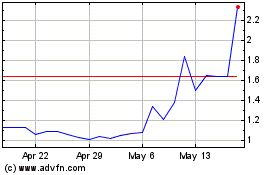

Oragenics (AMEX:OGEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Oragenics (AMEX:OGEN)

Historical Stock Chart

From Jan 2024 to Jan 2025