Power REIT (NYSE-AMEX: PW and PW.PRA) (“Power REIT” or the

“Trust”), with a focused “Triple Bottom Line” strategy and a

commitment to people, planet, and profit, today announced that it

is has filed its quarterly report for the three months ended March

31, 2022 on Form 10Q with the SEC. The information provided below

is an update that includes highlights from its quarterly report and

current business activities.

FINANCIAL

HIGHLIGHTS

| |

|

Three Months Ended March 31, |

| |

|

2022 |

|

2021 |

| |

|

|

|

|

| Revenue |

|

$ |

1,985,516 |

|

|

$ |

1,820,927 |

|

| |

|

|

|

|

|

|

|

|

| Net Income Attributable to Common Shareholders |

|

$ |

997,880 |

|

|

$ |

1,108,128 |

|

| Net Income per Common Share (basic) |

|

|

0.25 |

|

|

|

0.34 |

|

| |

|

|

|

|

|

|

|

|

| Core FFO Available to Common Shareholders |

|

$ |

1,348,533 |

|

|

$ |

1,274,939 |

|

| Core FFO per Common Share |

|

|

0.40 |

|

|

|

0.46 |

|

| |

|

|

|

|

|

|

|

|

| Growth Rates: |

|

|

|

|

|

|

|

|

| Revenue |

|

|

9 |

% |

|

|

|

|

| Net Income Attributable to Common Shareholders |

|

|

-10 |

% |

|

|

|

|

| Net Income per Common Share (basic) |

|

|

-27 |

% |

|

|

|

|

| Core FFO Available to Common Shareholders |

|

|

6 |

% |

|

|

|

|

| Core FFO per Common Share |

|

|

-13 |

% |

|

|

|

|

Commenting on the results and Q1-2021

achievements, David Lesser, Chief Executive Officer

stated, “As our investment platform continues to evolve,

we remain focused on sustainable farming solutions by investing in

Controlled Environment Agriculture properties in the form of

greenhouses. Our legacy is in other sustainable real estate assets

and we continue to embrace that ethos. The price for wholesale

cannabis has compressed dramatically over the past several

quarters, which has had a significant impact on our cannabis

tenants. As we work through these headwinds, we are proactively

backfilling space and are in active negotiations with replacement

tenants. We have also now diversified to add a greenhouse focused

on the cultivation of tomatoes.”

Mr. Lesser continued, “We remain optimistic that

our investments in greenhouse properties provide a sustainable

platform for indoor farming of food as well as cannabis.

Greenhouses are more cost efficient to build and more energy

efficient to operate than warehouse style indoor cultivation

facilities. We are also encouraged that the tenant at our Michigan

greenhouse commenced hemp cultivation having received a license

from the Michigan Department of Agriculture and Rural Development

that governs such activity. This will help our tenant gain valuable

experience growing a strain of cannabis plant and we believe it may

also support our belief that the greenhouse carries an agricultural

property designation while growing cannabis.”

- During the first quarter of 2022,

the Trust reported Core FFO of $0.40 per share (as adjusted),

compared to Core FFO per share of $0.46 for the comparable period

in 2021. Excluding one-time items and other adjustments Core FFO

would have been $0.46 per share for the period ended, March 31,

2022, compared to $0.46 per share for the period ended March 31,

2021. These results reflect the following one-time

adjustments:

| |

○ |

Core FFO for the period ended March 31, 2022 would have been $0.46

per share excluding two, one-time adjustments that in total reduced

FFO by $0.06 per share related to eliminating straight-line rent

for two tenants based on concerns about rent collectability at two

properties located in Huerfano County, Colorado. |

| |

|

|

| |

○ |

Core FFO for the period ended March 31, 2022 of $0.40 per share

compares to $0.35 per share for the quarter ended December 31,

2021. |

As previously disclosed, the Trust has stopped

including revenue from our property located in Michigan due to

uncertainty around cannabis licensing that is the subject of a

previously announced litigation related to the designation of the

property as an agricultural use while growing cannabis. Had the

straight-line rent for the Michigan property been included in the

first quarter 2022 calculation, the incremental FFO would increase

by approximately $0.38 per share per quarter. Effective April 27,

2022, our tenant received a license for the cultivation of Hemp and

has commenced growing operations.

ACQUISITION ACTIVITY

On March 31, 2022, Power REIT, through a newly

formed wholly owned subsidiary, PW MillPro NE LLC, (“PW MillPro”),

acquired its largest greenhouse property to date for $9.35 million

in O’Neill, Nebraska. The greenhouse is a 1,121,513 square foot

cultivation facility (the “MillPro Facility”) on approximately

86-acres, which will be used for the cultivation of tomatoes. The

acquisition included an additional 4.88-acre property with a

21-room employee housing building, which is a key strategic benefit

for attracting the necessary labor to operate the greenhouse. As

part of the transaction, the Trust agreed to fund the replacement

of Energy Curtains for $534,430. Simultaneous with the acquisition,

PW MillPro entered into a 10-year “triple-net” lease (the “MillPro

Lease”) with Millennium Produce of Nebraska LLC (“MillPro”), a

subsidiary of Millennium Sustainable Ventures Corp., of which David

Lesser is CEO and Chairman. MillPro will operate the MillPro

Facility for the sustainable cultivation of tomatoes. The lease

requires MillPro to pay all property related expenses including

maintenance, insurance and taxes. The MillPro Lease is structured

to provide an annual straight-line rent of approximately

$1,099,387, representing an estimated yield on costs of 11%.

Mr. Lesser commented on

the recent acquisition, “The Nebraska

transaction was funded using the Trust’s debt facility with a 5.52%

interest rate, representing a significant investment spread to our

cost of capital relative to traditional real estate asset classes.

Assuming no value is assigned to the employee housing facility or

the extra land for expansion, Power REIT’s cost basis for the

greenhouse is approximately $8.81 per square foot and represents a

substantial discount to replacement cost. This should help our

tenant operator which is focused on becoming a large-scale low-cost

tomato producer. This acquisition diversifies our exposure to the

cannabis industry gyrations while continuing our focus on the

benefits of Controlled Environment Agriculture in the form of

greenhouses.”

LEASING AND

TENANT ACTIVITY

On January 1, 2022, Power REIT’s subsidiary, (PW

CO CanRE Walsenburg LLC), entered into a lease amendment with

Walsenburg Cannabis LLC amended (the “Walsenburg Lease Amendment”)

to provide $625,000 funding to add processing space and equipment

that will be housed on the one Property owned by Power REIT

pursuant to a sublease with Power REIT’s tenant. The Walsenburg

Lease Amendment reflects a ten-year term with no renewal options

and is structured to provide an annual straight-line rent of

approximately $120,000.

On January 1, 2022, Power REIT’s subsidiary, (PW

CO CanRE Grail LLC) entered into a triple-net lease (the “Sandlot

Lease”) with a new tenant, The Sandlot, LLC (“SL Tenant”), which

replaces a prior tenant at this property who vacated the property

in November 2021. The Sandlot Lease is a 20-year term and provides

four, five-year extension options. Power REIT’s total commitment to

this project is approximately $2,432,000. The Sandlot Lease also

has financial guarantees from affiliates of the SL Tenant, which

intends to operate as a licensed cannabis cultivation and

processing facility. The annual straight-line annual rent is

approximately $462,000.

On January 15, 2022, Power REIT’s subsidiary,

(“PW CanRE Cloud Nine”) filed for the eviction of Cloud Nine LLC

(“Cloud Nine”) for its failure to pay rent. On February 11, 2022

the court granted a Writ of Restitution for the eviction of Cloud

Nine who has appealed the eviction ruling and filed counterclaims

against PW CanRE Cloud Nine. The appeal is currently pending and

Cloud Nine has posted a $25,000 bond. PW CanRE Cloud Nine has filed

a motion to increase the bond to an amount that reflects the back

rent due.

On March 1, 2022, the Sweet Dirt Lease was

amended (the “Sweet Dirt Lease Second Amendment”) to provide

funding in the amount of $3,508,000 to add additional items to the

property improvement budget for the construction of a Cogeneration

/ Absorption Chiller project to the Sweet Dirt Property. The term

of the Sweet Dirt Lease Second Amendment is coterminous with the

original lease and is structured to provide an annual straight-line

rent of approximately $654,000.

PORTFOLIO

Power REIT’s portfolio currently comprises:

- 22 Controlled Environment

Agriculture (CEA) properties (greenhouses) totaling more than

2,100,000 square feet;

- 7 solar farm ground leases totaling

601 acres; and

- 112 miles of railroad

property.

CAPITAL MARKETS

ACTIVITY

As previously announced, Power REIT entered into

a Debt Facility with initial availability of $20 million with a

5.52% fixed interest rate. As of March 31, 2022, $11,500,000 was

drawn on the Debt Facility.

SUBSEQUENT EVENTS

As previously disclosed, On April 1, 2022, Power

REIT’s wholly owned subsidiary (“PW Marengo”), filed a Complaint,

Petition for Writ of Mandamus and Jury Demand against the Marengo,

Michigan. The Complaint was filed in the United States District

Court – Western District of Michigan – Southern Division and the

Case Number is: 1:22-cv-00321. The Complaint is an action for

equitable, declaratory and injunctive relief arising out of

Township’s false promises, constitutional violations by the

Township’s deprivation of Plaintiffs’ civil rights through its

refusal and failure to comply with its own ordinances and state law

as well as a common dispute resolution mechanism. On April 7, 2022

PW Marengo filed a motion for an expedited hearing and on April 21,

2022 a reply brief was filed. We are awaiting a ruling from the

court.

On April 8, 2022, JKL2 Inc., Chelsey Joseph,

Alan Kane and Jill Lamoureux filed a complaint in District Court,

Crowley County Colorado (Case Number: 2022CV30009) against PW CO

CanRe JKL LLC, Power REIT and David H. Lesser (the “Power REIT

parties”) and Crowley County Builders, LLC and Dean Hiat (the “CC

Parties”). The complaint is seeking a judgement against the Power

REIT Parties for (i) fraudulent inducement and (ii)breach of duty

of good faith and fair dealing and (iii) civil conspiracy and (iv)

unjust enrichment. On April, May 2, 2022, PW CO CanRe JKL LLC

commenced an eviction process against JKL2 Inc. for failure to pay

rent when due and will be counter-claiming, seeking damages for

unpaid rent.

DISTRIBUTIONS

During the three months ended March 31, 2022,

the Trust paid quarterly dividends of approximately $163,000

($0.484375 per share) on Power REIT’s 7.75% Series A Cumulative

Redeemable Perpetual Preferred Stock., which was payable on March

15, 2022 to shareholders of record on February 15, 2022.

UPDATED INVESTMENT

PRESENTATION

Power REIT has posted an updated investor

presentation which is available using the following link:

https://www.pwreit.com/investors

STATEMENT ON SUSTAINABILITY

Power REIT owns real estate related to

infrastructure assets including properties for Controlled

Environment Agriculture facilities with a focus on greenhouses,

Renewable Energy and Transportation.

CEA facilities in the form of greenhouses,

provide an extremely environmentally friendly solution, which

consume approximately 70% less energy than indoor growing

operations that do not benefit from “free” sunlight. greenhouses

use 90% less water than field grown plants, and Power REIT’s

greenhouse properties operate without the use of pesticides and

avoid agricultural runoff of fertilizers and pesticides. These

facilities cultivate medical Cannabis, which has been recommended

to help manage a myriad of medical symptoms, including seizures and

spasms, multiple sclerosis, post-traumatic stress disorder,

migraines, arthritis, Parkinson's disease, and Alzheimer’s. To

date, the FDA has not approved a marketing application for cannabis

for the treatment of any disease or condition.

Renewable Energy assets are

comprised of land and infrastructure associated with utility scale

solar farms. These projects produce power without the use of fossil

fuels thereby lowering carbon emissions. The solar farms produce

approximately 50,000,000 kWh of electricity annually which is

enough to power approximately 4,600 homes on a carbon free

basis.

Transportation assets are

comprised of land associated with a railroad, an environmentally

friendly mode of bulk transportation.

ABOUT POWER REIT

Power REIT, with a focus on the “Triple Bottom

Line” and a commitment to people, planet and profit, is a

specialized real estate investment trust (REIT) that owns

sustainable real estate related to infrastructure assets including

properties for Controlled Environment Agriculture, Renewable Energy

and Transportation. Power REIT is actively seeking to expand its

real estate portfolio related to Controlled Environment Agriculture

in the form of greenhouses for the cultivation of food and

cannabis.

Additional information about Power REIT can be

found on its website: www.pwreit.com

Cautionary Statement About

Forward-Looking Statements

This document includes forward-looking

statements within the meaning of the U.S. securities laws.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can generally identify forward-looking statements as

statements containing the words "believe," "expect," "will,"

"anticipate," "intend," "estimate," "project," "plan," "assume",

"seek" or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding our future strategy, future operations, future prospects,

the future of our industries and results that might be obtained by

pursuing management's current or future plans and objectives are

forward-looking statements. You should not place undue reliance on

any forward-looking statements because the matters they describe

are subject to known and unknown risks, uncertainties and other

unpredictable factors, many of which are beyond our control. Our

forward-looking statements are based on the information currently

available to us and speak only as of the date of the filing of this

document. Over time, our actual results, performance, financial

condition or achievements may differ from the anticipated results,

performance, financial condition or achievements that are expressed

or implied by our forward-looking statements, and such differences

may be significant and materially adverse to our security

holders.

Non-GAAP Financial Measures

This document contains supplemental financial

measures that are not calculated pursuant to U.S. generally

accepted accounting principles (“GAAP”), including the measure

identified by us as Core Funds From Operations Available to Common

Shares (“Core FFO”). Management believes that Core FFO is a useful

supplemental measure of the Trust’s operating performance.

Management believes that alternative measures of performance, such

as net income computed under GAAP, or Funds From Operations

computed in accordance with the definition used by the National

Association of Real Estate Investment Trusts (“NAREIT”), include

certain financial items that are not indicative of the results

provided by the Trust’s asset portfolio and inappropriately affect

the comparability of the Trust’s period-over-period performance.

These items include non-recurring expenses, such as those incurred

in connection with litigation, one-time upfront acquisition

expenses that are not capitalized under ASC-805 and certain

non-cash expenses, including non-cash, stock-based compensation

expense. Therefore, management uses Core FFO and defines it as net

income excluding such items. Management believes that, for the

foregoing reasons, these adjustments to net income are appropriate.

The Trust believes that Core FFO is a useful supplemental measure

for the investing community to employ, including when comparing the

Trust to other REITs that disclose similarly adjusted FFO figures,

and when analyzing changes in the Trust’s performance over time.

Readers are cautioned that other REITs may use different

adjustments to their GAAP financial measures than we do, and that

as a result the Trust’s Core FFO may not be comparable to the FFO

measures used by other REITs or to other non-GAAP or GAAP financial

measures used by REITs or other companies.

RECONCILIATION NET INCOME TO CORE

FFO

Management believes that Core FFO is a useful

supplemental measure of the Trust's operating performance.

Management believes that alternative measures of performance, such

as net income computed 56 under GAAP, or Funds From Operations

computed in accordance with the definition used by the National

Association of Real Estate Investment Trusts ("NAREIT"), include

certain financial items that are not indicative of the results

provided by the Trust's asset portfolio and inappropriately affect

the comparability of the Trust's period-over-period performance.

These items include non-recurring expenses, such as those incurred

in connection with litigation, one-time upfront acquisition

expenses that are not capitalized under ASC-805 and certain

non-cash expenses, including stock-based compensation expense

amortization and certain up front financing costs. Therefore,

management uses Core FFO and defines it as net income excluding

such items. Management believes that, for the foregoing reasons,

these adjustments to net income are appropriate. The Trust believes

that Core FFO is a useful supplemental measure for the investing

community to employ, including when comparing the Trust to other

REITs that disclose similarly adjusted FFO figures, and when

analyzing changes in the Trust's performance over time. Readers are

cautioned that other REITs may use different adjustments to their

GAAP financial measures than Power REIT do, and that as a result,

the Trust's Core FFO may not be comparable to the FFO measures used

by other REITs or to other non-GAAP or GAAP financial measures used

by REITs or other companies.

A reconciliation of our Core FFO to net income

for the three months ended March 31, 2022, and 2021 is included in

the table below:

CORE FUNDS FROM OPERATIONS

(FFO)(Unaudited)

| |

|

Three Months Ended March 31, |

| |

|

2022 |

|

2021 |

| Revenue |

|

$ |

1,985,516 |

|

|

$ |

1,820,927 |

|

| |

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

997,880 |

|

|

$ |

1,108,128 |

|

| Stock-Based Compensation |

|

|

109,100 |

|

|

|

66,158 |

|

| Interest Expense - Amortization of Debt Costs |

|

|

21,976 |

|

|

|

8,527 |

|

| Amortization of Intangible Lease Asset |

|

|

104,172 |

|

|

|

59,285 |

|

| Amortization of Intangible Lease Liability |

|

|

(9,925 |

) |

|

|

- |

|

| Depreciation on Land Improvements |

|

|

288,537 |

|

|

|

196,051 |

|

| Core FFO Available to Preferred and Common Stock |

|

|

1,511,740 |

|

|

|

1,438,149 |

|

| |

|

|

|

|

|

|

|

|

| Preferred Stock Dividends |

|

|

(163,207 |

) |

|

|

(163,210 |

) |

| |

|

|

|

|

|

|

|

|

| Core FFO Available to Common Shares |

|

$ |

1,348,533 |

|

|

$ |

1,274,939 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares Outstanding (basic) |

|

|

3,367,531 |

|

|

|

2,755,502 |

|

| |

|

|

|

|

|

|

|

|

| Core FFO per Common Share |

|

|

0.40 |

|

|

|

0.46 |

|

| |

|

|

|

|

|

|

|

|

| Growth Rates: |

|

|

|

|

|

|

|

|

| Revenue |

|

|

9 |

% |

|

|

|

|

| Net Income |

|

|

-10 |

% |

|

|

|

|

| Core FFO Available to Common Shareholders |

|

|

6 |

% |

|

|

|

|

| Core FFO per Common Share |

|

|

-13 |

% |

|

|

|

|

CONACT:

|

David H. Lesser, Chairman & CEO |

Mary Jensen, Investor Relations |

|

dlesser@pwreit.com |

mary@irrealized.com |

|

212-750-0371 |

310-526-1707 |

|

|

|

| 301 Winding RoadOld Bethpage, NY

11804 |

|

| www.pwreit.com |

|

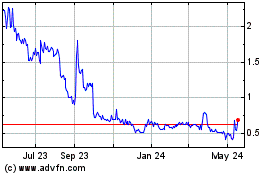

Power REIT (AMEX:PW)

Historical Stock Chart

From Dec 2024 to Dec 2024

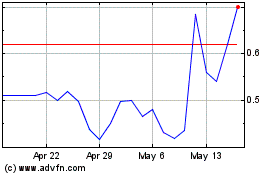

Power REIT (AMEX:PW)

Historical Stock Chart

From Dec 2023 to Dec 2024