Can Tech Stocks Continue to Gain Pace This Week?

20 November 2023 - 9:43PM

Finscreener.org

Tech investors are heading

towards Thanksgiving with a buoyant mood. Last week, the Nasdaq

Composite index climbed 2.4%, marking a 12% rise over the past

three weeks. The upsurge is the most significant since April 2020,

when the onset of COVID-19 and related stay-at-home orders spurred

a spike in e-commerce and cloud software stocks.

Intel (NASDAQ:INTC)

emerged as the top performer in the

large-cap tech sector this week, with a 13% increase in its share

price. Intel shares have surged 35% since the chip maker beat Wall

Street revenue and estimates in its quarterly results reported on

October 26.

Mizuho Securities upgraded Intel

to a U+02019buyU+02019 rating from U+02019neutralU+02019 this week,

pointing to a refocused strategy on its data center business and a

promising customer pipeline, which could lead to increased market

share and improved profit margins.

Nvidia to report results on Tuesday

Next week, semiconductors will be

the focal point for tech investors, with

Nvidia (NASDAQ:NVDA)

set to announce its results on Tuesday. The stock has risen 22% in

the last three weeks, with year-to-date gains reaching 237%,

outperforming all other

S&P 500 companies.

Nvidia, a key player in the

generative artificial intelligence boom, provides the GPUs required

for these demanding processes. The company is expected to reveal

over 170% revenue growth in its upcoming earnings report in the

third quarter. Analysts anticipate NvidiaU+02019s forecast for the

fourth quarter to indicate nearly 200% growth, as per

LSEG.

Eric Jackson, founder of EMJ

Capital, shared on CNBC’s “Closing Bell” that all eyes are on

Nvidia’s upcoming earnings. He considers Nvidia his "top large-cap

pick" and believes the market is in the early stages of a rebound

linked to the anticipated end of Federal Reserve rate

hikes.

The FedU+02019s benchmark

borrowing rate, currently at its highest in 22 years, is expected

to start declining from May, with projections of a full percentage

point reduction by the end of 2024, according to CME GroupU+02019s

FedWatch.

Tech stocks, susceptible to

interest rate changes, tend to benefit from low borrowing costs,

encouraging risk-taking, whereas higher rates steer investors

towards safer assets.

The broader market received a

lift this week from moderate U.S. inflation data. The Consumer

Price Index (CPI) remained unchanged in October, defying

expectations of a 0.1% increase. This data fueled optimism that the

FedU+02019s rate-hiking period might be drawing to a

close.

Airlines expect record travel in Thanksgiving

2023

Airlines are anticipating an

unprecedented surge in travel demand this Thanksgiving, and

industry leaders assure they are ready to handle the

influx.

The Transportation Security

Administration (TSA) is preparing to screen about 30 million

passengers from November 17 to November 28, setting a new record.

The peak travel day is predicted to be the Sunday following

Thanksgiving, with around 2.9 million passengers expected to

fly.

The holiday season at the end of

the year is a vital period for airlines to boost their revenues. In

times excluding peak holidays or high-demand periods, airlines

often resort to lowering fares or curtailing expansion as the

initial post-pandemic travel surge aligns more closely with

historical patterns. However, they are also grappling with

increased costs for fuel and labor, which have been impacting their

profit margins.

Nonetheless, the high-demand

travel days surrounding the holidays continue to attract high

ticket prices.

This Thanksgiving will serve as a

crucial indicator of how the airline industry copes with the

pressures of the holiday season, especially while navigating

ongoing challenges such as the persistent shortage of air traffic

controllers.

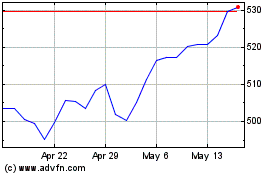

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2024 to Dec 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Dec 2023 to Dec 2024