false

0001898766

0001898766

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 19, 2024

| Trio

Petroleum Corp. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41643 |

|

87-1968201 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5401

Business Park South, Suite 115

Bakersfield,

CA 93309

(661)

324-3911

(Address

and telephone number, including area code, of registrant’s principal executive offices)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

7.01. |

Regulation

FD Disclosure. |

On

December 19, 2024, Trio Petroleum Corp., a Delaware corporation (the “Company”), issued a press release, announcing that

the Company entered into a non-binding Letter of Intent relating to the acquisition of a 100% working interest in certain petroleum and

natural gas assets held by Novacor Exploration Ltd., which are located in the Lloydminster, Saskatchewan heavy oil region in Canada.

The press release is furnished as Exhibit 99.1 and incorporated by reference herein.

The

information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished, shall not be deemed “filed” for

any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities

Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Trio

Petroleum Corp. |

| |

|

|

| Date:

December 19, 2024 |

By: |

/s/

Robin Ross |

| |

Name: |

Robin

Ross |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Trio

to acquire producing oil and gas assets in prolific heavy oil region of Saskatchewan Canada

Bakersfield,

CA, December 19, 2024 – Trio Petroleum Corp (NYSE American: TPET) (“Trio” or the “Company”), a California-based

oil and gas company, today is pleased to announce that it has entered into a non-binding Letter of Intent (“LOI”)

for the acquisition of a 100% working interest in certain petroleum and natural gas properties held by Novacor Exploration Ltd. (“Novacor”),

which are located in the prolific Lloydminster, Saskatchewan heavy oil region (the “Acquisition”). In the event that

Trio consummates the Acquisition, it believes that it could strategically position itself to expand its operations into one of North

America’s most promising heavy oil basins, with upside potential for long term production and reserve growth. Since the Novacor

assets are in the heavy oil area, they offer economical development and low operational costs. Market accessibility combined with a favorable

regulatory process makes this area very attractive for continued and future development within these lands.

The

Novacor assets are located at the South-West quarter of Section 19, Township 47, Range 26W3M and the North East Section 3, Township 48,

Range 24W3M, both in the Lloydminster, Saskatchewan area. There are currently seven producing wells located on the two properties. Production

from the wells in Section 19 is subject to Freehold Royalties of 13.5% and a GORR of 2%, and production from the wells in Section 3 is

subject to Freehold Royalties of 15%. The wells produce heavy crude oil from the McLaren/Sparky and Lloydminster formation(s). Novacor

is the operator of these cash flow positive wells. Current production is approximately 70 barrels per day with potential for 4 additional

re-entry wells and two fully equipped locations to be reactivated each capable of an additional 70 barrels in total per day. Two wells

in Section 19 are temporarily shut in waiting to be reactivated and commingled with a lower zone at a cost of approximately C$30,000

per well and once commingled will have the potential to add another 10 bpd each. All of the foregoing information was derived from reports

provided to the Company by Novacor.

Additionally,

a Reserve Report was prepared in August 2024 by Petrotech and Associates detailing 91.5MBBL for total proved and probable oil of those

wells currently being produced. Novacor has identified further potential upside in the Sparky GP thru some multi-lateral drill opportunities.

“We

are excited to acquire an initial footprint in this very lucrative oil and gas area of Canada and home to some of the largest players

in the industry such as Cenovus Energy, Canadian Natural Resources, Baytex Energy, Rife Resources and many others who have made Heavy

Oil a staple of their operation, and where numerous opportunities to acquire additional highly economic fields exist,” stated Robin

Ross, Trio’s Chief Executive Officer. Mr. Ross further explained, “that Trio’s relationship with Novacor is very important,

because Novacor has a long history of oil and gas development in the area. Trio’s plan is to aggressively grow its footprint in

the area utilizing Novacor as an operator of the assets. The initial project has the capability to rapidly double production, and we

are looking forward to a long and prosperous relationship with Novacor. Our focus remains on acquiring projects that generate immediate

cash flow or offer transformative growth potential with strategic investment like the Asphalt ridge Project in Utah. We believe that

this approach aligns with our long-term vision of creating exponential value while managing risk and resources effectively.”

Terms

of the Non-binding LOI

The

stated purchase price of the Acquisition is CD$2 million (approximately US$1.4 million based on current exchange rates) payable US$650,000

in cash and the remainder in shares of common stock of Trio, which we would agree to use our commercially reasonable efforts to register

for resale in a registration statement filed with the United States Securities and Exchange Commission. Upon execution of the LOI, the

Company paid Novacor a good faith deposit of $65,000, which will be applied to the cash portion of the purchase price at closing. Other

than obligations of confidentiality and exclusivity contained in the LOI, no other terms are binding until definitive acquisition documents

are signed by the parties. The definitive acquisition documents would likely contain customary representations and warranties of the

parties and certain conditions to closing, including approval of the Acquisition by the board of directors of each of Novacor and Trio,

and a condition that Trio raises sufficient financing to consummate the Acquisition. Unless extended by the mutual agreement of the parties,

the LOI will terminate on the earlier of (i) the mutual agreement of Novacor and Trio, (ii) the execution of definitive acquisition documents

or (iii) on February 15, 2025.

About

Trio Petroleum Corp

Trio

Petroleum Corp is an oil and gas exploration and development company headquartered in Bakersfield, California, with operations in Monterey

County, California, and Uintah County, Utah. In Monterey County, Trio owns an 85.75% working interest in 9,245 acres at the Presidents

and Humpback oilfields in the South Salinas Project, and a 21.92% working interest in 800 acres in the McCool Ranch Field. In Uintah

County, Trio owns a 2.25% working interest in 960 acres and options to acquire up to an additional 17.75% working interest in the 960

acres, and also an option to acquire 20% working interest in an adjacent 1,920 acres, and a right of first refusal to participate in

an additional approximate 30,000 acres of the Asphalt Ridge Project at terms offered to other third parties.

Cautionary

Statement Regarding Forward-Looking Statements

All

statements in this press release of Trio Petroleum Corp (“Trio”) and its representatives and partners that are not based

on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended (the “Acts”). In particular, when used in the preceding discussion, the words “estimates,” “believes,”

“hopes,” “expects,” “intends,” “on-track”, “plans,” “anticipates,”

or “may,” and similar conditional expressions are intended to identify forward-looking statements within the meaning of the

Acts and are subject to the safe harbor created by the Acts. Any statements made in this news release other than those of historical

fact, about an action, event or development, are forward-looking statements. While management has based any forward-looking statements

contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking

statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors,

many of which are outside of the Trio’s control, that could cause actual results to materially and adversely differ from such statements.

Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth in the Risk Factors sections

of the Trio reports filed with the Securities and Exchange Commission (SEC). Copies of such documents are available on the SEC’s

website, www.sec.gov. Trio undertakes no obligation to update these statements for revisions or changes after the date of this

release, except as required by law.

Investor

Relations Contact:

Redwood Empire Financial Communications

Michael Bayes

(404) 809 4172

michael@redwoodefc.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

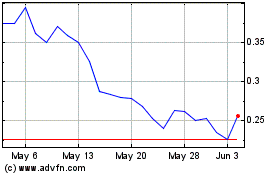

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Dec 2023 to Dec 2024