Taper Concerns Put Focus on Homebuilder ETFs - ETF News And Commentary

14 December 2013 - 6:00AM

Zacks

Revised U.S. GDP data of 3.6% for Q3 against 2.8% predicted

earlier, a reduction in jobless claims, better-than-expected data

in non-farm payroll numbers and a continued surge in manufacturing

numbers renewed the taper concerns all over again in early

December.

While this economic good news may spread cheer within the nation,

some corners of the investment world, such as the homebuilding

sector, will likely be hit by this bullishness. The sector has been

a star performer so far this year courtesy of historically low

interest rates, but might falter in the coming days owing to the

rising rate concerns (read: The Comprehensive Guide to Homebuilders

ETFs).

Why Homebuilders are Worried

High interest rates make mortgage loans more expensive which in

turn weakens the demand for new homes. The prospect of tapering has

started to push up interest rates. According to the Freddie Mac

mortgage survey, the 30-year fixed mortgage rate moved up from

3.59% on May 23 to 4.46% on December 5.

In fact, the rate edged upward by 24 bps within just 15 days in

December following a slew of positive economic data. Both existing

and pending home sales declined 3.2% and 0.6% respectively for the

second successive month in October.

Quite expectedly, the data penalized the homebuilding

ETFs. The three funds tracking the sector –

iShares

Dow Jones US Home Construction ETF (ITB),

SPDR

S&P Homebuilders ETF (XHB) and

PowerShares

Dynamic Building & Construct (PKB) – have all seen

weakness over the past few trading sessions, and continue their

slump if rates soar higher.

What to Expect from the Sector?

Notwithstanding all concerns, the sector is poised to stay afloat

even if the Fed tapers, in our opinion. The following reasons

explain the prospects in the sector.

Interest rates are still well below average levels, keeping housing

still reasonably priced. Also a better job market and improving

consumer confidence from the lows it witnessed two years ago are

encouraging consumers to purchase new homes.

Plus, home inventories remain tight. A scarcity of land and labor

is restricting the construction of homes, both single and

multifamily. As a result, lower housing inventory and a

still-steady demand profile are raising the price of

properties.

The new home sales data bounced back in October following a

year-low plunge in September. By now, buyers are presumably immune

to the ups-and-downs in mortgage rates.

In short, there is still a considerable amount of pent-up demand in

the homebuilding sector that can pull it through the coming days

(read: 3 Homebuilder ETFs Leading the Pack this Earnings

Season).

Conclusion

Even though a sword of Damocles hangs over the head of the sector

with the imminent taper, we really do not believe this is something

to panic over. Builder confidence in the market for newly built,

single-family homes did not deteriorate further in November.

Forward looking projections are pretty assuring. As per the

National Association of Homebuilders, both single and multi-family

home sales will likely rise at around double the pace in the coming

year and the year after from 2013.

In fact, an expected 76 bps and 86 bps rise in fixed mortgage rates

in 2014 and 2015, respectively, are not expected to hold back the

housing recovery. Prime rates are guided to stay the same next year

and nudge up 5 bps in the next, so concerns may be limited for the

long term.

Most homebuilders believe the housing momentum will continue into

2014. Bearing these in mind, the ETF outlook on the sector also

appears promising. Presently, ITB has a Zacks ETF Rank #2 (Buy) and

XHB and PKB carry a Zacks ETF Rank #3 (Hold) (see more ETFs in the

Zacks ETF Center).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US HO CO (ITB): ETF Research Reports

PWRSH-DYN BLDG (PKB): ETF Research Reports

SPDR-SP HOMEBLD (XHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

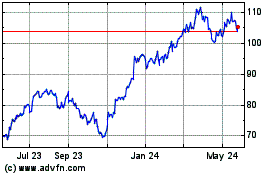

SPDR S&P Homebuilders (AMEX:XHB)

Historical Stock Chart

From Dec 2024 to Jan 2025

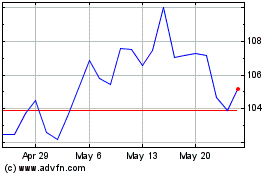

SPDR S&P Homebuilders (AMEX:XHB)

Historical Stock Chart

From Jan 2024 to Jan 2025