TIDMCIC

RNS Number : 9059N

Conygar Investment Company PLC(The)

28 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO OR FROM THE UNITED STATES, CANADA,

AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY

MEMBER STATE OF THE EUROPEAN ECONOMIC AREA OR ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OF LOCAL

APPLICABLE SECURITIES LAWS OR REGULATIONS.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION (EU) NO 596/2014

("MAR") WHICH IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018. UPON PUBLICATION OF THIS ANNOUNCEMENT, THE

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN FOR

THE PURPOSES OF MAR.

PLEASE SEE THE SECTION ENTITLED "IMPORTANT NOTICE" TOWARDS THE

OF THIS ANNOUNCEMENT.

28 September 2023

The Conygar Investment Company PLC (the "Company")

Conygar ZDP PLC (the "Issuer")

Launch of ZDP Issue

Further to the announcement on 22 May 2023, the board of the

Company announces the issue of 15,000,000 zero dividend preference

shares ("ZDP Shares") by the Issuer to raise GBP15 million through

a placing (the "Placing") and parent subscription (the "Parent

Subscription" and together with the Placing the "Issue").The net

proceeds from the issue of the ZDP Shares are expected to be

utilised to further continue development of The Island Quarter site

in Nottingham City Centre.

-- ZDP Shares will be issued at an issue price of 100 pence per ZDP Share (the "Issue Price").

-- The term of the ZDP Shares will be five years.

-- The ZDP Shares will have a final capital entitlement of

153.86 pence per share, equivalent to a gross redemption yield of

9.0 per cent.

-- None of the Issuer, the Company nor any member of the

Company's group will issue further zero dividend preference shares

at a price which has the effect of reducing the cover for the ZDP

Shares, at the time of such issue, below 2 times.

Institutional investors wishing to participate in the Placing

should contact their usual Liberum sales representative ahead of

the latest time and date for receipt of commitments under the

Placing, being 3.00 p.m. on 29 September 2023.

Upon completion of the Placing, the Company will publish a

listing document (the "Listing Document") to enable the ZDP Shares

to be admitted to the Official List of The International Stock

Exchange.

The Listing Document is expected to be published on 3 October

2023. Applications will be made to The International Stock Exchange

for the ZDP Shares issued pursuant to the Issue to be admitted to

the Official List of The International Stock Exchange

("Admission"). It is expected that Admission will become effective

at 8.00 a.m. on 4 October 2023.

Enquiries:

The Conygar Investment Company +44 (0) 20 7258 8670

PLC Robert Ware / David Baldwin

Liberum Capital Limited

Financial Adviser and Sole Bookrunner +44 (0)20 3100 2000

Chris Clarke / Darren Vickers

/ Owen Matthews / Will King

Nominated Adviser and Broker +44 (0)20 3100 2185

Richard Lindley /Jamie Richards

Temple Bar Advisory (Public +44 (0)7795 425580

Relations) Alex Child-Villiers

+44 (0)7827 960151

Will Barker

IMPORTANT NOTICE

This announcement contains inside information for the purposes

of Article 7 of MAR. Upon publication of this announcement, the

inside information is now considered to be in the public domain for

the purposes of MAR. The person responsible for arranging the

release of this announcement on behalf of the Issuer and the

Company is David Baldwin.

The value of the ZDP Shares can fall as well as rise due to

stock market movements. If you sell your investment prior to the

redemption date, you may get back less than you originally

invested. The final capital entitlement is not guaranteed.

Liberum, which is a member of the London Stock Exchange, is

authorised and regulated in the UK by the FCA and is acting

exclusively for the Issuer and the Company in connection with the

Issue, Admission and any other matter referred to in this

announcement. Liberum will not regard any other person as its

client in relation to the Issue, Admission or any other transaction

or arrangement referred to in this announcement and will not be

responsible to anyone other than the Issuer and the Company for

providing the protections afforded to its clients or for providing

any advice in relation to the Issue, Admission or any other

transaction or arrangement referred to in this announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Liberum by FSMA or the regulatory regime

established thereunder, Liberum does not make any representation,

express or implied, in relation to, nor accepts any responsibility

whatsoever for, the contents of this announcement or any other

statement made or purported to be made by it or on its behalf in

connection with the Issuer, the Company, the ZDP Shares, the Issue,

Admission or any other transaction or arrangement referred to in

this announcement, and nothing in this announcement is or shall be

relied upon as a promise or representation in this respect, whether

as to the past or future. Liberum and its affiliates accordingly,

to the fullest extent permissible by law, disclaim all and any

responsibility or liability (save for any statutory liability)

whether arising in tort, contract or otherwise which it or they

might otherwise have to any person, other than the Issuer and the

Company, in respect of this announcement or any such statement.

This announcement is only directed at persons in the United

Kingdom who are qualified investors within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017 on the prospectus to be published when

securities are offered to the public or admitted to trading on a

regulated market, and repealing Directive 2003/71/EC as it forms

part of the domestic law of the United Kingdom by virtue of the

European Union (Withdrawal) Act 2018 (as amended) and who also (i)

have professional experience in matters relating to investments and

who are investment professionals within the meaning of Article

19(5) of the Order; or (ii) fall within article 49(2) of the Order

(including certain high net worth companies, unincorporated

associations or partnerships and the trustees of high value trusts,

or other respective directors, officers or employees as described

in article 49 of the Order); or (iii) are other persons to whom

this announcement for the purposes of section 21 of FSMA can

otherwise lawfully be made without further action (together

"Relevant Persons"). This announcement must not be acted on or

relied on in the United Kingdom, by persons who are not Relevant

Persons.

The ZDP Shares have not been, and will not be, registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act"),

or under any securities laws of any state or other jurisdiction of

the United States and may not be offered, sold, resold, transferred

or delivered, directly or indirectly, in or into the United States

or to or for the account or benefit of any U.S. person (within the

meaning of Regulation S under the Securities Act) except pursuant

to an applicable exemption from, or a transaction not subject to,

the registration requirements of the Securities Act and in

compliance with the securities laws of any state or other

jurisdiction of the United States. The Issuer has not been, and

will not be, registered under the U.S. Investment Company Act of

1940, as amended. No public offering of securities is being made in

the United States.

Relevant clearances have not been, and will not be, obtained

from the securities commission (or equivalent) of any province of

Canada, Australia, New Zealand, the Republic of South Africa,

Japan, any member state of the European Economic Area or any other

jurisdiction where local law or regulations may result in a risk of

civil, regulatory, or criminal exposure or prosecution if

information or documentation concerning the Issue and/or Admission

and/or this announcement is sent or made available to a person in

that jurisdiction (each a "Restricted Jurisdiction") and

accordingly, unless an exemption under any relevant legislation or

regulations is applicable, none of the ZDP Shares may be offered,

sold, renounced, transferred or delivered, directly or indirectly,

in any Restricted Jurisdiction.

This announcement does not constitute, and may not be construed

as, an offer to sell or a solicitation of an offer to buy or

subscribe for ZDP Shares in any jurisdiction including, without

limitation, the United States and any Restricted Jurisdiction. No

information set out in this announcement is intended to form the

basis of any contract of sale, investment decision or any decision

to purchase ZDP Shares.

The Unregulated Collective Investment Schemes and Close

Substitutes Instrument 2013 (the "NMPI Regulations") extend the

application of the existing UK regime restricting the promotion of

unregulated collective investment schemes by FCA authorised persons

(such as independent financial advisers) to other "non-mainstream

pooled investments" ("NMPIs"). Consequently, financial advisers,

including authorised independent financial advisers, are restricted

from promoting NMPIs to retail investors who do not meet certain

high net worth tests or who cannot be treated as sophisticated

investors. The Issuer is an NMPI for the purposes of the NMPI

Regulations. Accordingly, the promotion of the ZDP Shares to retail

investors is restricted.

None of the Issuer, the Company, Liberum or any of their

respective affiliates accepts any responsibility or liability

whatsoever for, or makes or gives any representation, warranty,

undertaking or other assurance, express or implied, as to this

announcement, including the truth, accuracy or completeness of the

information in this announcement (or whether any information has

been omitted from this announcement) or any other information

relating to the Issuer, the Company, the ZDP Shares, the Issue

and/or Admission, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of this announcement or its

content or otherwise arising in connection therewith. The Issuer,

the Company, Liberum and their respective affiliates accordingly

disclaim all and any liability whether arising in tort, contract or

otherwise which they might otherwise have in respect of this

announcement or its content or otherwise arising in connection

therewith.

The information contained in this announcement is for

information purposes only and does not purport to be full or

complete. The information contained in this announcement is given

at the date of its publication (unless otherwise marked) and is

subject to updating, revision and amendment from time to time. No

reliance may be placed for any purpose on the information contained

in this announcement or its accuracy, fairness or completeness.

This announcement contains statements that are, or may be deemed

to be, "forward-looking statements" with respect to certain of the

Issuer's and/or the Company's current expectations and projections

about future events and the Company's group future financial

condition and performance. These forward-looking statements can

sometimes be identified by the use of forward-looking terminology,

including the terms "believes", "estimates", "anticipates",

"forecasts", "projects", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts. Any forward-looking

statements in this announcement reflect the current beliefs and

expectations of the directors of the Issuer and of the Company and

involve known and unknown risks, uncertainties and assumptions,

many of which are outside the Issuer's and the Company's control

and difficult to predict, that could cause actual results and

performance to differ materially from any expected future results

or performance expressed or implied by the forward-looking

statements. Given these uncertainties, prospective investors are

cautioned not to place any undue reliance on such forward-looking

statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLRMRTMTITBTJ

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

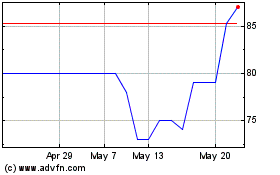

Conygar Investment (AQSE:CIC.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

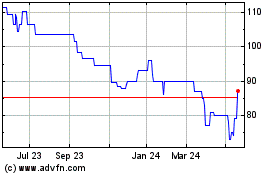

Conygar Investment (AQSE:CIC.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024