Time Out Group plc Holding(s) in Company (6131Z)

15 January 2024 - 6:00PM

UK Regulatory

TIDMTMO TIDMOCI

RNS Number : 6131Z

Time Out Group plc

15 January 2024

15 January 2024

Time Out Group plc

("Time Out" or the "Company")

TR-1: Standard form for notification of major holdings

As announced on 8 January, the Company was informed by its

shareholders TO Bermuda Limited and TONY Bermuda Limited, the

investment holding companies of Oakley Capital Private Equity L.P.

(the "Investment Fund") that the Investment Fund reached the end of

its life and has been liquidated. As a result, its shares (which

total 23.82% of the issued share capital of the Company) have been

redistributed to Oakley Capital Investments Limited and individuals

with a beneficial interest in the Investment Fund (the

"Redistribution").

The TR-1 notification below from Oakley Capital Investments

Limited relates to the Redistribution.

NOTIFICATION OF MAJOR HOLDINGS

1a. Identity of the issuer or the Time Out Group PLC

underlying issuer of existing shares LEI: 213800BWH4OF8S4R8K10

to which voting rights are attached

(ii) :

---------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer

----

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights X

----

An acquisition or disposal of financial instruments

----

An event changing the breakdown of voting rights

----

Other (please specify) (iii) :

----

3. Details of person subject to the notification obligation (iv)

Name Oakley Capital Investments Limited

City and country of registered office Rosebank Centre, 11 Bermudiana Road,

(if applicable) Pembroke, HM 08, Bermuda.

4. Full name of shareholder(s) (if different from 3.) (v)

Name

---------------------------------------------

City and country of registered office

(if applicable)

---------------------------------------------

5. Date on which the threshold was 28-12-2023

crossed or reached (vi) :

---------------------------------------------

6. Date on which issuer notified 09-01-2024

(DD/MM/YYYY):

---------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) held in issuer

of 8. A) (total of 8.B (8.A + 8.B)

1 + 8.B 2) (vii)

------------------ ---------------------- -------------- --------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 37.98% 0 37.98% 128,542,622

------------------ ---------------------- -------------- --------------------

Position of

previous notification

(if

applicable) 19.92% 0 19.92%

------------------ ---------------------- -------------- --------------------

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached (viii)

A: Voting rights attached to shares

Class/type of Number of voting rights % of voting rights

shares (ix)

ISIN code (if

possible)

Direct Indirect Direct Indirect

(DTR5.1) (DTR5.2.1) (DTR5.1) (DTR5.2.1)

---------------------

Ordinary GB00BYYV0629 128,542,622 0 37.98% 0%

--------------------- --------------------- -------------------- ----------------

SUBTOTAL 8.

A 128,542,622 37.98%

-------------------------------------------- --------------------------------------

B 1: Financial Instruments according to DTR5.3.1R (1) (a)

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date Conversion Period rights that may rights

(x) (xi) be acquired if

the instrument

is

exercised/converted.

----------- ------------------------- -------------------------- ----------------

SUBTOTAL 8. B

1

------------------------- -------------------------- ----------------

B 2: Financial Instruments with similar economic effect according to

DTR5.3.1R (1) (b)

Type of financial Expiration Exercise/ Physical Number of % of voting

instrument date (x) Conversion or cash voting rights rights

Period (xi) Settlement

(xii)

---------------- ---------------- ----------------- ----------------

SUBTOTAL

8.B.2

----------------- ----------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer (xiii)

Full chain of controlled undertakings through which the voting rights

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity (please add additional

rows as necessary) (xiv)

Name (xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is

is higher than the instruments if it higher than the

notifiable threshold equals or is higher notifiable threshold

than the notifiable

threshold

---------------------- --------------------- ------------------------

Oakley Capital Investments

Limited 37.98% 0 37.98%

---------------------- --------------------- ------------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

-----------------------------------------------

The number and % of voting rights N/A

held

-----------------------------------------------

The date until which the voting rights N/A

will be held

-----------------------------------------------

11. Additional information (xvi)

Oakley Capital Private Equity L.P. ("Fund I"), one of the private equity

funds advised by Oakley Capital Limited, has reached the end of its term

and has been liquidated, whereupon Oakley Capital Manager Limited ("OCML")

was appointed as liquidating trustee. Fund I's remaining investments

consisted solely of a direct 19.92 per cent shareholding in Time Out

Group PLC ("Time Out"). On 28 December 2023, Fund I made an in-specie

transfer of these shares to all Fund I investors, which has increased

Oakley Capital Investments Limited's ("OCI" or the "Company") direct

shareholding (the "In-Specie Transfer").

An agreement (the "Agreement") has also been entered into by Fund I and

the Company to, immediately prior to the In-Specie Transfer, settle Fund

I's outstanding loan (the "Fund I Loan") previously extended to it by

OCI and comprising approximately GBP8.0m of principal and GBP0.1m of

interest outstanding, via the transfer of shares in Time Out (settlement

of the Fund I loan together with the In-Specie Transfer, the "Transaction").

As a result of the Transaction, Shares in Time Out have been transferred

to OCI, resulting in a reduction of the Company's look-through ownership

in Time Out via its interest in Fund I to zero, and an increase in its

direct equity ownership in Time Out from 19.92 per cent. to 37.98 per

cent. For the avoidance of doubt, the outstanding interest held by Fund

I in Time Out as a result of the Transaction will decrease to 0%.

Place of completion London

Date of completion 09-01-2024

-----------

For further information, please contact:

Time Out Group plc Tel: +44 (0)207 813 3000

Chris Ohlund, CEO

Matt Pritchard, CFO

Steven Tredget, Investor Relations Director

Liberum (Nominated Adviser and Broker) Tel: +44 (0)203 100 2222

Andrew Godber / Edward Thomas /

Joshua Borlant

FTI Consulting LLP Tel: +44 (0)203 727 1000

Edward Bridges / Fiona Walker

Notes to editors

About Time Out Group plc

Time Out Group is a global media and hospitality business that

inspires and enables people to experience the best of the city

through its two divisions - Time Out Media and Time Out Market.

Time Out launched in London in 1968 to help people discover the

exciting new urban cultures that had started up all over the city -

today it is the only global brand dedicated to city life. Expert

journalists curate and create content about the best things to Do,

See and Eat across 333 cities in 59 countries and across a unique

multi-platform model spanning both digital and physical channels.

Time Out Market is the world's first editorially curated food and

cultural market, bringing a city's best chefs, restaurateurs and

unique cultural experiences together under one roof. The portfolio

includes seven open Markets in cities such as Lisbon, New York and

Dubai, several new locations with expected opening dates in 2024

and beyond, in addition to a pipeline of further locations in

advanced discussions. Time Out Group PLC, listed on AIM, is

headquartered in the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

HOLEAPFLFLXLEFA

(END) Dow Jones Newswires

January 15, 2024 02:00 ET (07:00 GMT)

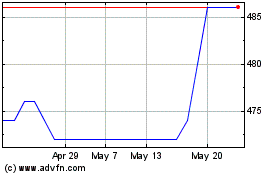

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025