CSL Makes US$11.7 Billion Offer for Switzerland's Vifor Pharma -- Update

14 December 2021 - 5:49PM

Dow Jones News

By Stuart Condie

SYDNEY--Australian biopharmaceutical company CSL Ltd. has made

an all-cash offer for Vifor Pharma Ltd. that values the Swiss

pharmaceutical developer's equity at US$11.7 billion.

CSL on Tuesday said it would partially fund the acquisition with

a fully underwritten 6.3 billion-Australian-dollar (US$4.49

billion) institutional share placement and a share purchase plan of

up to A$750 million. It will also tap US$6.0 billion in existing

cash and a combination of new and existing debt.

Vaccine and blood-product maker CSL said it made a public tender

offer of US$179.25 a share, representing a 40% premium to the

60-day volume-weighted average price on Dec. 1. The offer was

unanimously recommended by Vifor's directors and Patinex AG, Vifor

Pharma's largest shareholder with a 23.2% stake, agreed to tender

its shares, CSL said.

The tender offer is subject to a minimum acceptance rate of 80%

and is expected to commence around Jan. 18, CSL said.

Vifor's portfolio, focused on renal disease and iron deficiency,

will complement CSL's existing therapeutic focus areas, while the

Australian company's global reach, R&D capabilities and

resources will augment the delivery of Vifor Pharma products.

"Vifor Pharma will also expand our presence in the rapidly

growing nephrology market, while giving us the opportunity to

leverage our complementary scientific expertise," CSL Chief

Executive and Managing Director Paul Perreault said.

If the transaction goes through, it will be immediately

EPS-accretive and diversify CSL's revenue base, Mr. Perreault said.

CSL said it also identified US$75 million run-rate pretax cost

synergies over the first three years of ownership.

Investment bank Citi said last week that any move for Vifor

would likely be EPS-accretive, given CSL trades at a significantly

higher multiple than Vifor, which develops, manufactures and

markets iron-deficiency products.

Vifor has a market capitalization of 9.11 billion Swiss francs

(US$9.88 billion) after its shares surged 18% on Monday's

confirmation of talks with CSL.

CSL's market capitalization is A$135.46 billion (US$96.60

billion). Shares in CSL, the second-largest ASX-listed company by

market capitalization, didn't trade on Tuesday, after they were

placed in a trading halt until Thursday.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

December 14, 2021 01:34 ET (06:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

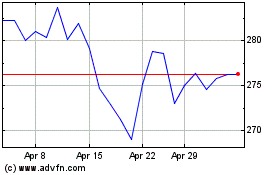

CSL (ASX:CSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

CSL (ASX:CSL)

Historical Stock Chart

From Dec 2023 to Dec 2024