- Diamond Infrastructure Solutions will leverage Dow’s

operational excellence and Macquarie Asset Management’s

infrastructure and energy expertise to generate growth

opportunities by opening access to Dow’s U.S. Gulf Coast sites to

third party customers

- A fund managed by Macquarie Asset Management to acquire an

initial 40% stake in select Dow U.S. Gulf Coast infrastructure

assets with an option to increase its equity stake to 49% within

six months of closing

- Dow is expected to receive initial cash proceeds of

approximately $US2.4 billion based on the initial transaction, with

potential to receive up to approximately $US3.0 billion in

total

Macquarie Asset Management today announced that a fund managed

by Macquarie Asset Management has entered into a definitive

agreement to acquire a 40% equity stake in select U.S. Gulf Coast

infrastructure assets of Dow Inc. (“Dow”) (NYSE: DOW).

This new partnership, Diamond Infrastructure Solutions

(“Diamond”), will be a specialist infrastructure provider to Dow

and other industrial customers at its five locations in Texas and

Louisiana, offering comprehensive services to its tenants with a

focus on world class efficiency, reliability and safety. As a

dedicated infrastructure company, Diamond will be a new business

model with greater strategic focus on operational efficiencies and

new customer acquisition.

Diamond is comprised of certain non-product producing assets

(power and steam production, pipelines, environmental operations

and general site infrastructure) located at five of Dow’s

manufacturing sites in the U.S. Gulf Coast (USGC): Freeport, Texas

City, and Seadrift in Texas, as well as Plaquemine and St. Charles

in Louisiana. Pipeline and storage assets span across the USGC with

connections to major natural gas, NGL and olefin hubs.

“As a long-term owner of essential infrastructure, we recognize

the value that can be unlocked through the development of

infrastructure platforms like Diamond Infrastructure Solutions,”

said Ben Way, Global Head of Macquarie Asset Management. “We

believe that our significant infrastructure experience and

capabilities, coupled with Dow’s operational excellence, will

deliver additional efficiencies and long-term growth.”

Macquarie Asset Management is a leading global infrastructure

asset manager with a focus on operational excellence. It

prioritizes investments in high quality, essential assets that can

be improved over time and deliver growth and reliable service to

customers, as well as the health and safety of employees. Macquarie

Asset Management has specific experience in managing and operating

industrial parks, regulated utilities and other industry-oriented

infrastructure platforms. Over the last 21 years, Macquarie Asset

Management has invested or committed more than $US21 billion in 54

portfolio companies across the Americas region.1

“Today’s announcement demonstrates Dow’s ongoing commitment to

value maximizing actions across our portfolio,” said Jim

Fitterling, chair and chief executive officer of Dow. “This

transaction further strengthens our financial flexibility and

enables continued cash deployment towards the most attractive

opportunities that will create long-term value for our

stakeholders. We are confident that Macquarie is the right

industrially minded partner due to our shared values to ensure the

ongoing safe and reliable operations of these assets to support Dow

and industrial customers across the U.S. Gulf Coast.”

Dow expects to receive initial cash proceeds of approximately

$US2.4 billion based on the sale of its 40% minority equity stake

with the potential to generate cash proceeds up to approximately

$US3.0 billion for a 49% minority equity stake. Macquarie Asset

Management will have the option to increase its equity share to 49%

within six months of closing. Dow and Macquarie Asset Management

expect to close the transaction in the first half of 2025, subject

to customary regulatory approvals and other closing conditions.

BMO Capital Markets acted as exclusive financial advisor to

Macquarie Asset Management and Sidley Austin LLP acted as legal

counsel.

About Macquarie Asset Management

Macquarie Asset Management is a global asset manager, integrated

across public and private markets. Trusted by institutions,

governments, foundations and individuals to manage approximately

$US633 billion in assets, we provide a diverse range of investment

solutions including real assets, real estate, credit and equities

& multi-asset.

Macquarie Asset Management is part of Macquarie Group, a

diversified financial group providing clients with asset

management, finance, banking, advisory, and risk and capital

solutions across debt, equity and commodities. Founded in 1969,

Macquarie Group employs over 20,600 people in 34 markets and is

listed on the Australian Securities Exchange.

All figures as at 30 September 2024.

About Dow

Dow (NYSE: DOW) is one of the world’s leading materials science

companies, serving customers in high-growth markets such as

packaging, infrastructure, mobility and consumer applications. Our

global breadth, asset integration and scale, focused innovation,

leading business positions and commitment to sustainability enable

us to achieve profitable growth and help deliver a sustainable

future. We operate manufacturing sites in 31 countries and employ

approximately 35,900 people. Dow delivered sales of approximately

$45 billion in 2023. References to Dow or the Company mean Dow Inc.

and its subsidiaries. Learn more about us and our ambition to

be the most innovative, customer-centric, inclusive and sustainable

materials science company in the world by visiting www.dow.com.

Cautionary Statement about Forward-Looking Statements

Certain statements in this press release are “forward-looking

statements” within the meaning of the federal securities laws,

including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements often address expected future business and

financial performance, financial condition, and other matters, and

often contain words or phrases such as “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “opportunity,” “outlook,”

“plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,”

“will be,” “will continue,” “will likely result,” “would” and

similar expressions, and variations or negatives of these words or

phrases.

Forward-looking statements are based on current assumptions and

expectations of future events that are subject to risks,

uncertainties and other factors that are beyond Dow’s control,

which may cause actual results to differ materially from those

projected, anticipated or implied in the forward-looking statements

and speak only as of the date the statements were made. These

factors include, but are not limited to: sales of Dow’s products;

Dow’s expenses, future revenues and profitability; any global and

regional economic impacts of a pandemic or other public

health-related risks and events on Dow’s business; any sanctions,

export restrictions, supply chain disruptions or increased economic

uncertainty related to the ongoing conflicts between Russia and

Ukraine and in the Middle East; capital requirements and need for

and availability of financing; unexpected barriers in the

development of technology, including with respect to Dow's

contemplated capital and operating projects; Dow's ability to

realize its commitment to carbon neutrality on the contemplated

timeframe, including the completion and success of its integrated

ethylene cracker and derivatives facility in Alberta, Canada; size

of the markets for Dow’s products and services and ability to

compete in such markets; failure to develop and market new products

and optimally manage product life cycles; the rate and degree of

market acceptance of Dow’s products; significant litigation and

environmental matters and related contingencies and unexpected

expenses; the success of competing technologies that are or may

become available; the ability to protect Dow’s intellectual

property in the United States and abroad; developments related to

contemplated restructuring activities and proposed divestitures or

acquisitions such as workforce reduction, manufacturing facility

and/or asset closure and related exit and disposal activities, and

the benefits and costs associated with each of the foregoing;

fluctuations in energy and raw material prices; management of

process safety and product stewardship; changes in relationships

with Dow’s significant customers and suppliers; changes in public

sentiment and political leadership; increased concerns about

plastics in the environment and lack of a circular economy for

plastics at scale; changes in consumer preferences and demand;

changes in laws and regulations, political conditions or industry

development; global economic and capital markets conditions, such

as inflation, market uncertainty, interest and currency exchange

rates, and equity and commodity prices; business, logistics, and

supply disruptions; security threats, such as acts of sabotage,

terrorism or war, including the ongoing conflicts between Russia

and Ukraine and in the Middle East; weather events and natural

disasters; disruptions in Dow’s information technology networks and

systems, including the impact of cyberattacks; and risks related to

Dow’s separation from DowDuPont Inc. such as Dow’s obligation to

indemnify DuPont de Nemours, Inc. and/or Corteva, Inc. for certain

liabilities.

Where, in any forward-looking statement, an expectation or

belief as to future results or events is expressed, such

expectation or belief is based on the current plans and

expectations of management and expressed in good faith and believed

to have a reasonable basis, but there can be no assurance that the

expectation or belief will result or be achieved or accomplished. A

detailed discussion of principal risks and uncertainties which may

cause actual results and events to differ materially from such

forward-looking statements is included in the section titled “Risk

Factors” contained in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023, and the Company's subsequent

Quarterly Reports on Form 10-Q. These are not the only risks and

uncertainties that Dow faces. There may be other risks and

uncertainties that Dow is unable to identify at this time or that

Dow does not currently expect to have a material impact on its

business. If any of those risks or uncertainties develops into an

actual event, it could have a material adverse effect on Dow’s

business. Dow Inc. and The Dow Chemical Company and its

consolidated subsidiaries assume no obligation to update or revise

publicly any forward-looking statements whether because of new

information, future events, or otherwise, except as required by

securities and other applicable laws.

1 Total count of distinct infrastructure businesses (realized

and unrealized) owned by private infrastructure funds investing in

the U.S., Canada, and Other Americas as of April 10, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209180993/en/

Media Contact: Lee Lubarsky Macquarie Asset Management

lee.lubarsky@Macquarie.com +1-347-302-3000

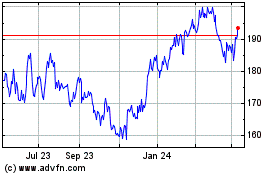

Macquarie (ASX:MQG)

Historical Stock Chart

From Dec 2024 to Jan 2025

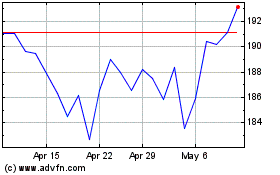

Macquarie (ASX:MQG)

Historical Stock Chart

From Jan 2024 to Jan 2025