Ramsay Health Shares Jump 30% Following KKR-Led Proposal

20 April 2022 - 10:58AM

Dow Jones News

By Stuart Condie

SYDNEY--Shares in Ramsay Health Care Ltd. jumped to a near

record high after the Australian private-hospital operator received

a takeover proposal from a KKR & Co. Inc.-led consortium.

Ramsay on Wednesday said the consortium submitted a non-binding

indicative proposal worth A$88.00 per share in cash. That

represents a 37% premium to Tuesday's closing share price of

A$64.39 and values the company's equity at 20.1 billion Australian

dollars (US$14.9 billion).

The stock jumped as much as 30% in early trade to A$83.55,

nearing the A$84.08 reached in September 2016. It was recently up

27% at A$82.05, making it the best-performing ASX 200 stock.

Ramsay disclosed the proposal following what it called media

speculation, noting that the consortium requested the proposal be

kept confidential and could now withdraw. The ASX-listed company

opened its books to the consortium on a non-exclusive basis.

Ramsay said it was continuing to explore the potential sale of

its Asian joint venture, Ramsay Sime Darby. Ramsay and partner Sime

Darby Holdings Bhd. last month received a takeover proposal from

IHH Healthcare Bhd. at a conditional enterprise value of about

US$1.35 billion.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

April 19, 2022 20:43 ET (00:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

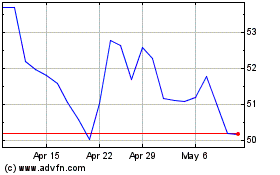

Ramsay Health Care (ASX:RHC)

Historical Stock Chart

From Apr 2024 to May 2024

Ramsay Health Care (ASX:RHC)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Ramsay Health Care Limited (Australian Stock Exchange): 0 recent articles

More Ramsay Health Care Limited News Articles