Australian Companies To Look Overseas For Acquisitions - Macquarie

27 April 2010 - 6:27PM

Dow Jones News

A tough stance by Australia's competition regulator and a strong

Australian dollar will drive Australian companies to look offshore

for targets as takeover activity ramps up over the coming year,

according to Macquarie Equities.

Below-average gearing, strengthening cash flows, and recovering

management confidence will "almost certainly" lead to pick-up in

merger and acquisition activity, Macquarie analysts said in a

report Tuesday.

"We expect the volume of offshore M&A by Australian

companies to once again be strong over this cycle as the Australian

economy has recovered well ahead of the rest of the world,

providing a solid domestic earnings base for most companies," the

analysts said.

Australia's big four banks - Commonwealth Bank of Australia

(CBA.AU), Westpac Banking Corp. (WBK), Australia & New Zealand

Banking Group Ltd. (ANZ) and National Australia Bank Ltd. (NAB) -

are likely to look offshore for acquisitions as the regulatory

environment restricts opportunities to expand at home.

The ACCC has taken a strict stance on mergers and acquisitions

recently. In December it rejected Caltex Australia Ltd.'s (CTX.AU)

proposed A$300 million takeover of 301 Exxon Mobil Corp. (XOM)

filling stations and GUD Holdings Ltd.'s (GUD.AU) proposed A$266.8

million takeover of rival kitchen appliance supplier Breville Group

Ltd. (BRG.AU). Last week it surprised the market with its

announcement it wouldn't allow NAB's A$13.29 billion bid for AXA

Asia Pacific Holdings Ltd. (AXA.AU).

"Australian banks have been at the heart of domestic and, to a

lesser degree, regional consolidation in the banking sector over

the last two years; helped by strong balance sheets, largely

pristine asset quality and AA credit ratings," the Macquarie

analysts said.

"However, the outlook is less favourable domestically where it

appears domestic regulators are concerned about the level of

concentration in the industry. This is likely to lead to the

Australian banks searching further afield for growth, with the

banks likely to have a broad choice of targets with the continued

shakeout from the global financial crisis."

Already restricted by the government's so-called "four-pillars"

policy, some of the major banks are looking to Asian acquisitions

to drive revenue growth.

ANZ, which already has a strong focus on expanding in Asia, is

considering a bid for Dallas-based Lone Star Fund's controlling

stake in Korea Exchange Bank (004940.SE), currently valued at

US$4.1 billion as it looks to boost its presence in Asia, a person

familiar with the situation said Wednesday.

Meanwhile, Commonwealth Bank of Australia said Wednesday that it

plans to acquire a 20% stake in small lender Vietnam Investment

Bank, marking the bank's first corporate transaction in that

fast-developing Asian economy.

While NAB has said it is pursuing its options, which include

legal action, with regards to the ACCC finding, analysts have said

the bank is more likely to expand in the U.K. if it can't take over

AXA APH. NAB put in an indicative bid for 318 Royal Bank of

Scotland branches there, people familiar with the situation have

said.

Other companies with a global mergers and acquisitions focus

that are expected to be active over the coming year include BHP

Billiton Ltd. (BHP), Rio Tinto PLC (RTP), CSL Ltd. (CSL.AU), Resmed

Ltd. (RMD.AU), Sonic Healthcare Ltd. (SHL.AU), Ansell Ltd.

(ANN.AU), QBE Insurance Group (QBE.AU), Lend Lease Group (LLC.AU),

Westfield Group (WDC.AU), Oz Minerals Ltd. (OZL.AU), Sims Metal

Management Ltd. (SGM.AU), AWE Ltd. (AWE.AU), Beach Energy

Ltd.(BPT.AU), Billabong International Ltd. (BBG.AU), Worley Parsons

Ltd.(WOR.AU), Aristocrat Leisure Ltd. (ALL.AU), Iress Market

Technology Ltd. (IRE.AU) and Seek Ltd. (SEK.AU).

"Australian companies of scale which have the ability to issue

relatively cheap debt in global markets are best placed to make

offshore acquisitions, benefiting from both a strong Australian

dollar and cheap financing," the analysts said.

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8272-4679;

rebecca.thurlow@dowjones.com

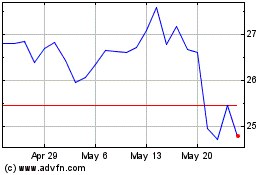

Sonic Healthcare (ASX:SHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

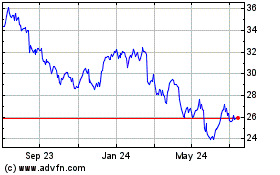

Sonic Healthcare (ASX:SHL)

Historical Stock Chart

From Nov 2023 to Nov 2024