2nd UPDATE: ANZ Bank Raises A$2.2 Billion Via Share Purchase Plan

09 July 2009 - 4:53PM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ.AU) said

Thursday that it raised A$2.2 billion in new equity through its

share purchase plan - significantly more than originally

flagged.

In a statement, Melbourne-based ANZ said that "following

outstanding support" it will accept all applications from retail

shareholders for new shares. The share purchase plan comes after

the group raised A$2.5 billion through an institutional placement

in late May.

When it first announced the institutional placement and outlined

details of the share purchase plan in May, ANZ said that it

reserved the right to scale back share purchase plan applications

if total demand exceeded A$350 million.

ANZ Bank shares fell after the details of the

higher-than-expected share purchase plan issue were announced. ANZ

closed Thursday down 2.8% or 45 cents at A$15.85. Prior to the

announcement, ANZ was trading at A$16.30.

"The size of the SPP makes it the most successful undertaken by

an Australian company and represents a strong endorsement of ANZ's

super regional strategy," ANZ Chief Executive Mike Smith said in

Thursday's statement.

The bank said the extra capital will provide increased financial

flexibility to pursue strategic and organic opportunities, and

further strengthen its capital position.

It said its talks to buy some of Royal Bank of Scotland Group

Plc's (RBS.LN) retail and commercial banking assets are progressing

but remain incomplete.

ANZ hasn't named which countries it wants to buy in but Smith

recently said that the lender is targeting general growth in

countries including Taiwan, Hong Kong, Singapore, Indonesia and

Vietnam.

Traders said the bigger-than-expected share purchase plan will

boost ANZ's Tier 1 capital position to 9.5%, and will give it

enough cash to buy any RBS assets it wants, with money to

spare.

One trader said speculation immediately shifted to

Suncorp-Metway Ltd. (SUN.AU), which could be open to offers for its

banking arm, even though ANZ has said its focus is on Asia. Suncorp

shares closed up 4.5% at A$6.48.

ANZ also said that, while the economic outlook remains subdued

and unpredictable, it is sticking to its previous guidance on bad

debt provisioning. It said in late May that it expects its second

half provisioning charge to be around 20% higher than the A$1.435

billion charge booked for the six months to March 31.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

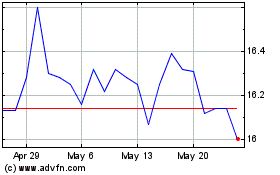

Suncorp (ASX:SUN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Suncorp (ASX:SUN)

Historical Stock Chart

From Feb 2024 to Feb 2025