BHP Taps Experienced Executives to Fill Out Changes in Board

23 August 2017 - 11:07AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--BHP Billiton Ltd. (BHP.AU) plans to

replace two directors who have opted to leave the resources giant

with experienced executives, another win for disgruntled

investors.

The move comes on the heels of BHP's decision to exit its

troubled U.S. shale oil-and-gas business following a months-long

campaign by activist investor Elliott Management Corp. for the

assets to be spun off. The lobbying by the U.S. hedge fund have

drawn out public calls from other investors for the resources

company to bring in directors with industry experience.

On Wednesday, outgoing Chairman Jac Nasser said recently named

director Grant King had decided not to stand for election to the

board at the upcoming annual shareholder meeting because of

concerns expressed by some investors.

Malcolm Brinded also has opted not to stand for re-election as a

non-executive director due to his involvement in ongoing legal

action in Italy related to his past employment at Royal Dutch Shell

PLC (RDSA), Mr. Nasser said.

In their place, the resources company's board will bring in

Terry Bowen and John Mogford from October.

Mr. Bowen has more than 25 years of strategic and financial

experience in a number of industries and has been finance director

of conglomerate Wesfarmers Ltd., a role he will leave toward the

end of the year. Mr. Mogford has over four decades experience in

oil and gas, including 33 years at BP PLC (BP) in technical and

operational roles.

The appointments were based on a five-year planning outlook,

consideration of their skills and experience, and after exhaustive

global searches, Mr. Nasser said.

A day earlier, BHP said its American shale operations aren't

core and it would seek to exit, possibly through a series of trade

sales, an initial public offering or other means. Management has

acknowledged the company overpaid to get a foothold in the onshore

U.S. industry and had grown to realize that the business couldn't

be replicated globally as shale-oil opportunities don't exist on

the same scale elsewhere.

Elliott, which has built up a 5% stake in BHP's U.K. shares, in

April went public with its calls for the company to sell the shale

operations and for it to collapse its dual British-Australian

structure around a single listing, initially suggesting it should

be in London but later revising that to Sydney. It and other

investors, including Tribeca Investment Partners, have sought an

overhaul of the board to tighten BHP's focus on shareholder

returns.

Mr. Brinded, a director since April 2004, will step down from

the board in October, although Mr. Nasser said he looked forward to

him being able to return in the future.

Italian prosecutors are investigating Shell's involvement in

buying a rich oil field off the coast of Nigeria. Mr. Brinded was a

director of the energy company between 2002 and 2012.

Mr. Nasser said he regretted that Mr. King, who has only been a

director since March, would leave the board at the end of the

month. He brought extensive oil-and-gas experience, having been

managing director and chief executive of Origin Energy Ltd.

(ORG.AU) for about 16 years until he stepped down last year, but

has been criticized for overseeing Origin's debt-funded investment

in liquefied natural gas and a dilutive equity raising. The

Australian newspaper reported some shareholders were prepared to

vote against his election.

When Mr. Nasser hands over at the end of the month to

Chairman-elect Ken MacKenzie, who has been a director for one year,

the average tenure of board directors will fall to about

4-and-a-half years from over 5 now.

Mr. Nasser noted that as finance director, Mr. Bowen had been

responsible for capital allocation among Wesfarmers' 38 business

and had extensive experience transforming and running the

operations, focusing on improving cash flows and cost efficiency.

Mr. Mogford, he said, also has private-equity experience in

addition to deep knowledge of oil and gas.

-Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 22, 2017 20:52 ET (00:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

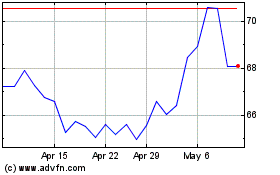

Wesfarmers (ASX:WES)

Historical Stock Chart

From Mar 2025 to Apr 2025

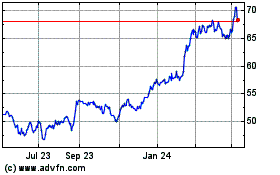

Wesfarmers (ASX:WES)

Historical Stock Chart

From Apr 2024 to Apr 2025