Litecoin Not To Be Overlooked, Analytics Firm Says: Here’s Why

11 December 2024 - 10:00AM

NEWSBTC

The market intelligence platform IntoTheBlock has explained why

Litecoin (LTC) isn’t an asset to be overlooked based on its

on-chain metrics. Litecoin Has Continued To Witness Significant

Activity Recently In a new post on X, IntoTheBlock has

discussed what the various key on-chain indicators have been like

for the Litecoin network recently. Below is the infographic

shared by the analytics firm. According to the data, there are

currently around 370,000 daily active addresses on the Litecoin

blockchain. An address is said to be ‘active’ when it participates

in some kind of transaction activity on the network, whether as a

receiver or sender. Related Reading: Bitcoin HODLing Rewards:

Long-Term Holders Selling At 326% Profit The metric’s value

basically tells us about the amount of users that are using the

cryptocurrency. Another indicator, the daily transactions, provides

information about the exact measure of activity that these users

are taking part in. At present, LTC users are making 200,000

transactions every day. IntoTheBlock has pointed out that this

level of user activity is higher than on other networks like

Dogecoin (DOGE) and Cardano (ADA). “Much of this activity stems

from Litecoin being one of the few cryptocurrencies actively used

for payments,” notes the analytics firm. LTC offers cheap and fast

transactions, so it has always been a network preferred as a mode

of payments. The activity-related metrics continuing to be high (in

fact, further growing over the past month) implies this selling

point of the chain is still attracting users. Another metric in the

infographic that correlates to activity is transaction

volume, which keeps track of the daily total amount of USD value

that’s being transferred to the network. Impressively, this

indicator currently stands at $10.27 billion, which is higher than

the coin’s total market cap. While Litecoin is continuing to do

well in terms of activity-related metrics, the cryptocurrency has

remained stagnant in terms of price growth. A result of this is

that just 72% of the addresses on the network are sitting in some

unrealized gain. Of course, this still means the majority are above

water, but other networks like Bitcoin (BTC) have it close to the

100% mark right now due to the bull run. That said, another way to

look at this could perhaps be that Litecoin has more relative room

to run, since the risk of a mass selloff goes up the more investors

get into profits. Related Reading: Analyst Sets $4.40 XRP Target As

3rd-Straight Bull Pennant Forms It seems that a strong majority of

the Litecoin userbase also thinks similarly, as 78% of the 7.94

million Litecoin holders have been HODLing since more than a year.

“As one of the older Layer 1 networks still seeing significant

usage, Litecoin shouldn’t be overlooked,” says IntoTheBlock. It

only remains to be seen, however, whether LTC can finally translate

its positive on-chain metrics into price appreciation or not. LTC

Price Litecoin has suffered a plunge of around 8% over the last 24

hours, which has taken its price to $113. Featured image from

Dall-E, IntoTheBlock.com, chart from TradingView.com

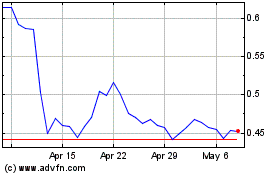

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024