Algorand Achieves New Record With 2 Billion Transactions, ALGO Price Jumps 14%

23 August 2024 - 7:00PM

NEWSBTC

In a recent report analyzing the second quarter (Q2) performance of

the Layer 1 (L1) blockchain Algorand (ALGO), data analytics firm

Messari highlighted several notable milestones achieved by the

network during the period, with a record in transactions being one

of the most notable ones. Rapid Network Growth One of the key

metrics that stood out was the surge in Algorand’s average daily

transactions, which skyrocketed by 104% to reach 4.7 million. The

total transactions recorded a more modest 6% quarter-over-quarter

(QoQ) increase, reaching 425 million. Despite this heightened

transaction volume, Algorand’s revenue took a hit, declining by 61%

to $152,000. The report attributed this to a 46% depreciation in

the value of ALGO against the US dollar compared to the previous

quarter. Even though the average transaction fee rose by 44%, the

overall dollar revenue still declined. Related Reading: Bitcoin

Could Target $63,000 But Must First Clear This Vital Resistance

Level The 61% decrease in quarterly revenue was also traced to a

correction following ALGO’s 1,747% surge in Q1, driven by a one-day

spike of 43 million transactions linked to the ORA memecoin

project. However, on a year-over-year (YoY) basis, Algorand’s

revenue saw a substantial 1,241% increase, climbing from $11,000 to

$152,000. On a positive note, Algorand reached a significant

milestone of 2 billion transactions during the quarter, showcasing

the network’s growth and adoption. Notably, the network took four

years to achieve its first billion transactions, while the second

billion was reached within just one year. Algorand Staking Drops To

Lowest Level In A Year In Q2 2024, the amount of ALGO staked on the

Algorand network declined 38% YoY and 6% QoQ, reaching its lowest

level at 1.6 billion ALGO staked in a year. Messari believes this

may be due to the decreasing rewards allocated per governance

period. The percentage of Algorand’s eligible supply that was

staked decreased by 4.7% QoQ and now stands at 20.2%. Meanwhile,

Algorand’s circulating supply increased by 1.2% to 8.2 billion

ALGO. Lastly, data shows that the market cap for stablecoins on

Algorand increased by 15% QoQ, rising from $73 million to $85

million, primarily driven by a 32% increase in Circle’s USDC

stablecoin market cap, which now accounts for 78% of the total

stablecoin market cap on Algorand. Conversely, Tether’s USDT

market cap dropped by 22%, making up 21% of Algorand’s stablecoin

market share. EURD’s market cap remained at a 1% share of

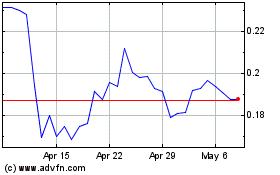

Algorand’s stablecoin market cap. ALGO Price Faces Make-Or-Break

Moment The ALGO token has seen significant price gains in recent

weeks after a challenging Q2 for the price and the broader market.

CoinGecko data shows that the token has seen a 14% price increase

in the last two weeks and 12% in the last seven days alone.

This has resulted in ALGO trading at $0.1357, just below its

200-day exponential moving average (EMA), marked by the yellow line

on the ALGO/USDT daily chart below, which currently acts as a wall

of resistance for the token. Related Reading: Solana Dump Far From

Over? Whales Continue To Dump SOL It will be essential to clear

this hurdle for a potential continuation of the price’s uptrend in

the coming days and to establish the same near-term support in the

event of a correction. Featured image from DALL-E, chart from

TradingView.com

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

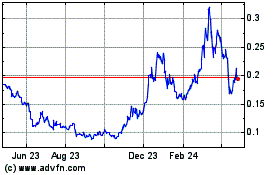

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025