Bitcoin Projected To Hit $1.5 Million By 2030, Says ARK Invest CEO Cathie Wood

17 November 2024 - 7:00PM

NEWSBTC

Cathie Wood, CEO of asset manager and crypto ETF issuer ARK Invest,

has long maintained her bullish outlook on Bitcoin, and her recent

comments reinforce her optimistic projections for the largest

cryptocurrency. Following Donald Trump’s electoral victory

over Vice President Kamala Harris last week and Bitcoin’s recent

surge to an all-time high of $93,250, investor sentiment

surrounding Bitcoin has notably improved. Anticipated Regulatory

Relief In a recent interview on CNBC’s Squawk Box, Wood discussed

her expectations for Bitcoin’s price trajectory. She stated that

ARK Invest’s targets for 2030 range between $650,000 and, in a

bullish scenario, between $1 million and $1.5 million. Ark’s

CEO attributed the current uptrend in Bitcoin’s value to several

catalysts, particularly the anticipated regulatory relief that

could come from Trump’s new administration. Related Reading: Major

Hindrances To Dogecoin Price Hitting $1 According To This Crypto

Analyst The now 47th President of the United States has vowed to

make significant changes, particularly in the leadership of the US

Securities and Exchange Commission (SEC), headed by Gary Gensler

and characterized by lawsuits, Wells Notices and increased scrutiny

of key industry players. This has led to notable discontent

over the past three years of his tenure at the regulatory agency,

prompting executives and investors in the digital asset ecosystem

to call for a change for a clearer regulatory framework that could

invite further adoption and growth of the market. However,

Trump promised to fire Gary Gensler on the first day of his new

administration, which is expected to begin on January 20. He also

vowed to make America the “crypto capital of the world” with a new

framework and support for digital assets, with Bitcoin at the

center of his economic agenda. This has resonated well with

industry advocates, as evidenced by the broader market rally led by

the market’s largest digital assets, which have risen nearly 25%

since Trump’s election victory. Bitcoin As A Unique Asset

Class During the interview, Wood also highlighted that ARK

Invest was the first public asset manager to invest in Bitcoin when

it was priced at just $250 in 2015. The asset manager believes that

even at approximately $90,000, Bitcoin still has significant growth

potential. According to Wood, Trump’s victory is pivotal, as

it signals a shift toward a more favorable regulatory environment

for the cryptocurrency sector—an outcome she views as crucial for

Bitcoin’s future. Related Reading: XRP Breaks Above Multi-Year

Resistance – Top Analyst Shares Price Target Furthermore, Wood

emphasized that Bitcoin has evolved into a distinct asset class,

separate from traditional currencies. She believes that this shift

indicates that institutional investors and asset allocators are

increasingly looking to include Bitcoin in their portfolios,

recognizing its potential as both a store of value and a hedge

against inflation. At the time of writing, BTC is hovering around

the $90,120 mark, still up 16% in the weekly time frame, despite

the current retracement experienced over the past 48 hours.

Featured image from DALL-E, chart from TradingView.com

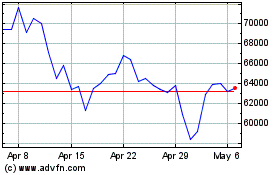

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

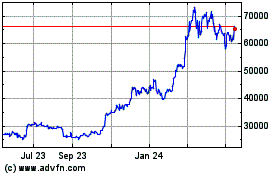

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024