Bitcoin Surges Above $57,000, But Investors Still Shorting: Fuel For More Rise?

11 September 2024 - 11:30AM

NEWSBTC

Data shows derivatives exchange users are still shorting Bitcoin

after the recovery that the cryptocurrency has enjoyed beyond the

$57,000 mark. Bitcoin Funding Rate Is Still Negative On Major

Exchanges According to data from the analytics firm Santiment,

investors have been shorting BTC for the last few days. The

indicator of interest here is the “Funding Rate,” which keeps track

of the periodic fee that the derivatives contract traders on a

given exchange are paying each other right now. Related Reading:

Ethereum Bullish Signal: Adoption Hits Four-Month High Rate When

the value of this metric is positive, it means the long contract

holders are paying a premium to the short investors in order to

keep their positions. Such a trend implies a bullish sentiment is

shared by the majority. On the other hand, the indicator being

negative suggests the shorts are outweighing the longs, so a

bearish mentality can be assumed to be the dominant one in the

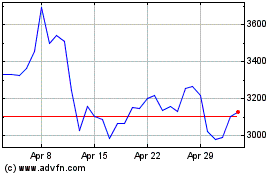

sector. Now, here is a chart that shows the trend in the Bitcoin

Funding Rate for two platforms, Binance and BitMEX, over the past

month: As is visible in the above graph, the Bitcoin Funding Rate

on both of these platforms had achieved large negative levels

around the price bottom a few days back. This means that

derivatives users had been expecting the decline of the

cryptocurrency to continue further. The bet of these Binance and

BitMEX traders clearly didn’t work out, though, as the coin has

been going up since then. In fact, the liquidation of these

investors is likely what has facilitated the rebound from the

bottom. Bitcoin has continued this surge during the past 24 hours,

breaking past the $57,000 level. According to data from CoinGlass,

this BTC surge and the uplift across the rest of the sector have

caused almost $123 million in liquidations. Out of these, over $88

million of the liquidations have involved the short investors, with

Bitcoin shorts alone making up for around $34 million of the flush.

As displayed in the Funding Rate chart, though, the metric has

still continued to be negative on these platforms, suggesting that

bearish speculators haven’t let up even after this heavy beating.

Related Reading: Dogecoin To $0.15: Analyst Explains What Could

Kick Off A Fresh Rally But as it has already happened in this surge

so far, these positions could end up finding liquidation, thus

fueling the price surge even further. It now remains to be seen if

Bitcoin will continue to go contrary to this expectation held by

the majority of the derivatives investors or not. BTC Price At the

time of writing, Bitcoin is trading at around $57,000, up more than

3% over the last 24 hours. Featured image from Dall-E,

Santiment.net, chart from TradingView.com

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024