Bitcoin Price Reclaims $101,000: Key Levels to Watch Moving Forward

28 January 2025 - 1:00PM

NEWSBTC

Bitcoin has seen a modest recovery after dipping below the $100,000

mark earlier today. At the time of writing, BTC is trading just

above $101,000, following a 3.7% decline in the last 24 hours. This

recent movement appears to have not only instilled hope in

investors but has also caught the attention of analysts now closely

monitoring on-chain data and short-term holder behavior to

understand the asset’s next potential move and the critical levels

to watch. Related Reading: Crypto Experts Forecast Bitcoin Market

Peak: Bear Market Could Emerge Within 3 Months Key Support level

for Bitcoin Yonsei Dent, a contributor to CryptoQuant’s QuickTake

Platform, has highlighted key metrics indicating that short-term

holders (STH) may play a pivotal role in defining Bitcoin’s

immediate support levels. In his latest analysis, Dent identified

$89,900 as a critical support level for holders who have held BTC

for one week to six months. He noted that most short-term holders

remain in profit, which reduces the likelihood of a sudden wave of

selling pressure. However, Dent also acknowledged that holders in

the three-to-six-month range are at a loss, though their limited

market share—9.4% of the Realized Cap—minimizes their potential to

disrupt broader market dynamics. Dent’s findings also indicate that

the $89,900 level serves as both a technical and on-chain support

zone. As market volatility continues to compress, this support

level gains importance. Any breach or bounce from this range is

likely to draw significant attention from traders and analysts. The

data suggests that short-term pullbacks may not trigger widespread

panic selling, keeping the market relatively stable around this

price mark. With Volatility Highly Compressed, Where is the Key STH

Support Level? “This suggests that $89.9k could be a stable support

zone, even amid short-term pullbacks.” – By @Yonsei_dent Link

👇https://t.co/4ayRJBQlWe pic.twitter.com/iNlBMriS78 —

CryptoQuant.com (@cryptoquant_com) January 27, 2025 Major Players

Refuse To Sell Their BTC Holdings Meanwhile, another CryptoQuant

analyst, Grizzly, provided additional insight into the behavior of

long-term and short-term holders. According to Grizzly, the SOPR

ratio—measuring the profit ratio between long-term and short-term

holders—has not risen as sharply during the current bull run

compared to previous cycles. This may indicate a shift in market

behavior as Bitcoin matures. Grizzly pointed out that as more

cycles occur, investors become less inclined to engage in

speculative trading. Instead, they appear to adopt a more measured

approach, treating Bitcoin as a long-term asset rather than a quick

profit opportunity. Furthermore, Grizzly noted that institutional

participation in Bitcoin has fundamentally “altered” market

dynamics. With more capital flowing into Bitcoin portfolios rather

than exchanges, there is a visible decrease in immediate selling

pressure. Related Reading: Bitcoin Poised For ‘Blow-Off Top’:

Elliott Wave Analysis Suggests New ATH Of $170,000 This trend,

coupled with the maturing investor base, suggests that Bitcoin

could enter a new cycle characterized by longer holding periods and

fewer speculative fluctuations. Featured image created with DALL-E,

Chart from TradingView

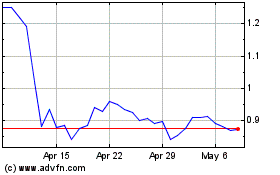

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025