DeepSeek Predicts Bitcoin Bull Run Peak At $500,000 – Here’s When

29 January 2025 - 4:00AM

NEWSBTC

DeepSeek, the Chinese open-source AI model making waves in Silicon

Valley, is extremely bullish on Bitcoin, predicting a potential

peak of between $500,000 and $600,000 by the first quarter of 2026.

This bold outlook emerged after the AI was asked to factor in both

historical models and on-chain data, alongside a pro-Bitcoin

approach from President Trump. DeepSeek’s Bitcoin Price Prediction

DeepSeek begins by discussing what it calls the “Key Implications

of the Crypto Executive Order,” which it believes would change the

calculus for both institutional and retail participants. The AI

states that “The exploration of a national Bitcoin reserve signals

institutional validation of Bitcoin as a strategic asset. If the US

government accumulates Bitcoin, it could create a significant

supply shock, driving prices higher.” This comment reflects a view

that the market could tighten substantially if large public

entities, such as national treasuries, decide to hold Bitcoin in

reserve. Furthermore, DeepSeek highlights the possibility that

“other nations and institutions could follow suit,” which would add

to the upward price pressure if a wave of competitive accumulation

were to ensue. Related Reading: Bitcoin Price Reclaims $101,000:

Key Levels to Watch Moving Forward The AI also remarks that by

banning CBDCs, the Trump administration would be “effectively

positioning Bitcoin and other decentralized cryptocurrencies as the

primary alternatives to fiat currencies,” which is a bold departure

from the policies adopted or explored by many other jurisdictions

that tend to see CBDCs as a means of maintaining control over

monetary policy in a digital economy. DeepSeek believes regulatory

clarity is another fundamental driver likely to magnify Bitcoin’s

gains. It explicitly points out that the “establishment of a

cryptocurrency working group led by David Sacks suggests a

pro-innovation regulatory approach” and that such a policy stance

is likely to foster a favorable climate for crypto businesses and

financial institutions looking for stable guidelines. The AI argues

that this, in turn, could encourage accelerated institutional

inflows and broader mainstream acceptance of Bitcoin, especially if

companies are assured that the regulatory framework allows them to

innovate without fear of sudden legal or compliance obstacles.

DeepSeek goes on to address the geopolitical aspects of the

executive order by saying, “The US is taking a leadership role in

the digital asset space, which could strengthen the dollar’s

dominance while simultaneously boosting Bitcoin’s status as a

global store of value.” Delving into the specific timeline, the AI

predicts that any news about the realization of thr strategic

Bitcoin reserve could trigger a short-lived but potent rally,

potentially pushing the price to the $120,000–$130,000 bracket as

traders, institutions, and the media absorb the implications of a

government-led push for a national Bitcoin reserve and enhanced

regulatory clarity. DeepSeek expects that by the second and third

quarters of 2025, as conversations around the working group’s

findings gain momentum, institutional investors and retail market

participants may exhibit what DeepSeek calls “Institutional FOMO,”

leading to a jump in Bitcoin’s price to the $200,000–$250,000 zone.

Related Reading: DeepSeek’s AI Breakthrough Triggers Fears In Tech

Sector, Impacting Bitcoin Prices The AI model then projects that by

the end of 2025, the price might rise further, potentially reaching

$300,000–$350,000. It points to ongoing speculation about the

government’s Bitcoin purchases, or at least the possibility of such

purchases, as well as heightened recognition of Bitcoin’s role as a

global reserve asset. DeepSeek believes this period would be marked

by increased media attention, new financial products enabling

Bitcoin exposure, and robust demand from both seasoned and new

investors. The AI’s analysis becomes especially dramatic when it

turns to the outlook for 2026, tying the bullish price momentum to

three key factors: the aftermath of the 2024 Bitcoin halving,

growing interest from major institutions, and direct involvement of

the US government. DeepSeek says, “Bitcoin could peak at

$500,000-$600,000, as the market enters the euphoria phase,”

suggesting that the first quarter of 2026 is the most likely time

for such a spike. DeepSeek stresses that the halving would reduce

Bitcoin’s issuance, while strong new demand from large-scale

players—possibly guided by the new executive order—could further

tighten supply. Yet, DeepSeek warns that after this euphoric peak,

the market may correct significantly, potentially falling back to

the $250,000–$300,000 range by mid to late 2026 as investors

realize profits and speculative excesses unwind. The AI still

anticipates a generally positive long-term picture, asserting that

“the long-term outlook remains bullish due to Bitcoin’s growing

role in the global financial system,” particularly if the

regulatory framework introduced during Trump’s administration

remains in place and encourages widespread adoption. At press time,

BTC traded at $102,948. Featured image created with DALL.E, chart

from TradingView.com

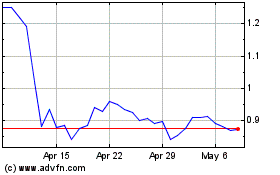

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025