LUNC Plunges 14% As SEC Scores Knockdown Blow Vs. Terraform Labs

30 December 2023 - 4:44PM

NEWSBTC

LUNC, the resilient token emerging from the tumultuous aftermath of

Terra’s downfall, witnessed a notable 14% downturn, mirroring a

substantial legal setback delivered by a U.S. District Court. This

judicial decision favored the Securities and Exchange Commission

(SEC) in their legal pursuit against Terraform Labs, the entity

steering the Terra blockchain, injecting uncertainty into the fate

of the beleaguered cryptocurrency. Harking back to the SEC’s

assertions in February, the once-mighty stablecoin, LUNA, now lies

at the heart of the controversy that unfolded in May 2022. The SEC

contends that LUNA transcended the classification of a digital

dollar, deeming it a security. Related Reading: Can BSV Hold Its

New 2023 Peak? Analysts Watch As Trading Volume Explodes Additional

Pain For LUNC Crucially, Terraform Labs allegedly neglected to

register it as such. The gravity of the situation intensifies as Do

Kwon, co-founder of Terraform Labs, faces accusations of

orchestrating the sale of these unregistered securities, placing

additional strain on the future trajectory of LUNC. Judge Jed

Rakoff’s definitive ruling echoes a harsh reality – both LUNA and

MIR, another token within the Terra ecosystem, are recognized as

securities. This legal stance paves the way for potential further

action by the SEC against Terraform Labs, casting a shadow over

LUNC’s future. Source: Santiment The abrupt shift in market

sentiment is evident as LUNC’s Weighted Sentiment, a metric gauging

market optimism, plummeted to -0.510 post-ruling. This stark

transformation from bullish to bearish suggests a loss of investor

confidence in the short-term prospects of the token. Social

Dominance, reflecting the attention given to LUNC, experienced a

surge on December 29th, correlating with the court ruling. However,

this heightened interest quickly dissipated, indicating that the

initial impact was ephemeral, and traders may have swiftly

incorporated the negative developments into their decision-making.

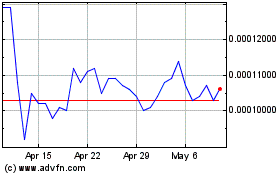

LUNCUSD currently trading at $0.000142 territory. Chart:

TradingView.com LUNC Price Analysis: Overall Downtrend With

Potential For Reversal The chart (below) confirms a downward

trend over the past seven days, mirroring the bearish

sentiment post-court ruling. However, technical indicators suggest

a potential for reversal: RSI: Dipping towards the

oversold zone, implying a possible price rebound. Negative

Divergence: Hints at an upcoming uptrend, though the legal

uncertainty adds complexity. EMAs: The recent 20 EMA crossover

above the 50 EMA offers a bullish signal, albeit weak. LUNC

seven-day price chart. Source: Coingecko Impact Of Court Ruling:

The sharp drop on December 29th coincides with the ruling,

highlighting its significant impact. Continued bearish momentum

suggests ongoing concerns about the legal and regulatory landscape.

Support And Resistance Levels: Support: The $0.00013 area has

acted as a barrier, holding price from further decline. Maintaining

this level is crucial for bullish momentum.

Resistance: Breaking above the $0.00015 level could signal a

stronger uptrend, but overcoming psychological resistance may be

challenging. Volume And Historical Trends: Low

volume indicates investor indecision, possibly due to the

legal uncertainty. Comparing to historical trends: Previous support

and resistance levels offer limited guidance due to the recent

crash. Past volatility patterns might not be reliable given the

unique legal context. Overall: The technical indicators present a

potential for LUNC reversal, but the court ruling casts a shadow of

uncertainty. Closely monitor key support and resistance levels,

watch for changes in volume, and remain cautious due to the

volatile market conditions. Related Reading: MATIC Blasts Off: 20%

Surge As Polygon Trading Volume Hits Records Featured image from

Shutterstock

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024