Bitcoin Sentiment Enters Danger Zone: Investors Now Extremely Greedy

08 November 2024 - 7:30PM

NEWSBTC

Data shows the Bitcoin investor sentiment has entered extreme greed

territory following the asset’s surge to a new all-time high (ATH).

Bitcoin Fear & Greed Index Is Now Pointing At ‘Extreme Greed’

The “Fear & Greed Index” is an indicator created by Alternative

that tells us about the average sentiment among the traders in the

Bitcoin and the wider cryptocurrency sectors. This index represents

the sentiment as a score between zero and hundred. To calculate the

score, the metric uses data from the following five factors:

volatility, trading volume, market cap dominance, social media

sentiment, and Google Trends. When the indicator’s value is greater

than 53, it means the investors share a sentiment of greed right

now. On the other hand, the metric being below 47 suggests the

market is currently observing fear. Naturally, the index between

these two regions implies a net neutral mentality. Related Reading:

Dogecoin Descending Triangle Could Hint At Next Destination For

DOGE Besides these three core sentiments, there are two special

zones: extreme greed and fear. The former occurs at values above

75, while the latter is under 25. Now, here is what the Bitcoin

Fear & Greed Index is like right now: As is visible above, the

indicator is at a value of 77, which suggests the traders in the

sector are currently holding a sentiment of extreme greed. This is

a change from yesterday when the market was still inside the normal

greed region. Here is a chart that shows how the index’s value has

changed over the past year: Historically, the extreme sentiments

have proven significant for Bitcoin, as major price tops and

bottoms in the asset have tended to occur inside these zones. Thus,

the relationship between sentiment and price has been an inverse

one, however, meaning that extreme greed has led to tops, while

extreme fear has paved the way for bottoms. From the above graph,

it’s apparent that the Fear & Greed Index had surged high into

the extreme greed territory when Bitcoin had topped out in the

first quarter of this year. Related Reading: Bitcoin Records

$75,000 All-Time High: Here’s If BTC Is ‘Overheated’ Now It’s

possible that, with the market once again becoming too hyped about

the cryptocurrency after the latest all-time high (ATH) break,

another top could form for BTC. Generally, however, major tops only

occur when the index hits particularly high levels. The top above,

for instance, took place alongside a value of 88. Thus, it’s

possible that sentiment could still have room to heat up, before

the rally hits a major obstacle. BTC Price At the time of writing,

Bitcoin is floating around $75,900, up 8% over the last seven days.

Featured image from Dall-E, Alternative.me, chart from

TradingView.com

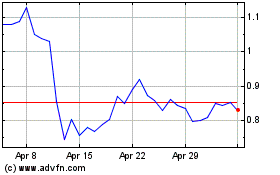

Mina (COIN:MINAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

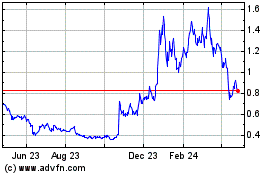

Mina (COIN:MINAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024