Bitcoin’s Non-Realized Profits Hit Negative Levels—What Does This Mean for Investors?

09 October 2024 - 8:00PM

NEWSBTC

As Bitcoin is currently still struggling to reclaim major highs, a

recent analysis of its fundamentals has highlighted a possible

buying opportunity for Bitcoin based on insights from the

Non-Realized Profit metric. A CryptoQuant analyst known as Darkfost

highlighted this metric’s importance in a recent post on the

CryptoQuant QuickTake platform, mentioning what its trend means for

investors. According to the analyst, the Non-Realized Profit metric

offers a window into the unrealized gains or losses held by Bitcoin

investors, which can influence future market movements. Related

Reading: Bitcoin Investors Not Sold On Uptober As Sentiment Remains

Neutral Understanding The Current Zone In Non-Realized Profits The

Non-Realized Profit metric is often used to calculate the

difference between the current price of Bitcoin and the price at

which each coin was last moved, without accounting for coins that

have been sold. High values in this metric suggest that investors

hold significant unrealized profits, which could lead to increased

selling pressure as they may choose to realize these gains.

Conversely, negative values indicate that many investors hold

positions at a loss, potentially signaling a market bottom and a

favourable entry point for new investors. According to the

CryptoQuant analyst, the Non-Realized Profit metric is mostly in

the negative zone. This situation implies that many Bitcoin holders

are either at break-even points or experiencing unrealized losses.

Historically, such conditions have been associated with market

bottoms, where the asset is considered undervalued. This scenario

could present a strategic “opportunity” for investors looking to

enter the market or increase their holdings. According to Darkfost,

what sets the current market apart is that the unrealized profits

have reached unprecedented highs compared to previous cycles, even

while in the negative zone. This anomaly suggests that the ongoing

market cycle may differ from past Bitcoin patterns. The analyst

cautions that while this could lead to unique investment

opportunities, it also introduces potential risks due to the

deviation from established trends. Bitcoin Continuous Struggle

Below $70,000 After briefly touching the $64,000 price level

yesterday, Bitcoin has faced correction once again, falling back

below this price mark—currently, the asset trades for $62,340, down

by 1.8% in the past 24 hours. This decline in performance from

Bitcoin appears to have also dragged the global crypto market cap

along with it, with the overall market cap valuation of crypto

currently down by 3.3% in the past day to $2.26 trillion. The

plunge has had a severe impact on traders, most especially the ones

on long positions. According to data from Coinglass, in the past 24

hours, 59,005 traders were liquidated, with the total liquidations

sitting at $176.57 million. Related Reading: Bitcoin Price

Forecast: This Week’s Trends And Historical Patterns For Q4 Out of

the total liquidations, long positions account for $130 million,

while short positions account for only $45.91 million. Featured

image created with DALL-E, Chart from TradingView

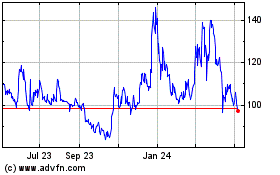

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

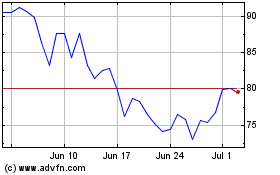

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024