$1.87B Bitcoin Withdrawals From Coinbase In 24H – What This Means To Price

05 December 2024 - 2:30AM

NEWSBTC

Bitcoin has been consolidating below the $100,000 level for twelve

consecutive days, marking a pause in its recent historic rally. The

aggressive surge since November 5 appears to be cooling off, with

market attention gradually shifting toward altcoins. Despite the

slowdown, Bitcoin remains a cornerstone of market strength, holding

firmly above the critical $90,000 support level. Related Reading:

Dogecoin Whales Keep Buying – DOGE Metrics Reveal Demand Remains

Strong Key data from CryptoQuant highlights two significant

outflows exceeding 8,000 BTC each from Coinbase in the past 24

hours, signaling sustained institutional interest and potential

accumulation. These outflows suggest that major players remain

optimistic about Bitcoin’s long-term trajectory, even as short-term

price action steadies. As Bitcoin maintains its consolidation

phase, the broader crypto market is poised for dynamic changes.

Analysts are closely watching whether this stabilization period

will pave the way for BTC’s next leg upward or signal an

opportunity for altcoins to take the spotlight. The next few days

will be crucial in determining whether Bitcoin reclaims momentum or

continues its current range-bound movement. Bitcoin Leading A

Heated Market Bitcoin continues to lead the crypto market with

remarkable gains, even as it halts just below the highly

anticipated $100,000 level. The current pause in its rally has

triggered a liquidity shift, gradually pumping capital into the

altcoin market. However, analysts and investors anticipate that

Bitcoin may slow down in the short term after its aggressive recent

surge, providing an opportunity for other cryptocurrencies to

shine. Metrics from CryptoQuant highlight notable activity on

Coinbase, where two massive outflows, exceeding 8,000 BTC each,

were recorded in the last 24 hours. A total of 19,487 BTC, valued

at an average price of $96,043, was withdrawn in these

transactions, amounting to approximately $1.87 billion. Such

significant movements indicate the involvement of institutional

players or whales who may be positioning themselves for Bitcoin’s

next major move. Historically, market dips have followed similar

outflows, as large transactions often signal profit-taking or

redistribution of holdings. However, these transactions could also

suggest growing confidence among major investors in Bitcoin’s

long-term potential. Related Reading: XRP Reaches 6-Year High –

Whales And STH Accumulate Together If BTC maintains its position

above $90,000 and demand continues to build, the market may see a

renewed push toward six-figure territory in the weeks ahead.

Price Levels To Watch Bitcoin is trading at $96,700, continuing a

range-bound movement between $93,500 and $98,700 without

establishing a clear direction. This consolidation follows a period

of aggressive rallies, with BTC approaching but not yet surpassing

its all-time high. Market participants are closely watching the

$90,000 mark, which has proven to be a critical level of support.

Holding above this level has been essential in signaling market

strength and sustaining bullish momentum. If Bitcoin maintains its

position above the $95,000 mark over the next few days, the

likelihood of a breakout to new all-time highs becomes

significantly stronger. A stable consolidation above this level

would fuel buyers to push BTC past the psychological $100,000

barrier. Conversely, losing the $95,000 support would raise

concerns, potentially prompting a test of the $90,000 level again.

Should this key level fail, Bitcoin could experience a deeper

correction with lower support zones. Related Reading: Cardano Could

Be Heading For A 20% Correction – Technical Data Signals Bearish

Price Structure Bitcoin’s ability to remain above $95,000 will be

crucial in determining its next move. Bulls are eyeing another

upward push, while bears are looking for signs of exhaustion to

capitalize on. Featured image from Dall-E, chart from TradingView

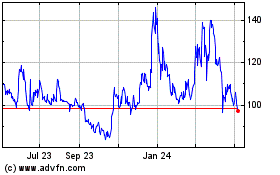

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

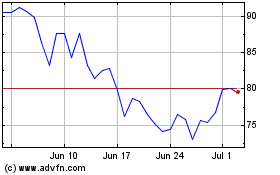

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024