Bitcoin’s Latest ATH: Is The Top Finally In Or Just Getting Started?

25 January 2025 - 9:00PM

NEWSBTC

In the past months, Bitcoin has broken multiple resistance levels

to achieve consistent all-time highs each month. So far, the

asset’s latest all-time high sits above $109,000 marking a more

than 150% increase in year-over-year performance. Amid this price

performance, CryptoQuant analyst Gaah has recently examined

Bitcoin’s current position in the market cycle and whether the

asset might be nearing a peak. Related Reading: Bitcoin

Profit-Taking Drops 93% From December Peak – What’s Next For BTC?

Bitcoin: Is The Top In? According to Gaah’s analysis, the Index of

Bitcoin Cycle Indicators (IBCI)—a composite metric that includes

on-chain data points like the Puell Multiple, MVRV, NUPL, and

SOPR—has entered the “distribution region” for the first time in

eight months. While this doesn’t “yet confirm a market top,” it

serves as a cautionary signal that Bitcoin could be approaching the

final stages of its current bull cycle. For IBCI to hit a

definitive top, all its components would need to reach their

historical peak levels, according to the analyst. However, as long

as the IBCI remains above 50%, the broader market trend remains

bullish, indicating continued demand and the potential for further

price increases. Beyond the IBCI, Gaah notes that additional

on-chain indicators present a mixed picture. While the NUPL metric

hovers near its upper range, suggesting a possible end to the bull

run, the Puell Multiple remains closer to the lower zone, which

could indicate room for continued growth. This interplay of signals

suggests that the market may not have reached a definitive top just

yet. According to Gaah, historically, a fully realized IBCI peak

has preceded corrections and longer-term bear phases. However, the

current position offers room for optimism, provided that demand

remains strong and other indicators remain supportive. Related

Reading: Bitcoin Capital Inflows See Notable Slowdown, But Is This

A Worry? Another Diverging Interpretation In contrast to Gaah’s

cautious perspective, another CryptoQuant analyst, Burak Kesmeci,

highlights a different scenario using the Bitcoin NVT Golden Cross.

This metric, designed to spot local tops and bottoms, recently fell

to its lowest point in 60 days, signaling a potential “local

bottom.” Kesmeci explains that historically when the NVT Golden

Cross drops below -1.6, it often indicates that the asset is

trading within a bottom range. As Bitcoin recently pulled back by

about 7.5% after reaching its all-time high, the metric’s current

reading could be a precursor to renewed upward momentum. Kesmeci

wrote: Rather than indicating a specific price level, this metric

suggests that Bitcoin may be trading within a local bottom zone.

Historically, such signals have often preceded recovery and trend

reversals, making it an important indicator to monitor. Featured

image created with DALL-E, Chart from TradingView

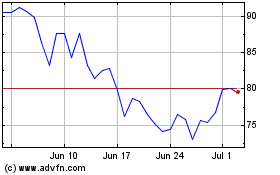

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

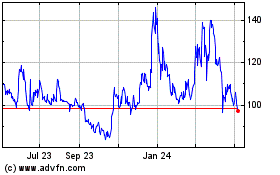

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025