Ethereum Faces Aggressive Shorting As Taker Sellers Outpace Buyers By $350M Daily – Analyst

05 January 2025 - 11:30PM

NEWSBTC

Ethereum, the second-largest cryptocurrency by market

capitalization, had a lackluster 2024, underperforming against

Bitcoin and many altcoins throughout the year. However, as 2025

begins, Ethereum is starting to show signs of recovery, gaining

over 10% in less than a week. This early surge has rekindled hope

among investors and analysts who see potential for a strong

performance this year. Related Reading: Dogecoin Explodes Overnight

– Price Action Suggests Fresh Highs Above $0.50 Top analyst

Maartunn recently shared insightful data highlighting an ongoing

trend of aggressive shorting in Ethereum markets. According to

Maartunn, taker sellers have been dominating the market, outpacing

taker buyers by over $350 million daily. This aggressive shorting

could explain Ethereum’s poor performance in 2024, as constant

selling pressure likely suppressed upward momentum. With the new

year’s optimism, many believe this shorting trend may begin to

shift, creating conditions for Ethereum to reclaim its position as

a market leader. As the altcoin leader pushes past its challenges,

the coming weeks will be critical to determine whether this early

rally marks the beginning of a more sustained upward trend.

Investors are closely watching Ethereum, anticipating that a

reversal of these bearish trends could lead to a stellar 2025 for

the network. Ethereum Rising Amid Aggressive Shorting Trends

Ethereum is attempting to push above its 2024 high, but a decisive

breakout remains elusive. Recent price action indicates the

potential for a rally, with ETH posting early gains in 2025.

However, the path forward isn’t clear-cut, as significant selling

pressure continues to weigh on the altcoin leader. Top analyst

Maartunn recently shared insightful data from CryptoQuant, shedding

light on the current market dynamics. According to the data,

Ethereum is experiencing aggressive shorting, with taker sellers

dominating trading activity. Over $350 million more in sell-side

pressure than buy-side activity is recorded daily, creating a

challenging environment for ETH to break free from its current

range. This trend, while suppressing prices in the short term,

can’t last indefinitely. Market cycles often see such aggressive

shorting as a precursor to a reversal, as sellers run out of

momentum and buying pressure begins to build. Long-term investors

are reportedly eyeing this phase as an opportunity, positioning

themselves to capitalize on Ethereum’s relatively low prices.

Related Reading: Solana Breaks Above Daily Downtrend – Analyst

Expects New ATH Soon As Ethereum navigates these dynamics, the next

few weeks will be crucial. A clean breakout above last year’s high

could signal the start of a broader rally, attracting renewed

interest and potentially reversing the ongoing shorting trend. For

now, ETH remains at a pivotal juncture. Price Testing Crucial

Levels Ethereum is trading at $3,650 after a robust start to 2025,

gaining significant traction in the early days of the year. The

price recently broke above the 4-hour 200 EMA with impressive

strength, a technical indicator often viewed as a critical

threshold for long-term trends. ETH is now testing the 200 MA on

the same timeframe, a level that could confirm the bullish trend if

reclaimed and held as support. A strong daily close above the 200

MA would solidify Ethereum’s upward momentum, potentially paving

the way for a massive rally to challenge and surpass last year’s

highs. Such a move would likely reinvigorate market sentiment and

attract additional buying pressure, driving Ethereum to new levels

in the near term. Related Reading: Chainlink Tunrns Resistance Into

Support – ATH Next? However, the bullish outlook is not without its

risks. If Ethereum fails to hold the 200 MA as support, the market

could witness a renewed wave of selling pressure. This would likely

push ETH back toward lower levels, eroding recent gains and

prolonging its battle to regain upward momentum. Featured image

from Dall-E, chart from TradingView

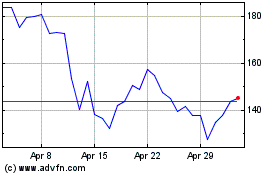

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025