XRP Sees Over $12 Million Sell-Off: Whale Warning Or Buying Opportunity?

29 April 2024 - 6:50PM

NEWSBTC

The once-booming cryptocurrency XRP, championed by Ripple Labs,

finds itself precariously perched on a stormy sea of uncertainty.

Recent weeks have been a tempestuous voyage for the digital asset,

rocked by a confluence of challenges: regulatory scrutiny,

dwindling investor confidence, and now, the ominous exodus of major

whales. Related Reading: Render Revving Up: Analyst Predicts

Potential Climb To $16 XRP Whale Exodus Sparks Fear These “whales,”

the deep-pocketed investors holding vast quantities of XRP, have

begun executing sizable sell orders, sending tremors through the

market. On-chain data reveals a colossal transfer exceeding 24

million units, valued at slightly over $12 million, departing from

the Bitvavo exchange and vanishing into an anonymous wallet. Such

sizeable movements are often interpreted as a bearish signal,

signifying a potential lack of faith among these influential

investors and casting a dark cloud over XRP’s immediate future.

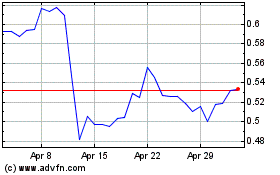

Source: Whale Alert/X XRP Price Takes A Tumble The negative

undercurrents permeating the market have manifested in a

precipitous decline of XRP’s price. At the time of writing, XRP is

trading at a meager $0.51, representing a staggering 16%

devaluation over the past month alone. This price plunge

underscores XRP’s struggle to regain its footing amidst a broader

market correction that has gripped the cryptocurrency space since

May 2023. Institutional Investors Lose Their Appetite For XRP

Adding fuel to the fire of anxiety is a noticeable decline in

institutional interest. Insights gleaned from Santiment’s data

point towards a palpable disinterest among entities holding

significant XRP reserves. XRP market cap currently at $27.7

billion. Chart: TradingView.com Investors with holdings ranging

from 100,000 to 100 XRP, typically categorized as high-net-worth

individuals or institutional players, are exhibiting signs of

skepticism. This trend further diminishes XRP’s allure in the

market, amplifying the prevailing bearish sentiment. On-Chain

Metrics Signal Trouble On The Horizon Looking deeper into the murky

waters of XRP’s on-chain metrics reveals a disturbing trend – a

decline in both network growth and transaction velocity. The

acquisition of new users on the XRP network appears to be

stagnating, coupled with a decrease in the frequency of

transactions. XRP 24-hour price action. Source: CoinMarketCap This

suggests a potential loss of interest among investors and a

reluctance to trade XRP. However, a solitary beacon of hope shines

through the gloom – a surge in long-term holders. This uptick

indicates that some investors remain confident in XRP’s long-term

prospects, choosing to hold onto their assets despite the current

turbulence. Related Reading: Is SUI Sinking? TVL Tanks As Crypto

Price Fails To Keep Afloat Development Activity Dwindles, Raising

Concerns About Innovation The realm of development also paints a

concerning picture for XRP. Indicators such as code commits and the

number of active developers working on XRP-related projects have

displayed a downward trajectory. This dearth of development

activity raises concerns about a potential lack of innovation or

progress within the XRP ecosystem. A stagnant ecosystem can further

erode investor confidence and exacerbate the bearish sentiment

surrounding the cryptocurrency. Featured image from Corporate

Finance Institute, chart from TradingView

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024