Is The Crypto Bull Run Over? Top Exec Discusses The Market Crash

20 December 2024 - 12:00AM

NEWSBTC

The broader crypto market experienced a pronounced downturn

following yesterday’s Federal Open Market Committee (FOMC) meeting,

held on December 18. After the US Federal Reserve delivered a

25-basis-point rate cut as anticipated, it also signaled fewer cuts

in 2025 than previously expected. In response, the Bitcoin price

fell by more than 5%, dropping below the $100,000 mark before

showing slight signs of recovery. Altcoins saw across-the-board

double-digit percentage declines. The Federal Reserve’s

decision—while meeting expectations for a 25-basis-point

reduction—came with a notable shift in the projected rate

trajectory for next year. Rather than the previously communicated

four cuts, the central bank now anticipates only two, signaling a

more cautious stance. This recalibration of future monetary policy

sent ripples through the entire risk asset spectrum, prompting the

S&P 500 to decline 3% and the Russell 2000 Small Cap Index to

drop 4.4%. Is The Crypto Bull Run Over? Within the crypto sector,

the immediate aftermath was pronounced. Matt Hougan, Chief

Investment Officer at Bitwise Asset Management, addressed the

market conditions this morning via X, writing: “The big catalyst

today was the Fed announcement […] The Fed cut rates by 25 basis

points as expected, but lowered expectations for next year from 4

cuts to 2 cuts. Higher rates are bad for risk assets, and the Fed’s

announcement caused a sharp pullback in all risk assets.” Related

Reading: Bitwise Exec Reveals His Personal Top 3 Crypto Predictions

For 2025 According to Hougan, Bitcoin’s price action reflected

heightened sensitivity to shifting monetary conditions. He noted

that Bitcoin price drop was exaggerated by leveraged positions

being liquidated. “$600 million of leveraged long positions were

blown out in today’s market, exacerbating the pullback.” Despite

the steep correction, Hougan argued that the broader outlook

remains constructive: “Crypto now has internal momentum, and

nothing about today’s announcement interrupts the mega-trends: The

pro-crypto reversal in Washington policy, rising institutional

adoption and ETF flows, Bitcoin purchases by governments and

corporations, and major tech breakthroughs in the programmable

blockchain space.” He pointed to technical indicators as a

supporting factor for his thesis: “My favorite momentum gauge is

still positive: Bitcoin’s 10-day exponential moving average ($102k)

is still above its 20-day exponential moving average ($99k).”

Related Reading: Crypto Watchlist: Top 5 Coins To Watch This Week

Hougan concluded his thread by maintaining that the shift in Fed

expectations would not derail the longer-term bull run, stating:

“Crypto’s in a multi-year bull market. 50bps of projected rate cuts

won’t change that.” Other market observers offered similar

interpretations of the Fed’s communication strategy. Warren Pies,

Founder of 3Fourteen Research, commented via X: “By upping

inflation forecast, lowering UE rate, and keeping cuts in place,

the Fed has actually opened the path to more than 2 cuts in 2025 as

data ‘surprises’ to the dovish side.” Renowned macro analysts

echoed this sentiment. Crypto analyst and podcaster Fejau

(@fejau_inc) described the central bank’s approach as a strategy

designed to guide market expectations: “Fed forced itself into

cutting this week so is using a hawkish 2025 FFR dot plot forecast

to talk down long bond yields despite cutting today […] Welcome to

macro psyop warfare. Smoke and mirrors baby.” He characterized the

dot plots as a tool for psychological influence rather than a

strict roadmap: “It’s important to view the dot plots not as a

future forecast of events, but as a psychological tool […] The Fed

has bought themselves time to allow further data to come out before

they actually make a move […] Can almost guarantee you 2025 will

not occur as is forecasted in their dots.” Andreas Steno Larsen,

CIO of Steno Global Macro Fund and CEO at Steno Research, offered a

similar assessment: “By hawking up all forecasts a lot, the Fed

lowers the bar materially for cuts next year. It is a wise move, if

you want to cut further, but do not want to precommit.” At press

time, Bitcoin traded at $101,766. Featured image created with

DALL.E, chart from TradingView.com

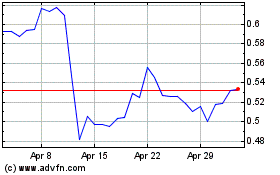

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024