AkzoNobel share buyback (July 1, 2019 – July 5, 2019)

08 July 2019 - 4:00PM

AkzoNobel share buyback (July 1, 2019 – July 5, 2019)

July 8, 2019

AkzoNobel share buyback (July 1, 2019 – July 5,

2019)

AkzoNobel (AKZA; AKZOY) has repurchased 608,372 of its own

ordinary shares in the period from July 1, 2019 up to and including

July 5, 2019, at an average price of €83.78 per share. The

consideration of the repurchase was €50.97 million.

This is part of a repurchase program announced on February 13,

2019. The total number of shares repurchased under this program to

date is 19,945,500 ordinary shares for a total consideration of

€1,553.75 million.

AkzoNobel intends to repurchase common shares up to a value of

€2.5 billion as part of a total €6.5 billion being distributed to

shareholders following the sale of the Specialty Chemicals

business. The share buyback is due to be completed by the end of

2019.

In accordance with regulations, AkzoNobel will inform the market

about the progress made in the execution of this program through

weekly updates and at

https://www.akzonobel.com/for-investors/shares/share-buyback-overview

About AkzoNobel

AkzoNobel has a passion for paint. We’re experts

in the proud craft of making paints and coatings, setting the

standard in color and protection since 1792. Our world class

portfolio of brands – including Dulux, International, Sikkens and

Interpon – is trusted by customers around the globe. Headquartered

in the Netherlands, we are active in over 150 countries and employ

around 34,500 talented people who are passionate about delivering

the high-performance products and services our customers

expect.

Not for publication – for more

information

| Media Relations |

Investor Relations |

| T +31 (0)88 – 969 7833 |

T +31 (0)88 – 969 7856 |

| Contact: Joost

RuempolMedia.relations@akzonobel.com |

Contact: Lloyd

MidwinterInvestor.relations@akzonobel.com |

Safe Harbor StatementThis press

release contains statements which address such key issues such as

AkzoNobel’s growth strategy, future financial results, market

positions, product development, products in the pipeline and

product approvals. Such statements should be carefully considered,

and it should be understood that many factors could cause

forecasted and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures, as well as

the sale of Specialty Chemicals. Stated competitive positions are

based on management estimates supported by information provided by

specialized external agencies. For a more comprehensive discussion

of the risk factors affecting our business please see our latest

annual report, a copy of which can be found on our website:

www.akzonobel.com.

- 20190708 Media release Share buyback

- Weekly fills 20190701_20190705

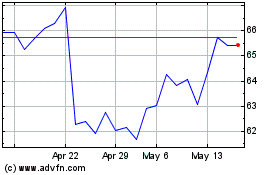

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Dec 2024 to Dec 2024

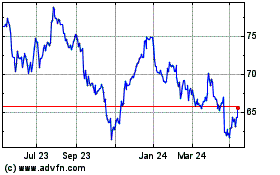

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Dec 2023 to Dec 2024