- 2024 full-year revenue of €181.6 million achieved in a still

challenging market environment

- Deployment of post-integration synergies for acquisitions

made in 2024 in accordance with the Group's roadmap

- Post-closing:

- Acquisition of Kingfisher PCB, a British expert in the

distribution of printed circuit boards

- Launch of a share buyback program

- Reaffirmation of the Group's commercial and financial

targets

Regulatory News:

The ICAPE Group (ISIN code: FR001400A3Q3 - Ticker: ALICA), a

global technology distributor of printed circuit boards (“PCB”) and

custom-made electromechanical parts, today announced its revenue

for the 2024 financial year, ending December 31.

Yann DUIGOU, Chief Executive Officer of the ICAPE Group,

stated: "The ICAPE Group demonstrated the resilience of its

development model throughout 2024. In a deteriorated economic

context, affected by geopolitical tensions and sluggish global

activity in the printed circuit board market, we remained committed

to our strategy based on offensive external growth. This dynamic is

reflected in the acquisition of multiple operational assets,

particularly in Europe and Asia, consolidating our position in

several strategic markets. We pursued this strategy at the

beginning of 2025 with the acquisition of Kingfisher PCB, a British

company specialized in the distribution of PCB for more than 35

years. This latest operation completes the structuring of our

Business Unit in the United Kingdom, one of the main European PCB

distribution markets. It is on these solid foundations and thanks

to the activation of our operational levers that we intend to take

full advantage of the resumption of growth that is beginning to

take place over the months and achieve our growth and profitability

targets."

2023 restated IFRS

2024 restated IFRS

Change (IFRS)

Change on a like-for-like

basis

Change due to external

growth

Revenue

€185.6m

€181.6m

-2.2%

-10.2%

+8.0%

2024 business activity

As of December 31, 2024, the Group's revenue amounted to €181.6

million, down -2.2% compared to 2023, with the reintegration of

DIVSYS activities in the United States1. The ICAPE activity,

dedicated to the distribution of PCB, represents more than 80% of

full-year revenue and the CIPEM activity, dedicated to the

distribution of custom-made electromechanical parts, constitutes

approximately 18%. At the end of December 2024, the ICAPE Group

recorded a backlog of €51.9 million.

Continuation of the selective acquisitions policy in 2024 and

post-closing

Over the period, the ICAPE Group benefited from the commercial

performance of the various acquisitions made in 2024, namely those

of the Italian distributor PCS. Srl, Studio E2, the Japanese group

NTW, its main intermediary François Frères and the British

distributor ALR Services, resulting in a contribution from external

growth to revenue of €14.8 million, or 8.2% of the Group's

full-year revenue.

The Group also announced today the acquisition of Kingfisher

PCB, a company created in 2019 by Victor Sproat, a British PCB

specialist for over 35 years. This distributor serves a wide range

of industries, including aerospace, telecommunications, automotive

and energy. Kingfisher PCB expects to record sales of around £1.5

million for the 2025 financial year. This acquisition is financed

in cash and will be consolidated in the ICAPE Group's accounts from

February 2025.

Reaffirmation of all the Group's growth and profitability

targets

In a context of gradual resumption of growth in the PCB

distribution market, the ICAPE Group intends to pursue its external

growth policy by targeting companies with synergies that could lead

to significant organic growth post-integration.

Thanks to its position as a leading player in PCB distribution,

its proven acquisition strategy and the activation of its

operational levers, the Group reaffirms all its other indicators

for 2026, namely:

- an average annual organic growth rate of 10% between 2023 and

2026;

- around €120 million of additional revenue through external

growth between the beginning of 2023 and the end of 2026;

- an EBIT margin of around 9.5% by 2026.

Exceptional event

The ICAPE Group has announced that it has been the victim of

accounting fraud within its American subsidiary, limited to this

entity, through the implementation of a sophisticated scheme

involving the misappropriation of client receipts and supplier

payments, as well as the falsification of accounting entries. The

loss amounts to a total of $4.5 million (approximately €4.3

million) corresponding to embezzlement of funds over several years.

The Company has recognized, under other operating expenses, an

amount of less than €0.9 million on the 2024 net result and an

amount of €1.2 million for the 2023 financial year. The impact of

€2.2 million relating to previous financial years has been charged

to opening equity, in accordance with IAS 8.

As soon as the fraud was discovered, the ICAPE Group initiated

legal action with the American authorities. An in-depth

investigation has been conducted by the Federal Bureau of

Investigation (FBI) over the past six months. At their request, the

ICAPE Group was unable to communicate in July 2024, the date of

discovery of the fraud, to preserve the confidentiality of the

investigation.

The ICAPE Group states that it has used all the necessary

procedures and formalities to recover the misappropriated amounts,

although the likelihood of a favorable outcome remains low

according to the US authorities.

In accordance with its risk management policy and in application

of Middlenext recommendations, the Company has carried out an

in-depth audit of its internal procedures to consolidate its

anti-fraud system and has deployed the appropriate corrective

actions throughout the group.

Launch of a share buyback program

The Board of Directors of the ICAPE Group, at its meeting on

February 12, 2025, decided to implement a share buyback program and

entrusted an investment services provider with a share buyback

mandate for a maximum amount of €5 million. The shares concerned by

this program are issued by ICAPE HOLDING on the Euronext Growth

Paris market under ISIN code FR001400A3Q3.

The Combined General Meeting of the ICAPE Group held on January

8, 2025, in its first resolution, authorized the Company's Board of

Directors to implement a share buyback program, in accordance with

the provisions of Articles L. 225-209 et seq. of the French

Commercial Code and Regulation (EU) No. 596/2014 of April 16, 2014

on market abuse supplemented by Delegated Regulation (EU) 2016/1052

of March 8, 2016. The maximum purchase price set by the Combined

General Meeting is €30 per share.

It is specified that a maximum amount of 5% of the shares

comprising the Company's share capital may be allocated with a view

to their retention and subsequent delivery in payment or exchange

in the context of a merger, demerger or contribution, and that in

the event of acquisition under a liquidity contract, the number of

shares taken into account for the calculation of the limit of 10%

of the amount of the share capital mentioned above will correspond

to the number of shares purchased minus the number of shares resold

during the term of this authorization.

Next financial release

- 2024 Full-Year Results, Thursday, March 27, 2025, before

market opening.

About the ICAPE Group

Founded in 1999, the ICAPE Group acts as a key technological

expert in the PCB and technical parts supply chain. With a global

network of 35 subsidiaries and a major presence in China, where

most of the world’s PCB production is done, the Group is a

one-stop-shop provider for the products and services which are

essentials for customers. As of December 31, 2024, the ICAPE Group

recorded a consolidated revenue of €181.6 million.

For more information: icape-group.com

1 The Group's Board of Directors, at its meeting on December 12,

2024, decided to stop the sale of the company DIVSYS. It has

therefore been reintegrated into the Group's consolidated accounts

for the 2023 and 2024 financial years.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212635934/en/

ICAPE Group CFO Arnaud Le Coguic Tél : 01 58 18 39

10 investor@icape.fr Investor Relations NewCap

Nicolas Fossiez Louis-Victor Delouvrier Tél : 01 44 71 94 98

icape@newcap.eu Media Relations NewCap Arthur Rouillé

Elisa Play Tél : 01 44 71 94 94 icape@newcap.eu

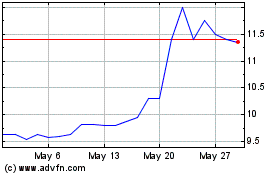

Icape (EU:ALICA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Icape (EU:ALICA)

Historical Stock Chart

From Mar 2024 to Mar 2025