IntegraGen: 2024 Half-Year Results - Sales up 6% on a Like-for-Like Basis (Excluding SeqOIA) and Profitability Maintained

18 October 2024 - 3:29AM

Business Wire

- Revenue growth for the Évry laboratory activities

- Restructuring and cost reduction plan implemented after

cessation of services to SeqOIA in February

- Overall profitability remained stable

Regulatory News:

IntegraGen (FR0010908723 - ALINT - PEA PME eligible), an

OncoDNA Group company specializing in cancer and rare genetic

disease genomics, and providing genomic analyses for both academic

and private clients, today announced its unaudited results for the

first half of 2024, following approval by the Board of Directors on

October 15, 2024

Bernard Courtieu, Chief Executive Officer of IntegraGen,

comments: “The first half of 2024 was marked by intensified

commercial efforts focused on genomic services from Évry, along

with the implementation of a strategic restructuring plan, which

became necessary following the cessation of activities with GCS

SeqOIA. These initiatives resulted in a 6% increase in sales

(excluding SeqOIA) and an improvement in net income compared to the

same period in 2023.”.

We anticipate an acceleration of our growth thanks to the

ongoing acquisition of customers in the pharmaceutical sector. In

January, we obtained CLIA (Clinical Laboratory Improvement

Amendments) certification from the CMS (Centers for Medicare &

Medicaid Services), paving the way for us to provide services to

the pharmaceutical industry, notably for the clinical development

of innovative treatments in oncology”.

Financials

- Simplified profit & loss statement

In Euro thousands

June 30th,

June 30th,

2024

2023

Delta

Revenues

4.570

6.088

-25%

Of which SeqOIA

727

2.200

-67%

Operating subsidies and other income

269

151

78%

Total income

4.839

6.239

-22%

Operating expenses

-5.195

-6.528

-20%

Gross operating income

-356

-289

23%

Depreciation, amortization and

provisions

-54

-102

-47%

Operating income

-410

-391

5%

Net financial expense

40

29

38%

Exceptional items

219

14

Income tax

36

87

Net income

-115

-261

56%

Total income totaled €4,839k, down 22% compared to the

first half of 2023, a reduction mainly due to the discontinuation

of services provided to the SeqOIA platform, which ended on

February 28. Excluding SeqOIA, sales rose by 6.4% over the period,

excluding exceptional items linked to the shutdown of the platform,

such as the sale of hardware and associated LIMS software.

Operating expenses amounted to €5,195k, down 20% compared to

the first half of 2023. This substantial reduction is primarily

the result of the restructuring plan carried out between late 2023

and early 2024, aimed at mitigating the loss of SeqOIA-related

revenues, as well as significant savings on external expenses, such

as the optimization of cloud IT costs.

The increase in revenues, excluding SeqOIA, along with the cost

reduction program, resulted in an EBITDA loss of -€356k, compared

to -€289k in the first half of 2023.

After accounting for financial and exceptional items, net income

showed a loss of -€115k, compared to -€261k in the first half of

2023, reflecting a 56% improvement.

The exceptional items are mainly related to the transfer of

equipment from the platform to GCS SeqOIA.

ASSETS

In € thousands

June 30th, 2024

Dec 31st, 2023

Non-current assets

243

316

Inventories

334

311

Trade receivables

2.072

2.960

Other receivables

1.656

1.535

Cash and cash equivalents

1.907

2.879

Current assets

5.970

7.684

Adjustments

4

TOTAL ASSETS

6.217

8.000

LIABILITIES

In € thousands

June 30th, 2024

Dec 31st, 2023

Shareholders' equity

1.895

2.011

Provisions for liabilities and charges

4

157

Financial debt

869

1.125

Operating liabilities

2.107

2.915

Other liabilities

1.342

1.784

adjustments

9

TOTAL LIABILITIES

6.217

8.000

The cash position at the end of June 2024 was €1,907k, a

decrease of €971k compared to December 31, 2023. Additionally, the

net position does not include the €1m loan granted to OncoDNA in

August 2023, which is due for repayment in October 2024, along with

6.5% annual interest.

ABOUT INTEGRAGEN

IntegraGen is an OncoDNA group company specializing in the

genomics of cancer and rare genetic diseases. Backed by highly

competent and qualified teams, IntegraGen is a leading player in

DNA sequencing services and genomic data interpretation software.

The company runs one of the largest NGS labs in France and operates

for research institutes of excellence. As part of OncoDNA group,

IntegraGen leverages the power of next generation sequencing with

the mission of delivering the promise of precision medicine to

patients. IntegraGen has about 42 employees and generated €12.5

million of turnover in 2023. Based in France, IntegraGen is part of

the Belgian OncoDNA group present in Spain, UK, Germany and works

with an international network of 35 distributors. The Group also

provides biomarker testing and clinical interpretation tools to

guide treatment and monitoring of late stage solid tumors and

accelerate the development of new cancer drugs.

IntegraGen is listed on Euronext Growth in Paris (ISIN:

FR0010908723 – Mnemo: ALINT – Eligible PEA- PME).

For further information, please visit www.integragen.com or

connect with us on LinkedIn or Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017349158/en/

IntegraGen Bernard COURTIEU Directeur Général

contact@integragen.com Tél. : +33 (0)1 60 91 09 00

NewCap Relations Investisseurs Louis-Victor

DELOUVRIER integragen@newcap.eu Tél. : +33 (0)1 44 71 98 53

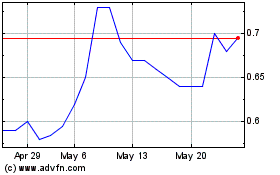

Integragen (EU:ALINT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Integragen (EU:ALINT)

Historical Stock Chart

From Nov 2023 to Nov 2024