Amundi: Launch of the capital increase reserved for employees

Amundi: Launch

of the capital

increase reserved for

employees

Amundi launches a capital increase reserved for

employees (under the name We Share Amundi). This capital

increase was initially decided on 6 February 2024 under the terms

specified below.

This offer reflects Amundi’s desire to involve

employees not only in the Company’s development but also in the

creation of economic value. This will strengthen the employees’

sense of belonging.

The discount offered to employees will be 30%,

as for the five previous capital increase reserved for

employees.

Eligible

employees can

subscribe to the

offering between 23

September and 4 October

2024 included. The capital increase is

scheduled for 31 October 2024 and the newly issued Amundi shares

will be listed on Euronext Paris on 4 November 2024.

As a

reminder, employees

currently own 1.41

% of Amundi’s

share capital.

The impact of this offering on the net earnings

per share should be negligible. The maximum number of Amundi shares

to be issued will be capped at 1,000,000 shares (i.e. less than

0.5% of the Company’s share capital and voting rights).

Terms of

the capital

increase

Issuer

Amundi, a French limited company (société

anonyme) with share capital of €511.619.085 and with its offices

located at 91-93, Boulevard Pasteur, 75015 Paris, France,

registered with the Paris Trade and Companies Registry under number

314 222 902 (the “Company”).

Securities offered

The offering is a capital increase in cash

reserved for employees, employees who have taken early retirement

and retired employees of Amundi Group companies that are members of

the UES Amundi Company Savings Plan (“PEE”) or Amundi’s

International Group Savings Plan (“PEGI”). The capital increase

will be carried out pursuant to Resolution 24 of the Annual General

Meeting of 12 May 2023, without preferential shareholder

subscription rights.

The capital increase will be capped at 1,000,000

shares with a par value of €2.50 per share. The newly issued shares

will be fully assimilated to existing ordinary shares.

Amundi will request that the newly issued shares

under the offering be admitted for trading on Euronext Paris as

soon as possible after the capital increase is completed, currently

scheduled for 31 October 2024. These shares will be listed on

the same line as the existing shares, under ISIN code

FR0004125920.

Terms of the

2024 offering

We Share Amundi is being made available

to employees in France and Amundi Group entities in the following

countries: Austria, Czech Republic, Germany, Hong Kong, Ireland,

Italy, Japan, Luxembourg, Malaysia, Singapore, Spain, Taiwan,

United Kingdom and United States.

Employees of companies that are members of the

PEE or PEGI, with at least three months of employment, whether

consecutive or not, between 1 January 2023 and the last day of the

subscription period, as well as retired employees in France that

have kept assets in the PEE, are eligible to the 2023 offering.

The

subscription price

is set at

47.00 euros. This subscription

price is the average of the share opening price over the 20

trading days between 23 August and 19 September 2024 (included),

minus a 30% discount.

Eligible employees can subscribe to the offering between

23 September 2024 and 4 October 2024 included. Shares can

be subscribed to via the FCPE (Employment Shareholding Fund) AMUNDI

ACTIONNARIAT RELAIS 2024 or FCPE

AMUNDI SHARES RELAIS 2024, with the exception of certain countries

where shares will be subscribed to directly. Once the capital

increase is completed, and following decisions by the funds’

Supervisory Boards and the approval of the French Autorité des

Marchés Financiers (AMF), the FCPE AMUNDI ACTIONNARIAT RELAIS 2024

will be merged into the FCPE AMUNDI ACTIONNARIAT, and the FCPE

AMUNDI SHARES RELAIS 2024 will be merged into the FCPE AMUNDI

SHARES.

The voting rights attached to the shares held

via the Funds will be exercised by the Fund’s Supervisory Board.

The voting rights attached to the directly-held shares will be

exercised by the subscribers.

The shares subscribed to under We

Share Amundi will be subject to a five-year

lock-up period, unless an early-exit event occurs as described in

the PEE or PEGI plan rules. Early-exit events will be adjusted

where applicable for certain countries.

An employee can invest up to a maximum of

€40,000. This cap is assessed on all the employee shareholding

operations of the Crédit Agricole group in which Amundi employees

could participate in 2024. Employees may finance their subscription

by making voluntary contributions to the plans, up to the annual

cap on investments in employee savings plans which is set at 25% of

their gross annual compensation. Members of the UES Amundi PEE are

also entitled to use their assets held in

another specific fund of the PEE.

Should subscription requests exceed the maximum

number of shares available under the offering, the smallest

subscriptions will be fully honoured while the highest

subscriptions will be subject to successive caps until all

available shares are subscribed. In France, any cap on

subscriptions will first be applied to portions of subscriptions

financed by voluntary contributions, then on the subscriptions

financed by the transfer of available assets held in another

specific fund of the PEE, and finally on the subscriptions financed

by the transfer of unavailable assets held in another specific fund

of the PEE.

Disclaimer

This press release is for information only and

is not a solicitation to subscribe to Amundi shares.

We Share Amundi is strictly reserved to

the eligible employees mentioned in this release and shall only be

available in countries where such an offer has been registered with

the competent local authorities, or the latter has been notified

thereof, and/or following the approval of a prospectus by the

competent local authorities, or if an exemption has been granted

from the obligation to publish a prospectus or to register the

offering with the authorities, or to notify the latter thereof.

More generally, We Share Amundi will

only be available in countries where all required registration

and/or notification procedures have been completed and the

necessary authorizations obtained.

Contact

For any questions about We Share

Amundi, eligible employees may contact their Head of Human

Resources or visit the following website:

www.weshare.amundi.com

***

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players1, offers its 100

million clients - retail, institutional and corporate - a complete

range of savings and investment solutions in active and passive

management, in traditional or real assets. This offering is

enhanced with IT tools and services to cover the entire savings

value chain. A subsidiary of the Crédit Agricole group and listed

on the stock exchange, Amundi currently manages more than €2.15

trillion of assets2.

With its six international investment

hubs3, financial and extra-financial research

capabilities and long-standing commitment to responsible

investment, Amundi is a key player in the asset management

landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working every day in the

interest of its clients and society

www.amundi.com

Press contacts:

Natacha Andermahr

Tel. +33 1 76 37 86 05

natacha.andermahr@amundi.com

Corentin Henry

Tel. +33 1 76 36 26 96

corentin.henry@amundi.com

Investor contacts:

Cyril Meilland, CFA

Tel. +33 1 76 32 62 67

cyril.meilland@amundi.com

Thomas Lapeyre

Tel. +33 1 76 33 70 54

thomas.lapeyre@amundi.com

Annabelle Wiriath

Tel. + 33 1 76 32 43 92

annabelle.wiriath@amundi.com

1 Source: IPE “Top 500 Asset Managers”

published in June 2023, based on assets under management as at

31/12/2022

2 Amundi data as at 31/12/2023

3 Boston, Dublin, London, Milan, Paris and

Tokyo

- Amundi 2024 - PR EN - Launch of the capital increase reserved

for employees_

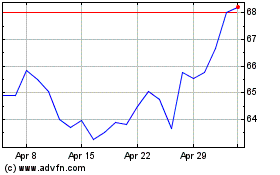

Amundi (EU:AMUN)

Historical Stock Chart

From Dec 2024 to Dec 2024

Amundi (EU:AMUN)

Historical Stock Chart

From Dec 2023 to Dec 2024